Search Market Research Report

Managed Security Services Market Size, Share Global Analysis Report, 2022 – 2028

Managed Security Services Market Size, Share, Growth Analysis Report By Deployment Mode (On-Premise and Cloud), By Enterprises Size (Large Enterprises and Small & Medium-Sized Enterprises), By Application (Managed IPS and IDS, Distributed Denial of Services (DDoS), Unified Threat Management (UTM), Secured Information & Event Management (SIEM), Firewall Management, Endpoint Security, and Others), By Vertical (BFSI, Healthcare, Manufacturing, Retail, Telecom & IT, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

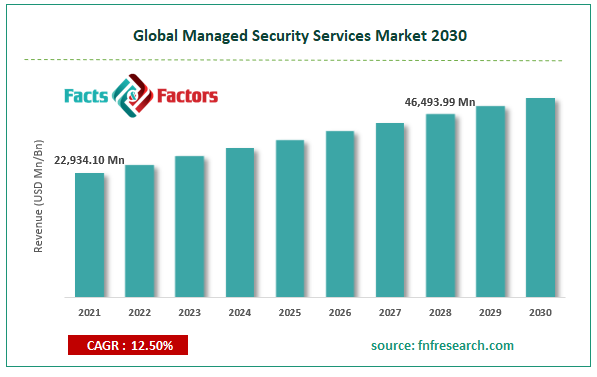

[234+ Pages Report] According to the report published by Facts & Factors, the global managed security services market size was worth USD 22,934.10 million in 2021 and is estimated to grow to USD 46,493.99 million by 2028, with a compound annual growth rate (CAGR) of approximately 12.50% over the forecast period. The report analyzes the managed security services market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the managed security services market.

Market Overview

Market Overview

Managed security services (MSS) is a third-party IT security firm that offers comprehensive cybersecurity measures to protect online data. Hiring an outsourcing business is done to protect sensitive information that could be accidentally or purposefully exposed. The managed security services industry is expanding primarily due to increased market competition and the prevalence of online crimes, including spam, malware, and web invasions.

COVID-19 Impact:

COVID-19 Impact:

It is projected that the COVID-19 outbreak will benefit the market share growth of managed security services. It is explained by the fact that, in light of COVID-19, businesses should be able to solve security concerns and provide secure information access when doing remote work, thanks to the usage of managed security services. Additionally, due to the rise in internet traffic, many businesses now face a major increase in the risk of cyberattacks, necessitating the deployment of managed security services. Market growth has been spurred by innovations and developments in managed security services, including firewall management, endpoint security, and an increase in cyberattacks since the start of the pandemic. The average ransomware payment, for instance, increased by 82% to a record $570,000 in the first half of 2021 from $312,000 in 2020, according to a report from Palo Alto Networks' Unit 42 security consultancy group. Thus, the rise in cyberattacks and ransomware increases the need for managed security services, propelling the expansion of the global managed security services market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the managed security services Market value is expected to grow at a CAGR of 12.50% over the forecast period.

- In terms of revenue, the managed security services market was worth USD 22934.10 million in 2021 and is estimated to grow to USD 46493.99 million by 2028.

- Strict government laws, the emergence of trends like BYOD, CYOD, and WFH, the increasing number of security breaches and sophisticated cyberattacks across companies, and the affordability of installing MSS are the main drivers anticipated to propel the growth of the managed security services market.

- In 2021, the cloud category led the market in deployment mode.

- By enterprise size, the large enterprise segment dominated the market in 2021.

- North America dominated the global managed security services market in 2021.

Growth Drivers

Growth Drivers

- Intensification of cybercrime activities is driving the growth of the market.

Globally, cybercrime is on the rise. Businesses still rely on outdated data protection methods despite the rising sophistication of attacks and the IT network's complexity. Bring-Your-Own-Device (BYOD), cellphones, social media, and cloud service usage, among other technical developments and behaviors, have dramatically exacerbated the difficulty of maintaining data security. These days, more and more well-funded, capable, coordinated, and motivated entities are driving organized cybercriminal operations. Cybercrime causes high financial costs for businesses and harms their reputation.

Additionally, there is a surge in cyberattacks on the systems of healthcare facilities, their medical equipment, and patient personal data, which is crucial for hospitals and patient privacy. Healthcare networks frequently host a large number of endpoints running outdated software. Due to the difficulty of fixing these endpoints, maintaining an acceptable security posture is expensive. Healthcare endpoint security is now more crucial than ever for safeguarding data, preventing unauthorized system modifications, and avoiding introducing dangerous malware. All of these factors will spur the growth of the global managed security services market during the forecast period.

Restraints

Restraints

- Lack of skilled security expertise is the major restraint in the market.

The absence of trained security knowledge and the constantly evolving nature of online threats impede global market expansion. Over the projection period, it is also anticipated that the shortage of skilled IT professionals and the low awareness of cyberattacks among small and medium-sized businesses will impede the growth of the global market.

Opportunities

Opportunities

- An increasing focus on technological advancements provides an opportunity for the market.

The increasing use of blockchain-based security may open up a lot of commercial prospects. Blockchain technology enables customers to keep track of all company transactions in one location without the risk of information being compromised or used for window dressing. As a result, there is less reliance on outside parties, and the information is more reliable and quicker to retrieve. Due to the great reliability of these sources of protection, all these technological developments in the managed security services sector have benefited the market expansion.

Segmentation Analysis

Segmentation Analysis

The global managed security services market has been segmented into deployment mode, enterprise size, application, vertical, and region.

The global managed security services market is divided into two categories based on deployment mode: on-premise and cloud. It is anticipated that the managed security system's cloud segment will experience significant growth in the global market and generate sizable sums of money over the projection period. Business houses worldwide are increasingly choosing cloud systems as their preferred security solution. In comparison to on-premise solutions, cloud solutions give their consumers additional flexibility, dependability, and security features. The cloud system is more affordable than on-premise security, and modifications and additions may be made remotely. These elements are anticipated to accelerate the expansion of the global market.

The global market has been divided into segments based on enterprise size, including large enterprises and small & medium-sized enterprises. Large companies will impact the biggest market expansion for managed security services. It is projected that there would be a big need for managed security service systems due to the exponential growth of industries like healthcare, retail, and telecommunications. This demand will ultimately fuel the expansion of the global market. Additionally, most companies that require managed security services are global in scope and often belong to the large enterprise market.

The worldwide managed security services market has been divided into Managed IPS and IDS, distributed denial of services (DDoS), unified threat management (UTM), secure information & event management (SIEM), firewall management, and endpoint security, and others by application.

The global market is divided into categories based on vertical: BFSI, healthcare, manufacturing, retail, telecom & IT, and others. The BFSI sector will have the largest proportion over the study period. This market's expansion is primarily due to the volume of sensitive data and security issues. In contrast, the healthcare industry will have the fastest increase during the predicted period. It is mostly because of concerns about confidentiality and the possibility of cyberattacks regarding the potential leakage of important patient data, money, medications, and research projects.

Recent Developments

Recent Developments

- September 2021: ATOS and Intigrit introduced a bug bounty service in September 2021. This service aims to offer customers vulnerability detection and remediation services. Audit, penetration testing, platform report analysis, vulnerability classification, monitoring, remediation, and managed detection and response services are just a few services that an ATOS consultant will offer.

- August 2021: To update network security, IBM will enhance the capabilities of its Zero Trust approach with new SASE services.

- July 2021: Accenture purchased a provider of cybersecurity services, Openmindedre; openminded offers consultation managed security, cloud and infrastructure security, and cyber defense services in France. With this acquisition, Accenture has increased the size of its MSS business in France.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 22,934.10 Million |

Projected Market Size in 2028 |

USD 46,493.99 Million |

CAGR Growth Rate |

12.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

AT&T Intellectual Property, Broadcom, BT Group, Check Point Software Technologies Ltd., Cisco System Inc., DXC Technology Company, Fortinet Inc., and Hewlett Packard Enterprise Development LP, IBM Corporation, SecureWorks Inc., and Others |

Key Segment |

By Deployment Mode, Enterprises Size, Application, Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America expected to dominate the managed security services market

According to estimates, North America holds the largest share in the global managed security services market. The region's managed security services market is anticipated to increase due to the early acceptance of the technology and numerous providers offering MSS solutions. Hospitals, medical facilities, and public institutions have been the most frequently targeted sectors due to the COVID-19 epidemic. It is vital to defend the agency's systems with robust security solutions after the US Department of Health and Human Services (HHS) suffered attacks on its servers during the epidemic. In a poll of Canadian CIOs, Massachusetts-based cybersecurity firm Carbon Black found that 82% believed that the number of assaults on Canadian businesses was rising quickly. Organizations have been driven to implement MSS to protect their assets from intrusions due to these security issues.

Competitive Landscape

Competitive Landscape

- AT&T Intellectual Property

- Broadcom

- BT Group

- Check Point Software Technologies Ltd.

- Cisco System Inc.

- DXC Technology Company

- Fortinet Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- SecureWorks Inc.

Global Managed Security Services Market is segmented as follows:

By Deployment Mode

By Deployment Mode

- On-premise

- Cloud

By Enterprises Size

By Enterprises Size

- Large Enterprises

- Small & Medium-sized Enterprises

By Application

By Application

- Managed IPS and IDS

- Distributed Denial of Services (DDoS)

- Unified Threat Management (UTM)

- Secured Information & Event Management (SIEM)

- Firewall Management

- Endpoint Security

- Others

By Vertical

By Vertical

- BFSI

- Healthcare

- Manufacturing

- Retail

- Telecom & IT

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- AT&T Intellectual Property

- Broadcom

- BT Group

- Check Point Software Technologies Ltd.

- Cisco System Inc.

- DXC Technology Company

- Fortinet Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- SecureWorks Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors