Search Market Research Report

Dry Concrete Market Size, Share Global Analysis Report, 2020–2026

Dry Concrete Market By Type (High-Performance Concrete, Self-Consolidating Concrete, and Others) and By Application (Residential Building, Commercial Building, Industrial Building, and Infrastructure): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

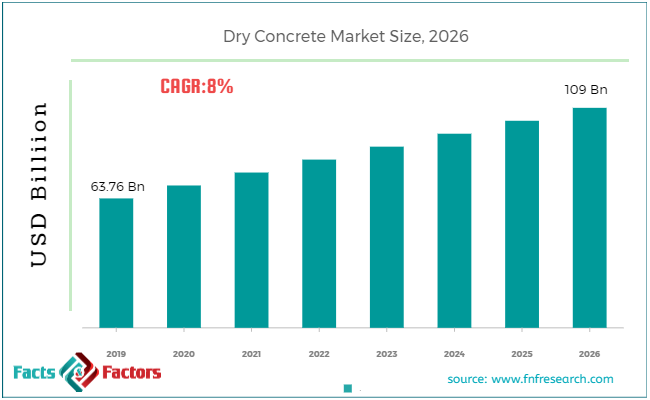

According to the report published by Facts & Factors, the global Dry Concrete market size was worth around USD 63.76 billion in 2019 and is predicted to grow around USD 109 billion by 2026 with a compound annual growth rate (CAGR) of roughly 8% between 2020 and 2026.

The dry concrete market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire dry concrete market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in value (USD Billion) and volume (Million Tons) from FY 2016 – 2026.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the dry concrete industry. The report analyzes and declares the historical and current trends analysis of the dry concrete industry and subsequently recommends the projected trends anticipated to be observed in the dry concrete market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

- After conducting primary research with industry experts, our analysts have estimated that the global dry concrete market is predicted to reach a market value of USD 109 billion in 2026 while registering a CAGR of nearly 8%.

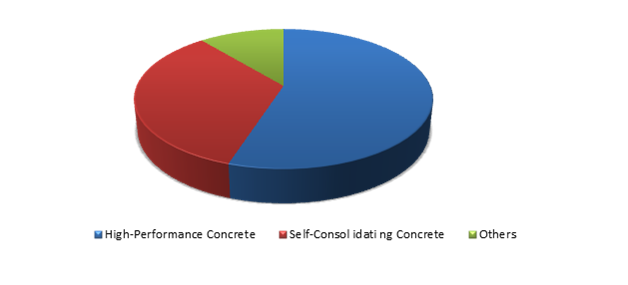

- According to our primary respondents, the high-performance concrete segment dominated the global dry concrete market in 2019, the rising demand for the high-performance dry concrete market is due to an increase in the number of residential skyscrapers in urban areas which has influenced construction companies to opt for high-performance concrete.

- Our primary interviewee also predicted the amount of high-performance dry concrete consumed in 2019 was approximately 340 million tons and is expected to reach a value of 575 million tons in 2026.

- On the basis of types, the self-consolidating dry concrete market was valued at approximately USD 22 billion in 2019 and is predicted to grow to record a CAGR of nearly 9% over the projected period.

- The Asia Pacific dominated the global dry concrete market in 2019 while being valued at around 24 billion in 2019 and is expected to have the fastest growth over the projected period.

Key Recommendations from Analysts

Key Recommendations from Analysts

- According to our analysts, the growth in the global construction industry due to the rise in urbanization and soaring demand for necessary investment has been a key factor that has fueled the global dry concrete market.

- According to our analysts, on the basis of geography, the North American region segment significantly contributed to the global dry concrete market in 2019. Soaring growth in commercial construction activities in the United States of America and Canada has contributed to the growth of the North American dry concrete market.

- The demand for dry concrete is also bolstered by soaring investment in developing city infrastructure. Developing economies are expected to contribute significantly to market growth.

- Our analysts also predict a significant rise in demand for the dry concrete markets from Europe. In terms of volume, the Europe dry concrete market was valued at nearly 150 million tons in 2019.

- Dry concrete consumption in Asia pacific for residential buildings was around 80 million tons and revenue generated from Asia Pacific dry concrete for residential buildings was nearly USD 7 billion in 2019.

Global Dry Concrete Sales Volume Market Share (%) by Types in 2019

Global Dry Concrete Sales Volume Market Share (%) by Types in 2019

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the dry concrete industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the dry concrete industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the dry concrete market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the dry concrete industry. The dry concrete market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market positions in the dry concrete sector. Key strategic developments in the dry concrete market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the dry concrete market are appropriately highlighted in the report.

Dry concrete is primarily used for offering suitable conditions to concrete to achieve a moisture condition for its intended use. Dry concrete is used for reducing shrinkage, increasing the strength of the structure, lowering water permeability, reduce hydrostatic pressures, etc. Apart from its uses in residential and commercial buildings, dry concrete is also used for the construction of sidewalks, building foundations, pavements, fence holes, etc. For dry-cast concrete, wet troweling is not required. Surface finishes and special shape requirements can be done by using hand tools. Other advantages offered by dry concrete over wet concrete is that dry concrete offers higher strength, reduced overall cost of construction, and fast curing rates.

A key factor that has wider adoption of dry concrete around the world is the rising commercial and residential construction market. In recent years, population growth in developing countries, especially in China and India, has augmented the demand for apartments, bungalows, etc., which has led to an increase in the consumption of dry concrete for residential applications. Further, rising investments in developing the necessary infrastructure have also fueled the dry concrete market. Moreover, rising investment in commercial and infrastructure construction activity is likely to create new avenues for the global dry concrete market.

The dry concrete market research report delivers an acute valuation and taxonomy of the dry concrete industry by practically splitting the market on the basis of different types, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the dry concrete industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the dry concrete industry is provided for the leading economies of the world.

The dry concrete market is segmented based on type and application. On the basis of type segmentation, the market is classified into high-performance concrete, self-consolidating concrete, and others. In terms of application segmentation, the market is bifurcated into residential buildings, commercial buildings, industrial buildings, and infrastructure.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 63.76 Billion |

Projected Market Size in 2026 |

USD 109 Billion |

CAGR Growth Rate |

8% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Wieser Concrete, Sika Corporation, Hannibal Concrete Products, Shope Concrete, FP McCann, ACP Limited, US Concrete Products, Standard Concrete, Rochester Concrete Products, Utility Concrete Products, MST Concrete Products Inc., Abbotsford Concrete Products, United Concrete Products, and others. |

Key Segment |

By Application, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the dry concrete market, but not restricted include:

Some of the essential players operating in the dry concrete market, but not restricted include:

- US Concrete Products

- Sika Corporation

- Rochester Concrete Products

- Shope Concrete

- MST Concrete Products Inc.

- United Concrete Products

- FP McCann

- Standard Concrete

- ACP Limited

- Utility Concrete Products

- Wieser Concrete

- Abbotsford Concrete Products

- Hannibal Concrete Products

The taxonomy of the dry concrete industry by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- High-performance Concrete

- Self-consolidating Concrete

- Others

By Application Segmentation Analysis

By Application Segmentation Analysis

- Residential Building

- Commercial Building

- Industrial Building

- Infrastructure

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising a dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- US Concrete Products

- Sika Corporation

- Rochester Concrete Products

- Shope Concrete

- MST Concrete Products Inc.

- United Concrete Products

- FP McCann

- Standard Concrete

- ACP Limited

- Utility Concrete Products

- Wieser Concrete

- Abbotsford Concrete Products

- Hannibal Concrete Products

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors