Search Market Research Report

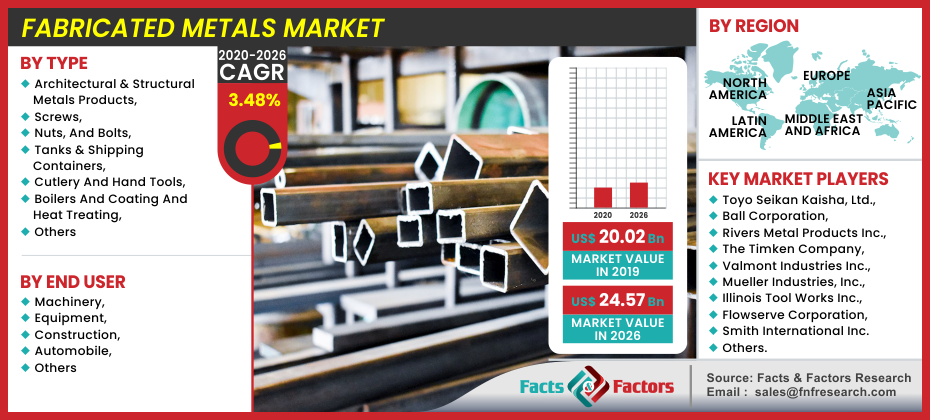

Fabricated Metals Market Size, Share Global Analysis Report, Metals Market by Type (Architectural & Structural Metals Products, Screws, Nuts, And Bolts, Tanks & Shipping Containers, Cutlery And Hand Tools, Boilers And Coating And Heat Treating, and Others) By End User (Machinery, Equipment, Construction, Automobile, And Others) By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Fabricated Metals Market by Type (Architectural & Structural Metals Products, Screws, Nuts, And Bolts, Tanks & Shipping Containers, Cutlery And Hand Tools, Boilers And Coating And Heat Treating, and Others) By End User (Machinery, Equipment, Construction, Automobile, And Others) By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Industry Insights

[195+ Pages Report] According to the report published by Facts and Factors, the global fabricated metals market was valued at approximately USD 20.02 billion in 2019 and is expected to generate revenue of around USD 24.57 billion by end of 2026, growing at a CAGR of around 3.48% between 2020 and 2026.

Market Overview

Market Overview

The fabricated metal goods manufacturing cluster includes companies that make everything from nails and screws to boilers and building frames out of metal. The end products of the cluster are classified into sub-sectors based on their uses. Metal forges and hand tool makers, structural metals, tanks, threaded materials, and heat-treated metals are among them.

Several supplier industries are related to the fabrication of metal products and include the materials, products, and services needed for production. According to IMPLAN results, steel/iron products for instance steel bars that are molded into the preferred products account for 19.1 percent of production costs. Aluminum sheets and plates account for an extra 12.3% of manufacturing costs.

Industry Growth Factors

Industry Growth Factors

From 2012 to 2016, the fabricated metal industry grew noticeably, thanks to developing Asian economies and increased automotive and industrial exports from European countries. The increase in consumption from Asian countries was the sole driver of growth from 2016 to 2019. Shifting developments in the finance and manufacturing sectors around the world are driving up demand. Companies were compelled to relocate their manufacturing operations to the Asia Pacific because of the region's growing population and large markets for various industry verticals. Manufacturing firms are the biggest users of fabricated metal, followed by the automotive industry and its ancillary industries. Over the forecast period, demand and supply for major industries in the fabricated metal market, such as aerospace and defense, are expected to grow. Global population growth is driving energy consumption and demand. Fabricated metal is expected to be in high demand as a result of rapid industrialization. The high cost of raw materials, on the other hand, is expected to be a major stumbling block to market expansion. Nonetheless, technological advancements and efforts to develop customized equipment are expected to provide manufacturers with new business opportunities in the near future.

Segmentation Analysis

Segmentation Analysis

The global Fabricated Metals Market is segregated based type, end-user, and region

Architectural & structural metals products, screws, nuts, and bolts, tanks & shipping containers, cutlery and hand tools, boilers and coating and heat treating, and others make up type segment of the global fabricated metal industry. The global fabricated metal industry is dominated by architectural and structural metals. During the forecast period, the segment is expected to grow at a rapid rate. Demand for structural metal products is expected to rise as the construction industry, particularly the infrastructure market, expands. Due to favorable government policies and increased FDI inflow, industrial and manufacturing activities are rapidly expanding in the Asia Pacific, specifically in Japan and China. As a result, the coating and heat treating, as well as boilers, tanks, and shipping containers segments, are expected to grow rapidly during the analysis period. The global fabricated metal market can be divided into machinery, equipment, construction, automobile, and others, depending on the end-user. The automotive industry is a significant end-user of the market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 20.02 Billion |

Projected Market Size in 2026 |

USD 24.57 Billion |

CAGR Growth Rate |

3.48% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Toyo Seikan Kaisha, Ltd., Ball Corporation, Rivers Metal Products Inc., The Timken Company, Valmont Industries Inc., Mueller Industries, Inc., Illinois Tool Works Inc., Flowserve Corporation, Schaeffler Technologies AG & Co. KG, and Smith International Inc. amongst others. |

Key Segment |

By Type, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is the world's largest market for fabricated metal and is home to some of the world's fastest-growing economies, including India and China. Economic activity has increased in Asia Pacific countries such as China, India, Malaysia, Indonesia, and the Philippines, owing to the steady growth of the manufacturing industry, which is expected to play a significant role. Singapore, Australia, Japan, and South Korea, as well as other developed nations in the area, are highly industrialized and provide strong demand for the fabricated metal. Because of the growing population, the fabricated metal market is expected to grow at a rapid rate as the world moves toward industrialization.

The second-largest market for fabricated metal is Europe. Demand is expected to be fueled in the near future by developed nations such as Germany, France, and Italy, among others. Because of its massive automotive and ancillary industries, Germany is Europe's largest economy. Italy, along with other markets such as Switzerland and Russia, leads Germany.

Competitive Players

Competitive Players

Some main participants of the global fabricated metals market are :

- The Timken Company

- Valmont Industries Inc.

- Mueller Industries, Inc.

- Illinois Tool Works Inc.

- Toyo Seikan Kaisha, Ltd.

- Ball Corporation

- Rivers Metal Products Inc.

- Flowserve Corporation

- Schaeffler Technologies AG & Co. KG

- Smith International Inc.

Fabricated Metals Market: Regional Segment Analysis

Fabricated Metals Market: Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- The Timken Company

- Valmont Industries Inc.

- Mueller Industries, Inc.

- Illinois Tool Works Inc.

- Toyo Seikan Kaisha, Ltd.

- Ball Corporation

- Rivers Metal Products Inc.

- Flowserve Corporation

- Schaeffler Technologies AG & Co. KG

- Smith International Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors