Search Market Research Report

Ethoxylates Market Size, Share Global Analysis Report, 2022 – 2028

Ethoxylates Market Size, Share, Growth Analysis Report By Type (Alcohol, Fatty Amine, Fatty Acid, Ethyl Ester, Glyceride, and Others), By Application (Household & Personal Care, Institutional & Industrial Cleaning, Pharmaceutical, Agrochemicals, Oilfield Chemicals, and Others), By End-use (Detergents, Personal Care, Ointments & Emulsions, Herbicides, Insecticides, Foam Control & Wetting Agents, Lubricants and Emulsifiers, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

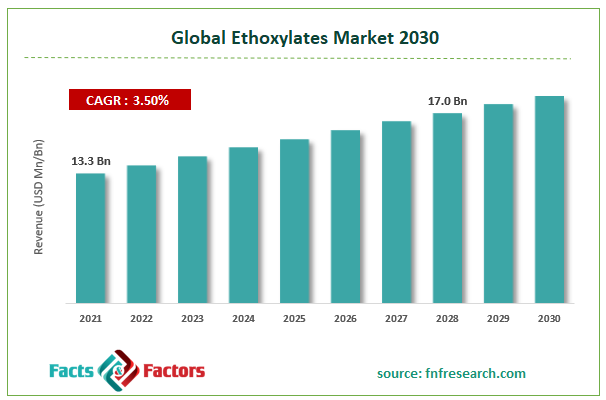

[207+ Pages Report] According to Facts and Factors, the global ethoxylates market size was worth around USD 13.3 billion in 2021 and is predicted to grow to around USD 17.0 billion by 2028 with a compound annual growth rate (CAGR) of roughly 3.5% between 2022 and 2028. The report analyzes the global ethoxylates market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ethoxylates market.

Market Overview

Market Overview

Ethoxylates are organic molecules created when suitable molar ratios of Epoxides or Ethylene Oxide (EO) are added to substrates such as alcohols, acids, amines, and vegetable oils. Depending on the type of ethoxylate employed in the procedure, they can dissolve in both water and oils due to their hydrophobic and hydrophilic natures. It lowers the surface tension that exists between a liquid and a gas. Additionally, it has properties like superior formulation, wettability, and low aquatic toxicity. It is also extremely water-soluble.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Ethoxylates market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2022-2028).

- In terms of revenue, the global ethoxylates market size was valued at around USD 13.3 billion in 2021 and is projected to reach USD 17.0 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, the alcohol ethoxylates were predicted to dominate the market in the year 2021

- Based on application segmentation, household & personal care applications held the largest market share in 2021

- Based on end-use, the detergent segment accounted for a major revenue share in 2021.

- Based on region, Europe held the largest revenue share in 2021.

Covid-19 Impact

Covid-19 Impact

Personal care has suffered as a result of COVID-19; despite increased awareness of the need for good hygiene to lower the risk of infection, there was a shortage of these products on the market. Worldwide sales of personal care products have decreased by more than 4.5%, and supply problems have arisen as a result of government restrictions, global lockdowns, and the closure of the majority of industrial facilities for the rest of the year to stop the virus' spread. Because of this, the market for ethoxylates has suffered. The markets are now gradually opening, which is a positive sign for the ethoxylates market.

Growth Drivers

Growth Drivers

- Growing demand for low-rinse detergents to drive the market expansion

In several applications, there is a significant rise in the need for low-rinse detergents. There is evidence that low-foaming detergents can be more effective cleansers than high-foaming detergents, although many studies have found no correlation between the amount of foam created and the cleaning power of detergents. Low-rinse detergents are becoming more and more common since they are resistant to hardness and do not ionize in solution, leaving them without an electrical charge. Companies are concentrating on creating low-rinse products like methyl ester ethoxylates since they produce little foam, which also helps to save water. Thus, the growing demand for low-rinse detergents is expected to drive the growth of the global ethoxylates market over the forecast period.

Restraints

Restraints

- Availability of substitutes to hamper the market growth

The need for ethoxylates will decline as alternative products are used more frequently in household and personal care products. Since some ethoxylates, like nonylphenol, are harmful by nature, they are restricted in many nations. Ammonium laurel sulphate, sodium laureth sulphate, and sodium lauryl sulphate are the major ethoxylate alternatives. A hurdle to the growth of ethoxylates is the rising market share of these substitute products. Growth of the market may be hampered by rising environmental concerns about the impacts of toxicity along with diversification of raw material feedstock by other end-users.

Opportunities

Opportunities

- The emergence of eco-friendly products provides a lucrative opportunity for the market

Environmental concerns about the toxicity of some ethoxylates are getting worse. The development of environmentally acceptable ethoxylate products should be a priority for the producers in particular. The primary replacement for these harmful ethoxylates is Alcohol Ethoxylates (AEs). Non-ionic surfactants in the AE class are manufactured and utilized all over the world. The use of AE in laundry and cleaning detergents is safe based on an evaluation of the risk to human health. The performance qualities of AE are good in many applications. They are a favored option for manufacturers since, unlike NPEs, they are easily biodegradable. The use of hazardous ethoxylates is subject to stringent regulations in many countries. In these countries, alcohol ethoxylates have a chance to gain market share. Therefore, the emergence of eco-friendly products provides a lucrative opportunity for the growth of the global ethoxylates market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global ethoxylates market is segmented based on type, application, end-use, and region

Based on the type, the global market is bifurcated into alcohol, fatty amine, fatty acid, ethyl ester, glyceride, and others. The alcohol ethoxylates accounted for the largest market share and are expected to show their dominance during the forecast period. Alcohol Ethoxylates (AE) are one of the main products used in the production of surfactants. Additionally, it is the biggest downstream market for fatty alcohols. They have advantages for usage in laundry detergent formulations, including quick biodegradation, improved cleaning of synthetic textiles, and water hardness tolerance.

Based on the application, the global ethoxylates market is categorized into household & personal care, institutional & industrial cleaning, pharmaceutical, agrochemicals, oilfield chemicals, and others. Household & personal care accounted for the largest revenue share in 2021 and is expected to show its dominance during the forecast period. The growth in the segment owing to a variety of household cleaning products, including glass cleaners, carpet cleaners, oven cleaners, air fresheners, liquid & powdered laundry detergents, dishwashing gels & detergents, fabric conditioners, and hard surface & floor cleaners, extensively employ it. On the other hand, the pharmaceutical sector is expected to grow at the highest CAGR during the forecast period. In the pharmaceutical industry, ethoxylates are frequently employed as emulsifiers in ointments, tablets, syrups, and gels. Moreover, the rising prevalence of chronic disease is further proliferating the growth of the ethoxylates market due to the continuous research & development and demand for innovative and effective pharmaceutical formulations.

Based on the end-use, the global market is segmented into detergents, personal care, ointments & emulsions, herbicides, insecticides, foam control & wetting agents, lubricants & emulsifiers, and others. The detergent segment is expected to dominate during the forecast period. Natural ethoxylates are mild and have little impact on human skin when added to products. As a result, several detergent producers are now leaning toward including ethoxylates from natural sources in their formulas. Additionally, ethoxylates are environmentally beneficial because they are inert, non-toxic, non-corrosive, and often have a high flash point that doesn't harm marine life. Thus, propelling the end-use segmental growth.

Recent Developments:

Recent Developments:

- In October 2021, a new alkoxylation plant will be constructed and run by Stepan Company at its current Pasadena, Texas location. A key surfactant technology for the agricultural, oilfield, construction, and domestic end-use markets is alkoxylates. With Stepan's investment, the company will be in a better position to meet the rising demand for surfactant and polymer businesses on a global scale. Stepan's investment is anticipated to provide a flexible capacity of 75,000 metric tonnes per year, capable of both ethoxylation and propoxylation.

- In April 2022, a prominent international provider in high-value surfactant industries, Oxiteno S.A. Indstria e Comércio, based in Brazil, has been acquired by Indorama Ventures Public Firm Limited (IVL), a global sustainable chemical company. Through the acquisition, IVL broadens its growth profile into lucrative markets in Latin America and the United States, establishing itself as the country's top producer of surfactants with additional opportunities to expand in Europe and Asia.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 13.3 Billion |

Projected Market Size in 2028 |

USD 17.0 Billion |

CAGR Growth Rate |

3.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF, Royal Dutch Shell Plc, Huntsman International LLC, Stepan Company, Clariant AG, The Dow Chemical Company, Sasol Ltd, India Glycols Ltd., Ineos Group Ltd., Solvay, and Others |

Key Segment |

By Type, Application, End-use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Europe hold the largest market share during the forecast period

Europe held the largest global ethoxylates market share in 2021 and is expected to show its dominance during the forecast period. The growth in the region is attributed to the growing demand from personal care, pharmaceuticals, and household & industrial cleaning industries. Consumption of personal care products has been fueled by people's improving lifestyles and increased awareness of personal cleanliness. Throughout the forecast period, increased efforts and initiatives by national governments as well as the European Commission to revive the end-use markets for ethoxylates, including pharmaceuticals and agrochemicals, are anticipated to drive product demand.

The Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth in the region is attributed to the high ethoxylate usage as a result of the booming personal care, cleaning, and pharmaceutical sectors in developing nations including China, India, Japan, and South Korea. Furthermore, the region ranks among the top producers and exporters of palm oil, with Indonesia and Malaysia accounting for 60% of global exports. One of the main raw materials for producing fatty alcohols and amines, which are essential for producing ethoxylates, is palm oil. Throughout the projection period, the consumption of products in the region is anticipated to be driven by an uninterrupted supply of raw materials and rising household cleaner demand.

Competitive Analysis

Competitive Analysis

- BASF

- Royal Dutch Shell Plc

- Huntsman International LLC

- Stepan Company

- Clariant AG

- The Dow Chemical Company

- Sasol Ltd

- India Glycols Ltd.

- Ineos Group Ltd.

- Solvay.

The global ethoxylates market is segmented as follows:

By Type

By Type

- Alcohol

- Fatty Amine

- Fatty Acid

- Ethyl Ester

- Glyceride

- Others

By Application

By Application

- Household & Personal Care

- Institutional & Industrial Cleaning

- Pharmaceutical

- Agrochemicals

- Oilfield Chemicals

- Others

By End-use

By End-use

- Detergents

- Personal Care

- Ointments & Emulsions

- Herbicides

- Insecticides

- Foam Control & Wetting Agents

- Lubricants and Emulsifiers

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- BASF

- Royal Dutch Shell Plc

- Huntsman International LLC

- Stepan Company

- Clariant AG

- The Dow Chemical Company

- Sasol Ltd

- India Glycols Ltd.

- Ineos Group Ltd.

- Solvay.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors