Search Market Research Report

Needle Coke Market Size, Share Global Analysis Report, 2019–2026

Needle Coke Market By Type (Petroleum Derived and Coal Tar Pitch Derived) and By Application (Graphite Electrode, Lithium Ion Batteries, Special Carbon Material and Others): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecasts 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the Needle Coke industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the Needle Coke market. The report study analyzes the market statistics at the global as well as the regional levels to gain an in-depth perspective of the overall Needle Coke market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volume (Kilo Tons) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the Needle Coke market in our study.

Key Insights from Primary Research

Key Insights from Primary Research

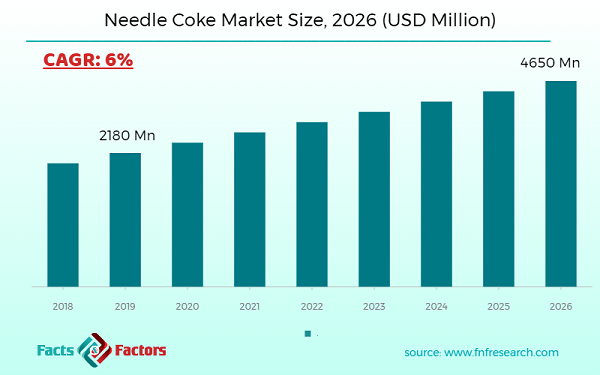

- As per our primary respondents, the global needle coke is set to grow annually at a rate of around 6%.

- It was established through primary research that the global needle coke was valued at around USD 2180 Million in 2019.

- In terms of volume, the global needle coke stood at around 860Kilo Tons, in 2019

- The “Petroleum Derived” category, was the prominent revenue-generating category accounting for around 65% share, in 2019.

- According to anapplication segmentation, the “Graphite Electrode”category is contributing to a share of65%, in 2019

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysis, the needle coke industry across the world is projected market grow at a significant rate. As needle coke is used in lithium-ion batteries, shifting to the clean energy and electric vehicle is projected marketpropels theneedle coke market.

- Growing at a CAGR around 6%, global needle coke provides numerous opportunities for all of the involved stakeholders across the entire value chain.

- Our analysts have identified “graphite electrode” and “coal tar pitch derived” categories as the leading investment pockets for global needle coke with respect to type and application segmentation.

- Needle coke market is projected market grow at a significant rate at the forecasted time, owing to the demand graphite electrode from aluminiumand steel industry.

- The needle coke withlow sulfur contentmaterial is projected market have momentous demand in the forecasted period.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the Needle Coke market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the Needle Coke market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the Needle Coke market.

The research study provides a critical assessment of the Needle Coke industry by logically segmenting the market on the basis of Type, Application, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the Needle Coke industry includes the holistic bifurcation of all the five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The Needle Coke market is segmented based on Type and Application. On the basis of type segmentation, the market is classified into CoveredPetroleum Derived and Coal Tar Pitch Derived. In terms of Application segmentation, the market is bifurcated into Graphite Electrode, Lithium-Ion Batteries, Special Carbon Material, and Others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 2180 Million |

Projected Market Size in 2026 |

USD 4650 Million |

CAGR Growth Rate |

6% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Jinzhou Petrochemical Co., Ltd., Bao-steel Group, Petroleum Coke Industries co. (K.S.C), Fangda Carbon, Phillips 66, C-Chem Co., Ltd., Shijiazhuang Deli Chemical Co., Mitsubishi Chemical Corporation, Indian Oil Corporation Ltd., Petrocokes Japan Ltd., Sinopec Shanghai Petrochemical Company Limited, Sinosteel Anshan Research Institute of Thermo-Energy Co., Ltd., Seadrift Coke LP, JXTG Holdings, Inc., Petrochina International, Baotailong New Material Co., Shanxi Meijin Energy Co., Ltd., and Shanxi Hongte Coal Chemical Co., Ltd. |

Key Segment |

By Type, By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the Needle Coke market, but not restricted to

Some of the essential players operating in the Needle Coke market, but not restricted to

- Jinzhou Petrochemical Co.Ltd.

- Bao-steel Group

- Petroleum Coke Industries co. (K.S.C)

- Fangda Carbon

- Phillips 66

- C-Chem Co.Ltd.

- Shijiazhuang Deli Chemical Co.

- Mitsubishi Chemical Corporation

- Indian Oil Corporation Ltd.

- Petrocokes Japan Ltd.

- Sinopec Shanghai Petrochemical Company Limited

- Shanxi Hongte Coal Chemical Co.Ltd.

- Sinosteel Anshan Research Institute of Thermo-Energy Co.Ltd.

- Seadrift Coke LP

- JXTG Holdings Inc.

- Petrochina International

- Baotailong New Material Co.

- Shanxi Meijin Energy Co.Ltd.

The taxonomy of the Needle Coke Market by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- Petroleum Derived

- Coal Tar Pitch Derived

By Application Segmentation Analysis

By Application Segmentation Analysis

- Graphite Electrode

- Lithium-Ion Batteries

- Special Carbon Material

- Others

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Jinzhou Petrochemical Co.Ltd.

- Bao-steel Group

- Petroleum Coke Industries co. (K.S.C)

- Fangda Carbon

- Phillips 66

- C-Chem Co.Ltd.

- Shijiazhuang Deli Chemical Co.

- Mitsubishi Chemical Corporation

- Indian Oil Corporation Ltd.

- Petrocokes Japan Ltd.

- Sinopec Shanghai Petrochemical Company Limited

- Shanxi Hongte Coal Chemical Co.Ltd.

- Sinosteel Anshan Research Institute of Thermo-Energy Co.Ltd.

- Seadrift Coke LP

- JXTG Holdings Inc.

- Petrochina International

- Baotailong New Material Co.

- Shanxi Meijin Energy Co.Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors