- Chapter 1. Executive Summary 20

- Chapter 2. Merchant Pig Iron market – Type Analysis 22

- 2.1. Global Merchant Pig Iron Market – Type Overview 22

- 2.2. Global Merchant Pig Iron Market Share, by Type, 2018 & 2025 (USD Million) 22

- 2.3. Basic 24

- 2.3.1. Global Basic Merchant Pig Iron Market, 2015-2027 (USD Million) 24

- 2.4. High Purity 25

- 2.4.1. Global High Purity Merchant Pig Iron Market, 2015-2027 (USD Million) 25

- 2.5. Foundry 26

- 2.5.1. Global Foundry Merchant Pig Iron Market, 2015-2027 (USD Million) 26

- Chapter 3. Merchant Pig Iron market – Production Facility Type Analysis 26

- 3.1. Global Merchant Pig Iron Market – Production Facility Type Overview 26

- 3.2. Global Merchant Pig Iron Market Share, by Production Facility Type, 2018 & 2025 (USD Million) 27

- 3.3. Dedicated Merchant Plants 28

- 3.3.1. Global Dedicated Merchant Plants Merchant Pig Iron Market, 2015-2027 (USD Million) 28

- 3.4. Integrated Steel Mills 29

- 3.4.1. Global Integrated Steel Mills Merchant Pig Iron Market, 2015-2027 (USD Million) 29

- Chapter 4. Merchant Pig Iron market – End-User Analysis 29

- 4.1. Global Merchant Pig Iron Market – End-User Overview 29

- 4.2. Global Merchant Pig Iron Market Share, by End-User, 2018 & 2025 (USD Million) 30

- 4.3. Engineering & Industrial 31

- 4.3.1. Global Engineering & Industrial Merchant Pig Iron Market, 2015-2027 (USD Million) 31

- 4.4. Automobile 32

- 4.4.1. Global Automobile Merchant Pig Iron Market, 2015-2027 (USD Million) 32

- 4.5. Railways 33

- 4.5.1. Global Railways Merchant Pig Iron Market, 2015-2027 (USD Million) 33

- 4.6. Agriculture & Tractor 34

- 4.6.1. Global Agriculture & Tractor Merchant Pig Iron Market, 2015-2027 (USD Million) 34

- 4.7. Power Generation 35

- 4.7.1. Global Power Generation Merchant Pig Iron Market, 2015-2027 (USD Million) 35

- 4.8. Pipes & Fittings 36

- 4.8.1. Global Pipes & Fittings Merchant Pig Iron Market, 2015-2027 (USD Million) 36

- 4.9. Sanitary & Decorative 37

- 4.9.1. Global Sanitary & Decorative Merchant Pig Iron Market, 2015-2027 (USD Million) 37

- 4.10. Others 38

- 4.10.1. Global Others Merchant Pig Iron Market, 2015-2027 (USD Million) 38

- Chapter 5. Merchant Pig Iron market – Regional Analysis 39

- 5.1. Global Merchant Pig Iron Market Regional Overview 39

- 5.2. Global Merchant Pig Iron Market Share, by Region, 2018 & 2025 (Value) 39

- 5.3. North America 41

- 5.3.1. North America Merchant Pig Iron Market size and forecast, 2015-2027 41

- 5.3.2. North America Merchant Pig Iron Market, by Country, 2018 & 2025 (USD Million) 41

- 5.3.3. North America Merchant Pig Iron Market, by Type, 2015-2027 43

- 5.3.3.1. North America Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 43

- 5.3.4. North America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 44

- 5.3.4.1. North America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 44

- 5.3.5. North America Merchant Pig Iron Market, by End-User, 2015-2027 45

- 5.3.5.1. North America Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 45

- 5.3.6. U.S. 46

- 5.3.6.1. U.S. Market size and forecast, 2015-2027 (USD Million) 46

- 5.3.7. Canada 47

- 5.3.7.1. Canada Market size and forecast, 2015-2027 (USD Million) 47

- 5.3.8. Mexico 48

- 5.3.8.1. Mexico Market size and forecast, 2015-2027 (USD Million) 48

- 5.4. Europe 49

- 5.4.1. Europe Merchant Pig Iron Market size and forecast, 2015-2027 49

- 5.4.2. Europe Merchant Pig Iron Market, by Country, 2018 & 2025 (USD Million) 49

- 5.4.3. Europe Merchant Pig Iron Market, by Type, 2015-2027 51

- 5.4.3.1. Europe Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 51

- 5.4.4. Europe Merchant Pig Iron Market, by Production Facility Type, 2015-2027 52

- 5.4.4.1. Europe Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 52

- 5.4.5. Europe Merchant Pig Iron Market, by End-User, 2015-2027 53

- 5.4.5.1. Europe Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 53

- 5.4.6. Germany 54

- 5.4.6.1. Germany Market size and forecast, 2015-2027 (USD Million) 54

- 5.4.7. France 55

- 5.4.7.1. France Market size and forecast, 2015-2027 (USD Million) 55

- 5.4.8. U.K. 56

- 5.4.8.1. U.K. Market size and forecast, 2015-2027 (USD Million) 56

- 5.4.9. Italy 57

- 5.4.9.1. Italy Market size and forecast, 2015-2027 (USD Million) 57

- 5.4.10. Spain 58

- 5.4.10.1. Spain Market size and forecast, 2015-2027 (USD Million) 58

- 5.4.11. Nordic Countries 59

- 5.4.11.1. Nordic Countries Market size and forecast, 2015-2027 (USD Million) 59

- 5.4.12. Benelux Union 60

- 5.4.12.1. Benelux Union Market size and forecast, 2015-2027 (USD Million) 60

- 5.4.13. Rest of Europe 61

- 5.4.13.1. Rest of Europe Market size and forecast, 2015-2027 (USD Million) 61

- 5.5. Asia Pacific 62

- 5.5.1. Asia Pacific Merchant Pig Iron Market size and forecast, 2015-2027 62

- 5.5.2. Asia Pacific Merchant Pig Iron Market, by Country, 2018 & 2025 (USD Million) 62

- 5.5.3. Asia Pacific Merchant Pig Iron Market, by Type, 2015-2027 64

- 5.5.3.1. Asia Pacific Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 64

- 5.5.4. Asia Pacific Merchant Pig Iron Market, by Production Facility Type, 2015-2027 65

- 5.5.4.1. Asia Pacific Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 65

- 5.5.5. Asia Pacific Merchant Pig Iron Market, by End-User, 2015-2027 66

- 5.5.5.1. Asia Pacific Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 66

- 5.5.6. China 67

- 5.5.6.1. China Market size and forecast, 2015-2027 (USD Million) 67

- 5.5.7. Japan 68

- 5.5.7.1. Japan Market size and forecast, 2015-2027 (USD Million) 68

- 5.5.8. India 69

- 5.5.8.1. India Market size and forecast, 2015-2027 (USD Million) 69

- 5.5.9. New Zealand 70

- 5.5.9.1. New Zealand Market size and forecast, 2015-2027 (USD Million) 70

- 5.5.10. Australia 71

- 5.5.10.1. Australia Market size and forecast, 2015-2027 (USD Million) 71

- 5.5.11. South Korea 72

- 5.5.11.1. South Korea Market size and forecast, 2015-2027 (USD Million) 72

- 5.5.12. South-East Asia 73

- 5.5.12.1. South-East Asia Market size and forecast, 2015-2027 (USD Million) 73

- 5.5.13. Rest of Asia Pacific 74

- 5.5.13.1. Rest of Asia Pacific Market size and forecast, 2015-2027 (USD Million) 74

- 5.6. Latin America 75

- 5.6.1. Latin America Merchant Pig Iron Market size and forecast, 2015-2027 75

- 5.6.2. Latin America Merchant Pig Iron Market, by Country, 2018 & 2025 (USD Million) 75

- 5.6.3. Latin America Merchant Pig Iron Market, by Type, 2015-2027 77

- 5.6.3.1. Latin America Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 77

- 5.6.4. Latin America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 78

- 5.6.4.1. Latin America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 78

- 5.6.5. Latin America Merchant Pig Iron Market, by End-User, 2015-2027 79

- 5.6.5.1. Latin America Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 79

- 5.6.6. Brazil 80

- 5.6.6.1. Brazil Market size and forecast, 2015-2027 (USD Million) 80

- 5.6.7. Argentina 81

- 5.6.7.1. Argentina Market size and forecast, 2015-2027 (USD Million) 81

- 5.6.8. Rest of Latin America 82

- 5.6.8.1. Rest of Latin America Market size and forecast, 2015-2027 (USD Million) 82

- 5.7. The Middle-East and Africa 83

- 5.7.1. The Middle-East and Africa Merchant Pig Iron Market size and forecast, 2015-2027 83

- 5.7.2. The Middle-East and Africa Merchant Pig Iron Market, by Country, 2018 & 2025 (USD Million) 83

- 5.7.3. The Middle-East and Africa Merchant Pig Iron Market, by Type, 2015-2027 85

- 5.7.3.1. The Middle-East and Africa Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 85

- 5.7.4. The Middle-East and Africa Merchant Pig Iron Market, by Production Facility Type, 2015-2027 86

- 5.7.4.1. The Middle-East and Africa Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 86

- 5.7.5. The Middle-East and Africa Merchant Pig Iron Market, by End-User, 2015-2027 87

- 5.7.5.1. The Middle-East and Africa Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 87

- 5.7.6. Saudi Arabia 88

- 5.7.6.1. Saudi Arabia Market size and forecast, 2015-2027 (USD Million) 88

- 5.7.7. UAE 89

- 5.7.7.1. UAE Market size and forecast, 2015-2027 (USD Million) 89

- 5.7.8. Egypt 90

- 5.7.8.1. Egypt Market size and forecast, 2015-2027 (USD Million) 90

- 5.7.9. Kuwait 91

- 5.7.9.1. Kuwait Market size and forecast, 2015-2027 (USD Million) 91

- 5.7.10. South Africa 92

- 5.7.10.1. South Africa Market size and forecast, 2015-2027 (USD Million) 92

- 5.7.11. Rest of Middle-East Africa 93

- 5.7.11.1. Rest of Middle-East Africa Market size and forecast, 2015-2027 (USD Million) 93

- Chapter 6. Merchant Pig Iron market – Competitive Landscape 94

- 6.1. Competitor Market Share – Revenue 94

- 6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 96

- 6.3. Strategic Development 97

- 6.3.1. Acquisitions and Mergers 97

- 6.3.2. New Products 97

- 6.3.3. Research & Development Activities 97

- Chapter 7. Company Profiles 98

- 7.1. Baosteel 98

- 7.1.1. Company Overview 98

- 7.1.2. Baosteel Revenue and Gross Margin 98

- 7.1.3. Product portfolio 99

- 7.1.4. Recent initiatives 100

- 7.2. Benxi Steel 100

- 7.2.1. Company Overview 100

- 7.2.2. Benxi Steel Revenue and Gross Margin 100

- 7.2.3. Product portfolio 101

- 7.2.4. Recent initiatives 102

- 7.3. Cleveland-Cliffs 102

- 7.3.1. Company Overview 102

- 7.3.2. Cleveland-Cliffs Revenue and Gross Margin 102

- 7.3.3. Product portfolio 103

- 7.3.4. Recent initiatives 104

- 7.4. Donetsk Metallurgical Plant 104

- 7.4.1. Company Overview 104

- 7.4.2. Donetsk Metallurgical Plant Revenue and Gross Margin 104

- 7.4.3. Product portfolio 105

- 7.4.4. Recent initiatives 106

- 7.5. KOBE Steel 106

- 7.5.1. Company Overview 106

- 7.5.2. KOBE Steel Revenue and Gross Margin 106

- 7.5.3. Product portfolio 107

- 7.5.4. Recent initiatives 108

- 7.6. Tata Metaliks 108

- 7.6.1. Company Overview 108

- 7.6.2. Tata Metaliks Revenue and Gross Margin 108

- 7.6.3. Product portfolio 109

- 7.6.4. Recent initiatives 110

- 7.7. Maritime Iron 110

- 7.7.1. Company Overview 110

- 7.7.2. Maritime Iron Revenue and Gross Margin 110

- 7.7.3. Product portfolio 111

- 7.7.4. Recent initiatives 112

- 7.8. Metinvest 112

- 7.8.1. Company Overview 112

- 7.8.2. Metinvest Revenue and Gross Margin 112

- 7.8.3. Product portfolio 113

- 7.8.4. Recent initiatives 114

- 7.9. DXC Technology 114

- 7.9.1. Company Overview 114

- 7.9.2. DXC Technology Revenue and Gross Margin 114

- 7.9.3. Product portfolio 115

- 7.9.4. Recent initiatives 116

- 7.10. Metalloinvest MC 116

- 7.10.1. Company Overview 116

- 7.10.2. Metalloinvest MC Revenue and Gross Margin 116

- 7.10.3. Product portfolio 117

- 7.10.4. Recent initiatives 118

- 7.11. Severstal 118

- 7.11.1. Company Overview 118

- 7.11.2. Severstal Revenue and Gross Margin 118

- 7.11.3. Product portfolio 119

- 7.11.4. Recent initiatives 120

- 7.12. Industrial Metallurgical Holding 120

- 7.12.1. Company Overview 120

- 7.12.2. Industrial Metallurgical Holding Revenue and Gross Margin 120

- 7.12.3. Product portfolio 121

- 7.12.4. Recent initiatives 122

- Chapter 8. Merchant Pig Iron — Industry Analysis 123

- 8.1. Merchant Pig Iron Market – Key Trends 123

- 8.1.1. Market Drivers 124

- 8.1.2. Market Restraints 124

- 8.1.3. Market Opportunities 125

- 8.2. Value Chain Analysis 126

- 8.3. Technology Roadmap and Timeline 127

- 8.4. Merchant Pig Iron Market – Attractiveness Analysis 128

- 8.4.1. By Type 128

- 8.4.2. By Production Facility Type 128

- 8.4.3. By End-User 129

- 8.4.4. By Region 131

- Chapter 9. Marketing Strategy Analysis, Distributors 132

- 9.1. Marketing Channel 132

- 9.2. Direct Marketing 133

- 9.3. Indirect Marketing 133

- 9.4. Marketing Channel Development Trend 133

- 9.5. Economic/Political Environmental Change 134

- Chapter 10. Report Conclusion 135

- Chapter 11. Research Approach & Methodology 136

- 11.1. Report Description 136

- 11.2. Research Scope 137

- 11.3. Research Methodology 137

- 11.3.1. Secondary Research 138

- 11.3.2. Primary Research 139

- 11.3.3. Models 140

- 11.3.3.1. Company Share Analysis Model 140

- 11.3.3.2. Revenue Based Modeling 141

- 11.3.3.3. Research Limitations 141

List of Figures

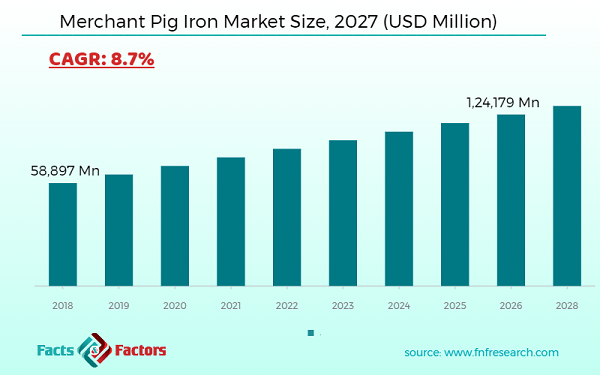

FIG. 1 Global Merchant Pig Iron Market, 2015-2027 (USD Million) 22

FIG. 2 Global Merchant Pig Iron Market Share, by Type, 2018 & 2025 (USD Million) 23

FIG. 3 Global Basic Merchant Pig Iron Market, 2015-2027 (USD Million) 25

FIG. 4 Global High Purity Merchant Pig Iron Market, 2015-2027 (USD Million) 26

FIG. 5 Global Foundry Merchant Pig Iron Market, 2015-2027 (USD Million) 27

FIG. 6 Global Merchant Pig Iron Market Share, by Production Facility Type, 2018 & 2025 (USD Million) 28

FIG. 7 Global Dedicated Merchant Plants Merchant Pig Iron Market, 2015-2027 (USD Million) 29

FIG. 8 Global Integrated Steel Mills Merchant Pig Iron Market, 2015-2027 (USD Million) 30

FIG. 9 Global Merchant Pig Iron Market Share, by End-User, 2018 & 2025 (USD Million) 31

FIG. 10 Global Engineering & Industrial Merchant Pig Iron Market, 2015-2027 (USD Million) 32

FIG. 11 Global Automobile Merchant Pig Iron Market, 2015-2027 (USD Million) 33

FIG. 12 Global Railways Merchant Pig Iron Market, 2015-2027 (USD Million) 34

FIG. 13 Global Agriculture & Tractor Merchant Pig Iron Market, 2015-2027 (USD Million) 35

FIG. 14 Global Power Generation Merchant Pig Iron Market, 2015-2027 (USD Million) 36

FIG. 15 Global Pipes & Fittings Merchant Pig Iron Market, 2015-2027 (USD Million) 37

FIG. 16 Global Sanitary & Decorative Merchant Pig Iron Market, 2015-2027 (USD Million) 38

FIG. 17 Global Others Merchant Pig Iron Market, 2015-2027 (USD Million) 39

FIG. 18 Global Merchant Pig Iron Market Share, by Region, 2018 & 2025 40

FIG. 19 North America Merchant Pig Iron Market, 2015-2027 42

FIG. 20 U.S. Merchant Pig Iron Market, 2015-2027 47

FIG. 21 Canada Merchant Pig Iron Market, 2015-2027 48

FIG. 22 Mexico Merchant Pig Iron Market, 2015-2027 49

FIG. 23 Europe Merchant Pig Iron Market, 2015-2027 50

FIG. 24 Germany Merchant Pig Iron Market, 2015-2027 55

FIG. 25 France Merchant Pig Iron Market, 2015-2027 56

FIG. 26 U.K. Merchant Pig Iron Market, 2015-2027 57

FIG. 27 Italy Merchant Pig Iron Market, 2015-2027 58

FIG. 28 Spain Merchant Pig Iron Market, 2015-2027 59

FIG. 29 Nordic Countries Merchant Pig Iron Market, 2015-2027 60

FIG. 30 Benelux Union Merchant Pig Iron Market, 2015-2027 61

FIG. 31 Rest of Europe Merchant Pig Iron Market, 2015-2027 62

FIG. 32 Asia Pacific Merchant Pig Iron Market, 2015-2027 63

FIG. 33 China Merchant Pig Iron Market, 2015-2027 68

FIG. 34 Japan Merchant Pig Iron Market, 2015-2027 69

FIG. 35 India Merchant Pig Iron Market, 2015-2027 70

FIG. 36 New Zealand Merchant Pig Iron Market, 2015-2027 71

FIG. 37 Australia Merchant Pig Iron Market, 2015-2027 72

FIG. 38 South Korea Merchant Pig Iron Market, 2015-2027 73

FIG. 39 South-East Asia Merchant Pig Iron Market, 2015-2027 74

FIG. 40 Rest of Asia Pacific Merchant Pig Iron Market, 2015-2027 75

FIG. 41 Latin America Merchant Pig Iron Market, 2015-2027 76

FIG. 42 Brazil Merchant Pig Iron Market, 2015-2027 81

FIG. 43 Argentina Merchant Pig Iron Market, 2015-2027 82

FIG. 44 Rest of Latin America Merchant Pig Iron Market, 2015-2027 83

FIG. 45 The Middle-East and Africa Merchant Pig Iron Market, 2015-2027 84

FIG. 46 Saudi Arabia Merchant Pig Iron Market, 2015-2027 89

FIG. 47 UAE Merchant Pig Iron Market, 2015-2027 90

FIG. 48 Egypt Merchant Pig Iron Market, 2015-2027 91

FIG. 49 Kuwait Merchant Pig Iron Market, 2015-2027 92

FIG. 50 South Africa Merchant Pig Iron Market, 2015-2027 93

FIG. 51 Rest of Middle-East Africa Merchant Pig Iron Market, 2015-2027 94

FIG. 52 Competitor Market Share – Revenue 95

FIG. 53 Baosteel Revenue and Growth Rate 100

FIG. 54 Baosteel Market Share 100

FIG. 55 Benxi Steel Revenue and Growth Rate 102

FIG. 56 Benxi Steel Market Share 102

FIG. 57 Cleveland-Cliffs Revenue and Growth Rate 104

FIG. 58 Cleveland-Cliffs Market Share 104

FIG. 59 Donetsk Metallurgical Plant Revenue and Growth Rate 106

FIG. 60 Donetsk Metallurgical Plant Market Share 106

FIG. 61 KOBE Steel Revenue and Growth Rate 108

FIG. 62 KOBE Steel Market Share 108

FIG. 63 Tata Metaliks Revenue and Growth Rate 110

FIG. 64 Tata Metaliks Market Share 110

FIG. 65 Maritime Iron Revenue and Growth Rate 112

FIG. 66 Maritime Iron Market Share 112

FIG. 67 Metinvest Revenue and Growth Rate 114

FIG. 68 Metinvest Market Share 114

FIG. 69 DXC Technology Revenue and Growth Rate 116

FIG. 70 DXC Technology Market Share 116

FIG. 71 Metalloinvest MC Revenue and Growth Rate 118

FIG. 72 Metalloinvest MC Market Share 118

FIG. 73 Severstal Revenue and Growth Rate 120

FIG. 74 Severstal Market Share 120

FIG. 75 Industrial Metallurgical Holding Revenue and Growth Rate 122

FIG. 76 Industrial Metallurgical Holding Market Share 122

FIG. 77 Market Dynamics 124

FIG. 78 Global Merchant Pig Iron – Value Chain Analysis 127

FIG. 79 Technology Roadmap and Timeline 128

FIG. 80 Market Attractiveness Analysis – By Type 129

FIG. 81 Market Attractiveness Analysis – By Production Facility Type 130

FIG. 82 Market Attractiveness Analysis – By End-User 130

FIG. 83 Market Attractiveness Analysis – By Region 132

FIG. 84 Market Channel 133

FIG. 85 Marketing Channel Development Trend 134

FIG. 86 Growth in World Gross Product, 2008-2018 135

List of Tables

TABLE 1 Global Merchant Pig Iron Market, 2018 & 2025 (USD Million) 21

TABLE 2 Global Merchant Pig Iron market, by Type, 2015-2027 (USD Million) 24

TABLE 3 Global Merchant Pig Iron market, by Production Facility Type, 2015-2027 (USD Million) 29

TABLE 4 Global Merchant Pig Iron market, by End-User, 2015-2027 (USD Million) 32

TABLE 5 Global Merchant Pig Iron market, by Region, 2015-2027 (USD Million) 41

TABLE 6 North America Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 45

TABLE 7 North America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 46

TABLE 8 North America Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 47

TABLE 9 Europe Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 53

TABLE 10 Europe Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 54

TABLE 11 Europe Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 55

TABLE 12 Asia Pacific Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 66

TABLE 13 Asia Pacific Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 67

TABLE 14 Asia Pacific Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 68

TABLE 15 Latin America Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 79

TABLE 16 Latin America Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 80

TABLE 17 Latin America Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 81

TABLE 18 The Middle-East and Africa Merchant Pig Iron Market, by Type, 2015-2027 (USD Million) 87

TABLE 19 The Middle-East and Africa Merchant Pig Iron Market, by Production Facility Type, 2015-2027 (USD Million) 88

TABLE 20 The Middle-East and Africa Merchant Pig Iron Market, by End-User, 2015-2027 (USD Million) 89

TABLE 21 Global Merchant Pig Iron Market - Company Revenue Analysis 2015-2018 (USD Million) 96

TABLE 22 Global Merchant Pig Iron Market - Company Revenue Share Analysis 2015-2018(%) 98

TABLE 23 Acquisitions and Mergers 99

TABLE 24 New Product/Service Launch 99

TABLE 25 Research & Development Activities 99

TABLE 26 Market Drivers 126

TABLE 27 Market Restraints 126

TABLE 28 Market Opportunities 127

Report Scope

Report Scope Some of the leading players in the global market include

Some of the leading players in the global market include  By Type

By Type By Production Facility Type

By Production Facility Type By End-User

By End-User By Region

By Region