Search Market Research Report

Corporate Travel Insurance Market Size, Share Global Analysis Report, 2022 – 2028

Corporate Travel Insurance Market Size, Share, Growth Analysis Report By Coverage Type (Single-Trip Travel Insurance and Annual Multi-Trip Travel Insurance), By Distribution Channels (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers,and Others), By End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

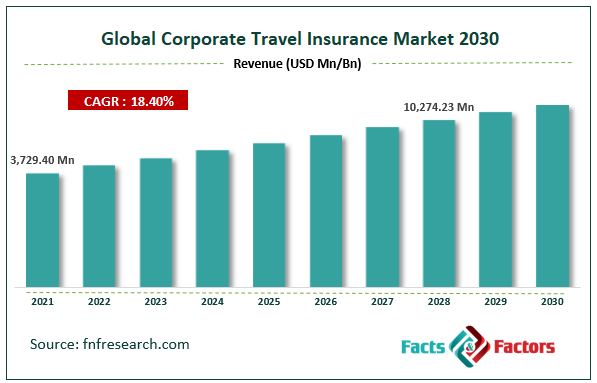

[217+ Pages Report] According to Facts and Factors, the global corporate travel insurance market size was worth USD 3,729.40 million in 2021 and is estimated to grow to USD 10,274.23 million by 2028, with a compound annual growth rate (CAGR) of approximately 18.40% over the forecast period. The report analyzes the corporate travel insurance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the corporate travel insurance market.

Market Overview

Market Overview

Travel insurance is designed to safeguard customers from potential risks and financial losses while they are traveling. The risks might range from little inconveniences like missed airplane connections and delayed luggage to more serious issues like injuries or life-threatening illnesses. They can be shielded from medical expenses incurred while traveling that are not covered by their usual health insurance by purchasing travel insurance. These health insurance plans frequently do not offer complete coverage in foreign countries, and some, like Medicare, offer no coverage at all. In addition to their usual health insurance, travel insurance can assist with supplemental medical expenditures should an insurer become ill or injured before or during their vacation.

It can cost a lot to replace lost or stolen luggage, but travel insurance may help. This is especially helpful if an airline misplaces the luggage of insurance, as getting them to cover lost property might be challenging. The Department of Transportation (D.O.T.) in the U.S. requires airlines to compensate passengers for lost baggage up to a predetermined amount. The maximum amount allowed in certain nations is lower than it is in the U.S. To receive the highest pay-outs, travelers must present proof of the value of the lost luggage and its contents. Additionally, a few airline firms demand that claims be submitted within 21 days.

COVID-19 Impact:

COVID-19 Impact:

The development of COVID-19 is anticipated to hinder the expansion of the corporate travel insurance sector. The COVID-19 pandemic has caused a considerable drop in business travel insurance. This is a result of the travel ban and nationwide lockdown that have been imposed in many nations. Additionally, as a result of countries closing their borders to foreigners, international travel has come to a standstill, and local travel preferences have significantly expanded in the market. Additionally, the increase in aircraft cancellations has led to more insurance claims, which has hampered the market's expansion since the COVID-19 epidemic.

Key Insights

Key Insights

- The global market is estimated to witness growth at a CAGR of 18.4% in the coming years.

- The global insurance market is transitioning to "digital-first" business models that might generate new value worth billions of dollars.

- Insurers are utilizing the Internet of Things, advanced analytics, and machine learning to develop more in-depth personal risk profiles. This is due to the growing significance of usage-based coverage and individualized premiums.

- Traditional insurers and insurtech firms will collaborate to develop new business models and revenue streams that will boost profitability and cut costs.

Growth Drivers

Growth Drivers

- Expansion of the Tourism industry

The travel and tourism sector has consistently grown during the past ten years. Numerous nations in the world are growing in popularity among millennials and becoming major tourist destinations. The growth of the tourism sector has been facilitated by an increase in package holidays, disposable income, extensive media coverage of various holiday types, and simple online travel reservations. Additionally, many students relocate to other nations for higher education, and many universities and colleges offer scholarship opportunities that draw students from all over the world. More incidences of important documents going missing, bags going missing, natural calamities happening, and health problems are documented as the tourism business grows.

Restraints

Restraints

- The cost of travel insurance is expensive

One of the main drawbacks is the price of buying travel insurance. A travel insurance plan can be rather expensive because it provides such a wide range of coverage. But many people think it's a waste of time and money because they might never utilize it. Many people believe that the cost of having peace of mind is worth it. Additionally, without insurance, customers can be required to spend a sizable sum of money on unplanned costs like medical care for accidents and illnesses. The majority of travel insurance policies do not cover pre-existing medical issues; instead, they only provide coverage for unforeseen medical expenses acquired while on the trip. Those that do frequently result in a sharp price increase.

Opportunities

Opportunities

- The rise in National and International Business Travel

Global market growth for business travel insurance is being accelerated by an abrupt rise in domestic and international business travel to buy raw materials from suppliers. As corporate tourism has grown, there have been more instances of airline cancellations, accidents, health problems, baggage theft or loss, natural disasters, and other unforeseen events when traveling. This increases the demand for business travel insurance, helping the global industry to expand.

Additionally, the corporate and tourist sectors' rapid digitalization, as well as the Internet of Things (IoT) rapid penetration in many industries, have encouraged international travel business travelers, which has significantly fuelled the market's international expansion. The market for business travel insurance has grown favorably as medium-sized businesses go abroad more frequently to meet new clients, expand their businesses, and learn about emerging business trends.

Challenges

Challenges

- Cybersecurity concern

Since so much of the world has gone digital, cybersecurity concerns are now a constant source of worry. Due to the growing demand for privacy and data protection among both individuals and organizations, this offers insurers a challenge.

Insurers can pay for the costs related to cybersecurity issues, which can include contacting authorities, notifying people, settlement costs, fines, costs of determining the cause, loss of business, loss of customers, loss of reputation, and cyber extortion, for people and businesses concerned about identity theft or a data breach.

Segmentation Analysis

Segmentation Analysis

Coverage type, distribution channels, and end users are the segments used to analyze the worldwide business travel insurance market.

The market is divided into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators based on the distribution channel. In terms of revenue, the travel insurance market had a significant revenue share for the Insurance Broker category in 2020. An insurance broker acts as a liaison between clients and the insurance provider. They can use both their background and their insurance skills to find the coverage that best satisfies consumers' needs at a reasonable price. Brokers may charge a fee for their services, but they can save customers money and time.

The market is divided into categories for family travelers, business travelers, senior citizens, students, and others based on the end user. In 2020, the market for travel insurance saw the biggest revenue share achieved by the Family Travelers segment. The fact that families travel with multiple people of different ages needs greater risk management and planning, which leads to larger adoption of travel insurance among family travelers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,729.40 Million |

Projected Market Size in 2028 |

USD 10,274.23 Million |

CAGR Growth Rate |

18.40% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ALLIANZ, AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., A.X.A., Insure and Go Insurance Services Limited, Seven Corners Inc., Trip Mate Inc., Travel Insured International, Travel Safe Insurance, USI INSURANCE SERVICES LLC, and Others |

Key Segment |

By Coverage Type, Distribution Channel, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In February 2022, Allianz and Vistara, an Indian full-service airline, entered cooperation. Through this alliance, the companies hoped to offer optional travel insurance and give security in various situations, including significant travel delays, medical emergencies, missed connections, baggage problems, trip cancellations, specified interference, and many others.

- In February 2022, Zurich Canada and Blink Parametric, a parametric platform owned by C.P.P. Group, partnered. This partnership aimed to provide shareholders of Zurich, Canada, with flight interruption insurance. Additionally, the Blink parametric service and Zurich Canada indicate that travelers must now consider purchasing travel insurance. Singapore Airlines and Allianz Partners, a global provider of insurance goods and services, partnered in January 2022. Singapore Airlines would assist Allianz in enhancing its position in the quickly expanding Asia Pacific region through this partnership. Due to Singapore Airlines' growing customer base each year, this alliance also aims to provide global travel insurance as well as appreciative protection solutions.

- Dec. 2021 saw the cooperation between regional carrier Porter Airlines and Allianz Global. Through this relationship, the companies wanted to develop Emergency Travel Medical Insurance, All-Inclusive Insurance, and Trip Cancellation Insurance. Porter customers also get access to Allianz emergency assistance, affirmation inquiries, and professional advice with the aid of pre-trip planning.

Regional Landscape

Regional Landscape

- Increasing business relations are likely to help Europe dominate the global market

In 2021, Europe has emerged as the travel insurance market's dominating region, accounting for the biggest revenue share. The sector is growing as a result of rising travel trends in the European region and local standards for sanitation, safety, and health. In addition, the market for travel insurance in the region is growing as a result of the abundance of important firms, organizations, and historical sites. This can be explained by the fact that the majority of businesses in the UK, Germany, and France purchased business travel insurance during the COVID-19 outbreak, which accelerated the market's growth.

However, due to the existence of various travel insurance carriers throughout Asian countries, such as Chubb, TATA AIG, and Bajaj Allianz, Asia-Pacific is predicted to have significant development throughout the projected period.

Competitive Landscape

Competitive Landscape

Key players within the global Corporate Travel Insurance market include

- ALLIANZ

- AMERICAN INTERNATIONAL GROUP INC.

- Assicurazioni Generali S.P.A.

- A.X.A.

- Insure and Go Insurance Services Limited

- Seven Corners Inc.

- Trip Mate Inc.

- Travel Insured International

- Travel Safe Insurance

- USI INSURANCE SERVICES LLC

The corporate travel insurance market is segmented as follows:

By Coverage Type

By Coverage Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

By Distribution Channel

By Distribution Channel

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

By End User

By End User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- ALLIANZ

- AMERICAN INTERNATIONAL GROUP INC.

- Assicurazioni Generali S.P.A.

- A.X.A.

- Insure and Go Insurance Services Limited

- Seven Corners Inc.

- Trip Mate Inc.

- Travel Insured International

- Travel Safe Insurance

- USI INSURANCE SERVICES LLC

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors