Search Market Research Report

Commercial Cold Equipment Market Size, Share Global Analysis Report, 2020–2026

Commercial Cold Equipment Market By Product Type (Refrigerator & Freezer, Transportation Refrigeration, Refrigerated Display Cases, Beverage Refrigeration, Ice Cream Merchandiser and Refrigerated Vending Machine), By Refrigerant (Fluorocarbons, Hydrocarbons and Inorganics) and By Application (Hotels & Restaurants, Supermarkets & Hypermarkets, Convenience Stores and Bakery): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

[225+ Pages PDF Report] According to the report published by Facts & Factors, the global Commercial Cold Equipment market size was worth around USD 50.08 million in 2019 and is predicted to grow around USD 68.09 million by 2026 with a compound annual growth rate (CAGR) of roughly 4.6% between 2020 and 2026. The report analyzes the global Commercial Cold Equipment market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Commercial Cold Equipment market.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the commercial cold equipment industry. The report analyzes and declares the historical and current trends analysis of the commercial cold equipment industry and subsequently recommends the projected trends anticipated to be observed in the commercial cold equipment market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

- Wide-ranging interviews with top rank executives of major commercial cold equipment manufacturing companies assisted our primary research with qualitative and quantitative insights of the global commercial cold equipment market. With the conclusion of interviews with the executives, our research team estimates the global commercial cold equipment market to undergo tempting growth in the proximity of 7 % CAGR during the forecast period of 2020 to 2026

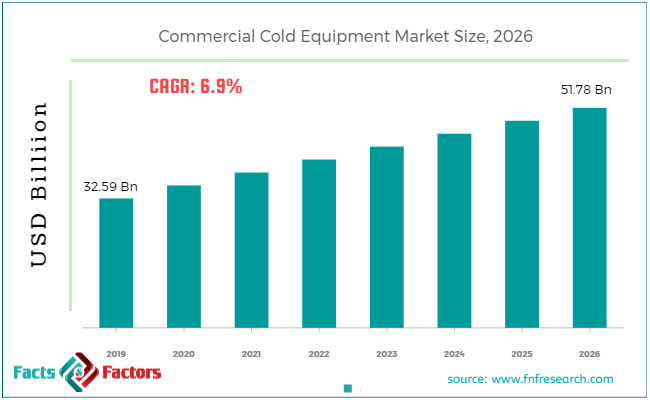

- Cumulative insights projected that the global commercial cold equipment market to surpass the value of USD 51 Billion by 2026. We authenticated the anticipated figures with our in house secondary research performed by our experienced analysts.

- Their projection predicts that hotels and restaurants to remain major end-users. The hotels and restaurants are also expected to remain the major drivers for the growth of the commercial cold equipment market.

- The representatives stated that the fluorocarbon-based refrigerant systems are the largest currently deployed units. Innovative and efficient technologies are leading to the growth of fluorocarbon-based systems.

- The North American region is expected to remain the highest revenue-generating region. CXOs also believe Asia Pacific to exhibit the highest growth with an expected CAGR of above 7 % in foreseeable future.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend for enhanced focus on hotels and restaurants in the Asia Pacific region. They expect the dominating hotel and restaurant application to exhibit the highest growth with the rising hospitality sector in this region.

- Our analysts also expect the demand for NH3/CO2 cascade systems to rise in near future owing to the benefits these systems provide for improved low-temperature distribution facilities and food processing. These advantages include low operational costs, increased efficiency, low capital investment, and increased output.

- Analysts are also pointing towards the rising international food trade which is generating an increase in the demand for refrigeration of seafood, processed foods, and frozen foods. Analysts also expect the market to witness faster growth during the forecast period of 2023 to 2026.

The commercial cold equipment market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire commercial cold equipment market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Billion) from FY 2016 – 2026.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the commercial cold equipment industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the commercial cold equipment industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the commercial cold equipment market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the commercial cold equipment industry. The commercial cold equipment market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the commercial cold equipment sector. Key strategic developments in the commercial cold equipment market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the commercial cold equipment market are appropriately highlighted in the report.

Stringent regulation in wake of the depleting ozone layer has led to the adoption of new eco-friendly refrigeration technology wherein old systems are been phased out. Additionally, the rise in demand for packaged food and beverages has led to the expansion of food retailers and supermarkets which in turn have led to significant growth of the commercial cold equipment market.

Changing the lifestyle of consumers wherein the preference for dining out across the globe is likely to drive the hospitality sector thereby propelling the commercial cold equipment market further.

The western region is witnessing a change of pattern of food consumption wherein seafood consumption has increased considerably as against the meat. With this changing pattern, the global food industry is focusing on seafood exports which create growth opportunities for the commercial refrigeration system manufacturers to handle extra seafood. Innovation in magnetic refrigeration systems and other evolving technologies are expected to positively impact market growth.

The commercial cold equipment market research report delivers an acute valuation and taxonomy of the commercial cold equipment industry by practically splitting the market on the basis of different product types, refrigerants, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

The regional segmentation of the commercial cold equipment industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the commercial cold equipment industry is provided for the leading economies of the world.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 32.59 Billion |

Projected Market Size in 2026 |

USD 51.78 Billion |

CAGR Growth Rate |

6.9% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Carrier Commercial Refrigeration Inc, Dover Corp., Daikin Industries, Ltd., Emerson Electric Company, Johnson Control Inc., Haier Group Corp, GEA Group AG. and others. |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The commercial cold equipment market is segmented based on product type, refrigerant, and Application. On the basis of product type segmentation, the market is classified into refrigerator & freezer, transportation refrigeration, refrigerated display cases, beverage refrigeration, ice cream merchandiser, and the refrigerated vending machine. On the basis of refrigerant, the market is bifurcated into fluorocarbons, hydrocarbons, and inorganics. In terms of Application segmentation, the market is bifurcated into hotels & restaurants, supermarkets & hypermarkets, convenience stores, and bakery.

Some of the essential players operating in the Commercial Cold Equipment Market, but not restricted to include

Some of the essential players operating in the Commercial Cold Equipment Market, but not restricted to include

- Daikin Industries Ltd.

- Carrier Commercial Refrigeration Inc

- Dover Corp.

- Emerson Electric Company

- GEA Group AG

- Johnson Control Inc.

- Haier Group Corp

The taxonomy of the commercial cold equipment market by its scope and segmentation is as follows:

By Product Type Segmentation Analysis

By Product Type Segmentation Analysis

- Refrigerator & Freezer

- Transportation Refrigeration

- Refrigerated Display Cases

- Beverage Refrigeration

- Ice Cream Merchandiser

- Refrigerated Vending Machine

By Refrigerant Type Segmentation Analysis

By Refrigerant Type Segmentation Analysis

- Fluorocarbons

- Hydrocarbons

- Inorganics

By Application Segmentation Analysis

By Application Segmentation Analysis

- Hotels & Restaurants

- Supermarkets & Hypermarkets

- Convenience Stores

- Bakery

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table of Content

Industry Major Market Players

- Daikin Industries Ltd.

- Carrier Commercial Refrigeration Inc

- Dover Corp.

- Emerson Electric Company

- GEA Group AG

- Johnson Control Inc. and Haier Group Corp

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors