Search Market Research Report

Middle East & Africa Freight & Cargo Market Size, Share Global Analysis Report, 2019 – 2027

Middle East & Africa Freight & Cargo Market By Mode (Air, Road, Marine, Rail, and Multimodal), By Service (Customs Clearance & Compliance, Insurance, Storage & Packaging, Inventory Management, Booking Management, Carrier Management, and Logistics Design), By Delivery Type (Normal and Express), By Industry Vertical (Aerospace, Manufacturing, Automotive, Pharmaceutical & Healthcare, FMCG, Retail, Oil & Energy Logistics, and Technology), and By Regional Coverage (Domestic and International): Industry Perspective, Comprehensive Analysis, and Forecast 2019 – 2027

Industry Insights

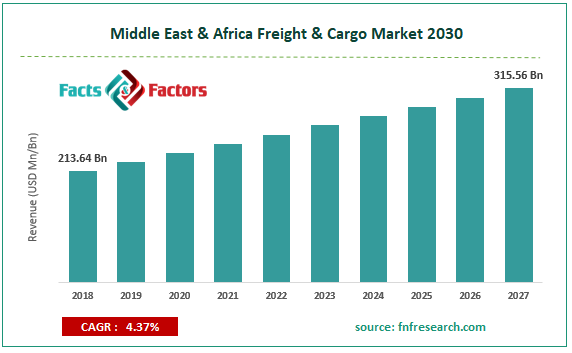

The report covers the forecast and analysis of the Middle East & Africa Freight & Cargo market. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Billion). The study includes drivers and restraints of the Middle East & Africa Freight & Cargo market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Middle East & Africa Freight & Cargo market.

In order to give the users of this report a comprehensive view of the Petrochemical market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new products & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Middle East & Africa Freight & Cargo market by segmenting the market based on mode, service, delivery type, industry vertical, regional coverage, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2027.

Rise in the eCommerce business in the Middle East and Africa will intensify the scope of the market in the region over the forecast period. Apart from this, the increase in the export and import business activities will further embellish the expansion of the freight & cargo industry in the Middle East and African market during the period from 2019 to 2027. In addition to this, large-scale cloud-based functions will propel the demand for freight & cargo activities in the region. Nonetheless, rising crude oil or fuel costs will impede the business expansion over the forecast timeframe. Apparently, complicated trade protection regulations will further obstruct the growth of the Middle East & Africa freight & cargo industry over the forecast timeline.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 213.64 Billion |

Projected Market Size in 2027 |

USD 315.56 Billion |

Growth Rate |

CAGR 4.37% |

Base Year |

2018 |

Forecast Years |

2019-2027 |

Key Market Players |

Agility, Al-Futtaim Logistics, Ardian Global Express LLC, CEVA Logistics, DHL International GmbH, Dolphin Shipping & Logistics, Expeditors International of Washington, Inc., GAC, Greenways Logistics Intl, and Hellmann Worldwide Logistics WLL and Others |

Key Segment |

By Mode, By Service, By Delivery Type, By Industry Vertical, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your res |

Competitive Analysis

Competitive Analysis

- Agility

- Al-Futtaim Logistics

- Ardian Global Express LLC

- CEVA Logistics

- DHL International GmbH

- Dolphin Shipping & Logistics

- Expeditors International of Washington Inc.

- GAC

- Greenways Logistics Intl

- Hellmann Worldwide Logistics WLL and Others

Table of Content

Industry Major Market Players

- Agility

- Al-Futtaim Logistics

- Ardian Global Express LLC

- CEVA Logistics

- DHL International GmbH

- Dolphin Shipping & Logistics

- Expeditors International of Washington Inc.

- GAC

- Greenways Logistics Intl

- Hellmann Worldwide Logistics WLL

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors