Search Market Research Report

Biocides Market Size, Share Global Analysis Report, 2022 – 2028

Biocides Market By Type (Oxidizing Biocides, Non-Oxidizing Biocides, Others), By Application (Water Treatment, Household & Personal Care, Paints & Coatings, Wood Preservatives, Other Biocides), and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends and Forecast 2022 – 2028

Industry Insights

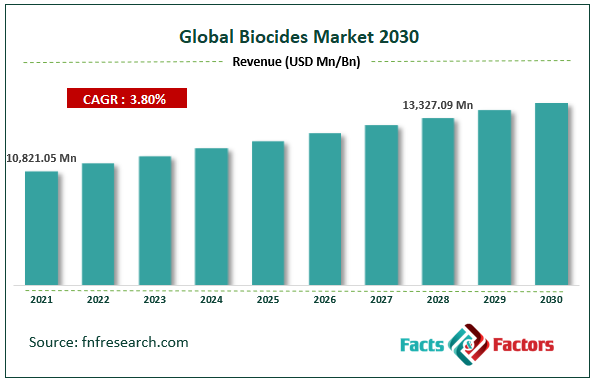

[227+ Pages Report] According to Facts and Factors, the global biocides market was valued at USD 10,821.05 million in 2021 and is predicted to increase at a CAGR of 3.8% to USD 13,327.09 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global biocides market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the biocides market.

Market Overview

Market Overview

A biocide is a microorganism or chemical product that is designed to render, discourage, eliminate, or control hazardous germs through biological or chemical synthesis. Its properties such as excellent cleansing action, nontoxicity, and high resonance with solvents make it suitable for a wide range of end industries. Continuous R&D investments, the creation of synergic chemistries for product diversity, innovation, improved performance, and application expansion may all be linked to the company's growth. Developed countries/regions with stricter rules and environmental standards, such as the United States and the European Union, are likely to present profitable prospects for environmentally friendly or bio-based products.

The demand for each application continues to fluctuate in response to seasonality fluctuations. Increased acceptance of oxidizing biocides by end-users, such as the pulp and paper industry, due to their effectiveness and low cost has resulted in a greater preference among manufacturers for oxidizing biocides. On-site generation-based biocide oxidation technologies, such as chlorine dioxide on-site generation, are also gaining traction in water treatment and pharmaceutical applications.

Growth Drivers

Growth Drivers

The growing use of water-based paints and coatings has increased the demand for biocides in these products. Third-party distribution channels have grown as a result of the primary manufacturers' concentration on niche clients and increased penetration. Distributors' investment in new technology and digital solutions has increased in an effort to boost their competitiveness. The Biocidal Products Regulation (BPR, Regulation (EU) 528/2012) intends to improve the use and operation of biocidal products in the European Union (EU) in order to provide a high level of protection for humans, animals, and the environment. Before they may be put on the market, all biocidal products must be approved.

Furthermore, before a biocidal product may be sold, the active ingredients in it must be approved. The registration of biocidal products is a time-consuming and costly process. The expense of registering each biocides product under the new legislation, according to industry analysts, is enormous. Furthermore, corporations outside the EU are not compelled to follow BPR, but EU suppliers are required to do so. This may limit the market's expansion.

COVID – 19 Impact

COVID – 19 Impact

The Biocides Market experienced significant hurdles as a result of economic loss during the COVID-19 epidemic. When the government ordered a lockdown, the market's industrial activities were halted, including the manufacturing process, production process, and other processes. When the sales rate was impeded, the supply chain process was disturbed. In the days following the lifting of the lockdown, the market saw a surge in demand from end-users. Biocides have a wide range of applications due to their versatility.

Biocides' principal role is to kill hazardous bacteria, hence their demand increased throughout this time period. To prevent the spread of the virus, the public and industrial sectors used a variety of disinfection agents. As a result, the market is likely to grow at a rapid pace in the future years.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The global biocides market is segregated based on type, and application.

In terms of type, oxidizing biocides are predicted to be the fastest-growing type in the Biocides market. Oxidizing biocides are compounds that kill germs by an electrochemical mechanism. During the oxidation process, the biocide gains an electron from the bacteria, and this electron loss kills the organism. Oxidizing biocides perform best in systems that use a lot of water. The most frequent oxidizing biocides used in water treatment include chlorine, bromine, iodine, chlorine dioxide, ozone, hydrogen peroxide, sodium chlorite, calcium hypochlorite, sodium hypochlorite, peracetic acids, hypobromous acid, and sodium bromide. According to industry experts, oxidizing biocides are frequently used in water treatment because they are less expensive than non-oxidizing biocides.

In terms of application, the paints and coatings application sector had the highest revenue share in the forecast period and is expected to continue its lead throughout the projected period. Due to their exposure to bulk handling and storage systems, paints and coatings are especially sensitive to aqueous and airborne microbiological contamination. The use of biocides in paints and coatings has several advantages, including dry-film preservation, microbial growth inhibition, and in-can preservation. It also helps to inhibit fungal development once the film has formed and the paint has dried. As a result, product application in paints and coatings to prevent deterioration has become a necessity for producers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 10,821.05 Million |

Projected Market Size in 2028 |

USD 13,327.09 Million |

CAGR Growth Rate |

3.8% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Lonza AG (Bain Capital and Cinven) (Switzerland), DuPont (IFF) (US), LANXESS (Germany), Ecolab Inc. (US), BASF SE (Germany), Kemira OJY (Finland), Solvay (Belgium), Nouryon (Netherlands), Solenis (US), Veolia (France), Thor Industries (US), Sigura Water (US), Italmatch chemicals (Italy), Albemarle Corporation (US), ICL Group (Israel), Accepta Water Treatment (UK), Buckman Laboratories Interanational Inc. (US), B&V Chemicals (UK), Kimberlite Chemicals (Singapore), Kurita Water Industries (Japan), Melzer Chemicals Pvt. Ltd. (India), Momar Inc. (US), Ozone Tech Systems (Sweden), Chemicrea Inc (China), and Others |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

During the projected period, Asia Pacific is expected to contribute the most value to the global market. This expansion can be attributed to increased construction activity as a result of the region's ever-increasing population. Developing economies such as China, Japan, and India are increasingly embracing sophisticated technology to improve product development in the paints and coatings business. Furthermore, the use of water treatment and cleaning solutions is predicted to rise due to increased demand for industrial and consumer applications. China is the largest consumer of all items since it has a vast population to feed and house while also keeping the environment clean.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global Biocides Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global Biocides Market:

- Lonza AG (Bain Capital and Cinven) (Switzerland)

- DuPont (IFF) (US)

- LANXESS (Germany)

- Ecolab Inc. (US)

- BASF SE (Germany)

- Kemira OJY (Finland)

- Solvay (Belgium)

- Nouryon (Netherlands)

- Solenis (US)

- Veolia (France)

- Thor Industries (US)

- Sigura Water (US)

- Italmatch chemicals (Italy)

- Albemarle Corporation (US)

- ICL Group (Israel)

- Accepta Water Treatment (UK)

- Buckman Laboratories Interanational Inc. (US)

- B&V Chemicals (UK)

- Kimberlite Chemicals (Singapore)

- Kurita Water Industries (Japan)

- Melzer Chemicals Pvt. Ltd. (India)

- Momar Inc. (US)

- Ozone Tech Systems (Sweden)

- Chemicrea Inc (China)

The global biocides market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Oxidizing Biocides

- Non-Oxidizing Biocides

- Others

By Application Segment Analysis

By Application Segment Analysis

- Water Treatment

- Household & Personal Care

- Paints & Coatings

- Wood Preservatives

- Other Biocides

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Lonza AG (Bain Capital and Cinven) (Switzerland)

- DuPont (IFF) (US)

- LANXESS (Germany)

- Ecolab Inc. (US)

- BASF SE (Germany)

- Kemira OJY (Finland)

- Solvay (Belgium)

- Nouryon (Netherlands)

- Solenis (US)

- Veolia (France)

- Thor Industries (US)

- Sigura Water (US)

- Italmatch chemicals (Italy)

- Albemarle Corporation (US)

- ICL Group (Israel)

- Accepta Water Treatment (UK)

- Buckman Laboratories Interanational Inc. (US)

- B&V Chemicals (UK)

- Kimberlite Chemicals (Singapore)

- Kurita Water Industries (Japan)

- Melzer Chemicals Pvt. Ltd. (India)

- Momar Inc. (US)

- Ozone Tech Systems (Sweden)

- Chemicrea Inc (China)

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors