Search Market Research Report

Insulin Biosimilars Market Size, Share Global Analysis Report, 2022 – 2030

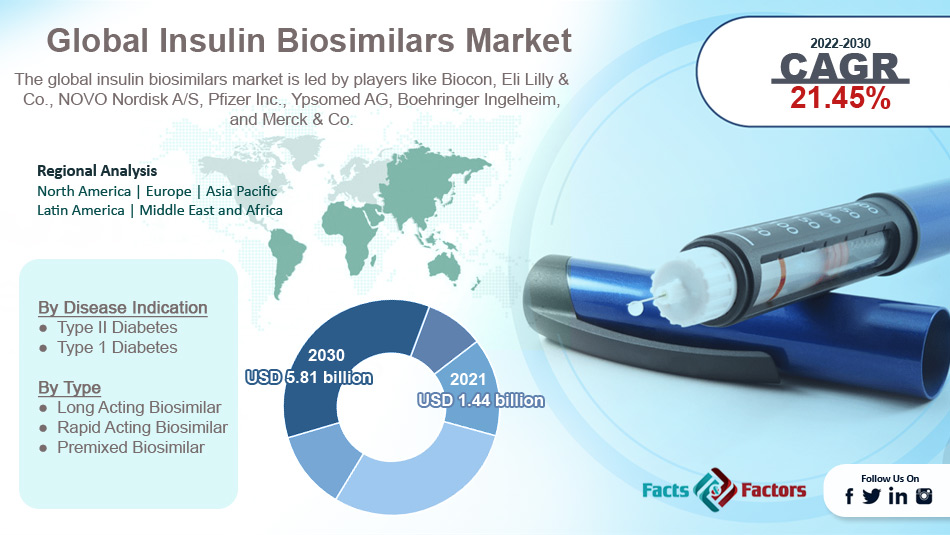

Insulin Biosimilars Market Size, Share, Growth Analysis Report By Disease Indication (Type II Diabetes, Type 1 Diabetes), By Type (Long Acting Biosimilar, Rapid Acting Biosimilar, and Premixed Biosimilar), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

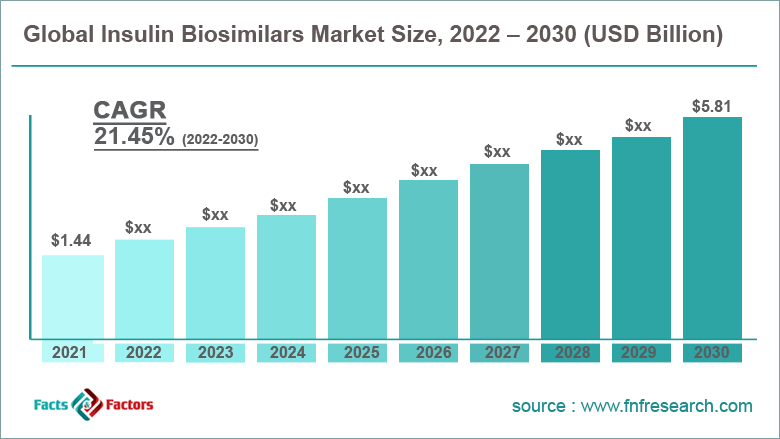

[223+ Pages Report] According to the report published by Facts Factors, the global insulin biosimilars market size was worth around USD 1.44 billion in 2021 and is predicted to grow to around USD 5.81 billion by 2030 with a compound annual growth rate (CAGR) of roughly 21.45% between 2022 and 2030. The report analyzes the global insulin biosimilars market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the insulin biosimilars market.

Market Overview

Market Overview

A biosimilar is a drug or a medicine that is extremely close in terms of structure and function to a biologic medicine, which is the type of medicine made from living organisms like bacteria, yeast, and systems including animal cells. Biosimilars can also be considered the same as generic versions of a branded biologic medicine, but there is a key difference between biosimilars and generic medicines. The former is not the exact copy of the branded drug, unlike generic medication.

The main points that make biosimilars and generic drugs somewhat alike are both undergo testing and comparison to the original brand name that was included in the studies, both types of medicines have to undergo testing and approvals from food and drug administering authorities in the region, and they are less in price as compared to the original brand. Biosimilar insulin is the biological copy of certain original insulin and is gaining extreme popularity in the global healthcare sector due to multiple factors.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global insulin biosimilars market is estimated to grow annually at a CAGR of around 21.45% over the forecast period (2022-2030)

- In terms of revenue, the global insulin biosimilars market size was valued at around USD 1.44 billion in 2021 and is projected to reach USD 5.81 billion, by 2030.

- The global insulin biosimilars market is projected to grow at a significant rate due to the growing number of diabetic patients across the globe

- Based on type segmentation, rapid-acting biosimilar was predicted to show maximum market share in the year 2021

- Based on disease indication segmentation, type I was the leading disease in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Increasing the number of diabetic patients to propel market demand

The global insulin biosimilars market is projected to grow owing to the increasing number of diabetic patients across the globe. Insulin therapy is generally used in patients with type 2 diabetes in case the other treatment plans fail to provide effective results. Supplying insulin externally helps patients avoid complications arising due to diabetes by helping in maintaining sugar levels in the target range.

As the world is witnessing a surge in the number of people suffering from different stages of high blood sugar levels, the demand for effective medication has grown tremendously, which is the leading cause for the global market players to invest in all possible means of developing new and efficient medicines to help curb the disease or avoid serious diabetes-related complications.

Insulin biosimilars are the latest in the new research activities related to diabetes medication and treatment therapy. As per the World Health Organization (WHO), more than 422 million people across the globe are affected by diabetes which is most significantly observed in middle to low-income economies. The medical issue is the cause of over 1.5 million deaths annually.

Restraints

Restraints

- Higher demand for generic medication to restrict the market growth

Generic and biosimilar drugs are identical in many ways but are significantly different from one another. Insulin biosimilars are not the exact chemical copy of the reference medicine, as the composition of living organisms cannot be copied one hundred percent. This means that there is a minor but considerable variation between insulin biosimilars and original insulin. This issue does not exist in generic medicines since they are the exact copy of the reference drug and hence generic medications are more in demand as compared to biosimilars. This could potentially impact the global market growth during the projection period.

Opportunities

Opportunities

- Increasing use of technology in healthcare to create higher expansion opportunities

The global insulin biosimilars market is anticipated to benefit from the growing adoption of technology and advanced devices in the healthcare and research field. The regional governments have extended a supportive environment for the pharmaceutical and drug-developing companies to contribute higher in the healthcare segment, which includes encouraging policies as well as allotment of funds to adopt better technological systems for research & innovation. In 2012, the Australian Pharmaceuticals Industry Council (PIC) agreed to broaden its pricing strategy for biosimilar, to encourage the associated production in the country.

Challenges

Challenges

- Complexities with the manufacturing of insulin biosimilar to act as a major challenge

Insulin is unlike small-molecule drugs that exhibit predictable and uniform structures which can be easily characterized. Insulin is a protein-based product that is derived from living organisms and hence has larger molecules and more complex structures that cannot be easily defined. They require specific conditions to achieve complete stability. Any minor changes in the composition can potentially damage the entire efficiency and safety of the final product. Management of the exact conditions is a major challenge for global market players.

Segmentation Analysis

Segmentation Analysis

The global insulin biosimilars market is segmented based on disease indication, type, and region

Based on disease indication, the global market segments are type II diabetes and type 1 diabetes with the former leading the global market growth in 2021. People suffering from type I diabetes do not produce insulin at all and hence in almost all cases, they require external insulin injections. Type I diabetic patients are required to take insulin injections or pumps almost daily. Patients with type II diabetes may have insulin therapy as a part of the treatment plan. As per the Centers for Disease Control and Prevention, more than 37 million of the American population suffers from diabetes, out of which around 90 to 95% have type II diabetes.

Based on type, the global market divisions are long acting biosimilar, rapid acting biosimilar, and premixed biosimilar. The global market is dominated by the rapid acting biosimilar segment due to the short time required by the insulin injections to showcase the effect. Rapid acting biosimilar start working within 15 minutes of application and their effect lasts up to a few hours. Long acting biosimilar proved effective during the initial phase of introduction but the high associated cost led to funding reduction.

Recent Developments:

Recent Developments:

- In April 2022, Merck & Co, an American international pharmaceutical company, announced the acquisition of the Modular Automated Sampling Technology (MAST) platform developed by Lonza. The move has helped the company expand its bioprocessing portfolio since the new platform is an aseptic, automated bioreactor sampling technology

- In July 2021, the US Food and Drugs Administration (FDA) approved the first-of-its-kind interchangeable biosimilar insulin product which is expected to improve glycemic control in adults patients with Type 2 diabetes mellitus and pediatric patients with Type 1 diabetes mellitus

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1.44 Billion |

Projected Market Size in 2030 |

USD 5.81 Billion |

CAGR Growth Rate |

21.45% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Biocon, Eli Lilly & Co., NOVO Nordisk A/S, Pfizer Inc., Ypsomed AG, Boehringer Ingelheim, Merck & Co., and others. |

Key Segment |

By Disease Indication, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead with the highest market share

The global insulin biosimilars market is anticipated to register the highest growth in North America driven by the technically advanced research infrastructure in the US which allows the country and its players to invest in modern drugs and innovation activities. The regional growth may also be driven by the presence of some of the most critical players working on insulin biosimilars as well as growing FDA approvals for the use of insulin biosimilars while treating diabetic patients. In November 2022, FDA approved the country’s second interchangeable insulin glargine biosimilar called Rezvoglar.

With this approval, patients in the US can now receive treatment with Rezvoglar and Semglee from the pharmacy making the products more accessible. Growth in Europe may be driven by the growing investments in regional pharmaceutical businesses, especially those directed toward modern research and developments. The European Commission is working consistently toward identifying potential biosimilars and approving them which could allow the surge in the use of insulin biosimilars.

Competitive Analysis

Competitive Analysis

- Biocon

- Eli Lilly & Co.

- NOVO Nordisk A/S

- Pfizer Inc.

- Ypsomed AG

- Boehringer Ingelheim

- Merck & Co.

The global insulin biosimilars market is segmented as follows:

By Disease Indication Segment Analysis

By Disease Indication Segment Analysis

- Type II Diabetes

- Type 1 Diabetes

By Type Segment Analysis

By Type Segment Analysis

- Long Acting Biosimilar

- Rapid Acting Biosimilar

- Premixed Biosimilar

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Biocon

- Eli Lilly & Co.

- NOVO Nordisk A/S

- Pfizer Inc.

- Ypsomed AG

- Boehringer Ingelheim

- Merck & Co.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors