Search Market Research Report

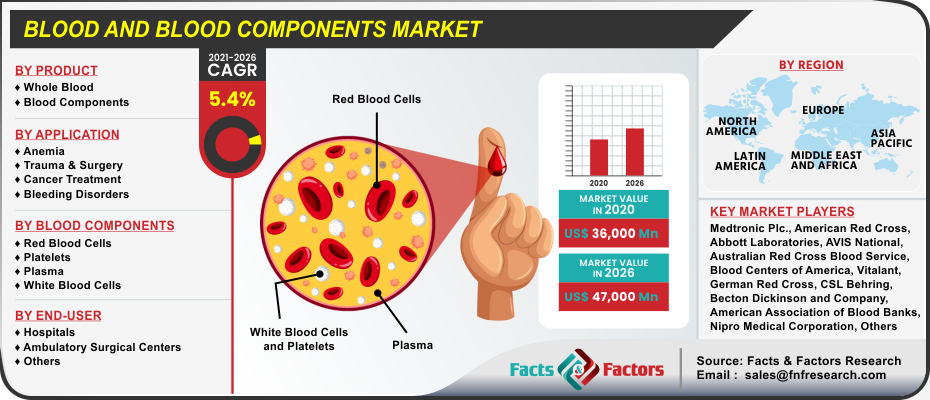

Blood and Blood Components Market Size, Share Global Analysis Report, Blood Components Market By Product (Whole Blood, and Blood Components), By Application (Anemia, Trauma & Surgery, Cancer Treatment, and Bleeding Disorders), By Blood Components (Red Blood Cells, Platelets, Plasma, and White Blood Cells), and By End-User (Hospitals, Ambulatory Surgical Centers, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Blood and Blood Components Market By Product (Whole Blood, and Blood Components), By Application (Anemia, Trauma & Surgery, Cancer Treatment, and Bleeding Disorders), By Blood Components (Red Blood Cells, Platelets, Plasma, and White Blood Cells), and By End-User (Hospitals, Ambulatory Surgical Centers, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Industry Insights

According to the report published by the Facts & Factors, global demand for the blood and blood components market was estimated at approximately USD 36,000 Million in 2020 and is expected to generate revenue of around USD 47,000 Million by the end of 2026, growing at a CAGR of around 5.4% between 2021 and 2026.

Market Overview

Market Overview

Blood alludes to the liquid which flows in the vascular arrangement of nearly all creatures, as well as people. The red blood cells, white blood cells, platelets, and plasma are its four primary components. Blood and blood components can be used in several medical condition treatments such as anemia, bleeding disorders, trauma and surgery, and cancer treatment. In addition, they are also extensively used in resuscitation applications and in the surgery of traumatized patients.

Industry Growth Factor

Industry Growth Factor

The growth of the global blood and blood components market is driven by the increase in the prevalence of trauma and road accidents and the growing occurrence of diseases. At times, due to traumas such as hemorrhage, the volume of blood gets reduced to a very low level and cannot be replaced quickly enough by the body.

The road accident causes extreme blood loss from the body, which has to be restored instantly. Sometimes, the blood itself is lacking only some components, as in the hemophilia case. All these situations demand transfusion of blood and blood components into the body of the patient. Moreover, the rising incidence of chronic diseases such as liver disease, cancer, among others will also encourage the growth of the global blood and blood components market during the forecast period.

Furthermore, the growing incidence of bleeding disorders along with the increase in the number of surgeries across the world is also propelling the blood and blood components market development globally. Also, the major rise in the elderly population base that is susceptible to lots of chronic diseases such as liver cirrhosis will make a significant demand for blood derivatives in the near future. Besides, the mounting awareness associated with the significance of blood donations between people will influence positively the industry viewpoint. Worldwide, the number of blood donations is also growing significantly.

However, the rising risk of developing or transferring an infection while the blood is transmitted to the patients, the inaccessibility of proficient blood stockpiling procedures, and the decline in the blood banks number are some restraining factors that might hinder the market growth. On the contrary, the production of novel advancements and the growing usage of plasma in the healthcare sector will most likely present growth prospects for the blood and blood components market growth in the forecast period.

Segmentation Analysis

Segmentation Analysis

The global blood and blood components market is classified into product, application, blood components, and end-user. On the basis of the product, the global blood and blood components market is segmented into whole blood, and blood components. Based on the application, the global blood and blood components market is divided into anemia, trauma & surgery, cancer treatment, and bleeding disorders.

The global blood and blood components market based on the blood components is classified into red blood cells, platelets, plasma, and white blood cells. In terms of the end-user industry, the global blood and blood components market is categorized into hospitals, ambulatory surgical centers, and others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 36,000 Million |

Projected Market Size in 2026 |

USD 47,000 Million |

CAGR Growth Rate |

5.4% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Medtronic Plc., American Red Cross, Abbott Laboratories, Australian Red Cross Blood Service, Blood Centers of America, German Red Cross, Becton Dickinson and Company, Nipro Medical Corporation, AVIS National, American Association of Blood Banks, National Blood Authority Australia, Baxter International Inc., Vitalant, CSL Behring, Novartis, Immucor, Novo Nordisk, Roche Diagnostics, Ortho Clinical Diagnostics, Grifols International SA, Fresenius Kabi, Medimmune (AstraZeneca), Thermo Fisher Scientific Inc., Sarstedt AG & Co., Terumo Corporation, Haemonetics Corporation, and Macopharma, and others |

Key Segment |

By Product, Application, Blood Components, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Geographically, the blood and blood components market is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In terms of region, the Asia-Pacific blood and blood components market is anticipated to record the fastest-growing market in the forthcoming years.

The high growth in this regional market can be attributed to the existence of many donors along with the highly developed healthcare infrastructure in the region. Furthermore, the favorable government initiatives and various untapped opportunities in the promising markets of India and China are some other key factors projected to propel the Asia-Pacific region during the forecast period.

Competitive Players

Competitive Players

Several market players in the global blood and blood components market cover :

- Medtronic Plc.

- American Red Cross

- Abbott Laboratories

- Australian Red Cross Blood Service

- Blood Centers of America

- German Red Cross

- Becton Dickinson and Company

- Nipro Medical Corporation

- AVIS National

- American Association of Blood Banks

- National Blood Authority Australia

- Baxter International Inc.

- Vitalant

- CSL Behring

- Novartis

- Immucor

- Novo Nordisk

- Roche Diagnostics

- Ortho Clinical Diagnostics

- Grifols International SA

- Fresenius Kabi

- Medimmune (AstraZeneca)

- Thermo Fisher Scientific Inc.

- Sarstedt AG & Co.

- Terumo Corporation

- Haemonetics Corporation

- Macopharma

Product Segment Analysis

Product Segment Analysis

- Whole Blood

- Blood Components

Application Segment Analysis

Application Segment Analysis

- Anemia

- Trauma & Surgery

- Cancer Treatment

- Bleeding Disorders

Blood Components Segment Analysis

Blood Components Segment Analysis

- Red Blood Cells

- Platelets

- Plasma

- White Blood Cells

End-User Segment Analysis

End-User Segment Analysis

- Hospitals

- Ambulatory Surgical Centers

- Others

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Table of Content

Industry Major Market Players

- Medtronic Plc.

- American Red Cross

- Abbott Laboratories

- Australian Red Cross Blood Service

- Blood Centers of America

- German Red Cross

- Becton Dickinson and Company

- Nipro Medical Corporation

- AVIS National

- American Association of Blood Banks

- National Blood Authority Australia

- Baxter International Inc.

- Vitalant

- CSL Behring

- Novartis

- Immucor

- Novo Nordisk

- Roche Diagnostics

- Ortho Clinical Diagnostics

- Grifols International SA

- Fresenius Kabi

- Medimmune (AstraZeneca)

- Thermo Fisher Scientific Inc.

- Sarstedt AG & Co.

- Terumo Corporation

- Haemonetics Corporation

- Macopharma.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors