Search Market Research Report

Facility Management Market Size, Share Global Analysis Report, 2021 - 2026

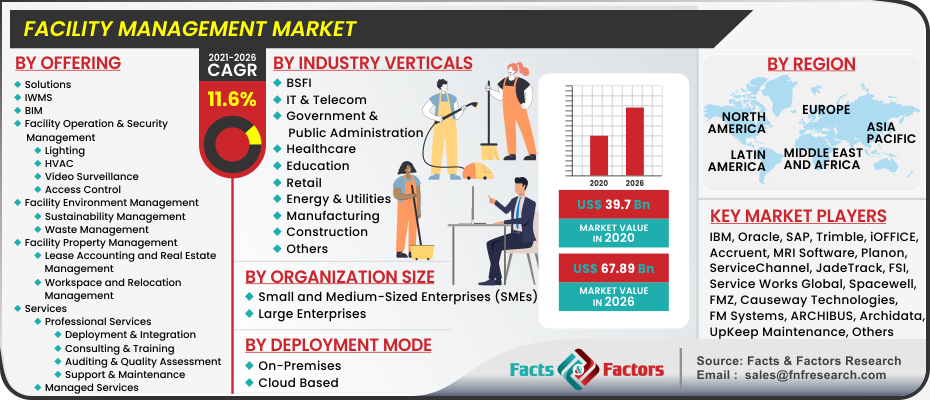

Facility Management Market By Offering (Solutions & Services), By Deployment Mode (On-Premises & Cloud Based), By Organization Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises), By Industry Verticals (BSFI, IT & Telecom, Government & Public Administration, Healthcare, Education, Retail, Energy & Utilities, Manufacturing, Construction, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

[173+ Pages Report] The latest publication titled “Global Facility Management Market” consists of the latest know-how about the market in a detailed and comprehensive manner. We at Facts & Factors estimate that the global Facility Management Market will be valued at USD 67.89 Billion in the year 2026 from an initial value of USD 39.7 Billion in the year 2020 with an anticipated CAGR growth of 11.6% during the period 2021-2026.

Market Overview

Market Overview

The international facility management association (IFMA) recently defined facility management as the practices associated with coordinating a physical space with the people working within the organization in order to maintain and regulate a variety of activities such as maintenance, space planning, and portfolio forecasting to name a few. Facility management further curtails planning and managing a wider range of activities such as emergency preparedness, business continuity, environmental sustainability, human errors accountability, communication and project management activities, real estate and property management, leadership, and strategic entailments, among others. In essence, facility management is the science of encompassing a variety of disciplines and practices that ensure the perfect integration of people, place, processes, and technologies.

Industry Growth Factors

Industry Growth Factors

The primary driving factors behind the global facility management market is the unprecedented and stagnant growth of services due to the advent of the pandemic where a majority of workforces are being confined to work from home coupled with increasing demand by a domino effect by increasing government investment towards a variety of industries such as transport, energy, construction, and others. Additional factors that can contribute to the rise of the global management facility market are rising awareness among consumers with regards to cleanliness practices, increasing prevalence of maintenance services, and rising security concerns to name a few. Furthermore, the adaptability of service providers in order to focus their services allows them to work within restricted spaces. The following practices are expected to dramatically increase the footprint of the global facility management market during the advent of the pandemic.

A rising trend of government bodies across the world diversifying their non-economic sectors coupled with the constant development of developed and developing economies in order to diversify their tourism sector will further propel the growth of the market during the forecast period. The rise of government sectors towards developing existing and building new infrastructure practices will push the market toward a positive outlook. Furthermore, the practice of government bodies linking their infrastructure across borders will further cater to a wider range of consumers during the forecast. However, a lack of stable and binding contracts can hamper the growth of the market to a certain extent. Moreover, the lack of technological advancements and the ability to compel resources and capabilities will further put a dent in the growth of the global facility management market during the forecast timeframe.

Segmentation Analysis

Segmentation Analysis

The global facility management market can be segmented into offering, deployment mode, organization size, industry verticals, and regions.

The global facility management market can be divided into solutions and services on the basis of offering type. The solution segment can be divided into IWMS, BIM, facility operation and security management, facility environment management, and facility property management. The facility and operation and security segment can be further broken down into lighting, HVAC, video surveillance, and access control while the facility environment management can be divided into sustainability and waste management. The service segment can be further disintegrated into professional services and managed services. The professional services can be further segmented across deployment and integration, consulting & training, auditing and quality assessment, and support and maintenance. The solution segment is expected to witness the largest market share during the advent of the forecast owing to the increasing rise of traditional services across the forecast. Effective management solution often consists of multi-level management services that provide lighting, HVAC control, security and emergency, and accident sustainability. The global facility management market can be divided into on-premises and cloud-based deployment on the basis of the deployment model. The on-premises deployment mode is expected to lead the market in terms of growth and market share during the forecast owing to the integrated package of software and infrastructure needs offered by the latter. Furthermore, these services also offer a wider range of services such as offline data analytics and configuration in order to cater to a long range of solutions. Based on the organization size, the market can be segmented into small and medium-sized enterprises and large enterprises. The global facility management market can be divided into BSFI, IT & telecom, government and public administration, healthcare, education, retail, energy & utilities, manufacturing, construction, and others. The BSFI segment is expected to witness the largest market share during the advent of the forecast owing to the rise in demand from the sector in terms of maintenance and management of real estate investments.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 39.7 Billion |

Projected Market Size in 2026 |

USD 67.89 Billion |

CAGR Growth Rate |

11.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

IBM, Oracle, SAP, Trimble, Accruent, MRI Software, Planon, ServiceChannel, Service Works Global, FMZ, Causeway Technologies, FM Systems, Spacewell, iOFFICE, FSI, ARCHIBUS, Archidata, JadeTrack, UpKeep Maintenance, Apleona, FacilityONE Technologies, Office Space Software, and Facilio among others. |

Key Segment |

By Offering, Deployment, Organization, Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Regional Overview

Regional Overview

North America is expected to witness the largest market share during the advent of the forecast in terms of global revenue contribution. Factors contributing to the dominant market share are early adoption of technology solutions and a well sustained and developing economic atmosphere. Furthermore, rising investment toward technological developments such as AI, ML, cloud computing, and big data analytics will further boost the growth of the global facility management market in the region during the forecast. The presence of key players and vendors in the region will further aid in boosting the growth of the market to a higher economic benefit.

Competitive Players

Competitive Players

The key participants in the global facility management market are:

- IBM

- Oracle

- SAP

- Trimble

- Accruent

- MRI Software

- Planon

- ServiceChannel

- Service Works Global

- FMZ

- Causeway Technologies

- FM Systems

- Spacewell

- iOFFICE

- FSI

- ARCHIBUS

- Archidata

- JadeTrack

- UpKeep Maintenance

- Apleona

- FacilityONE Technologies

- Office Space Software

- Facilio

By Offering Segment Analysis

By Offering Segment Analysis

- Solutions

- IWMS

- BIM

- Facility Operation & Security Management

- Lighting

- HVAC

- Video Surveillance

- Access Control

- Facility Environment Management

- Sustainability Management

- Waste Management

- Facility Property Management

- Lease Accounting and Real Estate Management

- Workspace and Relocation Management

- Services

- Professional Services

- Deployment & Integration

- Consulting & Training

- Auditing & Quality Assessment

- Support & Maintenance

- Managed Services

- Professional Services

By Deployment Mode Segment Analysis

By Deployment Mode Segment Analysis

- On-Premises

- Cloud Based

By Organization Size Segment Analysis

By Organization Size Segment Analysis

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Verticals Segment Analysis

By Industry Verticals Segment Analysis

- BSFI

- IT & Telecom

- Government & Public Administration

- Healthcare

- Education

- Retail

- Energy & Utilities

- Manufacturing

- Construction

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- IBM

- Oracle

- SAP

- Trimble

- Accruent

- MRI Software

- Planon

- ServiceChannel

- Service Works Global

- FMZ

- Causeway Technologies

- FM Systems

- Spacewell

- iOFFICE

- FSI

- ARCHIBUS

- Archidata

- JadeTrack

- UpKeep Maintenance

- Apleona

- FacilityONE Technologies

- Office Space Software

- Facilio

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors