Search Market Research Report

Flavors and Fragrance Market Size, Share Global Analysis Report, 2021 – 2026

Flavors and Fragrance Market By Type (Flavors & Fragrances), By Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceutical, Home & Floor Care, Fine Fragrances, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

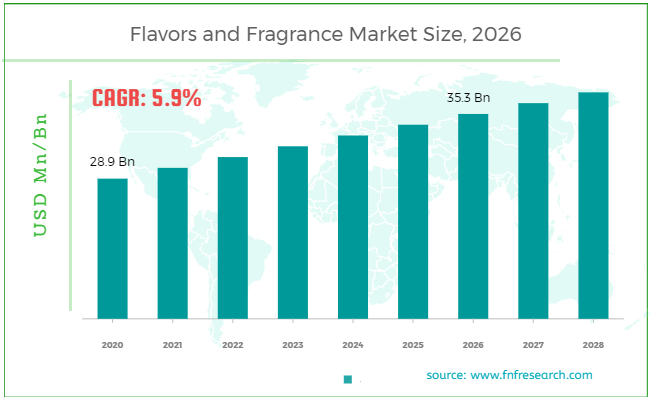

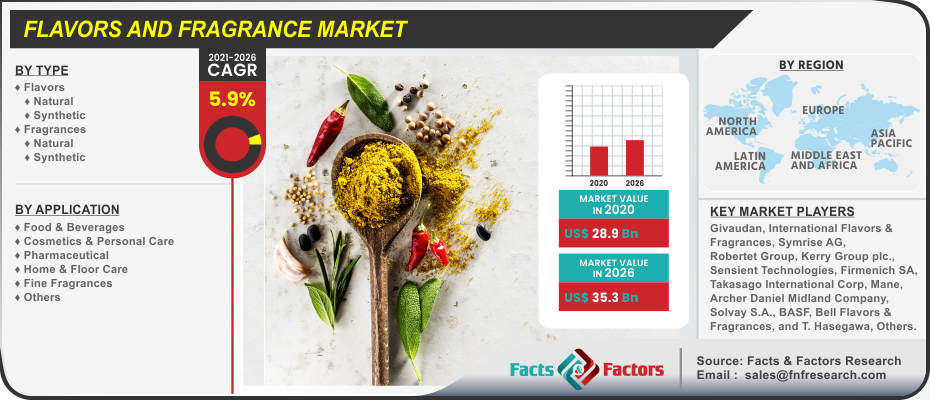

[209+ Pages Report] The latest market study surrounding the Global Flavors and Fragrance Market published by Facts & Factors offers complete market statistics and analytics. We at Facts & Factors estimate that the global flavors and fragrance market will reach a projected value of USD 35.3 Billion by 2026 growing at a CAGR of 5.9% from an initial value of USD 28.9 Billion in 2020.

Market Overview

Market Overview

Flavor or flavor is the perception of taste that a food article leaves on the tongue and is detected primarily by the chemical senses that are triggered by the gustatory and the olfactory systems in the human anatomy. The basic tastes are sweet, sour, bitter, salty, and umami and these tastes can be achieved artificially. The fragrance is an aroma compound that is also referred to as odorant or aroma and is the class of chemicals that deals with the ability to give the user a sense of smell or fragrance.

Industry Growth Factors

Industry Growth Factors

The global flavors and fragrance market is expected to be occupied by contributing factors such as the rising targeted population from emerging economies coupled with the rising awareness among consumers owing to added benefits of the ingredients in food articles to name a few. Additionally, shifting consumers preferences to convenience foods coupled with increasing demand for consumer-based products is expected to increase the footprint of the global flavors and fragrance market during the forecast period. However, increased consumer participation in processed & packaged food products coupled with a rising working population is expected to boost the growth of the global flavors and fragrance market during the forecast period.

The global flavors and fragrance market is expected to be driven by factors such as the increasing digitization of the retail industry coupled with the increasing presence of the online food sector to name a few. Moreover, the increased focus of key market participants in the development of regional and novel flavors and fragrances is expected to fuel the growth of the global flavors and fragrance market during the advent of the forecast. However, the rising compliance pertaining to quality and increasing regulatory standards imposed by various governing bodies is expected to hamper the growth of the global flavors and fragrance market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global flavors and fragrance market is segmented into type, application, and region.

On the basis of type, the global flavors and fragrance market is divided into natural and synthetic. The segment pertaining to flavors is expected to witness the largest market share during the advent of the forecast owing to increasing demands from various sectors such as pharmaceutical and cosmetics coupled with rising functionality in terms of integration with various snacks, sodas, savories & dairy products to name a few. Additionally, factors pertaining to increased capability in terms of altering the taste of the products are expected to cement the dominant market position of the latter during the forecast period. On the basis of application, the global flavors and fragrance market is categorized into food & beverages, cosmetics & personal care, pharmaceutical, home & floor care, fine fragrances, and others. The food & beverages segment is expected to occupy the largest market share during the advent of the forecast owing to the integration of attractive taste and smell coupled with an increasing number of different flavors in hot beverages, soups, and tobacco products to name a few. Moreover, large-scale consumption of flavors from increasing consumer demand coupled with increased demand for home & floor care products is expected to cement the dominant market position of the latter during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 28.9 Billion |

Projected Market Size in 2026 |

USD 35.3 Billion |

CAGR Growth Rate |

5.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Givaudan, International Flavors & Fragrances, Symrise AG, Robertet Group, Kerry Group plc., Sensient Technologies, Firmenich SA, Takasago International Corp, Mane, Archer Daniel Midland Company, Solvay S.A., BASF, Bell Flavors & Fragrances, and T. Hasegawa, among others. |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Regional Analysis

Regional Analysis

Europe is expected to witness the largest market share during the advent of the forecast owing to a larger established food and beverage sector in the region coupled with increased uptake abilities in terms of manufacturing capabilities to name a few. Additionally, the presence of key market players in the region coupled with increased usage among liquid-based drinks is expected to increase the footprint of the flavors and fragrance market during the forecast period. Asia-Pacific is expected to witness the largest market share during the advent of the forecast owing to increased availability of raw materials for the production of flavors and fragrances-based products coupled with increased demands for processing, pharmaceuticals, dietary supplementary, and nutraceuticals to name a few. Additionally, changing consumer preference for exotic-based scents coupled with increasing demand from the sector of personal care, cosmetics, home care, and oral care, to name a few.

Competitive Players

Competitive Players

The key market participants for the global flavors and fragrance market are :

- Givaudan

- International Flavors & Fragrances

- Symrise AG

- Robertet Group

- Kerry Group plc.

- Sensient Technologies

- Firmenich SA

- Takasago International Corp

- Mane

- Archer Daniel Midland Company

- Solvay S.A.

- BASF

- Bell Flavors & Fragrances

- T. Hasegawa

By Type Segment Analysis

By Type Segment Analysis

- Flavors

- Natural

- Synthetic

- Fragrances

- Natural

- Synthetic

By Application Segment Analysis

By Application Segment Analysis

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceutical

- Home & Floor Care

- Fine Fragrances

- Others

Table of Content

Industry Major Market Players

- Givaudan

- International Flavors & Fragrances

- Symrise AG

- Robertet Group

- Kerry Group plc.

- Sensient Technologies

- Firmenich SA

- Takasago International Corp

- Mane

- Archer Daniel Midland Company

- Solvay S.A.

- BASF

- Bell Flavors & Fragrances

- T. Hasegawa

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors