Search Market Research Report

Automotive Pumps Market Size, Share Global Analysis Report, 2021 - 2026

Automotive Pumps Market By Pump Type (Transmission Pump, Fuel Pump, Oil Pump, Steering Pump, Water Pump, Windshield Pump, Vacuum Pump, & Injection Pump), By Sales Channel (OEM & Aftermarket), By Technology (Mechanical Pump & Electrical Pump), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, &Heavy Commercial Vehicles), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

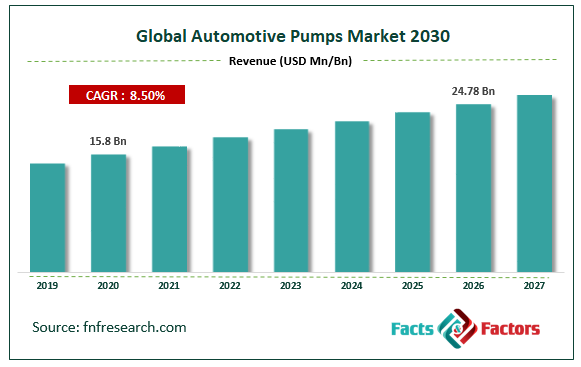

[197+ Pages Report] The latest finding surrounding the “Global Automotive Pumps Market” has recently been published by Facts & Factors in a neatly packaged and comprehensive read. We at Facts & Factors estimate that the automotive pumps market will reach a projected value of USD 24.78 Billion in the year 2026 with a growth rate of 8.5% CAGR from an initial value of USD 15.8 Billion in the year 2020.

Market Overview

Market Overview

The automotive pump is responsible for transferring fuel from one part of the fuel tank to the carburetor or fuel injector of the internal combustion engine for the functioning of the Rankine cycle. Internal combustion engines often incorporate a low-pressure mechanical pump whereas fuel injected pumps are often integrated in systems that are mounted on specially mounted brackets often bolted inside the fuel tank. The fuel that is regularized in these is highly controlled and needs to be within a set range for the smooth functioning of the engine. While a fuel pump is not completely necessary for the easy functioning of the engine, the longer shelf life of the engines is often found to be the case when a fuel pump is equipped.

Industry Growth Factors

Industry Growth Factors

The primary driving factors for the global automotive pumps market are the introduction of highly modified technologies coupled with the rising demand for fuel efficiency and higher operating capabilities to name a few. Additionally, factors relating to higher efficiency and optimum performance will further increase the footprint of the global automotive market during the forecast period. Moreover, steady growth in the sales of production of electric vehicles and an ongoing trend of electrification of internal engines are further expected to open new revenue opportunities for the global automotive pumps market during the forecast period. The market is further projected to be plagued by EPS and driven by wire technologies which are further expected to fuel the growth of the global automotive pumps market during the forecast period to a higher overview.

Rising demand for environmentally friendly automobiles and an increase in vehicular demand are expected to trigger a domino effect regarding the sales of automotive pumps during the forecast period. A generalized expansion of the automotive sector coupled with the rising technological advancements will further increase the footprint of the global automotive pumps market during the forecast period. Rising disposable cash among consumers and rising awareness about pump-mounted automobiles being the highly beneficial component will further boost the growth of the global automotive pumps market during the forecast period. However, a higher cost of implementation and the high technical skillset required for installation and maintenance purposes will decrease the market value of the global automotive market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global automotive pumps market is segmented into pump type, sales channel, technology, vehicle type, and regions.

On the basis of pump type, the global automotive pumps market can be broken down into transmission pump, fuel pump, oil pump, steering pump, water pump, windshield pump, vacuum pump, and injection pump. The segment pertaining to the fuel pump is expected to witness the largest market share during the advent of the forecast owing to the critical functionality of the latter component coupled with rising demand for fuel-efficient vehicles.

On the basis of sales channels, the global automotive pumps market can be divided into OEM and aftermarket. The OEMS segment is expected to occupy the largest market share during the advent of the forecast owing to the rising investment rounds pertaining to product R&D in attempts to develop superior products coupled with the rising amount of products that cater to a wider branch of consumers to name a few.

On the basis of technology, the global automotive pumps market can be fragmented into mechanical pumps and electrical pumps. The electrical pumps category is expected to gain a reasonable market share during the advent of the forecast owing to innovative designs in fuel pump designs due to integrated usage of smart electronics coupled with rising demand for electric vehicles over the forecast period.

On the basis of vehicle type, the global automotive pumps market is expected to be segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The segment pertaining to passenger cars is expected to witness the largest market share during the advent of the forecast owing to the rising demand for passenger vehicles during the forecast period coupled with rising income levels among consumers and an increased per capita income per consumer to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 15.8 Billion |

Projected Market Size in 2026 |

USD 24.78 Billion |

CAGR Growth Rate |

8.5% |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Seiki Co. LTD, Denso Corporation, Johnson Electric, Robert Bosch Gmbh, Magna International, Aisin Seiki Co. Ltd., Delphi Automotive, TRW Automotive, KSPG AG, Mikuni Corporation, SHW, Concentric AB, Hella Co., Continental AG, JTEKT Corporation, MagnetiMarelli, and Pricol Ltd., among others. |

Key Segments |

Pump Type, Sales Channel, Technology, Vehicle Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Europe is expected to witness the largest market share during the advent of the forecast in terms of global revenue contribution. Contributing factors for the dominant market share can be credited to Europe’s current prowess in vehicular production and sales coupled with the early adoption of electrification of vehicles to name a few. Additionally, stringent vehicular policies aimed at reducing pollution controls measures coupled with increased vehicular production are expected to increase the footprint of the automotive pumps market during the forecast period. Government-based incentives for setting up local production plants will further increase a surge of inflow of automotive pumps during the forecast period.

Competitive Players

Competitive Players

The key market players for the global automotive pumps market are:

- Seiki Co. LTD

- Denso Corporation

- Johnson Electric

- Robert Bosch Gmbh

- Magna International

- Aisin Seiki Co. Ltd.

- Delphi Automotive

- TRW Automotive

- KSPG AG

- Mikuni Corporation

- SHW

- Concentric AB

- Hella Co.

- Continental AG

- JTEKT Corporation

- MagnetiMarelli

- Pricol Ltd.

By Pump Type Segment Analysis

By Pump Type Segment Analysis

- Transmission Pump

- Fuel Pump

- Oil Pump

- Steering Pump

- Water Pump

- Windshield Pump

- Vacuum Pump

- Injection Pump

By Sales ChannelSegment Analysis

By Sales ChannelSegment Analysis

- OEM

- Aftermarket

By TechnologySegment Analysis

By TechnologySegment Analysis

- Mechanical Pump

- Electrical Pump

By Vehicle TypeSegment Analysis

By Vehicle TypeSegment Analysis

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Seiki Co. LTD

- Denso Corporation

- Johnson Electric

- Robert Bosch Gmbh

- Magna International

- Aisin Seiki Co. Ltd.

- Delphi Automotive

- TRW Automotive

- KSPG AG

- Mikuni Corporation

- SHW

- Concentric AB

- Hella Co.

- Continental AG

- JTEKT Corporation

- MagnetiMarelli

- Pricol Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors