Search Market Research Report

Medical Sensor Market Size, Share Global Analysis Report, 2021 – 2026

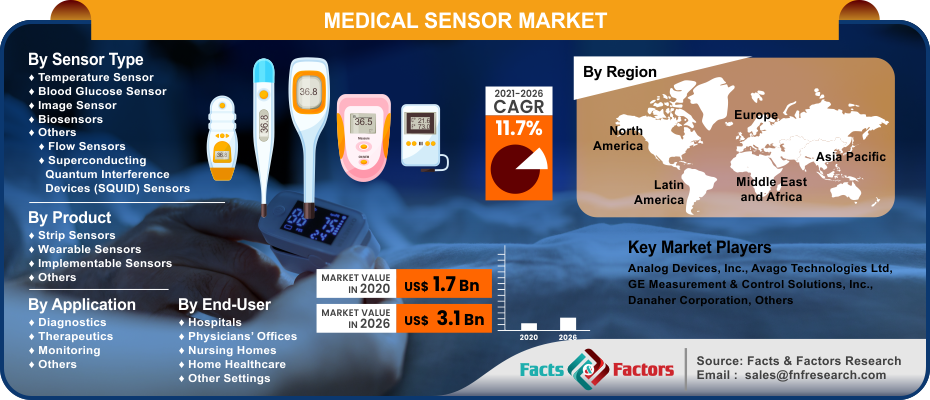

Medical Sensor Market By Sensor Type (Temperature Sensor, Blood Glucose Sensor, Image Sensor, Biosensors, & Others), By Product (Strip Sensors, Wearable Sensors, Implementable Sensors, & Others), By Application (Diagnostics, Therapeutics, Monitoring, & Others), By End-User (Hospitals, Physicians’ Offices, Nursing Homes, Home Healthcare, & Other Settings), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

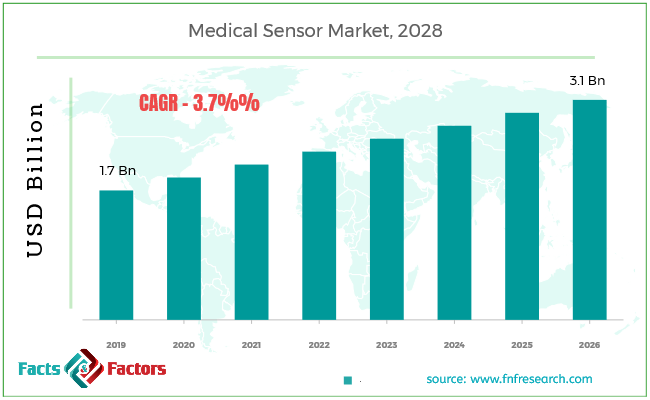

[198+ Pages Report] Facts & Factors have recently published a report titled “Global Medical Sensor Market” that encompasses the spectacle of the global medical sensor market in an analytical and comprehensive manner. In this report, the market is expected to value around USD 3.1 Billion in the year 2026 from an initial value of USD 1.7 Billion in the year 2020 growing at a CAGR value of 11.7%.

Market Overview

Market Overview

Medical sensors are electronic devices that are integrated into medical devices, equipment, and probes for the sole intent of enabling accurate diagnosis, regulated control, and treatment solutions. These sensors are widely implemented in disease diagnosis measures and other health-based associated platforms to name a few. Medical sensors transmit a signal that can be read at a remote location by wired or wireless transmission. The current generation of medical sensors has the ability to possess data processing capabilities in real-time.

Industry Growth Factors

Industry Growth Factors

The global medical sensor market will be driven to a higher market share from its last iteration due to contributing factors such as increased adoption of medical sensors in portable and connected medical sensors coupled with the rising elderly population to name a few.

Additionally, increasing demands for raising life expectancy coupled with rising demand for wearable devices are expected to increase the footprint of the global medical sensor market during the advent of the forecast period. Moreover, increased adoption of IoT-based services by medical sensors coupled with increasing budgets on healthcare expenditure will boost the growth of the global medical sensor market during the advent of the forecast period.

The global medical sensor market is driven by rising demands for improving patient care by eliminating unnecessary complications coupled with a wider array of applications in terms of a numerous range of parameters and analytes to name a few. Factors pertaining to increasing demand for automated needs in terms of patient temperature measuring and blood pressure monitoring coupled with the rising burden of chronic diseases will fuel the growth of the global medical sensor market during the advent of the forecast period.

However, increasing complexity in designing and producing compatible medical sensors and a higher cost of the product is expected to hamper the growth of the global medical sensor market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global medical sensor market is segmented into sensor type, product, application, end-user, and region.

On the basis of sensor type, the global medical sensor market is divided into temperature sensor, blood glucose sensor, image sensor, biosensors, and others. The segment pertaining to biosensors is expected to witness the largest market share during the advent of the forecast period owing to increased adaptability in laboratories and home care settings coupled with the increasing diabetic population to name a few. Based on product, the global medical sensor market is classified into strip sensors, wearable sensors, implementable sensors, and others.

The non-invasive products segment is expected to witness the largest market share during the advent of the forecast period owing to rising demand for connected medical devices, increased penetration of IoT-based sensors, and including demand for portable-based monitoring devices to name a few. The global medical sensor market is fragmented into diagnostics, therapeutics, monitoring, and others on the basis of application. The therapeutic segment is expected to witness the largest market share during the advent of the forecast period owing to technological advancements in the latter leading to highly reliable and specific engagements coupled with easy-to-maintain operability to name a few.

Global diagnostics, therapeutics, monitoring, and others are classified into hospitals, physicians offices, nursing homes, home healthcare, and other settings on the basis of end-user. The hospital's segment is expected to occupy the largest market share during the advent of the forecast period owing to cost-effective testing kits available at the latter setting coupled with rapid results deliverance to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 1.7 Billion |

Projected Market Size in 2026 |

USD 3.1 Billion |

CAGR Growth Rate |

11.7% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Analog Devices, Inc., Avago Technologies Ltd, Danaher Corporation, GE Measurement & Control Solutions, Inc., Honeywell International, Inc., Stellar Technologies, Inc., OmniVision Technologies, Inc., Senserion AG, TE Connectivity Ltd., Micro-Epsilon Messetechnik GmbH Co. & KG, and NXP Semiconductors N.V., among others. |

Key Segment |

Sensor Type, Product Segment, Application Segment, End-User Segment, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast period owing to the availability of primary, secondary, and tertiary healthcare settings available in the region coupled with a well-established reimbursement network to name a few.

Additionally, suitable government funding coupled with rising healthcare awareness towards facilitating the incorporation of sensors is expected to increase the footprint of the global medical sensor market during the advent of the forecast period. Factors pertaining to increased key market participants in the region coupled with the rising number of reliable vendors is expected to boost the growth of the medical sensor market in the region.

Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast period owing to the rising number of individuals suffering from chronic disorders such as diabetes, hypertension, and respiratory problems coupled with improving healthcare infrastructure to name a few.

Competitive Players

Competitive Players

The key market participants for the global medical sensor market are :

- Analog Devices Inc.

- Avago Technologies Ltd

- Danaher Corporation

- GE Measurement & Control Solutions Inc.

- Honeywell International Inc.

- Stellar Technologies Inc.

- OmniVision Technologies Inc.

- Senserion AG

- TE Connectivity Ltd.

- Micro-Epsilon Messetechnik GmbH Co. & KG

- NXP Semiconductors N.V.

By Sensor Type Segment Analysis

By Sensor Type Segment Analysis

- Temperature Sensor

- Blood Glucose Sensor

- Image Sensor

- Biosensors

- Others

- Flow Sensors

- Superconducting Quantum Interference Devices (SQUID) Sensors

By Product Segment Analysis

By Product Segment Analysis

- Strip Sensors

- Wearable Sensors

- Implementable Sensors

- Others

By Application Segment Analysis

By Application Segment Analysis

- Diagnostics

- Therapeutics

- Monitoring

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Physicians’ Offices

- Nursing Homes

- Home Healthcare

- Other Settings

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Analog Devices Inc.

- Avago Technologies Ltd

- Danaher Corporation

- GE Measurement & Control Solutions Inc.

- Honeywell International Inc.

- Stellar Technologies Inc.

- OmniVision Technologies Inc.

- Senserion AG

- TE Connectivity Ltd.

- Micro-Epsilon Messetechnik GmbH Co. & KG

- NXP Semiconductors N.V.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors