Search Market Research Report

Digitization in Lending Market Size, Share Global Analysis Report, 2018 – 2025

Digitization in Lending Market By Loan Type (Personal Loans, Business Loans, and Auto Loans) and By Deployment (On Computer and On Smart Phone): Global Industry Perspective, Comprehensive Analysis, and Forecast 2018 – 2025

Industry Insights

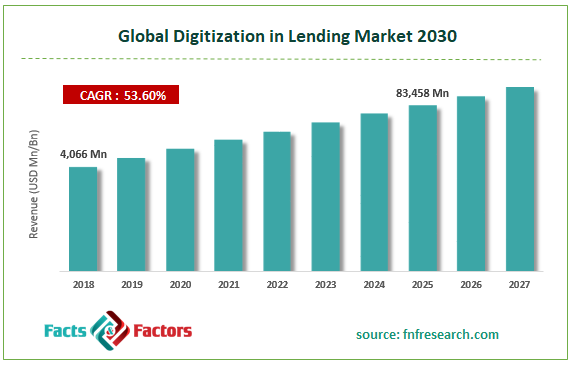

The report covers the forecast and analysis of the Digitization in Lending market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2025 based on revenue (USD Million). The study includes drivers and restraints of the Digitization in Lending market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Digitization in Lending market on a global level.

In order to give the users of this report a comprehensive view of the Digitization in Lending market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Digitization in Lending market by segmenting the market based on loan type, deployment, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2025. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 4,066 Million |

Projected Market Size in 2025 |

USD 83,458 Million |

CAGR Growth Rate |

53.6% CAGR |

Base Year |

2018 |

Forecast Years |

2019-2025 |

Key Market Players |

Lending Stream, 118118Money, Prosper Marketplace Inc., Avant Inc., Elevate, Rise Credit, FirstCash Inc., Speedy Cash, Check ‘n Go, LendUp, NetCredit, Opportunity Financial LLC, Simplic, Headway Capital Partners LLP, Blue Vine, RapidAdvance, Amigo Loans Ltd., Lendico, Trigg, Wonga Group, and Others |

Key Segment |

By Loan Type, Deployment, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Digitization in lending across the banking sector has become a standard for retail credit processing. With the onset of digital revolution along with the growing digitization in lending activities, personal-loan applications nowadays are submitted through swiping on the smartphones. Today, banks are treating small & medium-sized enterprises as their digital priority. Moreover, traditional banks, as well as FinTech firms, have started offering online plans in lending for small & medium-scale firms. This has resulted in less time in approving of the loans or disbursements and this has made the digitized lending popular both among the consumers and the firms. Digitization in lending also helps the banks to improve their operational efficacy.

The overall Digitization in Lending industry is sectored based on loan type and deployment. Based on the loan type, the market is classified into Personal Loans, Business Loans, and Auto Loans. In terms of deployment, the industry is classified into On Computer and On Smart Phone.

This report segments the Digitization in Lending market as follows:

This report segments the Digitization in Lending market as follows:

- Lending Stream

- 118118Money

- Prosper Marketplace Inc.

- Avant Inc.

- Elevate

- Rise Credit

- FirstCash Inc.

- Speedy Cash

- Check ‘n Go

- LendUp

- NetCredit

- Opportunity Financial LLC

- Simplic

- Headway Capital Partners LLP

- Blue Vine

- RapidAdvance

- Amigo Loans Ltd.

- Lendico

- Trigg

- Wonga Group

- and Others

By Loan Type Analysis

By Loan Type Analysis

- Personal Loans

- Business Loans

- Auto Loans

By Deployment Analysis

By Deployment Analysis

- On Computer

- On Smart Phone

Digitization in Lending: By Regional Segment Analysis

Digitization in Lending: By Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table of Content

Industry Major Market Players

- Lending Stream

- 118118Money

- Prosper Marketplace Inc.

- Avant Inc.

- Elevate

- Rise Credit

- FirstCash Inc.

- Speedy Cash

- Check ‘n Go

- LendUp

- NetCredit

- Opportunity Financial LLC

- Simplic

- Headway Capital Partners LLP

- Blue Vine

- RapidAdvance

- Amigo Loans Ltd.

- Lendico

- Trigg

- Wonga Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors