Search Market Research Report

Hand Tools Market Size, Share Global Analysis Report, 2025 – 2034

Hand Tools Market Size, Share, Growth Analysis Report By Products (Screwdrivers, Spanners, Clamps, Flyers, Household Tools, Grease, Guns, Wrenches, Hammers, Gauges, Metal Working Tools, And Others), By Applications (Home Use, Professional, And Industrial), By Distribution Channels (Online And Offline), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

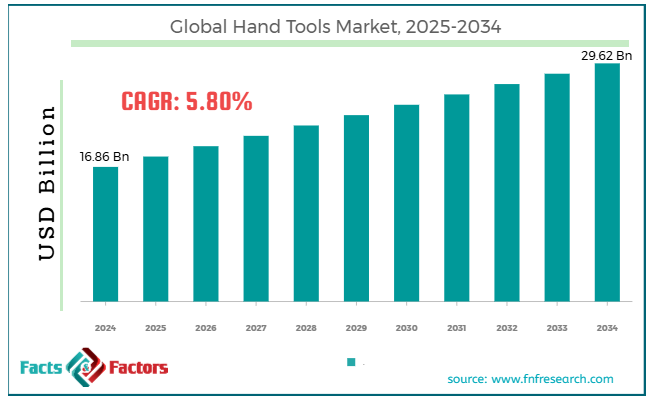

[221+ Pages Report] According to Facts & Factors, the global hand tools market size was valued at USD 16.86 billion in 2024 and is predicted to surpass USD 29.62 billion by the end of 2034. The hand tools industry is expected to grow by a CAGR of 5.80% between 2025 and 2034.

Market Overview

Market Overview

Hand tools refer to the manual tools used by humans to perform everyday tasks like tightening, shaping, cutting, measuring, and assembling. These tools do not depend on any external power sources like motors or batteries. Hand tools are widely used in woodworking, automotive, construction, plumbing, and many other home improvement projects. These are portable, durable, and low-maintenance products as compared to power tools.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global hand tools market size is estimated to grow annually at a CAGR of around 5.80% over the forecast period (2025-2034).

- In terms of revenue, the global hand tools market size was valued at around USD 16.86 billion in 2024 and is projected to reach USD 29.62 billion by 2034.

- Surge in infrastructure development is driving the growth of the global hand tools market.

- Based on the products, the spanners segment is growing at a high rate and is projected to dominate the global market.

- Based on applications, the industrial segment is anticipated to grow with the highest CAGR in the global market.

- Based on the distribution channels, the online segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Surge in infrastructure development is driving the growth of the global market.

Urbanization in developing and underdeveloped countries is a prime factor fueling the growth of the global hand tools market. Developing regions are witnessing a surge in heavy infrastructure projects, including highways, metro lines, smart cities, and airports, which is fueling the global demand for hand tools. Rural housing schemes in countries like India are further strengthening the demand in the market, particularly in remote and semi-urban areas. The rise of auto service and OEM centers is further posing a high demand for specialized tools like socket sets, torque wrenches, etc.

The emergence of electric vehicles is expected to revolutionize the market by introducing specialized insulated hard tools for electric systems. Roadside assistance services are also eventually contributing to the high sales of hand tools in the market. The Western market has taken the industry by storm because of the spike in self-home renovation activities. The DIY retail ecosystem boasts the sales of seasonal toolkits and combo packs.

However, this trend is fueled by social media influencers and content creators on YouTube and other social media channels. Also, the ongoing industrialization in emerging markets is supporting the growth of the market. There are heavy investments in manufacturing hubs, industrial parks, and export processing zones, which are anticipated to develop the market further. For instance, Smith's Group successfully acquired Modular Metal Fabricators and Wattco in 2024 for 110 million dollars. This strategic action is aimed at strengthening the company's position in America.

Restraints

Restraints

- Increasing preference for power tools is expected to restrict the growth of the market.

People nowadays are looking forward to electric and battery-powered tools, particularly in professional applications. The emergence of cordless power tools is lowering the dependency on manual hand tools. Automation in assembly lines and manufacturing hubs is further slowing down the growth of the hand tools industry.

Opportunities

Opportunities

- Innovation and technology integration are expected to foster growth opportunities in the global market.

The emergence of multifunctional tools and foldable kits is expected to foster numerous growth opportunities in the global hand tools market. Manufacturers are trying to incorporate more ergonomic designs and functions like lightweight alloys and anti-vibration handles to help users achieve high comfort. However, the innovation of advanced features in hand tools, like digital readouts and RFID tags, is further expected to revolutionize the market.

Furthermore, the shift towards more eco-friendly and durable products is also widening the scope of the market. Many brands are incorporating recycled materials into their products to reduce their carbon footprint, thereby attracting environmentally conscious customers. This landscape is therefore expected to accelerate the growth of industry in the coming years.

For instance, Great Star USA announced its intention to acquire SK Professionals Tools in 2021. Great Star is attempting to strengthen its manufacturing base in the US, while also expanding its distribution channels.

Challenges

Challenges

- Substandard tools are a big challenge in the global market.

The high influx of low-grade tools is a big challenge in the hand tools industry. Also, the counterfeiting of products leads to high failure rates and customer dissatisfaction issues. Also, it undermines the credibility of well-known bands. Therefore, such a landscape is expected to negatively influence the growth of the market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 16.86 Billion |

Projected Market Size in 2034 |

USD 29.62 Billion |

CAGR Growth Rate |

5.80% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Emil Lux GmbH & Co. KG, Weidmuller Interface GmbH and Co. KG, KNIPEX Group, Fluke Corporation, Klein Tools, Snap-On Inc., Milwaukee Tool Corporation, MISUMI Group Inc., Robert Bosch GmbH, Stanley Black and Decker, and others. |

Key Segment |

By Products, By Applications, By Distribution Channels, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global hand tools market can be segmented into products, applications, distribution channels, and regions.

On the basis of products, the market can be segmented into screwdrivers, spanners, clamps, flyers, household tools, grease, guns, wrenches, hammers, gauges, metal working tools, and others. Spanners are expected to be the fastest-growing segment in the hand tools industry. The consumption pattern shows a strong demand for spanners in the automotive industry, as these are indispensable tools for maintenance and assembly tasks. The emergence of modern precision tools, such as spanners, is expected to further boost the segment's growth. Spanners find a majority of the functions in the oil & gas, construction, and mining sectors because of their high torque and precision.

Moreover, DIY is a pivotal trend reshaping the market, particularly across Europe and North America. Consumers are posing a strong demand for multifunctional spanner sets. Product innovations, such as ergonomic and smart designs, are expected to further enhance its appeal in the market by improving safety and efficiency. Additionally, manufacturers are making efforts to come up with advanced materials.

For instance, manufacturers are using chrome vanadium steel and anticorrosive coatings to make these panels more durable. Companies are also working on torque accuracy, which is also expected to widen the scope of the segment in the coming years.

On the basis of applications, it can be segmented into home use, professional, and industrial. The industrial segment is anticipated to dominate the global hand tools market during the forecast period. Mega projects across developing economies are emerging as a transformative force in the market. These mega projects and other similar infrastructural developments require comprehensive hand tools. The government is expediting its public works projects like the construction of railways, smart cities, and bridges, which is also anticipated to fuel the growth of the segment.

Also, the aerospace and automotive sector is a significant adopter of hand tools because of the increasing number of service workshops, OEMs, and assembly lines, which utilize an array of hand tools ranging from flyovers and spanners to torque and wrenches.

However, the surging demand for electric fields is creating numerous growth opportunities. This development is expected to encourage manufacturers to come up with exclusive tools with all-new specifications, which in turn is also expected to positively influence the growth of the segment.

On the basis of distribution channels, the market can be segmented into online and offline. The online segment is likely to account for the largest share of the hand tools industry during the forecast period. The fast expansion of farmers across the globe is likely to solidify the growth of the segment in the market. Online platforms like Amazon, Alibaba, and eBay offer a wide range of products for selection.

Moreover, online shopping offers doorstep delivery at affordable pricing, which further attracts consumers. The local e-commerce ecosystem is becoming a significant transformative force in the market. Platforms like JD.com and Flipkart are targeting tier III and tier II cities to enhance customer accessibility to these products.

Also, the significant shift in consumer behavior towards hand tools is expected to further revolutionize the market. Small businesses and DIY users are purchasing advanced tools for their convenience. Therefore, all these factors are expected to fuel the growth of the segment in the coming years.

Regional Analysis

Regional Analysis

- North America is expected to dominate the global market.

The North American market is poised for steady growth in the global hand tool market during the forecast period. Fast-growing infrastructural construction is paving the way for exponential market growth. Also, the rising trend of DIY culture is encouraging US homeowners to increase their spending on hand tools. Increasing home renovation activities, particularly with DIY projects, are also supporting the growth trajectory of the industry in North America.

However, the US leads the market as the region boasts a well-developed industrial sector. The presence of strong market players is likely to further widen the scope of the market because of their commitment to innovation and quality. Canada is also projected to witness exceptional CAGR growth during the forecast period. Technological advancements are one of the major factors supporting the growth of the market. Canada is witnessing higher demand from the manufacturing and construction sectors, which is further expected to positively influence the global hand tools market's growth.

Asia-Pacific is also a leading region expected to see growth in the coming years because of its strong manufacturing sector. China is the largest exporter of hand tools, which is expected to solidify the regional market's growth. India is also an emerging market, as the construction sector in the region is projected to witness a high valuation over the coming years. Japan is contributing heavily towards the growth of the regional market because of its high consumption of hand tools in recent years.

The automotive sector in Japan is the largest consumer of specialized hand tools. Therefore, such a landscape is expected to lead the market in APAC in the coming years. For instance, Stanley Black & Decker came up with the Powershift cordless equipment system in 2024. It comprises a 554-watt-hour battery. It is expected to lower the carbon emissions by 60%.

Competitive Analysis

Competitive Analysis

The key players in the global hand tools market include:

- Emil Lux GmbH & Co. KG

- Weidmuller Interface GmbH and Co. KG

- KNIPEX Group

- Fluke Corporation

- Klein Tools

- Snap-On Inc.

- Milwaukee Tool Corporation

- MISUMI Group Inc.

- Robert Bosch GmbH

- Stanley Black and Decker

For instance, Techtronic Industries Ltd. has revealed its plan to set up a new manufacturing facility in West Bend in 2020. This facility is expected to assist manufacturers in getting space to innovate advanced hand-operated tools.

The global hand tools market is segmented as follows:

By Products Segment Analysis

By Products Segment Analysis

- Screwdrivers

- Spanners

- Clamps

- Flyers

- Household Tools

- Grease

- Guns

- Wrenches

- Hammers

- Gauges

- Metal Working Tools

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Home Use

- Professional

- Industrial

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Online

- Offline

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Emil Lux GmbH & Co. KG

- Weidmuller Interface GmbH and Co. KG

- KNIPEX Group

- Fluke Corporation

- Klein Tools

- Snap-On Inc.

- Milwaukee Tool Corporation

- MISUMI Group Inc.

- Robert Bosch GmbH

- Stanley Black and Decker

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors