Search Market Research Report

Building Optimization And Commissioning Services Market Size, Share Global Analysis Report, 2025 – 2034

Building Optimization And Commissioning Services Market Size, Share, Growth Analysis Report By Building Type (Commercial, Industrial, And Residential Buildings), By Building Optimization Technology (Automated Control Systems, Energy Management Systems, Building Automation Systems, And Others), By Service (Retro-Commissioning, Re-Commissioning, New Construction Commissioning, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

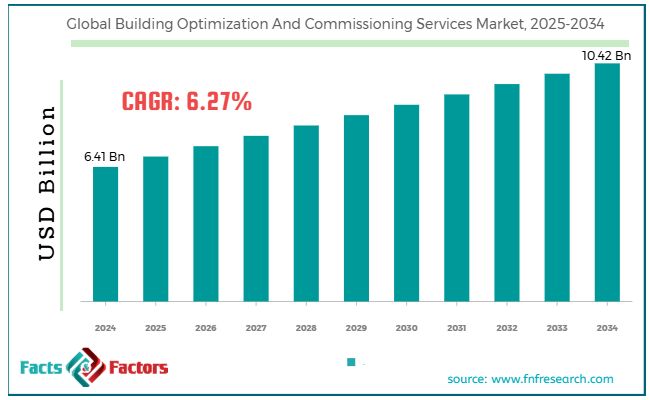

[217+ Pages Report] According to Facts & Factors, the global building optimization and commissioning services market size was valued at USD 6.41 billion in 2024 and is predicted to surpass USD 10.42 billion by the end of 2034. The building optimization and commissioning services industry is expected to grow by a CAGR of 6.27% between 2025 and 2034.

Market Overview

Market Overview

Building optimization and commissioning services encompass a comprehensive range of technical, engineering, and consulting services that help optimize the efficient operation of a building's systems. There are various types of commissioning services available on the market, including new building commissioning, re-commissioning, retro-commissioning, continuous commissioning, and others. End-users can adopt any kind of commissioning as per their requirements. Building optimization refers to the fine-tuning of operational systems, which helps improve comfort, energy efficiency, and equipment life.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global building optimization and commissioning services market size is estimated to grow annually at a CAGR of around 6.27% over the forecast period (2025-2034).

- In terms of revenue, the global building optimization and commissioning services market size was valued at around USD 6.41 billion in 2024 and is projected to reach USD 10.42 billion by 2034.

- The growing demand for green building certification is driving the growth of the global building optimization and commissioning services market.

- Based on the building type, the commercial building segment is growing at a high rate and is projected to dominate the global market.

- Based on building optimization technology, the building automation system segment is anticipated to grow with the highest CAGR in the global market.

- Based on the service, the retro-commissioning segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- How will growing demand for green building certification drive the growth of the global building optimization and commissioning services market?

There are several crucial green building certifications, including LEED, WELL, BREEAM, CASBEE, Green Mark, and GRIHA, which are prerequisites for organizations seeking certification. These certifications are crucial for organizations to achieve their corporate ESG goals, such as ZEB (Zero Energy Building) and ZNC (Zero Net Carbon) targets. These are likely to foster developments in the global building optimization and commissioning services market in the coming years. Many buildings globally are aging, having been in existence for several years, and therefore require retro-commissioning services to optimize their performance.

Moreover, the growing demand for energy efficiency is also likely to revolutionize the market. Municipalities and governments are implementing various performance-based energy codes, including ASHRAE, EPBD, and Title 24. Additionally, the rising energy costs are encouraging owners to invest in energy-efficient products that can optimize their energy consumption.

However, the smart city initiative by governments worldwide is likely to be a transformative force in the global market. Smart city projects involve the installation of automation systems driven by data analytics and many more, which require commissioning services. Numerous government-backed programs are strengthening the demand for integrated BAS platforms, intelligent HVAC systems, smart lighting, energy dashboards, and other related technologies. These smart technologies will improve work performance and ROI.

For instance, BrainBox AI introduced a Cloud Building Management System (CBMS) in 2025. It offers centralized remote optimization with an AI-based virtual engineer.

Restraints

Restraints

- What impact does high initial capital have on the growth of the global building optimization and commissioning services market?

Commissioning services require specialized software, skilled professionals, and advanced working infrastructure, which poses high implementation costs. This cost is a significant barrier for many building owners, small to medium-sized enterprises, and others with budget constraints.

Additionally, the lack of awareness among end-users is likely to impact the building optimization and commissioning services industry's growth negatively.

Opportunities

Opportunities

- The growing corporate real estate sector is expected to foster growth opportunities in the global market.

Corporate organizations are decentralizing their working offices, which is expected to revolutionize the global building optimization and commissioning services market. The growing demand for remote support facilities and shared spaces is strengthening the requirement for cloud-based optimization dashboards, multi-site commissioning, retro-commissioning, and subscription-based monitoring. The COVID-19 pandemic had a profound impact on the market, as it heightened the demand for HVAC systems, air filters, and other related products.

Nowadays, people seek safe ventilation, air changes per hour, and other features, which are further driving demand for re-commissioning services in the market. For instance, Johnson Controls introduced HVAS, data centers, and software technology in 2025. The company is stepping up its security and fire offerings.

Challenges

Challenges

- Shortage of skilled professionals is a big challenge in the global market.

Commissioning services require professionals with multidisciplinary skills in various fields, including data analytics, electrical systems, HVAC, and other related areas.

Additionally, there is a lack of standardization due to the highly fragmented building optimization and commissioning services industry. Also, there is no global protocol or standards, which further results in inconsistent quality and limited compatibility.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 6.41 Billion |

Projected Market Size in 2034 |

USD 10.42 Billion |

CAGR Growth Rate |

6.27% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

WSP, Syska Hennessy Group, Sain Engineering Associates Inc., Pinnacle Infotech, Johnson Controls Inc., Hunton Group Inc., Honeywell International Inc., CIM ENVIRONMENTAL PTY LTD, Affiliated Engineers Inc., and others. |

Key Segment |

By Building Type, By Building Optimization Technology, By Service, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global building optimization and commissioning services market can be segmented into building type, building optimization technology, and service type.

- Based on building type, which segment will dominate the building optimization and commissioning services market?

The market can be segmented into commercial, industrial, and residential buildings. The commercial building segment is expected to be the fastest-growing in the building optimization and commissioning services industry during the predicted period. Strict building regulatory mandates are the primary reasons for the segment's high growth rate. Mandates like ASHRAE 90.1, LEED, BREEAM, Green Globes, and Energy Star are facilitating commercial developments. The high operating costs of commercial buildings are also a critical factor driving growth in the segment.

Therefore, owners invest in HVAC systems and install automation systems to improve overall performance. Also, the high influx of investment in smart commercial infrastructure is fueling the growth rate. There is an increase in the adoption of building automation systems across commercial buildings.

Moreover, facility owners are installing AI-powered fault detection and diagnostics solutions, which are also expected to influence the growth of the segment positively. The solutions have huge applications in airports, offices, and data centers due to the re-commissioning of aging infrastructure. The increasing number of data centers globally is raising the demand for cooling solutions. Hotels and the hospitality sector are using many automation solutions, like lighting and AC systems. The increasing demand for predictive maintenance models to reduce downtime in smart infrastructure is further expected to expand the market.

Based on building optimization technology, the market can be segmented into automated control systems, energy management systems, building automation systems, and others. The building automation system segment is expected to account for the largest share of the global building optimization and commissioning services market. Building automation systems refer to the central system that controls and accesses the entire automated system.

However, it helps in optimizing energy efficiency by facilitating real-time energy monitoring and automated load balancing. Technological advancements are widening the scope of building automated systems. Protocols like BACnet, Modbus, LonWorks, and KNX make BAS more scalable. A cloud-based system is a unique feature of BAS, which enables real-time optimization and remote diagnostics. BAS integrates well with AI models, which help improve the performance of buildings. However, it is an essential aspect of cybersecurity. It offers network encryption and intrusion detection systems, which can prevent unauthorized access in smart buildings.

Additionally, the increasing adoption of smart infrastructure, particularly in developing economies, is likely to strengthen the segment's growth. However, smart city projects by governments in countries such as Japan, Singapore, and India are also expected to create new growth opportunities in the market.

Based on service, the market can be segmented into retro-commissioning, commissioning, new construction, and others. The retro-commissioning segment is likely to dominate the building optimization and commissioning services industry during the forecast period. Retro-commissioning refers to the commissioning of existing buildings due to various reasons, such as performance degradation over time. Many buildings across the globe are years old and, therefore, function inefficiently. Such a landscape is fueling the demand for retro-commissioning without replacing the entire system.

Additionally, organizations are working to lower their energy usage and reduce greenhouse gas emissions. Retro-commissioning can offer energy savings without requiring significant investment. Additionally, there are government mandates for the re-commissioning of certain buildings. However, the government is offering subsidies and rebates for the commissioning works, which is further expected to foster growth opportunities in the market.

Regional Analysis

Regional Analysis

- Will North America continue to dominate the global building optimization and commissioning services market?

North America is expected to account for the largest share of the global building optimization and commissioning services market during the forecast period. One of the major reasons for the high growth rate of the regional market is the energy efficiency mandates by the North American government. Many industrial facilities are fostering demand for energy optimization, which is likely to increase the need for building optimization services.

The United States is the fastest-growing country in North America, primarily due to federal and state-level energy codes, such as ASHRAE and the IECC. The government is incentivizing retro-commissioning services, thereby expanding the market for these services. Mexico's major infrastructure is prompting demand for retro-commissioning. Urban commercial developments in Monterrey and Guadalajara are also expected to drive market growth.

The Asia-Pacific region is another fastest-growing region in the world and is expected to experience significant developments in the years to come. The APAC region is witnessing numerous smart city projects initiated by governments in countries such as India, China, and Japan.

Additionally, the growing emphasis of regional governments on digitizing public assets is expected to develop the market further. China is the largest market in the APAC region due to the government's increasing focus on offering green building certifications. There is a rise in smart commercial real estate, which is expected to fuel the growth in the segment. India is also growing rapidly due to the increasing public-private partnerships in urban sustainability programs, which are expected to contribute significantly to the growth of the regional market.

Singapore is known for its innovations and is expected to foster numerous developments in the building optimization and commissioning services industry. Additionally, the government has initiated several programs aimed at mandating the commissioning of public infrastructure, which is expected to expand the market further.

Competitive Analysis

Competitive Analysis

The key players in the global building optimization and commissioning services market include:

- WSP

- Syska Hennessy Group

- Sain Engineering Associates Inc.

- Pinnacle Infotech

- Johnson Controls Inc.

- Hunton Group Inc.

- Honeywell International Inc.

- CIM ENVIRONMENTAL PTY LTD

- Affiliated Engineers Inc.

For instance, Trane Technologies successfully acquired BrainBox AI in 2024. The acquired company is a Montreal-based firm, a leader in AI-driven HVAC control systems.

The global building optimization and commissioning services market is segmented as follows:

By Building Type Segment Analysis

By Building Type Segment Analysis

- Commercial

- Industrial

- Residential Buildings

By Building Optimization Technology Segment Analysis

By Building Optimization Technology Segment Analysis

- Automated Control Systems

- Energy Management Systems

- Building Automation Systems

- Others

By Service Segment Analysis

By Service Segment Analysis

- Retro-Commissioning

- Re-Commissioning

- New Construction Commissioning

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- WSP

- Syska Hennessy Group

- Sain Engineering Associates Inc.

- Pinnacle Infotech

- Johnson Controls Inc.

- Hunton Group Inc.

- Honeywell International Inc.

- CIM ENVIRONMENTAL PTY LTD

- Affiliated Engineers Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors