Search Market Research Report

Europe Precision Medicine Market Size, Share Global Analysis Report, 2018 – 2025

Europe Precision Medicine Market By Technology (Big Data Analytics, Gene Sequencing, Companion Diagnostics, Bioinformatics, Drug Discovery, and Others), By End-User(Diagnostic Tool Companies, Clinical Labs, Healthcare IT/Big Data Companies, and Pharma & Biotech Companies), and By Application (Oncology, Respiratory, CNS, Immunology, and Others): Industry Perspective, Comprehensive Analysis, and Forecast 2018 – 2025

Industry Insights

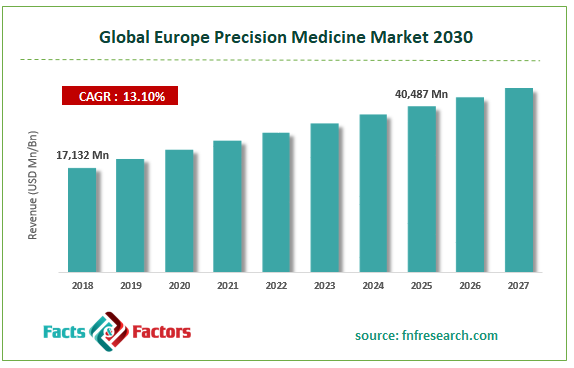

The report covers the forecast and analysis of the Europe Precision Medicine market. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2025 based on revenue (USD Million). The study includes drivers and restraints of the Europe Precision Medicine market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Europe Precision Medicine market.

In order to give the users of this report a comprehensive view of the Europe Precision Medicine market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Europe Precision Medicine market by segmenting the market based on technology, end-user, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2025.

Patient outcomes are likely to be improved through the utility of precision drugs in the European continent. It comprises of medical institutes ready to make genetic testing & analytics tools and investors willing to compensate the drug costs. Apart from this, drug institutes in Europe are focusing on creating new personalized modes of treatments while companion diagnostics providers are concentrating on gathering data efficiently. Additionally, genetic analytics help in interpreting the outcomes of the clinical data of the patients.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 17,132 Million |

Projected Market Size in 2025 |

USD 40,487 Million |

CAGR Growth Rate |

13.1% CAGR |

Base Year |

2018 |

Forecast Years |

2018-2025 |

Key Market Players |

Thermo Fisher Scientific, Cepheid, Intel Corporation, Randox Laboratories, Novartis, Almac Group, Illumina, Johnson & Johnson, Qiagen, GE Healthcare, Roche, IBM, Laboratory Corporation of America Holdings, Abbott Laboratories, Biomrieux Sa, and Healthcore, and Others |

Key Segment |

By Technology, End-User, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

The Europe precision medicine industry is sectored based on technology, end-user, and application. Based on the technology, the industry is segregated into Big Data Analytics, Gene Sequencing, Companion Diagnostics, Bioinformatics, Drug Discovery, and Others, In terms of end-user, the precision medicine market in Europe is classified into Diagnostic Tool Companies, Clinical Labs, Healthcare IT/Big Data Companies, and Pharma & Biotech Companies. Application-wise the market is divided into Oncology, Respiratory, CNS, Immunology, and Others.

Top Players in the Market Are:

Top Players in the Market Are:

Some of the key players involved in the business includer

Some of the key players involved in the business includer

- Thermo Fisher Scientific

- Cepheid

- Intel Corporation

- Randox Laboratories

- Novartis

- Almac Group

- Illumina

- Johnson & Johnson

- Qiagen

- GE Healthcare

- Roche

- IBM

- Laboratory Corporation of America Holdings

- Abbott Laboratories

- Biomrieux Sa

- Healthcare among othes

This report segments the Europe Precision Medicine market as follows:

By Technology Analysis

By Technology Analysis

- Big Data Analytics

- Gene Sequencing

- Companion Diagnostics

- Bioinformatics

- Drug Discovery

- Others

By End-User Analysis

By End-User Analysis

- Diagnostic Tool Companies

- Clinical Labs

- Healthcare IT/Big Data Companies

- Pharma & Biotech Companies

By Application Analysis

By Application Analysis

- Oncology

- Respiratory

- CNS

- Immunology

- Others

By Country-wise Segment Analysis

By Country-wise Segment Analysis

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

Table of Content

Industry Major Market Players

- Thermo Fisher Scientific,

- Cepheid,

- Intel Corporation,

- Rox Laboratories,

- Novartis,

- Almac Group,

- Illumina,

- Johnson & Johnson,

- Qiagen,

- GE Healthcare,

- Roche,

- IBM,

- Laboratory Corporation of America Holdings,

- Abbott Laboratories,

- Biomrieux SA,

- Healthcore among others.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors