Search Market Research Report

Middle East Seismic Survey Market Size, Share Global Analysis Report, 2020–2026

Middle East Seismic Survey Market By Service (Data Acquisition, Data Processing, and Data Interpretation), Technology (2D Imaging, 3D Imaging, and 4D Imaging), and By Application (Geological, Geophysical, Geotechnical, and Others): Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

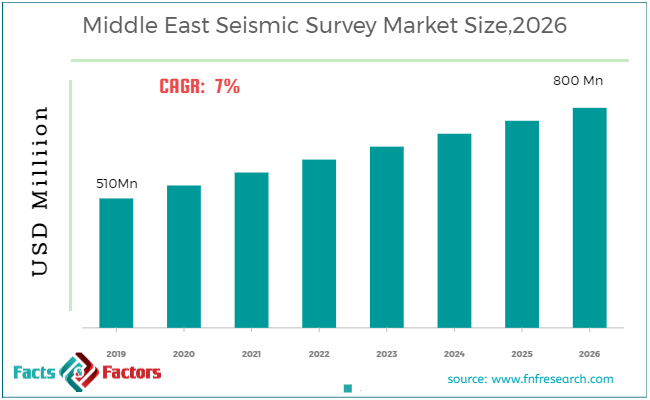

[175+ Pages Report] According to the report published by Facts and Factors, the global middle east seismic survey market size was valued around USD 510 million in 2019 and is expected to grow to around USD 800 million by 2026 with a compound annual growth rate (CAGR) of roughly 7% between 2020 and 2026. The report analyzes the global middle east seismic survey market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the middle east seismic survey market.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the Middle East seismic survey industry. The report analyzes and declares the historical and current trends analysis of the Middle East seismic survey industry and subsequently recommends the projected trends anticipated to be observed in the Middle East seismic survey market during the upcoming years.

The Middle East seismic survey market report analyzes and notifies the industry statistics at regional and country levels in order to acquire a thorough perspective of the entire Middle East seismic survey market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Million) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, rising offshore and onshore oil and gas explorations in Saudi Arabia, Iran, UAE has propelled the Middle East seismic survey market and is expected to fuel the market in the years to come.

- Through secondary research, we intended to verify the insights gathered from our primary interviewees. Our primary respondents predicted that the Middle East seismic survey market is expected to be valued at around USD 510 million in 2019.

- On the basis of country, Saudi Arabia dominated the Middle East seismic surveys market in 2019, accounting for a share of 40%, and is predicted to witness a similar trend over the forecasted period.

- Based on service, the Middle East seismic survey market was dominated by the data processing segment. The segment held a share of 45% in the Middle East seismic surveys market, due to the growing demand for data processing of huge amounts of data collected from seismic surveys.

- By technology, the 3D imaging segment dominated the Middle East seismic surveys market in 2019. 3D imaging provides detailed imaging of subsurface layers in comparison with the 2D imaging method. This has been a key driving factor for the 3D seismic survey market.

Key Recommendations from Analysts

Key Recommendations from Analysts

- According to our analysts, rising offshore oil and gas exploration in emerging economies of the Middle East is expected to create huge market growing avenues for the Middle East seismic survey market.

- Oil and gas companies are focusing on enhanced oil recovery to boost oil and gas production. Such a trend is also expected to open up new opportunities for the Middle East seismic surveys market.

- The Middle East seismic surveys market is estimated to grow at a CAGR of approximately 7%, the growth in the market is attributed to rising in oil and gas exploration activities due to rising demand for oil and gas.

- Our analysts also estimate that the 4D imaging seismic surveys market is expected to grow at a CAGR of nearly 10% over the projected period. 4D imaging seismic survey market is expected to grow by a significant value in the years ahead due to rising demand for accessing the seismic data at different times over the desired area to evaluate the changes in a hydrocarbon reservoir with respect to time.

- As per our team of energy and natural resources analysts, the emergence of big data analytics and artificial intelligence technology in the oil and gas sector is anticipated to open new avenues for companies who are planning to enter the Middle East seismic survey market.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the Middle East seismic survey industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the Middle East seismic survey industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the Middle East seismic survey market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the Middle East seismic survey industry. The Middle East Seismic Survey market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the Middle East seismic survey sector. Key strategic developments in the Middle East seismic survey market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the Middle East Seismic Survey market are appropriately highlighted in the report.

Seismic surveys are performed through the deployment of a range of energy sources and a variety of sensors or receivers on the desired area of interest. Seismic surveys involve generating sound or energy waves that are transmitted into the earth and measuring those sound or energy waves that are reflected from subsurface layers.

Seismic surveys use manmade explosive ripples or vibrations on earth and often high-pressure air dumps in marine seismic surveys. The seismic survey will search for subsurface oscillations, layers and possibly rocks or structures. It is also useful for the detection and investigation of sources of oil and gas, coal, groundwater, huge metallic deposits, etc. Technological advancements in seismic surveys technology help in finding oil and natural gas with minimum risk and least impact on the earth.

Seismic surveys are primarily used by oil and gas companies for the exploration of oil and gas. Seismic surveys are used to determine the oil and gas location beneath the earth and the size of reservoirs. Oil and gas companies, with a focus on improving their oil and gas production, are heavily investing in seismic surveys. The rise in the number of oil and gas exploration activities in the Middle East region has been a key factor that is fueling the Middle East seismic survey market.

Moreover, the emergence of big data analytics and 4D imaging technology is expected to revolutionize the oil and gas drilling industry in years to come, as these emerging technologies will improve success rates and productive wells. Additionally, AI-powered seismic survey technologies also boost survey efficiency, which is expected to create lucrative avenues for the Middle East seismic surveys market.

The Middle East Seismic Survey market research report delivers an acute valuation and taxonomy of the Middle East Seismic Survey industry by practically splitting the market on the basis of different services, technology, applications, and regions.

Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the Middle East Seismic Survey industry includes country-wise data for the Middle East Seismic Survey industry is provided for the leading economies of the region.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 510 Million |

Projected Market Size in 2026 |

USD 800 Million |

CAGR Growth Rate |

7% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Ion Geophysical Corporation, CompagnieGenerale de Geophysique (CGG), Polarcus Limited, Petroleum GeoServices, Fugro N.V., Tomlinson Geophysical Services Inc., Seabird Exploration PLC, and others. |

Key Segment |

By Service, Technology, Application, and Region |

Major Regions Covered |

Saudi Arabia, Iran, Iraq, UAE, Kuwait, and the Rest of ME |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The Middle East Seismic Survey market is segmented based on service, technology, and application. On the basis of service segmentation, the market is classified into data acquisition, data processing, and data interpretation. On the basis of technology, the Middle East seismic survey market is classified as 2D imaging, 3D imaging, and 4D imaging. By application, the Middle East seismic survey market is classified into geological, geophysical, geotechnical, and others.

Some of the leading players in the global market include

Some of the leading players in the global market include

- Polarcus Limited

- Compagnie Generale de Geophysique (CGG)

- Fugro N.V.

- Petroleum GeoServices

- Seabird Exploration

- Ion Geophysical Corporation

- Tomlinson Geophysical Services Inc.,

The taxonomy of the Middle East Seismic Survey industry by its scope and segmentation is as follows:

By Service Segmentation Analysis

By Service Segmentation Analysis

- Data Acquisition

- Data Processing

- Data Interpretation

By Technology Segmentation Analysis

By Technology Segmentation Analysis

- 2D Imaging

- 3D Imaging

- 4D Imaging

By Application Segmentation Analysis

By Application Segmentation Analysis

- Geological

- Geophysical

- Geotechnical

- Others

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- Saudi Arabia

- Iran

- Iraq

- UAE

- Kuwait

- Rest of ME

Table of Content

Industry Major Market Players

- Polarcus Limited

- Compagnie Generale de Geophysique (CGG)

- Fugro N.V.

- Petroleum GeoServices

- Seabird Exploration

- Ion Geophysical Corporation

- Tomlinson Geophysical Services Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors