Search Market Research Report

Energy Drinks Market Size, Share Global Analysis Report, 2022 – 2028

Energy Drinks Market Size, Share, Growth Analysis Report By End-Users (Teenagers, Adults, and Children), By Type (Non-Alcoholic, and Alcoholic), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

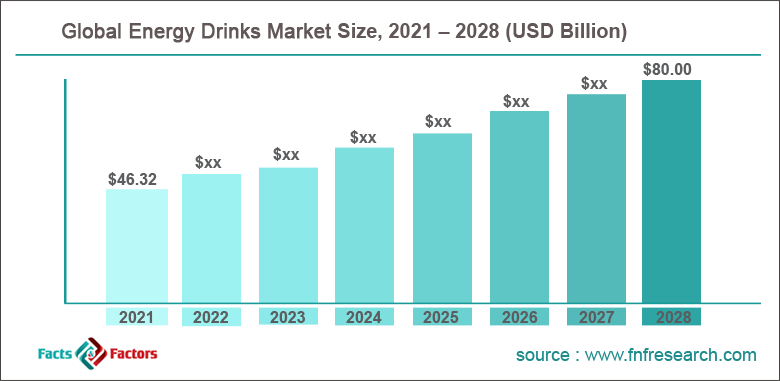

[221+ Pages Report] According to the report published by Facts Factors, the global energy drinks market size was worth around USD 46 billion in 2021 and is predicted to grow to around USD 108 billion by 2028 with a compound annual growth rate (CAGR) of roughly 8.15% between 2022 and 2028. The report analyzes the global energy drinks market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the energy drinks market.

Market Overview

Market Overview

Energy drinks are beverages containing stimulant compounds, in most cases, it is caffeine, and are known to provide mental and physical stimulation by increasing the activities associated with the central nervous system (CNS). Energy drinks may or may not be carbonated, which is a mixture of a sweetener, water, and artificial or natural flavoring. They may also comprise sugar, taurine, herbal extracts, and amino acids. They are a fraction of the larger energy products group that includes items like gels & bars, and other sports drinks, advertised to assist in advanced sports performance. In most cases, tea, coffee, or other drinks that are naturally caffeinated are not considered in the energy drinks segment, just like cola, even though it contains caffeine, is not considered an energy drink.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global energy drinks market is estimated to grow annually at a CAGR of around 8.15% over the forecast period (2022-2028).

- In terms of revenue, the global energy drinks market size was valued at around USD 46 billion in 2021 and is projected to reach USD 108 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on end-users segmentation, adults were predicted to show maximum market share in the year 2021

- Based on type segmentation, non-alcoholic was the leading type in 2021.

- On the basis of region, North America was the leading revenue generator in 2021

Covid-19 Impact

Covid-19 Impact

The global market cap witnessed steady growth during the pandemic. As per a December 2020 report by Hannah Hammond, energy drinks recorded a growth of 7.6% in USD sales along with year-over-year growth of 11.1% in volume across all markets for the 52 weeks of the year ending on November 28th. Red bull along with other industry giants register high sales volume during 2020 and 2021, which showcases that the growth trend in the market remained largely unaffected due to the virus.

Growth Drivers

Growth Drivers

- Increasing physical activity to propel market expansion

The global energy drinks market is projected to grow owing to the increase in the number of people enrolling in some form of sports activity. For young children, sports have become an important part of the teaching curriculum with educational institutes offering benefits like scholarships, study assistance, increase in grades for students winning sports events, etc. to encourage the younger generation to stay fit and incorporate a fitness regime in their regular day to day lives. Post the pandemic, more people have started enrolling in recreation centers to get accustomed to an active lifestyle, which was missing in 2020 and 2021 due to the impact of Covid-19. Even though a certain segment of people has reported avoiding going back to the gyms, a rising trend of home workouts or other forms of physical activity like hiking, swimming, running, etc. is witnessed across the globe. As per a recent report, more than 50% of the adults in the USA have been recorded to participate in some form of outdoor recreational activities.

Restraints

Restraints

- Concerns over false marketing to impede the addition of new customers

In October 2014, Red Bull, an energy drinks giant, faced a lawsuit of USD 13 million driven by misleading and false advertisement, specific to the use of words like ‘boost’ and ‘gives you wings’. The company was alleged to promote the product as a concentration-increasing drink, however it lacked the necessary scientific backing. The company had to reimburse the customers who were a part of the claim with a cheque of USD 10 or a USD 15 voucher. Such incidences may lead to restricted global market growth.

Opportunities

Opportunities

- Emerging markets to provide excellent growth opportunities

The global market cap may generate more revenues from the rising adoption of energy drinks in emerging markets that are marking an increased population along with the rise in disposable income and lifestyle habits. The market players are grabbing these opportunities to exhaustively market their products and create brand value in developing economies resulting in higher growth. Strategies like acquisition, collaboration, mergers, etc. may lead to further revenue-generating scenarios.

Challenges

Challenges

- Presence of unhealthy ingredients to challenge product claims

The global market size may face some challenges during its growth trajectory owing to the presence of unhealthy ingredients such as artificial sweeteners or sugar, which in large quantities may lead to the product losing its credibility in acting as an energy drink. The products also lack the necessary scientific research to confirm the credibility of the drinks in enhancing cognitive activities resulting in more people growing hesitant toward energy drinks consumption.

Segmentation Analysis

Segmentation Analysis

The global energy drinks market is segmented based on end-users, type, and region.

Based on end-users, the global market segments are teenagers, adults, and children. The global market is currently led by the adults segment with more than 46% of the global market revenue in 2021. This is due to the use of energy drinks along with alcoholic beverages. For instance, Red Bull is highly preferred among adults to be mixed with other drinks. There are health concerns associated with such mixing of different drinks and is recommended to be not considered by people with medical conditions.

Based on type, the global market is divided into non-alcoholic, and alcoholic. Around 54% of the global market share was owned by the non-alcoholic segment since these drinks offer much better efficiency as compared to their counterparts. Alcoholic drinks are not consumed by various religious segments thus eliminating a huge section of end-consumers automatically.

Recent Developments:

Recent Developments:

- In January 2022, Starbucks, an American multinational chain of coffeehouses, announced the launch of a new energy drink in collaboration with PepsiCo, American multinational food, snack, and beverage corporation. The product is called BAYA Energy and will be available in convenience stores, national retailers, and grocery stores, across the USA. The flavors offered are raspberry lime, guava, mango, and pineapple passionfruit.

- In October 2021, AB InBev, a Belgium-based largest brewer, announced the launch of Budweiser Beats for the Indian market. The new launch is the first energy drink manufactured by Budweiser and non-alcoholic. The product is launched as per the company’s ambition to reduce the harmful use of alcohol by 10% in at least 6 of the top 10 cities globally.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 46 Billion |

Projected Market Size in 2028 |

USD 108 Billion |

CAGR Growth Rate |

8.15% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Arizona Beverage Company, Red Bull, Rockstar Inc., Dr Pepper Snapple, Cloud 9, and others. |

Key Segment |

By End-Users, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead market growth during the forecast period

The global energy drinks market is projected to be dominated by North America in the coming years owing to high consumer awareness and acceptance rate. Energy drinks have long been part of the sports culture of the USA and Canada where alcoholic and non-alcoholic energy drinks are equally accepted. The regional revenue is further driven by excellent advertising strategies adopted by the market players including collaborating with top sports players for brand promotion. Various energy drinks in the market are owned by influential sports personalities, and these brands are witnessing surging growth mostly driven by the influencing power of the personalities. For instance, the brand ZOA, launched by Dwayne Johnson, a popular pro wrestler, was added to the list of top 15 energy drinks within its first year of launch, and the company had generated a revenue of USD 3.4 million as of October 2021.

Competitive Analysis

Competitive Analysis

- Arizona Beverage Company

- Red Bull

- Rockstar Inc.

- Dr Pepper Snapple

- Cloud 9

The global energy drinks market is segmented as follows:

By End-Users

By End-Users

- Teenagers

- Adults

- Children

By Type

By Type

- Non-Alcoholic

- Alcoholic

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Arizona Beverage Company

- Red Bull

- Rockstar Inc.

- Dr Pepper Snapple

- Cloud 9

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors