Search Market Research Report

Inertial Measurement Unit Market Size, Share Global Analysis Report, 2019–2026

Inertial Measurement Unit Market By Product (Accelerometer, Gyroscope, and Magnetometer) By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, MEMS, and Others) and By Application (Aircraft Missiles, Space Launch Vehicles, Marine, Military Armored Vehicles, Consumer Electronics, Automotive, and Others): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

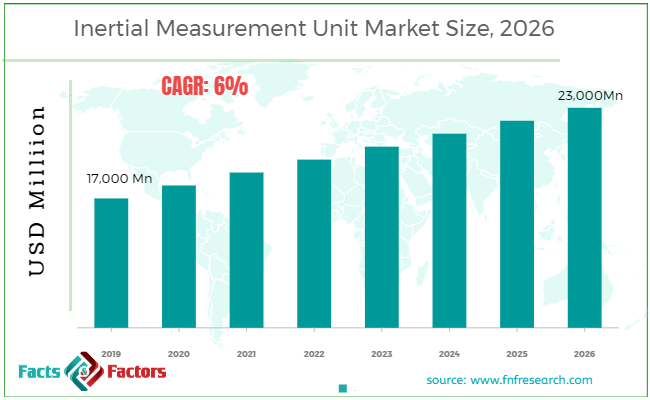

[110+ Pages Report] According to the report published by Facts Factors, the global inertial measurement unit market size was worth around USD 17,000 million in 2019 and is predicted to grow to around USD 23,000 million by 2026 with a compound annual growth rate (CAGR) of roughly 6% between 2020 and 2026. The report analyzes the global inertial measurement unit market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the inertial measurement unit market.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the inertial measurement unit market in our study.

Key Insights from Primary Research

Key Insights from Primary Research

- After exhaustive sessions of face-to-face and telephonic interviews with top executives working in the aerospace industry, we observed that the global IMU market is expected to see an enormous boost in aircraft application by 2026.

- As per an online survey done by our FnF team, the accelerometer is the most dominant product in the inertial measurement unit market and is expected to grow at a CAGR of 6% from 2020 to 2026.

- According to top researchers in the aerospace industry, they are focusing their attention on providing more stability to unmanned airplanes and quadcopters, and to achieve that researchers are continuously working on improvising the IMU system. In a recent development, researchers successfully integrated IMU with satellite connectivity resulting in enhanced stability and an increased range of UAVs.

- On the basis of application, customer electronics held the leading share at more than 29%, in 2019. According to the end-users of the IMU applications, increasing digitization and rising fitness awareness is the key to the growth of this segment.

- Based on the observation on test marketing, our analyst predicted that space launch vehicles application of the IMU industry is anticipated to bolster the global market with approximately 8% CAGR from 2020 to 2026.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analyst, increased demand for accurate and reliable navigation systems is expected to bring lucrative opportunities for new players in the global IMU market.

- Growing at a CAGR of around 8%, the customer electronic market is blooming in the global market this is going to create a lot of opportunities for the manufacturers to introduce new products in the market.

- Based on the data obtained through secondary research our analysts have anticipated that the Asia Pacific is the fastest-growing region with the biggest market share attributed to their rising investment in defense and automotive sectors, especially in China, Japan, and India.

- The significant CAGR of nearly 6% observed by the global inertial measurement unit market, is set to bring lucrative opportunities for the new players planning to enter the market. Some of the key opportunities include increasing fitness awareness in the population, inclination toward unmanned vehicles, and many more.

- Our analysts have identified accelerometer and customer electronics categories in the product and application sectors respectively, and are leading the inertial measurement unit industry. The growth is primarily attributed to the scope of enormous opportunities and innovations that can be done in the customer electronics segment.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the inertial measurement unit market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the inertial measurement unit market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the inertial measurement unit market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 17,000 Million |

Projected Market Size in 2026 |

USD 23,000 Million |

CAGR Growth Rate |

6% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Gladiator Technologies, General Electric Company, Honeywell International Inc, Northrop Grumman Corporation, LORD Sensing, VectorNav Technologies, Robert Bosch GmbH, Thales S.A, Safran Electronics & Defense, Teledyne Technologies, Inc, Trimble Inc, STMicroelectronics N.V., and Others |

Key Segment |

By Product, Technology, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The research study provides a critical assessment of the inertial measurement unit industry by logically segmenting the market on the basis of product, technology, application, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the inertial measurement unit industry includes the holistic bifurcation of all five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The IMU is an electronic monitoring device that records the angular velocity, physical power, and sometimes body orientation of a moving body by using a combination of gyroscopes, accelerometers, and magnetometers. IMUs are generally used to control aircraft, including engineless gliders, quadcopters and unmanned aerial vehicles (UAVs), GPS navigation, distance counter in smart phones, etc. The increase in sales and shipments of smartphones worldwide is one of the major factors driving the growth of the IMU market. As per the data released by International Data Corporation (IDC), the number of smartphones shipped in 2019 was 1,789.5 million, an increase of 10.5% compared to 1,557.7 million in 2018.

Additionally, growing awareness among the population related to their fitness and a huge number of fitness mobile applications and smartwatches available in the market is supporting the growth of the IMU industry. Moreover, they are being embedded in cloths, shoes, and even belts to get the location-related information of the end-user, this is one of the crucial steps towards women’s safety, as their family members will able to monitor them sitting at home. The governments are also investing in IMU, as the concern related to women’s safety is rising. The government is also investing in integrating the IMU system in military vehicles and aircraft and that is going to bolster IMU even more in the coming years.

The inertial measurement unit market is segmented based on the product, technology, and Application. On the basis of product segmentation, the market is classified into accelerometers, gyroscopes, and magnetometers. In terms of technology segmentation, the market is bifurcated into Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, MEMS, and Others. Application-wise, the market is further divided into aircraft, missiles, space launch vehicles, marine, military armored vehicles, consumer electronics, automotive, and others.

Some of the essential players operating in the inertial measurement unit industry, but not restricted to include:

Some of the essential players operating in the inertial measurement unit industry, but not restricted to include:

- General Electric Company

- Gladiator Technologies

- Honeywell International Inc

- Northrop Grumman Corporation

- LORD Sensing

- Robert Bosch GmbH

- Safran Electronics & Defense

- STMicroelectronics N.V.

- Teledyne Technologies

- Thales S.A

- Trimble Inc

- VectorNav Technologies

The taxonomy of the inertial measurement unit market by its scope and segmentation is as follows:

By ProductSegmentation Analysis

By ProductSegmentation Analysis

- Acceleromenter

- Gyroscope

- Magnetometer

Global Inertial Measurement Unit Market: By TechnologySegmentation Analysis

Global Inertial Measurement Unit Market: By TechnologySegmentation Analysis

- Mechnaical Gyro

- Ring Laser Gyro

- Fiber Optics Gyro

- MEMS

- Others

Global Inertial Measurement Unit Market: By Application Segmentation Analysis

Global Inertial Measurement Unit Market: By Application Segmentation Analysis

- Applications

- Aircraft

- Missiles

- Space Launch Vehicles

- Marine

- Military Armored Vehicles

- Consumer Electronics

- Automotive

- Others

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- General Electric Company

- Gladiator Technologies

- Honeywell International Inc

- Northrop Grumman Corporation

- LORD Sensing

- Robert Bosch GmbH

- Safran Electronics & Defense

- STMicroelectronics N.V.

- Teledyne Technologies

- Thales S.A

- Trimble Inc

- VectorNav Technologies

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors