Search Market Research Report

Automotive Wire Market Size, Share Global Analysis Report, 2019–2026

Automotive Wire Market By Type (Copper Core, Aluminum Core and Others) and By Application (Body, Chassis and Safety, Engine, HVAC, and Sensors): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the automotive wire industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the automotive wire market. The report study analyzes the market statistics at the global as well as regional levels to gain an in-depth perspective of the overall automotive wire market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volumes (Units) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

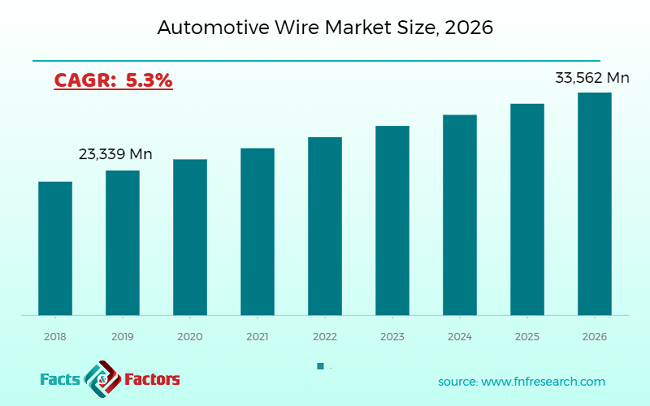

- As per our primary respondents, the global automotive wire is set to grow annually at a rate of around 5.3%

- It was established through primary interviews that the high-speed document scannermarket was valued at around USD 23,000 Million in 2019.

- Asia Pacific is presently holding the largest revenue share among all the regions and is further expected to maintain its position throughout the forecast period.

- The “copper” category, on the basis of type segmentation, was the leading revenue-generating category over the past years.

- On the basis of application segmentation, the “chassis” application holds the major market share.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the global automotive wire market is expected to grow significantly over the forecast period.

- The strategic and competitive advantage provided by the chassis is anticipated to be the key factor driving this market globally

- Our team of analysts has identified, electric vehicles will provide potential opportunities for the players operating in this market.

- In recent years, the use of aluminum will grow rapidly in coming years as it is lighter in weight and more cost-effective.

- Overall, the global market has the potential to grow owing to its rise in advancements of autonomous mobility solutions.

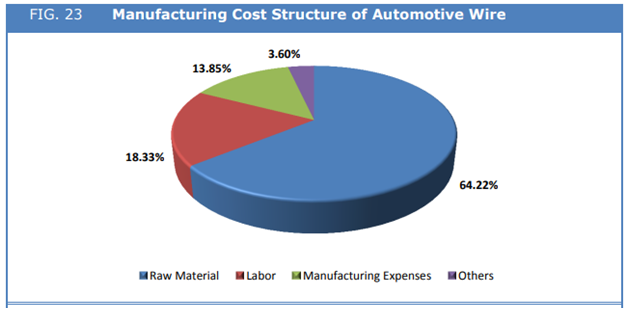

Automotive Wire Market- Manufacturing Cost Structure

Automotive Wire Market- Manufacturing Cost Structure

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the automotive wire market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the automotive wire market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the automotive wire market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the automotive wire market.

The research study provides a critical assessment of the automotive wire industry by logically segmenting the market on the basis of type, application, and region. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the automotive wire industry includes the holistic bifurcation of all five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Automotive wires have used the transmission of electrical signals within various components and systems. They are designed to resist grease, acids, oil, water, fungus, and solvents. In automotive, the wire is generally assembled into harnesses that are used for various automotive applications. They are a package of loose wires assembled together into a single coverage for a more systematized system. These are used for signal transmission and powering up of different electrical and electronic devices. They are also used in electrical circuits and are designed to operate in extreme heating conditions effectively. There are different types of automotive wires which are used for various applications such as GPT or Primary Wire, 1015 Hook-Up or Motor Wire, SXL Wire, Speaker Wire, Battery Cable, and Trailer Wire.

The growing consumer preferences for autonomous mobility solutions have increased the complexity of the wiring harness for automobiles. Additionally, the introduction of electric vehicles has brought rapid changes in the electronics of vehicles which in turn will result in massive changes in automotive cabling.

Moreover, increasing demand for advanced driver assistance systems (ADAS) in vehicles and consumer preference for electric mobility is further fueling demand from the industry. Installing connectivity systems for simplified and easy connection of electrical components in cars will further support growth in the industry. However, the design of these wires requires a special set of insulators and conductors with high resistance and durability which is expensive. As a result, the high development cost involved in constructing advanced automotive wires is hindering the growth of the global automotive wire market.

The automotive wire market has been segmented on the basis of type and application and region. In, the type segment, copper core, and aluminum core types are majorly considered. The application is bifurcated into the body, chassis and safety, engine, HVAC, and sensors. Copper core wire holds the major market share owing to its various advantages such as higher conductivity, ductility, and high tensile strength. The chassis and safety application segment dominates the automotive wire market as there is a rise in the production of passenger cars. It involves complex installations in the instrument panel of passenger cars. This factor drives the demand for chassis harnesses. Moreover, the government initiatives towards zero-emission vehicles are boosting the demand for electric vehicles, and designing these vehicles will create demand for automotive wires. Certain factor indicates that the automotive wire market has huge potential to grow over the forecast period.

The automotive wire market is segmented based on type and application. On the basis of type segmentation, the market is classified into copper core and aluminum core amongst others. In terms of application segmentation, the market is bifurcated into the body, chassis and safety, engine, HVAC, and sensors.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 23,339 Million |

Projected Market Size in 2026 |

USD 33,562 Million |

CAGR Growth Rate |

5.3% CAGR |

Base Year |

2020 |

Forecast Years |

2020-2026 |

Key Market Players |

Yazaki Corporation, Sumitomo Electric Industries, Leoni AG, Lear Corporation, Yura Corporation, Furukawa Electric, COFICAB, PKC Group, Fujikura, Coroplast Inc., General Cable, Beijing S.P.L Wire & Cable Co, Ltd, and Kyungshin Corp among others. |

Key Segment |

By Type, By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the automotive wire market, but not restricted include:

Some of the essential players operating in the automotive wire market, but not restricted include:

- Yazaki Corporation

- Sumitomo Electric Industries

- Leoni AG

- Lear Corporation

- Yura Corporation

- Furukawa Electric

- COFICAB

- PKC Group

- Fujikura

- Coroplast Inc

- General Cable

- Beijing S.P.L Wire & Cable Co Ltd

- Kyungshin Corp

The taxonomy of the automotive wire market by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- Copper Core

- Aluminum Core

- Others

By Application Segmentation Analysis

By Application Segmentation Analysis

- Body

- Chassis and Safety

- Engine

- HVAC

- Sensors

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Yazaki Corporation

- Sumitomo Electric Industries

- Leoni AG

- Lear Corporation

- Yura Corporation

- Furukawa Electric

- COFICAB

- PKC Group

- Fujikura

- Coroplast Inc

- General Cable

- Beijing S.P.L Wire & Cable Co Ltd

- Kyungshin Corp

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors