Search Market Research Report

Global Dental Anticoagulants Market Size, Share Global Analysis Report, 2019 – 2026

Global Dental Anticoagulants Market By Drug Class (DOACs, Vitamin K Antagonist, Heparin, and Others), By Route of Administration (Oral Anticoagulants and Injectable Anticoagulants), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Regions: Global Industry Perspective, Comprehensive Analysis, and Forecast 2019 – 2026

Industry Insights

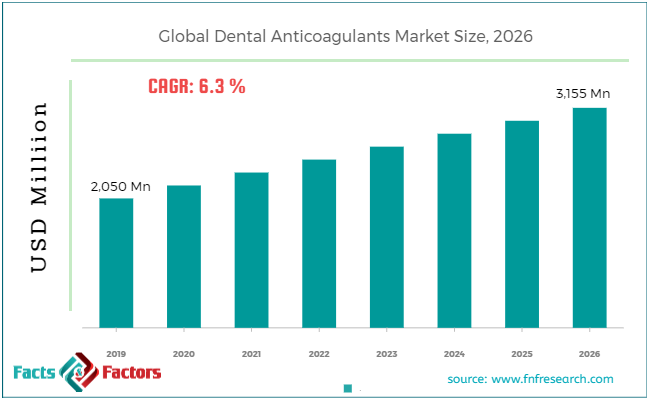

The use of trusted tools by our analysts has helped them conclude the market size of the global Dental Anticoagulants market in terms of USD Million during the forecast timeframe. The report showcases the historic data from 2016 to 2019 along with the forecast data from 2020 to 2026. The market research study provides the market statistics and drivers that help the market expand in a graphical and theoretical pattern.

Our experts have used some of the best tools like Porter’s Five Forces, PESTEL analysis, and SWOT analysis to study market trends and challenges. These tools also help study each and every microscopic data that has an impact on market growth. The market-oriented study offers all the details such as mergers, joint ventures, market share, market statistics, emerging trends, challenges & opportunities, and new launches.

Key Insights from Primary Research

Key Insights from Primary Research

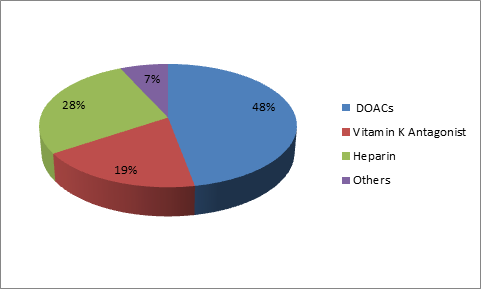

- As per our primary respondents, the direct oral anticoagulants (DOACs) are preferred choice of anticoagulants owing to their safety and efficiency profile.

- As per experts, the worldwide development in the healthcare sector owing to the high prevalence of chronic diseases will propel the market growth.

- Risk factors such as vascular platelets along with comorbidities such as renal and or hepatic impairment in individuals has increased during the recent years thus surging the overall demand for anticoagulants.

- Use of the latest pharmacokinetic or pharmacodynamic properties for the continuous development of anticoagulant medications may offer advantages that may lower the side effects linked with conventional anticoagulant treatments.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, liberty for regular international normalization ratio blood test monitoring along with faster onset & offset action is expected to propel the market growth.

- Rising development in the research and technological innovations has led to greater adoption and use of dental anticoagulants.

- The burgeoning market scope for direct oral anticoagulants or novel oral anticoagulants will draw many market players.

- In 2018, North America showed about 35% market share owing to the leading anticoagulants market in the U.S.

- Europe is likely to show significant market growth due to increasing cases of chronic diseases, helpful government policies, and the growing geriatric population in the region.

- The increasing awareness of the use of oral anticoagulants and disposable income will bolster the global Dental Anticoagulants market.

Market Attractiveness in 2018: By Drug Class

Market Attractiveness in 2018: By Drug Class

Anticoagulant drugs are commonly referred to as blood thinners. These are chemical substances that help prevent or lower coagulation of blood and instead increase blood clotting time. Anticoagulant drugs are primarily used in cases of chronic medical conditions with a higher risk of blood clots. Anticoagulant drugs such as direct anticoagulants are generally used during dental invasive treatments and surgeries.

The growing occurrence of severe disorders such as diabetes, cardiovascular diseases, cancer, etc. along with technological innovations is likely to surge the Dental Anticoagulants market. In addition, the increasing expenditure on research and development will further supplement the growth of the market. The rising number of the older population, high labor costs, and high supply & demand will further propel the market during the forecast timeframe. Likewise, growing healthcare awareness and disposable income are anticipated to drive the market growth.

Direct oral anticoagulants (DOACs) are widely used anticoagulants due to their easy use and excellent safety profile. They have set doses and do not require regular international standardizations. Thus, the high demand for DOACs owing to their safety is expected to drive the global Dental Anticoagulants market over the forecast period. The novel alternative anticoagulants are expected to open new doors of opportunities for the Dental Anticoagulants market. However, the risks associated with the use of anticoagulants and stringent regulatory requirements are the major market restraints.

Based on drug class, the market for dental anticoagulants is segregated into DOACs, Vitamin K Antagonist, Heparin, and Others. On the basis of the route of administration, the global Dental Anticoagulants market is divided into Oral Anticoagulants and Injectable Anticoagulants. In terms of distribution channels, the market is categorized into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 2,050 Million |

Projected Market Size in 2026 |

USD 3,155 Million |

CAGR Growth Rate |

6.3% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Daiichi Sankyo Company, Limited, Sanofi S.A, Aspen Holdings, Bayer AG, Bristol-Myers Squibb Company, GlaxoSmithKline Plc, Boehringer Ingelheim GmbH, Pfizer, Inc., Abbott, Portola Pharmaceuticals, Inc. , Mylan N.V., and others. |

Key Segment |

By Drug Class, Route of Administration,Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players in the global Dental Anticoagulants market are

Some of the key players in the global Dental Anticoagulants market are

- Daiichi Sankyo Company Limited

- Sanofi S.A

- Aspen Holdings

- Bayer AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline Plc

- Boehringer Ingelheim GmbH

- Pfizer Inc.

- Abbott

- Portola Pharmaceuticals Inc.

- Mylan N.V.

The global Dental Anticoagulants market is segmented into:

By Drug Class

By Drug Class

- DOACs (Direct Oral Anticoagulants)

- Apixaban

- Dabigatran

- Rivaroxaban

- Edoxaban

- Others

- Vitamin K Antagonist

- Heparin

- Others

By Route of Administration

By Route of Administration

- Oral Dental Anticoagulants

- Injectable Dental Anticoagulants

By Distribution Channel

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- The Middle-East and Africa

- GCC Countries

- South Africa

- Rest of Middle-East Africa

Key Pointers Addressed by the Report

Key Pointers Addressed by the Report

- Historical data and forecast analysis of the market

- Drivers and Restraints affecting market dynamics

- Exhaustive analysis about the future market trends

- Comprehensive information about the leading market segments and region

- Strategic developments made by the competitive players and in-depth analysis of its impact on market growth.

Table of Content

Industry Major Market Players

- Daiichi Sankyo Company Limited

- Sanofi S.A

- Aspen Holdings

- Bayer AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline Plc

- Boehringer Ingelheim GmbH

- Pfizer Inc.

- Abbott

- Portola Pharmaceuticals Inc.

- Mylan N.V.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors