Search Market Research Report

Dimethyl Disulfide Market Size, Share Global Analysis Report, 2019–2026

Dimethyl Disulfide Market By Application (By Application: Food Use and Industrial Use): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

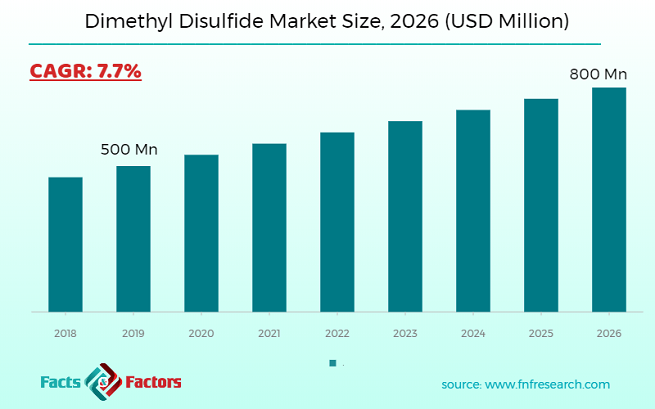

This professional and specialized report study examines the technical and business perspective of the Dimethyl Disulfide industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the Dimethyl Disulfide Market. The report study analyzes the market statistics at the global as well as regional levels to gain an in-depth perspective of the overall Dimethyl Disulfide Market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volumes (Kilo Tons) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the Dimethyl Disulfide Market in our study.

Key Insights from Primary Research

Key Insights from Primary Research

- Our primary respondents believe the market to witness a rapid growth of 7.7% over the forecast period on account of the rising packaged food and beverage industry around the globe.

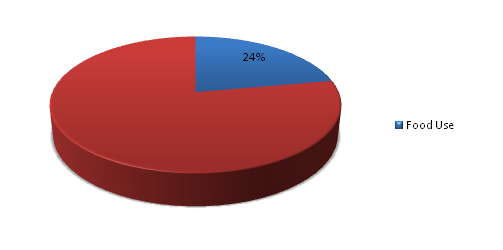

- Some of the CXOs predict the industrial use segment to maintain its dominance throughout 2026 as dimethyl disulfide is most effective in specific manufacturing and production processes. Furthermore, the manufacturers operating in this market are expanding their presence through mergers and acquisitions across various industry verticals.

- Some of the industry experts interviewed in the Asia Pacific revealed that increasing the agricultural industry has propelled the use of the Dimethyl Disulfide market globally.

- Regionally, the Europe region is expected to contribute largely to the global Dimethyl Disulfide market. Some of the interviewees said that their future plans are to focus majorly on Dimethyl Disulfide application areas. The manufacturers operating in countries such as the U.S. and Canada are expected to create higher adoption opportunities for the Dimethyl Disulfide market.

- The research and development subject matter experts suggest investing in R&D activities to come up with newer and more efficient Dimethyl Disulfide end-use sectors. They believe advanced technology in the chemical industry will witness widespread acceptance across the value chain of the Dimethyl Disulfide market.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend focusing on the Asia Pacific dimethyl disulfide market since their calculations revealed that this region turned out to be the top investment pocket across the globe owing to greater opportunities in emerging countries such as India and China.

- The major reason behind the upsurge in growth and lucrative opportunities underlying in this region is the introduction of dimethyl disulfide as peptides in agricultural application areas.

- North America, on the other hand, is expected to foresee robust growth accounting for USD 132 Mn in 2019. This is majorly attributed to the rising adoption of high-performing chemicals in the manufacturing industry across the U.S. and Canada.

- The strategic mergers and acquisitions by key industry players and high demand across application areas are anticipated to fuel the market growth

- The executive summary of the report reads the total opportunity underlying the global Dimethyl Disulfide market is nearly USD 800 Mn between 2020 and 2026.

Global Dimethyl Disulfide (DMDS) Market Volume Share by Application in 2019

Global Dimethyl Disulfide (DMDS) Market Volume Share by Application in 2019

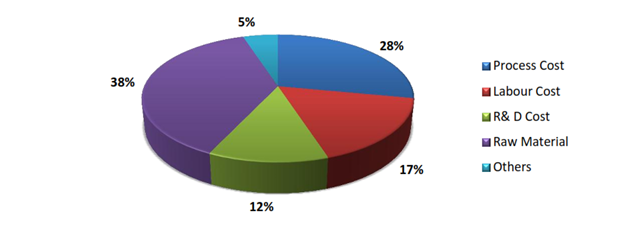

Dimethyl Disulfide – Cost Structure

Dimethyl Disulfide – Cost Structure

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the Dimethyl Disulfide Market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the Dimethyl Disulfide Market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the Dimethyl Disulfide Market.

The research study provides a critical assessment of the Dimethyl Disulfide industry by logically segmenting the market on the basis of product type, connectivity, port, distribution channel, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the Dimethyl Disulfide industry includes the holistic bifurcation of all five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Dimethyl disulfide is a colorless compound widely used in food and industrial applications. It has a higher density than water dimethyl disulfide is soluble in water making it highly suitable in various end-use verticals. It is stored away from potential ignition sources; however, it is easy to pack in bulk and transport. Dimethyl disulfide is used as a food additive to enrich the aroma and flavor of specific food products such as garlic, onion, fruit flavors, soups, meats, cheese, and others. Furthermore, it is used during the preparation of various pesticides. A growing trend in agriculture to use Dimethyl disulfide instead of other substitutes is expected to be one of the primary reasons for the growth of the dimethyl disulfide market globally.

The market has witnessed growth owing to increasing packaged food such as cheese, oil, and others have increased use of dimethyl disulfide in the packaged food industry around the globe. The need for safe and side effects industrial chemicals requirements have propelled the growth of the Dimethyl Disulfide market over the forecast period.

The Dimethyl Disulfide Market is categorized by application into Food Use and Industrial Use.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 500 Million |

Projected Market Size in 2026 |

USD 800 Million |

CAGR Growth Rate |

7.7% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Chevron Phillips Chemical Company LLC., IRO Group Inc., Shinya Chem Co., Ltd., Arkema S.A., Hangzhou Rongshunjia Technology Co., Ltd., Haihang Industry Co., Ltd., Varsal, Inc., Penta International Corporation, Alpha Chemika, Tianjin TopGlobal Co., Ltd., and Others. |

Key Segment |

By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

Some of the key players operating in the Dimethyl Disulfide Market around the globe include :

- Chevron Phillips Chemical Company LLC.

- IRO Group Inc.

- Shinya Chem Co.Ltd.

- Arkema S.A.

- Hangzhou Rongshunjia Technology Co.Ltd.

- Haihang Industry Co.Ltd.

- Varsal Inc.

- Penta International Corporation

- Alpha Chemika

- Tianjin TopGlobal Co.Ltd.

The taxonomy of the Dimethyl Disulfide industry by its scope and segmentation is as follows:

By Application Segmentation Analysis

By Application Segmentation Analysis

- Food Use

- Industrial Use

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Chevron Phillips Chemical Company LLC.

- IRO Group Inc.

- Shinya Chem Co.Ltd.

- Arkema S.A.

- Hangzhou Rongshunjia Technology Co.Ltd.

- Haihang Industry Co.Ltd.

- Varsal Inc.

- Penta International Corporation

- Alpha Chemika

- Tianjin TopGlobal Co.Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors