Search Market Research Report

Automotive Transmission Market Size, Share Global Analysis Report, 2020–2026

Automotive Transmission Market By Transmission Type (Manual transmission, Continuously variable transmission, Automatic transmission, Dual clutch transmission, and Automated manual transmission) and By Vehicle Type (Passenger Cars, HCVs, and LCVs), By Fuel Type(Diesel, and Gasoline), By Number of Forward Gears(<5, 5 – 6, 7 – 8, 9 – 10, and 10<):Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

This specialized and expertise oriented industry research report scrutinizes the technical and commercial business outlook of the Automotive Transmission market. The report analyzes and declares the historical and current trends analysis of the Automotive Transmission industry and subsequently recommends the projected trends anticipated to be observed in the Automotive Transmission market during the upcoming years.

The Automotive Transmission market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire Automotive Transmission market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of both volume (Units) and value (USD Million) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

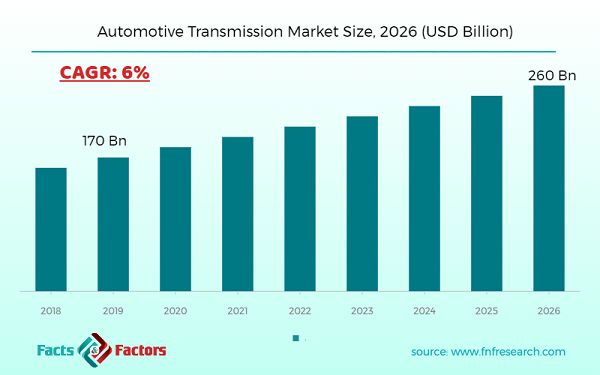

- It was recognized through primary research that automotive transmission market was valued at around USD 170 Billion in 2019.

- Asia Pacific is expected to hold the largest market share of the automotive transmission in the revenue, in 2019.

- Based on transmission type segmentation the “Manual transmission” category, was the leading revenue-generating category in 2019.

- Based on the vehicle type, the “LCVs” category, contributing to the largest revenue-generation.

- According to our primary respondents, the automotive transmission market is set to grow annually at a rate of around 6%.

Key Recommendations from Analysts

Key Recommendations from Analysts

- The demand for car transmission is propelled by a rise in vehicle production and sales around the world.

- Passenger car production and sales are on the rise in the APAC and North American areas.

- Growing technological development in automobiles worldwide along with an increase in consumer disposable income in developed economies is a significant factor in the growth of the demand for automotive transmission.

- The Asia Pacific is the market leader in the automotive sector and is gearing up for the forecast period for augmented growth.

- In North America and Europe, demand for the aftermarket transmission system is high which could have a positive effect on the overall market for a vehicle transmission.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the Automotive Transmission industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the Automotive Transmission industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the Automotive Transmission market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the Automotive Transmission industry. The Automotive Transmission market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the Automotive Transmission sector. Key strategic developments in the Automotive Transmission market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the Automotive Transmission market are appropriately highlighted in the report.

The Automotive Transmission market research report delivers an acute valuation and taxonomy of the Automotive Transmission industry by practically splitting the market on the basis of different types, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the Automotive Transmission industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Further, country-wise data for the Automotive Transmission industry is provided for the leading economies of the world.

The automotive transmission market segmented according to transmission type, vehicle type, fuel type, and a number of forwarding gears. Based on the transmission type, the market is categorized as Manual transmission, continuously variable transmission, Automatic transmission, Dual-clutch transmission, and automated manual transmission. According to vehicle type, the market is bifurcated as Passenger Cars, HCVs, and LCVs. In addition to this by fuel type market is further divided as Diesel and Gasoline. Moreover, based on the Number of Forwarding Gears market is segmented as <5, 5 to 6, 7 to 8, 9 to 10, and 10<.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 170 Billion |

Projected Market Size in 2026 |

USD 260 Billion |

CAGR Growth Rate |

6% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Toyota Boshoku Corp, DENSO Corporation, Hitachi Automotive Systems, Continental AG, JTEKT Corp., Robert Bosch GmbH, Yazaki Corp., Sumitomo Electric Industries, Aisin Seiki Co. Ltd., Valeo SA, Johnson Controls Inc., Magna International Inc., TRW Automotive Holdings Corp., Hyundai Mobis Co. Ltd, Delphi Automotive PLC, Faurecia S.A., Lear Corp., and ZF Friedrichshafen AG., and others. |

Key Segment |

By Transmission, Type,Vehicle, Fuel,Number of Forward Gears, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the Automotive Transmission market, but not restricted to include T

Some of the essential players operating in the Automotive Transmission market, but not restricted to include T

- Toyota Boshoku Corp

- DENSO Corporation

- Hitachi Automotive Systems

- Continental AG

- JTEKT Corp.

- Robert Bosch GmbH

- Yazaki Corp.

- Sumitomo Electric Industries

- Aisin Seiki Co. Ltd.

- Valeo SA

- Johnson Controls Inc.

- Magna International Inc.

- TRW Automotive Holdings Corp.

- Hyundai Mobis Co. Ltd

- Delphi Automotive PLC

- Faurecia S.A.

- Lear Corp.

- ZF Friedrichshafen AG

The taxonomy of the Automotive Transmission industry by its scope and segmentation is as follows:

By Transmission Type Segmentation Analysis (Customizable)

By Transmission Type Segmentation Analysis (Customizable)

- Manual transmission

- Continuously variable transmission

- Automatic transmission

- Dual clutch transmission

- Automated manual transmission

By Vehicle Type Segmentation Analysis (Customizable)

By Vehicle Type Segmentation Analysis (Customizable)

- Passenger Cars

- HCVs

- LCVs

By Fuel Type Segmentation Analysis (Customizable)

By Fuel Type Segmentation Analysis (Customizable)

- Diesel

- Gasoline

By Number of Forward Gears Segmentation Analysis (Customizable)

By Number of Forward Gears Segmentation Analysis (Customizable)

- <5

- 5 – 6

- 7 – 8

- 9 – 10

- 10<

Regional Segmentation Analysis (Customizable)

Regional Segmentation Analysis (Customizable)

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table of Content

Industry Major Market Players

- Toyota Boshoku Corp

- DENSO Corporation

- Hitachi Automotive Systems

- Continental AG

- JTEKT Corp.

- Robert Bosch GmbH

- Yazaki Corp.

- Sumitomo Electric Industries

- Aisin Seiki Co. Ltd.

- Valeo SA

- Johnson Controls Inc.

- Magna International Inc.

- TRW Automotive Holdings Corp.

- Hyundai Mobis Co. Ltd

- Delphi Automotive PLC

- Faurecia S.A.

- Lear Corp.

- ZF Friedrichshafen AG

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors