Search Market Research Report

Medical Device Market Size, Share Global Analysis Report, 2021 - 2026

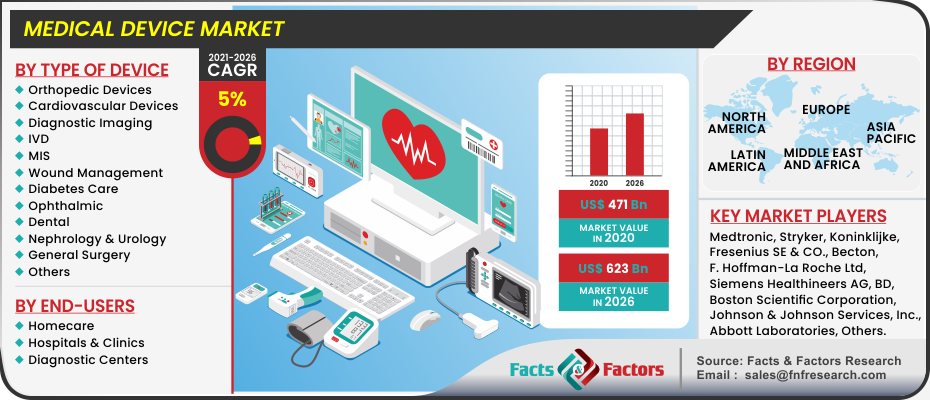

Medical Device Market By Type of Device (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, IVD, MIS, Wound Management, Diabetes Care, Ophthalmic, Dental, Nephrology & Urology, General Surgery, & Others), By End-User (Homecare, Hospitals & Clinics, & Diagnostic Centers), And By Regions – Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

[205+ Pages Report] The latest market study published by Facts & Factors titled “Medical Device Market” contains the latest about the market in terms of an analytical approach. We estimate that the global Medical Device Market will flourish at an astounding rate of 5% CAGR during the forecast period to grow to a value of USD 623 Billion by 2026 from an initial value of USD 471 Billion in the year 2020.

Market Overview

Market Overview

Medical devices are apparatus that aid and assists medical practitioners and professionals in a wide range of medical procedures. They often provide medical caregivers the ability to diagnose and treat patients by adding an extra set of mechanical and optical utilities. Their main function is to provide a better quality of life for the ailing patient and help them overcome a particular sickness or disease. Since medical devices are often integrated with life or death situations, they are thoroughly vetted in order to keep up with the global standards of safety by organizations across the world. As such, as a general rule, the more vital the device’s capabilities are, the most testing it goes through before getting approved for usage.

Industry Growth Factors

Industry Growth Factors

The major driving forces behind the global medical device market are the increased uptake of investment in the sector coupled with favorable and loosened medical regulation on the approval and testing of these devices. Additional factors include the rise in increasing regional support for the establishment and demand of these devices and the global economy slowing inching towards post-pandemic levels. Furthermore, with the latest trend of wearable medical device catching on for a larger consumer base, the market is expected to be in a swollen condition during the forecast. Moreover, factors pertaining to the advanced model being introduced by key players in the market, the latest features, optimal prices, and increasing marketing campaigns will propel the growth of the global medical device market over the forecast period.

The rapid changing sedentary lifestyle of consumers and a declining rate of patient visits to clinic for regular checkups will further boost the growth of the market over the forecast period. An increase in the prevalence of chronic diseases such as hypertension, diabetes, and cardiovascular disorders will increase the volumetric sales of medical devices. A large population of consumer being dependent on ophthalmic and orthopedic devices due to declining vision and deteriorating body functions will further open new revenue streams for the global medical device market to a larger consumer base. Moreover, increased healthcare facilities and agencies working toward providing a routine diagnosis of patients and rising awareness among the growing population will nudge the market to a ballooned state. However, the high initial cost present for these devices is expected to witness the market to a certain extent.

Segmentation Analysis

Segmentation Analysis

The global medical device market can be segmented on the basis of type of devices, end-users, and regions.

On the basis of type of device, the global medical device market can be broken down into orthopedic devices, cardiovascular devices, diagnostic imaging, IVD, MIS, wound management, diabetes care, ophthalmic, dental, nephrology & urology, general surgery, and others (dental equipment & supplies, patient monitoring devices, anesthesia & respiratory devices). The in-vitro diagnostics (IVD) segment is expected to occupy the largest market share during the forecast period owing to factors pertaining to increasing prevalence of chronic and infectious diseases such as cancer, diabetes, and HIV/AIDS among others. The wound care segment is expected to occupy a significant market share as well owing to crediting factors such as rising investment by medical device companies for introducing the latest iteration of wound care devices and bioactive therapies in the market. On the basis of end-users, the global medical device market can be divided into home care, hospitals & clinics, and diagnostic centers. The hospitals and clinics are expected to witness the largest market share during the forecast owing to a larger footprint of multispecialty and community hospitals across the globe. Furthermore, increasing healthcare expenditure and government-assisted regular checkup programs will boost the growth of the segment to a dominant position.

Regional Analysis

Regional Analysis

North America is expected to occupy the largest market share during the forecast in terms of global revenue collection with recent trends indicating the market to occupy a 35% market share. Factors pertaining to the aggressive market position in the region can be credited to the larger presence of key players in the region, rising healthcare infrastructure, rapid adoption of advanced medical technologies, and favorable regulations surrounding these devices will boost the growth of the market in the region. Europe is expected to witness the fastest growing CAGR during the forecast timeframe owing to a well-established healthcare system and increased adoption of advanced diagnostic and treatment devices to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 471 Billion |

Projected Market Size in 2026 |

USD 623 Billion |

Growth Rate |

CAGR 5% |

Base Year |

2020 |

Forecast Years |

2021–2026 |

Key Market Players |

Medtronic, Stryker, Fresenius SE & CO., Koninklijke, F. Hoffman-La Roche Ltd, Siemens Healthineers AG, BD, Boston Scientific Corporation, Johnson & Johnson Services, Inc., Abbott Laboratories, Becton, Dickinson and Company, General Electric Company, 3D, and Fisher & Paykel Healthcare Limited among others. |

Key Segment |

By Type of Device, By End-Users and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key Players

Key Players

The competitive players in the global medical device market are :

- Medtronic

- Stryker

- Fresenius SE & CO.

- Koninklijke

- F. Hoffman-La Roche Ltd

- Siemens Healthineers AG

- BD

- Boston Scientific Corporation

- Johnson & Johnson Services Inc.

- Abbott Laboratories

- Becton

- Dickinson and Company

- General Electric Company

- 3D

- Fisher & Paykel Healthcare Limited

By Type of Device Segment Analysis

By Type of Device Segment Analysis

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- IVD

- MIS

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology & Urology

- General Surgery

- Others

By End-Users Segment Analysis

By End-Users Segment Analysis

- Homecare

- Hospitals & Clinics

- Diagnostic Centers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Medtronic

- Stryker

- Fresenius SE & CO.

- Koninklijke

- F. Hoffman-La Roche Ltd

- Siemens Healthineers AG

- BD

- Boston Scientific Corporation

- Johnson & Johnson Services Inc.

- Abbott Laboratories

- Becton

- Dickinson and Company

- General Electric Company

- 3D

- Fisher & Paykel Healthcare Limited

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors