Search Market Research Report

Fungicides Market Size, Share Global Analysis Report, 2021 - 2026

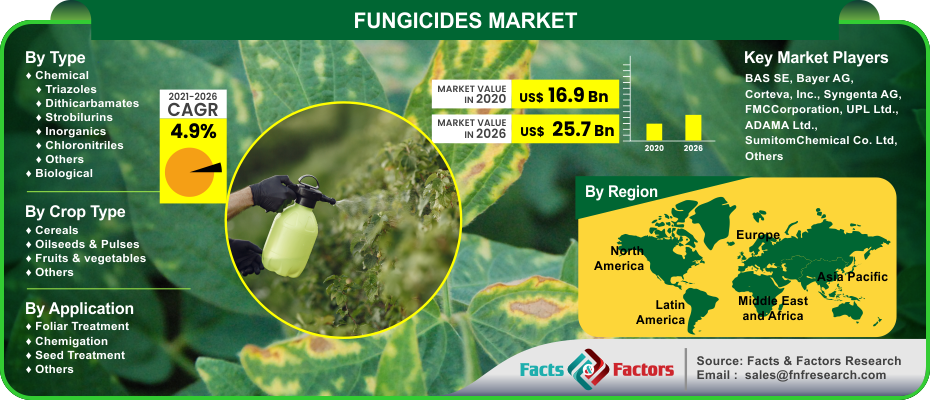

Fungicides Market By Type (Chemical & Biological), By Crop Type (Cereals, Oilseeds & Pulses, Fruits & vegetables, & Others), By Application (Foliar Treatment, Chemigation, Seed Treatment, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

[198+ Pages Report] Facts & Factors published “Global Fungicides Market” report encompasses the spectacle of the market in an analytical and comprehensive manner. In this report, the global fungicides market is projected to value USD 25.7 Billion by 2026 from an initial value of USD 16.9 Billion in the year 2020 growing at a CAGR value of 4.9%.

Market Overview

Market Overview

Fungicides are biological chemical compounds or biological organisms that are often used for killing parasites fungi and their accompanying spores. A fungicide often surrounds its own growth formations. Fungi are often the main factor causing substantial damage in the sector of agriculture in terms of fighting fungal infections in animals. Chemicals such as oomycetes which belong to the same family as fungicides are required for repairing and protecting infected plants.

Industry Growth Factors

Industry Growth Factors

The global fungicides market is expected to register a higher market share during the advent of the forecast period owing to contributing factors such as an increase in demand for food security measures owing to rising population coupled with advancements in farming practices and techniques to name a few. Additionally, changing climatic conditions on a global purview owing to rising occurrences of diseases coupled with increasing instances of growing resistance against fungicides is expected to increase the footprint of the global fungicides market during the advent of the forecast period. Moreover, the introduction of novel fungicide products during the advent of the forecast duration owing to the outbreak of several diseases skyrocketing is expected to fuel the growth of the global fungicides market.

The global fungicides market is driven by the rising amount of countries dependent on agriculturally based GDPs coupled with an increasing amount of agriculturally based global bodies extending support to name a few. Rising usage of organic-based products coupled with an increasing amount of products by the key market participants is expected to boost the growth of the global fungicides market during the advent of the forecast period. However, disruptions in the supply chains due to the ongoing pandemic coupled with rising incidences of fungicides during the advent of the forecast period is expected to decrease the growth of the global fungicides market.

Segmentation Analysis

Segmentation Analysis

The global fungicides market is segmented into product, crop types, application, and region.

On the basis of type, the global fungicides market is divided into chemical and biological. The segment pertaining to chemicals is expected to witness the largest market share during the advent of the forecast period owing to the latter’s immediate effect in controlling and regulating the growth of the fungi coupled with major applications in the sector of cereals and fruits & vegetables to name a few. Based on crop type, the global fungicides market is categorized into cereals, oilseeds & pulses, fruits & vegetables, and others. The cereals segment is expected to occupy the largest market share during the advent of the forecast period owing to the latter being a staple food in regions such as America, Europe, and Asia-Pacific coupled with rising demand arising from increased production and vice versa to name a few. On the basis of application, the global fungicides market is fragmented into foliar treatment, chemigation, seed treatment, and others. The segment pertaining to foliar treatment is expected to witness the largest market share during the advent of the forecast period owing to a uniform application process w.r.t a low fungicide volume per hectare coupled with the latter covering vulnerable plant surfaces while blocking the entry of other pathogens to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 16.9 Billion |

Projected Market Size in 2026 |

USD 25.7 Billion |

CAGR Growth Rate |

4.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

BAS SE, Bayer AG, Corteva, Inc., Syngenta AG, FMCCorporation, UPL Ltd., ADAMA Ltd., SumitomChemical Co. Ltd, Nufarm, Isagro SpA, CropScience, Dow AgroSciences, Lanxess AG, Monsanto, Adama Agricultural Solutions, Simonis B.V., Drexel Chemical Company, Biostadt India Limited, and Heranba Industries Ltd, among others. |

Key Segment |

Type, Crop Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to a rising population sector, increasing population, and growing rice cultivations to name a few. Additionally, rising instances of post-harvest losses coupled with the region being the home to China which is deemed as the global leader in terms of production and export rates is expected to increase the footprint of the fungicides market during the forecast period. Factors such as increased production such as rice, sugar beet, fruits & vegetables, cereals, and grains coupled with rising consumption patterns is expected to further boost the growth of the fungicides market during the advent of the forecast period. Europe is expected to occupy a substantial market share owing to rising occurrence of climatic changes leading to the onset of various diseases coupled with the region being the home to a stronger market presence in terms of a large number of key market participants.

Competitive Players

Competitive Players

The key market participants for the global fungicides market are :

- BAS SE

- Bayer AG

- Corteva Inc.

- Syngenta AG

- FMCCorporation

- UPL Ltd.

- ADAMA Ltd.

- SumitomChemical Co. Ltd

- Nufarm

- Isagro SpA

- CropScience

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V.

- Drexel Chemical Company

- Biostadt India Limited

- Heranba Industries Ltd

By Type Segment Analysis

By Type Segment Analysis

- Chemical

- Triazoles

- Dithicarbamates

- Strobilurins

- Inorganics

- Chloronitriles

- Others

- Biological

By Crop Type Segment Analysis

By Crop Type Segment Analysis

- Cereals

- Oilseeds & Pulses

- Fruits & vegetables

- Others

By Application Segment Analysis

By Application Segment Analysis

- Foliar Treatment

- Chemigation

- Seed Treatment

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- BAS SE

- Bayer AG

- Corteva Inc.

- Syngenta AG

- FMCCorporation

- UPL Ltd.

- ADAMA Ltd.

- SumitomChemical Co. Ltd

- Nufarm

- Isagro SpA

- CropScience

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V.

- Drexel Chemical Company

- Biostadt India Limited

- Heranba Industries Ltd

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors