Search Market Research Report

Healthcare Data Interoperability Market Size, Share Global Analysis Report, 2021 – 2026

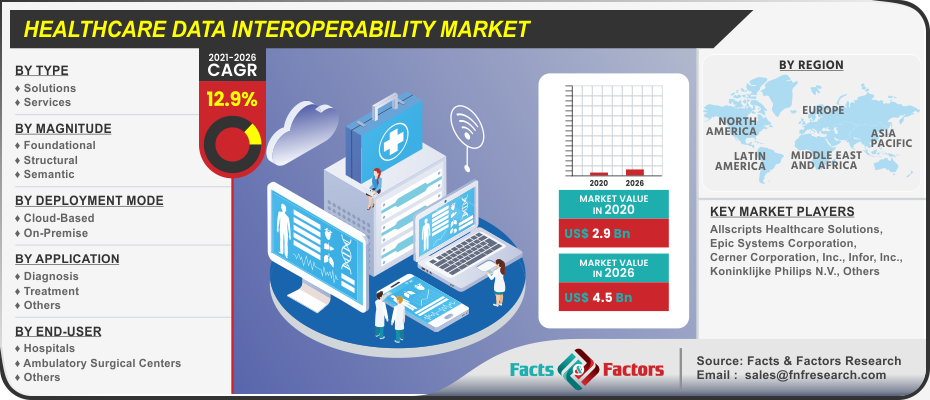

Healthcare Data Interoperability Market By Type (Solutions & Services), By Magnitude (Foundational, Structural, &Semantic), By Deployment Mode (Cloud Based & On Premise), By Application (Diagnosis, Treatment, & Others), By End-User (Hospitals, Ambulatory Surgical Centers, & Others), And By Regions ¬ Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

[197+ Pages Report] The latest finding surrounding the Global Healthcare Data Interoperability Market published by Facts & Factors offers a neatly packaged and comprehensive read. We at Facts & Factors estimated the market surrounding the global healthcare data interoperability market to reach a value of USD 4.5 Billion by 2026 with a growth rate of 12.9% CAGR from an initial value of USD 2.9 Billion in the year 2020.

Market Overview

Market Overview

Interoperability in healthcare refers to the interpreted capacity of devices and equipment in order to interchange and utilize electronic data that is often harvested from other systems without the aid of any human interactions. Generally speaking, interoperability in the healthcare sector is the process of automating systems in order to reduce errors. Interoperability can also aid in increasing patient care standards for offering customized healthcare plans and effective population health management measures.

Industry Growth Factors

Industry Growth Factors

The factors expected to drive the growth of the global healthcare data interoperability market are the rising need for curbing increasing healthcare costs coupled with increasing government initiatives for improving patient care to name a few. Additionally, factors pertaining to rising demands for mobilizing patient care data coupled with carefully implemented healthcare data interoperability systems leading to efficient and correspondent patient care are expected to increase the footprint of the global healthcare data interoperability market during the advent of the forecast. Moreover, the rising demand for transparency among consumers regarding patient data and treatment plans coupled with increasing technological advancements in the sector of healthcare IT is expected to fuel the growth of the global healthcare data interoperability market during the advent of the forecast.

The global healthcare data interoperability market is expected to be driven by factors such as a higher adoption rate of HER software coupled with rising demand for personalized healthcare systems to name a few. Factors such as the rising sector of e-prescribing coupled with increasing adoption of updating existing systems to integrate interoperability solutions are expected to increase the consumer boundary for the global healthcare data interoperability market during the advent of the forecast. However, a higher cost of implementation coupled with low awareness regarding interoperability software is expected to hamper the growth of the global healthcare data interoperability market during the advent of the forecast.

Segmentation Analysis

Segmentation Analysis

The global healthcare data interoperability market is segmented into type, magnitude, deployment mode, application, end-user, and region.

On the basis of type, the global healthcare data interoperability market is bifurcated into solutions and services. The services segment is expected to witness the largest market share during the advent of the forecast owing to the rising adoption of cloud computing and cloud-based platform services coupled with reducing operational costs for better and efficient performance measures to name a few. On the basis of magnitude, the global healthcare data interoperability market is divided into foundational, structural, and semantic. The structural category is expected to witness the largest market share during the advent of the forecast owing to favorable government initiatives coupled with a higher level of robust operation when compared to its counterparts to name a few. On the basis of deployment mode, the global healthcare data interoperability market is fragmented into cloud-based and on-premise. The segment pertaining to on-premise deployment is expected to occupy the largest market share during the advent of the forecast owing to rising demand for data exchange services due to rising e-prescribing measures coupled with increasing integration of on-premise installation within hospitals having multiple specialty departments owing to the rapid exchange of relevant information to name a few. Based on application, the global healthcare data interoperability market is classified into diagnosis, treatment, and others. The diagnosis segment is expected to witness the largest market share during the advent of the forecast owing to the rising need for effective solutions for handling an increased flow of information about the diagnosis for diseases coupled with an increasing need for accurate and timely diagnosis to name a few. On the basis of end-user, the global healthcare data interoperability market is branched into hospitals, ambulatory surgical centers, and others. The segment pertaining to hospitals is expected to witness the largest market share during the advent of the forecast owing to favorable government policies coupled with the rising number of qualified professionals to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 2.9 Billion |

Projected Market Size in 2026 |

USD 4.5 Billion |

CAGR Growth Rate |

12.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Allscripts Healthcare Solutions, Epic Systems Corporation, Cerner Corporation, Inc., Infor, Inc., Koninklijke Philips N.V., Orion Health Group Limited, Quality Systems, Inc., OSP Labs, Inc., InterSystems Corporation, iNTERFACEWARE, Jitterbit, and ViSolve among others. |

Key Segments |

Type, Magnitude, Deployment Mode, Application, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast owing to the rising demand for efficient healthcare services coupled with a surging need to reduce incremental healthcare costs to name a few. Additionally, a well-established healthcare infrastructure coupled with the increasing adoption of EHR solutions is expected to increase the footprint of the healthcare data interoperability market during the advent of the forecast. Moreover, increasing demand for rapid healthcare services coupled with the implementation of favorable government policies is expected to boost the growth of the healthcare data interoperability market during the forecast period. Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast owing to the rising sector of medical tourism coupled with increasing demand for quality healthcare to name a few.

Competitive Players

Competitive Players

The key market participants for the global healthcare data interoperability market are :

- Allscripts Healthcare Solutions

- Epic Systems Corporation

- Cerner Corporation Inc.

- Infor Inc.

- Koninklijke Philips N.V.

- Orion Health Group Limited

- Quality Systems Inc.

- OSP Labs Inc.

- InterSystems Corporation

- iNTERFACEWARE

- Jitterbit

- ViSolve

By Type Segment Analysis

By Type Segment Analysis

- Solutions

- Services

By Magnitude Segment Analysis

By Magnitude Segment Analysis

- Foundational

- Structural

- Semantic

By Deployment Mode Segment Analysis

By Deployment Mode Segment Analysis

- Cloud-Based

- On-Premise

By Application Segment Analysis

By Application Segment Analysis

- Diagnosis

- Treatment

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Ambulatory Surgical Centers

- Others

Table of Content

Industry Major Market Players

- Allscripts Healthcare Solutions

- Epic Systems Corporation

- Cerner Corporation Inc.

- Infor Inc.

- Koninklijke Philips N.V.

- Orion Health Group Limited

- Quality Systems Inc.

- OSP Labs Inc.

- InterSystems Corporation

- iNTERFACEWARE

- Jitterbit

- ViSolve

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors