Search Market Research Report

Cannabis Testing Market Size, Share Global Analysis Report, 2021 - 2028

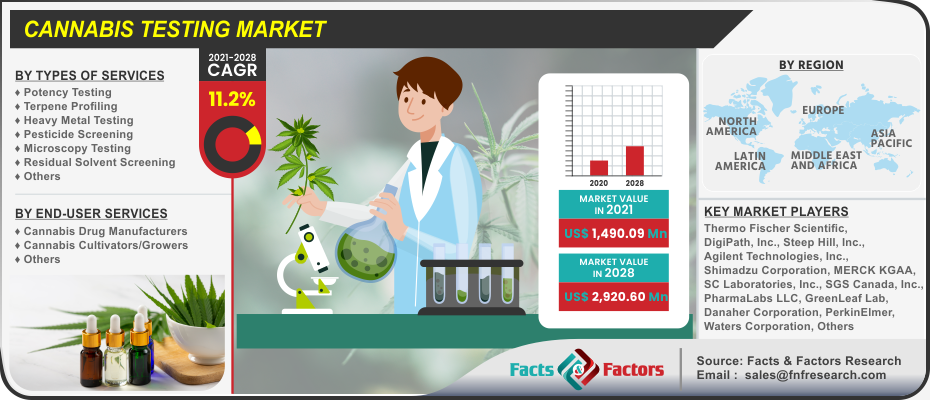

Cannabis Testing Market By Types of Services (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening, & Others), By End-User Services (Cannabis Drug Manufacturers, Cannabis Cultivators/Growers, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2028

Industry Insights

According to Facts & Factors, the latest report on the global cannabis testing market provides information about market data and market analytics. The global cannabis testing market size was worth about USD 1,490.09 Million in 2021 and is predicted to generate revenue of around USD 2,920.60 Million by the end of 2028, with a CAGR of approximately 11.2% during the forecast period 2021 to 2028.

Market Overview

Market Overview

Cannabis drug testing is the methodology that is used to describe the use of cannabis in the sector of medicine, sports, and law. The usage of cannabis into human anatomy is highly detectable and can be detected by urinalysis, hair analysis, as well as saliva tests over a period of days or even weeks in some cases after consumption. The most common form of test used for detecting cannabis usage is known as the Duquenois-Levine test and is often incorporated as a screening test in order to definitively confirm the presence of cannabis.

Industry Growth Factors

Industry Growth Factors

The driving factors for the significant rise of the global cannabis testing market are the legalization of medical cannabis in many parts of the globe coupled with the rising number of cannabis testing laboratories to name a few. Additionally, increasing adoption of LIMS in cannabis testing laboratories coupled with rising awareness about regulated amounts of medical cannabis is expected to increase the footprint of the global cannabis testing market during the forecast period. Moreover, the global cannabis testing market is expected to be driven by factors pertaining to reducing nausea caused by chemotherapy measures, stimulating appetite in AIDS patients, controlling muscular spasms in multiple sclerosis patients, and reducing intraocular pressure in patients with glaucoma is expected to open new revenue opportunities during the forecast period.

Additionally, the ongoing trend suggests removing of legislative actions by emerging economies across LATAM and the MEA regions coupled with increasing investments by the private and personal sector is expected to push the boundaries of the global cannabis testing market during the forecast period. Favorable government policies coupled with the increasing number of key players are expected to increase the consumer base for the global cannabis testing market during the forecast duration. However, a certain lack of uniformity in rules and regulations among the usage and testing of cannabis coupled with higher costs is expected to hamper the growth of the global cannabis testing market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global cannabis testing market is segmented into types of services, end-user, and regions.

The global cannabis testing market is divided into potency testing, terpene profiling, heavy metal testing, pesticide screening, microscopy testing, residual solvent screening, and others on the basis of types of services. The segment pertaining to potency testing is expected to witness the largest market share during the advent of the forecast owing to effective potency testing techniques such as gas chromatography and high-performance liquid chromatography (HPLC) coupled with an increasing number of testing cannabinoids such as CBD (Cannabidiol) and Tetrahydrocannabinol (THC) to name a few. Additionally, an increasing number of quality checks for cannabinoids coupled with increasing export activities is expected to cement the dominant market position of the latter segment during the forecast period.

On the basis of end-user, the global cannabis testing market is broken down into cannabis drug manufacturers, cannabis cultivators/growers, and others. The segment pertaining to cannabis cultivators/growers are expected to witness the largest market share during the advent of the forecast owing to increasing signing agreements with testing laboratories and research centers coupled with favorable government policies to name a few. Additionally, rising product launches from these growers/cultivators coupled with the rising number of approved manufacturers and wholesalers are expected to cement the latter segment at a dominant market position during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,490.09 Million |

Projected Market Size by 2028 |

USD 2,920.60 Million |

CAGR Growth Rate |

11.2% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2028 |

Key Market Players |

Agilent Technologies, Inc., Shimadzu Corporation, MERCK KGAA, Thermo Fischer Scientific, DigiPath, Inc., Steep Hill, Inc., SC Laboratories, Inc., PharmaLabs LLC, GreenLeaf Lab, Saskatchewan Research Council (SRC), SGS Canada, Inc., Danaher Corporation, PerkinElmer, and Waters Corporation, among others. |

Key Segment |

By Types of Services, By End-User Services, and By Region |

Major Regions Covered |

North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast owing to the rising number of testing laboratories coupled with rigorous guidelines set by the government for marijuana cultivators to name a few. Additionally, the rising number of key market players in the region coupled with an increasing number of cultivators is expected to increase the consumer base for the cannabis testing market during the forecast period. The region of Europe is expected to occupy a substantial amount of market share after the subsequent region owing to the rising legalization measures in the region of Europe and the increasing investment in research and development activities to name a few.

Competitive Players

Competitive Players

The key market participants in the global cannabis testing market are :

- Agilent Technologies Inc.

- Shimadzu Corporation

- MERCK KGAA

- Thermo Fischer Scientific

- DigiPath Inc.

- Steep Hill Inc.

- SC Laboratories Inc.

- PharmaLabs LLC

- GreenLeaf Lab

- Saskatchewan Research Council (SRC)

- SGS CanadaInc.

- Danaher Corporation

- PerkinElmer

- Waters Corporation

By Types of Services Analysis

By Types of Services Analysis

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

By End-User Services Analysis

By End-User Services Analysis

- Cannabis Drug Manufacturers

- Cannabis Cultivators/Growers

- Others

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table of Content

Industry Major Market Players

- Agilent Technologies Inc.

- Shimadzu Corporation

- MERCK KGAA

- Thermo Fischer Scientific

- DigiPath Inc.

- Steep Hill Inc.

- SC Laboratories Inc.

- PharmaLabs LLC

- GreenLeaf Lab

- Saskatchewan Research Council (SRC)

- SGS CanadaInc.

- Danaher Corporation

- PerkinElmer

- Waters Corporation

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors