Search Market Research Report

Indoor Plant Market Size, Share Global Analysis Report, 2025 – 2034

Indoor Plant Market Size, Share, Growth Analysis Report By Type (Shade-Loving Plants, Low Light Plants, High Light Plants), By Product Type (Succulent Plants, Herbaceous Plants, Woody Plants, and Others), By Application (Absorption of Harmful Gasses, Home Decoration), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

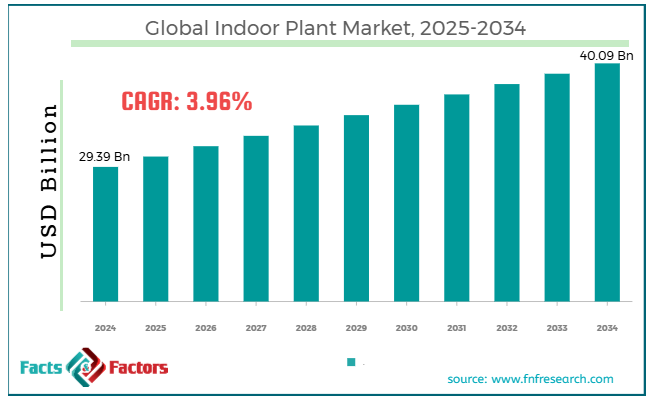

[221+ Pages Report] According to Facts & Factors, the global indoor plant market size was worth around USD 29.39 billion in 2024 and is predicted to grow to around USD 40.09 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.96% between 2025 and 2034.

Market Overview

Market Overview

Indoor plants are the flora grown inside offices, homes, and other interior spaces for health, decorative, and psychological benefits. They improve air quality by filtering pollutants, contribute to enhanced mental wellbeing and stress reduction, and add aesthetic appeal. Indoor plants have gained popularity among consumers seeking more mindful and eco-friendly living spaces, coinciding with the rise of wellness trends and urbanization. The global indoor plant market is projected to experience significant growth over the coming years, driven by an increasing awareness of the health benefits and air-purification capabilities of indoor plants. Plants like spider plants, areca palms, and peace lilies are believed to enhance indoor air quality by eliminating VOCs and improving oxygen levels. This benefit leads to a higher adoption of indoor plants as a passive wellness strategy.

Moreover, home-focused lifestyle induced by COVID-19 and wellness-based work environments are a few other leading drivers of the market. Indoor plants have become a vital tool for enhancing the beauty of spaces and promoting mental well-being, sustaining healthy demand post-pandemic. During lockdowns, people spent more time at home, which raised interest in indoor gardening.

Additionally, corporations are investing in wellness programs for employees that enhance concentration, incorporate natural greenery, and reduce employee fatigue. Such offices are admired and are linked to greater productivity and improved employee retention.

However, the global market is limited by light and space constraints in urban areas, as well as the complexity of plant maintenance. Even though indoor plants are suitable for space-constrained apartments, the airflow and sunlight in many homes limit plant choices. Low-light selection of plants addresses this issue, but limitations still exist for large or tropical ornamental plants. Also, high-maintenance plants demand extra time and energy. Users usually prefer low-effort decoration, which makes them more hesitant to grow plants that need repeated attention, thus limiting market growth.

Still, the global indoor plant industry is anticipated to progress notably over the estimated period owing to tech-based smart gardening, stylish and sustainable plant accessories, and association with interior designers. The integration of AI and IoT into plant care presents significant opportunities for tech-savvy users. These tools help automate watering, monitor plant health, and reduce maintenance.

Moreover, there is a growing demand for recycled, biodegradable pots, eco-friendly filters, and sustainable packaging. This trend aligns well with value-oriented consumers who adore sustainability and beauty. Partnerships between nurseries and interior design companies yield services that seamlessly integrate lighting, furniture, and greenery within an interconnected home environment.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global indoor plant market is estimated to grow annually at a CAGR of around 3.96% over the forecast period (2025-2034)

- In terms of revenue, the global indoor plant market size was valued at around USD 29.39 billion in 2024 and is projected to reach USD 40.09 billion by 2034.

- The indoor plant market is projected to grow significantly owing to mounting interest in biophilic design, the substantial impact of lifestyle trends, and corporate wellness initiatives.

- Based on type, the low-light plants segment is expected to lead the market, while the shade-loving plants segment is expected to grow considerably.

- Based on product type, the succulent plants is the dominating segment, while the herbaceous plants segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the home decoration segment is expected to lead the market compared to the absorption of harmful gases segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- Environmental benefits and air purification fuel the market growth

Indoor air quality is a growing priority, particularly in densely populated regions. Indoor plants absorb harmful pollutants, such as formaldehyde, carbon monoxide, and benzene, thereby enhancing humidity and improving air quality. According to a 2024 study by the World Green Building Council, workstations with indoor greenery experienced a 15% growth in employee productivity and a 30% decrease in carbon dioxide levels.

High-pollution nations like China and India are experiencing an increasing adoption of air-purifying plants, such as the Snake Plant, Peace Lily, and Areca Palm. This surging consumer preference is projected to accelerate as the global climate crisis rises.

- Commercial and corporate adoption of biophilic design fuels the market growth

The increasing integration of biophilic design in commercial spaces is a significant driver for the indoor plant market. Hotels, offices, hospitals, and educational institutes are embracing and arranging indoor plants to reduce stress, enhance aesthetics, and boost productivity. According to a 2024 report by the International WELL Building Institute, companies that incorporate greenery into their spaces experience a 12% increase in employee satisfaction and a 20% decrease in absenteeism. Amazon and Google have expanded their biophilic office design programs to global campuses, underscoring their primary objective of employee wellness. This is projected to drop down to the startups and SMEs, boosting B2B demand for indoor plants.

Restraints

Restraints

- Vulnerability to plant diseases and pests unfavorably impacts market progress

Indoor plants are susceptible to pests like aphids, spider mites, whiteflies, and fungal infections. Once infected, plants may release a foul odor, become a source of irritation, and trigger allergic reactions, especially in confined spaces. Additionally, overwatering or improper storage of soil can lead to mold growth, which may cause respiratory issues, particularly for individuals with sensitive respiratory systems.

This led to a few consumers avoiding indoor plants, particularly in homes with children and pets. The lack of broader access to affordable, plant-safe pest control solutions remains a growing concern, particularly in developing regions.

Opportunities

Opportunities

- Integration with lifestyle, wellness, and gifting industries remarkably influences the market growth

Indoor plants are often regarded as wellness accessories, popular gift items, and lifestyle products for special occasions, such as holidays, corporate events, and housewarmings. This offers opportunities for hurrying products like plants with books, interior décor, aromatherapy kits, and plant care items, thus positively affecting the growth of the indoor plant industry.

A 2023 Shopify retail insights report revealed that sales of plant subscription boxes and gift plants increased by 31 percent annually, primarily during special events and the festive season. Leading companies are embracing this trend by offering personalized messages, customizable packaging, and theme-based plant sets, such as 'Desk Detox,' 'Love in Bloom,' and 'Zen Corner.' This is fueling the revenue from emotional gifting and impulse buying, mainly in e-commerce and digital-first networks.

Challenges

Challenges

- Logistic and high transportation fragility may limit the market progress

Indoor plants are delicate and living goods that require special transportation and packaging conditions, such as cushioning, humidity regulation, and temperature control, especially when traveling over long distances in extreme climates.

An IBISWorld report found that nearly 25-30% of online plant deliveries witness some damage, resulting in negative customer experiences, high return rates, and logistical issues. These problems are more severe than those caused by imported and rare plants that are transported across borders.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 29.39 Billion |

Projected Market Size in 2034 |

USD 40.09 Billion |

CAGR Growth Rate |

3.96% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

The Sill, Bloomscape, Patch Plants, Costa Farms, Leaf Envy, Plants.com, Rooted, Lazy Flora, Lively Root, UrbanStems (Indoor Plant Division), PlantVine, Greendigs, House of Plants, Nature Hills Nursery, and Click & Grow.The Sill, Bloomscape, Patch Plants, Costa Farms, Leaf Envy, Plants.com, Rooted, Lazy Flora, Lively Root, UrbanStems (Indoor Plant Division), PlantVine, Greendigs, House of Plants, Nature Hills Nursery, Click & Grow., and others. |

Key Segment |

By Type, By Product Type, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global indoor plant market is segmented based on type, product type, application, and region.

Based on type, the global indoor plant industry is divided into shade-loving plants, low light plants, and high light plants. The 'low light plants' segment led the market in the past year and is expected to lead in the future. These plants, such as snake plants, ZZ plants, and pothos, are adaptable and can thrive in low light conditions, making them suitable for homes with limited natural light, as well as urban apartments and offices. Their low-maintenance nature attracts beginners and people with hectic schedules, which notably drives their prominence.

Based on product type, the global indoor plant market is segmented into succulent plants, herbaceous plants, woody plants, and others. The ‘succulent plants’ segment held a majority share due to their minimal water requirements, compact size, attractive appearance, and wide variety, which make them popular among young consumers, urban dwellers, and beginners. Species like Echeveria, Vera, and Jade plants lead the way in the gifting and online sales categories. These plants are highly familiar in North America and the Asia Pacific due to their ease of care and trendiness.

Based on application, the global market is segmented into absorption of harmful gases and home decoration. Home decoration is the dominating segment in the market. Indoor plants are vital elements of modern interior design, personalizing living spaces, introducing natural elements, and embracing ambiance. The rising impact of lifestyle blogs, biophilic design trends, and social media has increased the desirability of decorative plants, mainly among Gen Z and millennial consumers. These factors contribute to the segment's dominance in absorbing harmful gases.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America holds a dominant share of the global indoor plant market due to high urbanization and apartment living, as well as the popularity of plant subscription services and strong adoption of home décor and DIY trends. North America holds a leading urbanization rate of over 85%. Urban dwellers typically reside in flats with limited outdoor space, driving the demand for compact indoor plants. Snake plants, pothos, and succulents are widely popular in metro cities like Toronto, Los Angeles, and New York.

The region also boasts an established e-commerce infrastructure, with prominent companies like Bloomscape, The Sill, and Léon & George offering handpicked plant delivery services, subscription models, and care guides. Canada and the United States have a thriving home décor industry, estimated to be worth over $190 billion, with indoor plants leading the way, among others. Users are incorporating greenery into home makeovers and DIY projects, influenced by home renovation trends and social media, thereby boosting the sales of indoor plants.

Asia Pacific is expected to progress as the second-leading region in the global indoor plant industry. This growth is driven by the expansion of real estate and urbanization, the growth of the middle class, and increasing awareness of public health and air pollution. Asia Pacific is witnessing notable urban growth and development, with over 50 percent of its population residing in urban areas. Cities like Tokyo, Mumbai, Shanghai, and Seoul are experiencing a surge in high-rise living, thereby increasing the demand for compact living spaces and indoor greenery.

The APAC middle class is rapidly expanding, with a projected 1.5 billion middle-income consumers by 2030. Changing lifestyles and growing disposable income have increased spending on health, wellness, and home décor. This contributes to the growth of plant sales, primarily in Vietnam, Indonesia, and India.

Furthermore, cities in Asia experience severe air quality concerns. Hence, there is a rising shift towards enhancing air quality with plants like areca palms, spider plants, and peace lilies. This familiarity has led to widespread adoption in schools, offices, and homes.

Competitive Analysis

Competitive Analysis

The leading players in the global indoor plant market are:

- The Sill

- Bloomscape

- Patch Plants

- Costa Farms

- Leaf Envy

- Plants.com

- Rooted

- Lazy Flora

- Lively Root

- UrbanStems (Indoor Plant Division)

- PlantVine

- Greendigs

- House of Plants

- Nature Hills Nursery

- and Click & Grow.The Sill

- Bloomscape

- Patch Plants

- Costa Farms

- Leaf Envy

- Plants.com

- Rooted

- Lazy Flora

- Lively Root

- UrbanStems (Indoor Plant Division)

- PlantVine

- Greendigs

- House of Plants

- Nature Hills Nursery

- Click & Grow.

Key Market Trends

Key Market Trends

- Growth of tech-integrated and smart plant care:

Smart pots embedded with sensors that track light levels, soil moisture, and temperature are gaining prominence. Connected applications offer watering reminders and real-time care tips, simplifying care for both tech-savvy users and beginners. This blend of gardening and technology is fueling the industry by minimizing maintenance obstacles.

- Popularity of exotic and rare plant varieties:

There is a notable surge in demand for visually appealing and rare plants, such as fiddle-leaf figs, variegated monstera, and string of pearls. Social media influencers and collectors fuel this trend, changing rare plants into status symbols. This creates a premium niche industry with high price points and specialty nurseries.

The global indoor plant market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Shade-Loving Plants

- Low Light Plants

- High Light Plants

By Product Type Segment Analysis

By Product Type Segment Analysis

- Succulent Plants

- Herbaceous Plants

- Woody Plants

- Others

By Application Segment Analysis

By Application Segment Analysis

- Absorption of Harmful Gasses

- Home Decoration

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- The Sill

- Bloomscape

- Patch Plants

- Costa Farms

- Leaf Envy

- Plants.com

- Rooted

- Lazy Flora

- Lively Root

- UrbanStems (Indoor Plant Division)

- PlantVine

- Greendigs

- House of Plants

- Nature Hills Nursery

- and Click & Grow.The Sill

- Bloomscape

- Patch Plants

- Costa Farms

- Leaf Envy

- Plants.com

- Rooted

- Lazy Flora

- Lively Root

- UrbanStems (Indoor Plant Division)

- PlantVine

- Greendigs

- House of Plants

- Nature Hills Nursery

- Click & Grow.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors