Search Market Research Report

Industrial Food Blanchers Market Size, Share Global Analysis Report, 2025 - 2034

Industrial Food Blanchers Market Size, Share, Growth Analysis Report By Product (Drum Blanchers, Screw Blanchers, Belt Blanchers), By Application (Vegetables, Meat, Pasta, Nut), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

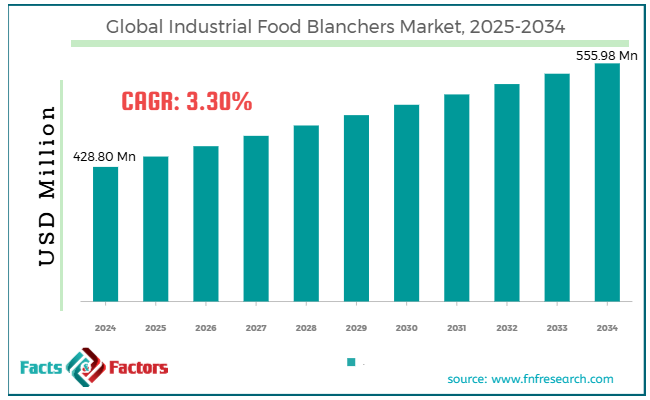

[221+ Pages Report] According to Facts & Factors, the global industrial food blanchers market size was worth around USD 428.80 million in 2024 and is predicted to grow to around USD 555.98 million by 2034, with a compound annual growth rate (CAGR) of roughly 3.30% between 2025 and 2034.

Market Overview

Market Overview

Industrial food blanchers are large-scale food processing machinery that quickly heat fruits, vegetables, and other products before further processing, like drying, freezing, or canning. The process usually comprises steaming or exposing food to water to destroy enzymes, preserve texture, color, and flavor, and guarantee food safety. The global industrial food blanchers market is anticipated to grow considerably over the estimated period owing to the increasing demand for convenience and processed foods, growing health awareness among a large population, technological improvements, and strict food safety rules.

With changing lifestyles, especially in the urban regions, the demand for ready-to-eat, canned, and frozen foods is also rising. Blanching is vital in making these foods more durable than other processes. Consumers are also becoming more aware of the importance of maintaining better health, favoring food items that are less processed. Blanching destroys harmful enzymes and retains the nutritional value of the food.

Moreover, improvements in water and steam blanchers, like automation, precise temperature controls, and energy efficiency, increase the machinery's appeal to producers. Furthermore, the blanching process helps food processors comply with regulatory standards, such as those of the EU and FDA, by ensuring product consistency and microbial safety.

Nevertheless, the global industry is restrained by growing energy usage, complicated maintenance and operation, and the prominence of alternative technologies. Blanching comprises steaming or heating water, demanding significant energy and increasing operational costs, mainly where energy prices are soaring. These machineries mostly demand a professional workforce for better operation and maintenance, thus increasing overhead expenses.

Additionally, technologies such as infrared or microwave heating may offer equivalent results, thereby reducing the demand for the blanching process. Yet, the global industrial food blanchers industry is well-positioned to develop energy-saving blanchers that incorporate smart technologies and grow in developing economies. Equipment that uses minimal water, electricity, or steam will gain significant traction among eco-friendly and cost-conscious food producers.

Moreover, artificial intelligence and IoT-based blanchers offer predictive maintenance, remote monitoring, and efficiency in real-time, thus improving efficiency. Also, regions like Latin America, Asia Pacific, and Africa are experiencing speedy urbanization and changes in dietary patterns, offering manufacturers unexplored potential.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global industrial food blanchers market is estimated to grow annually at a CAGR of around 3.30% over the forecast period (2025-2034)

- In terms of revenue, the global industrial food blanchers market size was valued at around USD 428.80 million in 2024 and is projected to reach USD 555.98 million by 2034.

- The industrial food blanchers market is projected to grow significantly owing to the burgeoning demand for processed food, the growing number of health-conscious consumers, and stringent food safety regulations.

- Based on product, the belt blanchers segment is expected to lead the market, while the drum blanchers segment is expected to grow considerably.

- Based on application, the vegetable segment dominates, while the meat segment is projected to witness sizeable revenue over the forecast period.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Growth Drivers

Growth Drivers

- Are growing flexibility and customization of equipment driving the growth of the industrial food blanchers market?

Blanchers handle various products like potatoes, leafy greens, nuts, tropical fruits, pasta, and legumes. Mid and small-scale processors need scalable, modular, and adjustable machinery.

More than 60% of modern industrial blanchers offer customizable settings, including temperature, time, pressure, and rotation. Moreover, these systems are easy to maintain and reduce downtime, decreasing the total cost of ownership by 20%.

Prominent firms like GEA Group, Bühler, and Heat and Control are introducing multi-products with substitutable components.

The demand for niche dietary trends like allergen-free products, gluten-free, and vegan products is forcing processors to modify blanchers to clean and process smaller batches.

- Technological improvements in blanching equipment propel the market growth

The current food processors demand energy-saving, faster, and scalable technologies. There is a rising inclination towards conventional water blanchers, microwave, steam, and hybrid systems that use less water and enhance productivity. Rising demand for these blanchers may fuel the overall industrial food blanchers market growth.

Innovative blanchers utilizing automation and sensors are projected to progress at a 5.5% CAGR, more than conventional systems. A few modern blanchers claim 35-40% less energy use than the former models.

OctoFrost launched an economic IFQ blanching system for vegetables and fruits, gaining prominence in Asia and Europe.

Lyco Manufacturing introduced blanchers, 'Clean-Flow®', with enhanced cleaning systems and reduced water use.

Restraints

Restraints

- Will nutrient loss during blanching negatively hamper the industrial food blanchers market progress?

Blanching, when not accurately handled, may lead to vital nutrient loss in foods. Minerals and vitamins may leach out or degrade during the process, impacting the nutritional quality of the end product.

Consumer worries regarding nutritional retention may hamper the adoption of blanching procedures, mainly in health-conscious regions. This may shift food processors' preference towards alternative preservation techniques that maintain nutritional quantity better.

Opportunities

Opportunities

- How will the integration of smart technologies contribute to the industrial food blanchers industry growth?

IoT, automation, and artificial intelligence are speedily changing the food processing market, and blanching machines are no exception. Producers could continuously monitor pressure, temperature, and water quality using IoT sensors, thus reducing downtime and ensuring consistency. AI-based predictive analysis can efficiently estimate possible breakdowns and maintenance requirements. This significantly extends the lifespan and reduces unplanned downtime of the blanching machine.

Moreover, machine learning algorithms can automatically regulate the blanching temperature and time, thereby enhancing the process of every batch. This leads to high throughput and better-quality products, impelling the global industrial food blanchers market.

Challenges

Challenges

- Environmental concerns and energy consumption restrict the growth of the market

Blanching processes, mainly conventional techniques, consume major amounts of water and electricity. This raises ecological concerns about waste generation and resource depletion and escalates operational costs.

The growing emphasis on energy efficiency and sustainability in the food processing market may offer challenges for the industry, demanding the creation of eco-friendly blanching solutions.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 428.80 Million |

Projected Market Size in 2034 |

USD 555.98 Million |

CAGR Growth Rate |

3.30% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

GEA Group, Bühler Group, Tetra Pak, Andritz AG, JBT Corporation, Heat and Control Inc., Apex Equipment, Alfa Laval, Krones AG, Turatti S.p.A., Multivac, Stalam S.p.A., Austropressen, FENCO Food Machinery, Zambelli, and others. |

Key Segment |

By Product, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global industrial food blanchers market is segmented based on product, application, and region.

Based on product, the global industrial food blanchers industry is divided into drum blanchers, screw blanchers, and belt blanchers. The belt blanchers segment led the market in previous years and is expected to lead in the future. The progressing potato processing industry, the high efficiency of belt blanchers, and the versatility majorly fuel the segmental growth. The advancing potato processing market is a leading driver, especially for highly demanded food items like French Fries. Belt blanchers are embedded with water-cooling solutions that ensure accurate temperature control, improving overall product quality. These blanchers offer improved throughput and even heat distribution, making them suitable for many large-scale operations. They are also ideal for a broad range of food products, comprising fruits, seafood, and vegetables.

On the other hand, the drum blanchers segment is expected to grow considerably, backed by its simplicity in operation and performance, and high suitability in a broad range of products.

Based on application, the global industrial food blanchers industry is segmented into vegetables, meat, pasta, and nuts. The vegetable blanching category led the global market in 2024 and is expected to flourish. The segmental growth is attributed to the growing demand for dietary and health preservation, as well as convenience. The rising adoption of vegan lifestyles and plant-based diets has positively fueled the demand for vegetable-based foods. Blanched vegetables are vital for frozen, ready-to-eat, and canned foods, which satisfy the rising consumer preference for convenience. The process also helps in preserving the flavor, color, and nutritional value of vegetables, increasing their appeal among consumers.

Regional Analysis

Regional Analysis

- What factors will aid Asia Pacific in witnessing significant growth in the industrial food blanchers market?

Asia Pacific dominated the global industrial food blanchers market in the past years and is expected to continue its dominance in the future, owing to urbanization and economic growth, improvements in food processing infrastructure, and growing demand for convenience foods. Nations like China and India are experiencing significant economic growth, leading to increased spending and demand for easy-to-prepare, processed, and convenience foods. The rising urban population is fueling the demand for easy and ready meals, which ultimately drives the demand for effective food processing technologies, including blanching.

Furthermore, high investments are made in transportation infrastructure and cold storage, which boosts the availability and the shelf life of processed food products. Adopting energy-efficient and automated blanching equipment is advancing product quality and production efficiency. Consumers in the Asia Pacific prefer easy and quick meal solutions due to busy lifestyles, resulting in increased demand for ready-to-eat and frozen foods.

Moreover, blanching is vital in preserving the flavor, color, and nutritional value of fruits and vegetables, increasing their significance for producing superior-quality frozen food products.

North America holds a second-leading position in the global industrial food blanchers industry, owing to its strong presence in the frozen food sector, energy-efficient equipment and automation adoption, and consumer demand for convenience food products. The region, particularly the United States, is a forerunner in the worldwide frozen food industry, which is a significant propeller for market growth. Blanching is crucial in making frozen foods, especially fruits and vegetables.

Additionally, the region is at the forefront of technological advancements in food processing. North America heavily invests in automation, artificial intelligence, and energy-saving systems in manufacturing food, including blanching solutions.

In addition, changing consumer lifestyles, mainly in urban regions and smart cities, with surging preference for quick meals and convenience, are a leading driver of the regional market. Pre-cooked and frozen foods are highly demanded because of minimal preparation or cooking and high convenience.

Competitive Analysis

Competitive Analysis

The global industrial food blanchers market is led by players like:

- GEA Group

- Bühler Group

- Tetra Pak

- Andritz AG

- JBT Corporation

- Heat and Control Inc.

- Apex Equipment

- Alfa Laval

- Krones AG

- Turatti S.p.A.

- Multivac

- Stalam S.p.A.

- Austropressen

- FENCO Food Machinery

- Zambelli

Key Market Trends

Key Market Trends

- Customization and flexibility:

Food processors need blanching machines that can efficiently manage various food products and better accommodate different processing needs. Producers are actively offering customized blanchers with adjustable parameters, versatile potential, and modular designs to satisfy the diverse needs of the global food processing market.

- Hybrid blanching solutions:

Developing hybrid solutions like infrared, microwave, high-humidity hot air temperature, and radio frequency blanching are offering key opportunities to industry players. These hybrid processes blend two blanching techniques to address the restrictions of a single process. This enhances processing efficacy and product quality.

The global industrial food blanchers market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Drum Blanchers

- Screw Blanchers

- Belt Blanchers

By Application Segment Analysis

By Application Segment Analysis

- Vegetables

- Meat

- Pasta

- Nut

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- GEA Group

- Bühler Group

- Tetra Pak

- Andritz AG

- JBT Corporation

- Heat and Control Inc.

- Apex Equipment

- Alfa Laval

- Krones AG

- Turatti S.p.A.

- Multivac

- Stalam S.p.A.

- Austropressen

- FENCO Food Machinery

- Zambelli

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors