Search Market Research Report

Fault Indicators Market Size, Share Global Analysis Report, 2019–2026

Fault Indicators Market By Product Type (Overhead Line Fault Indicators, Cable Fault Indicators, Underground Fault Indicators and Others), and By Application (Construction and Mining Industry, Automobiles, Equipment Manufacturing Industry, Military and Aerospace, Chemical and Pharmaceutical Industry, Power Industry and Others): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the Fault Indicators industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the Fault Indicators Market. The report study analyzes the market statistics at the global as well as the regional levels to gain an in-depth perspective of the overall Fault Indicators Market.

The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volumes (Thousand Units) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

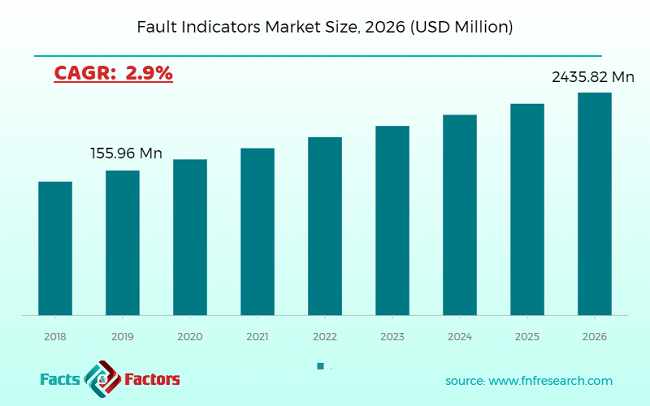

- Our primary respondents believe the market to witness a steady growth of 2.9% over the forecast period on account of the rising need for efficient and safe electricity requirements around the globe.

- Most of the CXOs predict the equipment manufacturing industry to maintain its dominance throughout 2026 due to the increase need for high capacity and efficient short circuit indicators. Furthermore, the manufacturers operating in this market are partnering with local and domestic players to increase their goodwill in the ever-competitive market ecosystem.

- Some of the industry experts interviewed in the Asia Pacific revealed that the underground fault indicators type is expected to generate considerable revenues for the Fault indicators industry.

- Regionally, Asia Pacific is expected to contribute largely to the global Fault indicators market. Some of the interviewees said that their future plans are to focus majorly on innovating in features of fault indicator device application areas. The manufacturers operating in countries such as China and India are expected to create higher adoption opportunities for the Fault indicators market.

- The information & technology subject matter experts suggest investing in R&D activities to come up with newer, economic and more efficient Fault indicators. They believe advanced technology in the medical industry will witness widespread acceptance across the value chain of the Fault indicators market.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend focusing on the Asia Pacific Fault indicators market since their calculations revealed that this region turned out to be the top investment pocket across the globe owing to greater opportunities in countries such as India and China.

- The major reason behind the upsurge growth and lucrative opportunities underlying in this region is the rising need for high volume electricity across the globe in several industry verticals.

- Europe, on the other hand, is expected to foresee a robust growth of around 2.5% per annum. This is majorly attributed to rising equipment manufacturers requiring safe electricity measures in countries such as Germany, France, Netherland, and others.

- The strategic mergers and acquisitions by key industry players and high demand across end-use industries is anticipated to fuel the market growth

- The executive summary of the report reads the total incremental opportunity underlying in the global Fault indicators market is nearly USD 184.91 million between 2020 and 2026.

Fault Indicators Market

Fault Indicators Market

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the Fault Indicators Market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the Fault Indicators Market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the Fault Indicators Market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the Fault Indicators Market.

The research study provides a critical assessment of the Fault Indicators industry by logically segmenting the market on the basis of product type, connectivity, port, distribution channel, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the Fault Indicators industry includes the holistic bifurcation of all the five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

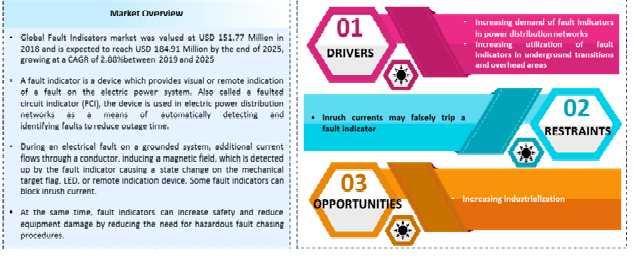

Fault indicators are devices used to detect short circuits in electric networks.

The primary aim of the fault indicator device is to enhance safety by indicating circuit faults. Once the fault indicator detects a short circuit in the system, the alarms and hazards lights are flashed; this information is transferred to the control system where appropriate actions can be taken to avoid any damage. These devices range in various voltages to indicate high as well as low power electric short circuits.

Fault indicators are expected to eliminate any hazardous incident due to short circuits by enhancing the safety of the electric supply network. This is one of the major reasons for the growth of the fault indicator market.

Fault Indicators provide multiple advantages such as result accuracy, time efficiency; accelerate R&D, human error elimination, reduced labor costs, and others. The complete process involving sample testing, data analysis and verification of sample tests becomes highly easier with automation processes.

Furthermore, these devices require high initial investment and maintenance this has created a limitation for the growth of the Fault Indicators market. However, Fault Indicators manufacturers are engaged in expanding their business presence by catering to wide industry verticals by introducing high capacity fault indicators.

The Fault Indicators Market is categorized into by product type and by the application. The product type segment is further divided into Overhead Line Fault Indicators, Cable Fault Indicators, Underground Fault Indicators and Others. By Application, the market is divided Construction and Mining Industry, Automobiles, Equipment Manufacturing Industry, Military and Aerospace, Chemical and Pharmaceutical Industry, Power Industry and Others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 155.96 Mn |

Projected Market Size in 2026 |

USD 184.91 Mn |

CAGR Growth Rate |

2.9% CAGR |

Base Year |

2019 |

Forecast Years |

2019-2026 |

Key Market Players |

Dipl. Ing. H. Horstmann GmbH, SEL, Cooper Power Systems (Acquired by Eaton), Megacon, Suparule Systems Ltd., Elektro-Mechanik GMBH, Siemens, Bowden Bros Ltd, ABB Group, Schneider Electric, Nortroll AS, CelsaMessgeräte GmbH, ELECTRONSYSTEM MD srl, Littelfuse, Streamer Electric, Franklin Electric Grid Solution, Beijing HCRT Electrical Equipment, Creative Distribution Automation Co., Ltd. (CREAT) , Sentient Energy, Inc., Tollgrade Communications, Inc.and others. |

Key Segment |

By product type, By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players operating in the Fault Indicators Market around the globe include:

Some of the key players operating in the Fault Indicators Market around the globe include:

- Dipl. Ing. H. Horstmann GmbH

- SEL

- Cooper Power Systems (Acquired by Eaton)

- Megacon

- Suparule Systems Ltd.

- Elektro-Mechanik GMBH

- Siemens

- Bowden Bros Ltd

- ABB Group

- Schneider Electric

- Nortroll AS

- Celsa Messgeräte GmbH

- ELECTRONSYSTEM MD srl

- Littelfuse

- Streamer Electric

- Franklin Electric Grid Solution

- Beijing HCRT Electrical Equipment

- Creative Distribution Automation Co.Ltd. (CREAT)

- Sentient Energy Inc.

- Tollgrade Communications Inc.

The taxonomy of the Fault Indicators industry by its scope and segmentation is as follows:

By product type Segmentation Analysis

By product type Segmentation Analysis

- Overhead Line Fault Indicators

- Cable Fault Indicators

- Underground Fault Indicators

- Others

By Application Segmentation Analysis

By Application Segmentation Analysis

- Construction and Mining Industry

- Automobiles

- Equipment Manufacturing Industry

- Military and Aerospace

- Chemical and Pharmaceutical Industry

- Power Industry

- Others

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

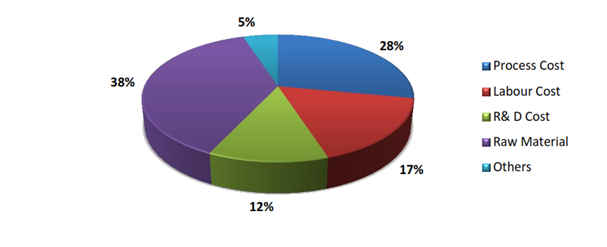

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Dipl. Ing. H. Horstmann GmbH

- SEL

- Cooper Power Systems (Acquired by Eaton)

- Megacon

- Suparule Systems Ltd.

- Elektro-Mechanik GMBH

- Siemens

- Bowden Bros Ltd

- ABB Group

- Schneider Electric

- Nortroll AS

- Celsa Messgeräte GmbH

- ELECTRONSYSTEM MD srl

- Littelfuse

- Streamer Electric

- Franklin Electric Grid Solution

- Beijing HCRT Electrical Equipment

- Creative Distribution Automation Co.Ltd. (CREAT)

- Sentient Energy Inc.

- Tollgrade Communications Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors