Search Market Research Report

Automotive Ethernet Market Size, Share Global Analysis Report, 2021 – 2026

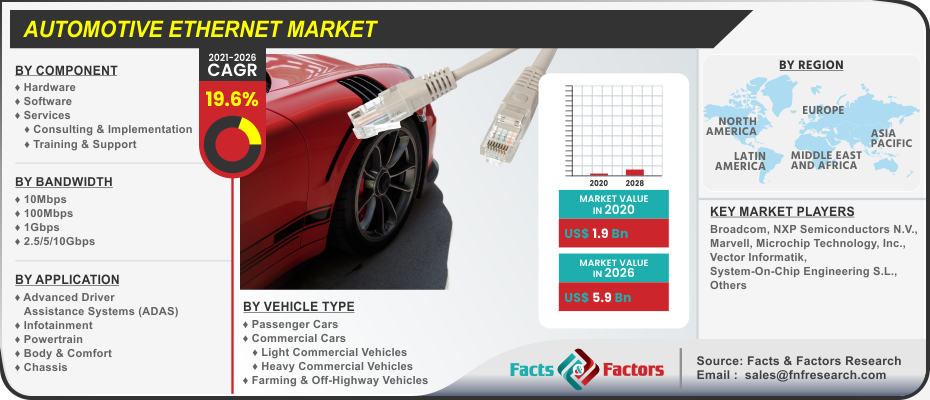

Automotive Ethernet Market By Component (Hardware, Software, & Services), By Bandwidth (10 Mbps, 100 Mbps, 1 Gbps, & 2.5/5/10 Gbps), By Application (Advanced Driver Assistance Systems (ADAS), Infotainment, Powertrain, Body & Comfort, & Chassis), By Vehicle Type (Passenger Cars, Commercial Cars, & Farming & Off-Highway Vehicles), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

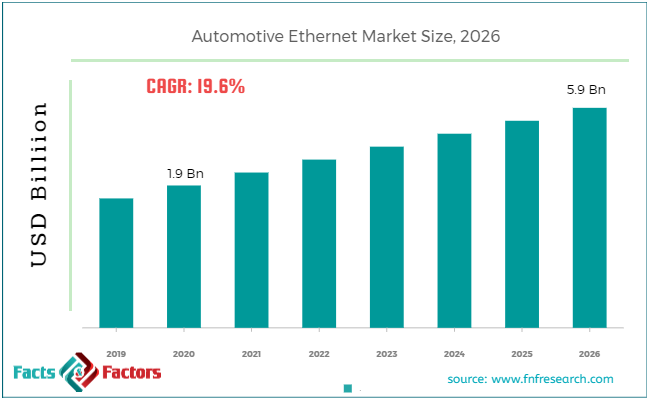

[196+ Pages Report] The latest finding surrounding the “Global Automotive Ethernet Market” published by Facts & Factors offers a neatly packaged and comprehensive read. We at Facts & Factors projected the global automotive ethernet market to value USD 5.9 Billion by 2026 with a growth rate of 19.6% CAGR from an initial value of USD 1.9 Billion in the year 2020.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the global automotive Ethernetis set to grow annually at a rate of around 20%

- It was established through primary research that the automotive Ethernet market was valued at around USD 1700 Million in 2019

- Europe leads the global automotive Ethernet market in 2019. However, Asia Pacific is predicted to overtake Europe by the end of 2024.

- The hardware components segment accounted for the largest share and is predicted to continue its dominance with 47% in 2026.

- Based on the application, ADAS accounted for 41% of the revenue share in 2019.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts,the global automotive Ethernet market is set to grow with a CAGR OF 19.6 % from the years 2020 to 2026.

- The rise in demand for infotainment and advanced driver-assistance systems is predicted to be the key driving factor for the global automotive Ethernet market in the analysis period.

- Our team of analysts has identified, the infotainment segment is expected to be the fastest-growing application segment for the global automotive Ethernet market owing to rising need higher Bandwidth and low latency to increase adoption of Ethernet in infotainment systems. Moreover, the emergence of intelligent infotainment systems is making the car an extension of their owner‘s digital lifestyle is predicted to open massive opportunities to market players in the coming years.

- In recent years, autonomous-vehicle technology growths from craving driver assistance to full autonomy, and driverless cars are expected to become a reality soon. With these weighty benefits, including increased personal safety, mobility for no drivers, time-saving for drivers, reduced transportation costs, and decreased environmental harm. Moreover, it will also lead to radical shifts in value chains.

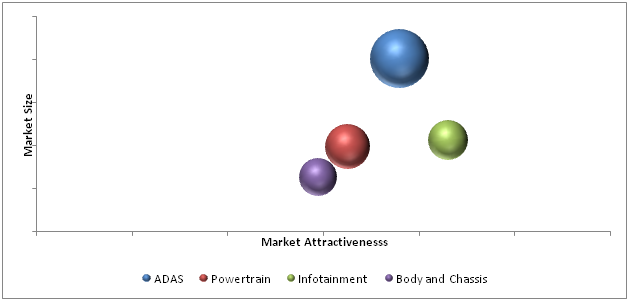

Market Attractiveness – By Application

Market Attractiveness – By Application

Market Overview

Market Overview

Automotive ethernet refers to the set of protocols and equipment that is the physical endowment of networking which is used for connecting components in a car with the help of a wired network. Ethernet often refers to a wider range of functions such as smartphone connectivity, navigation, high-powered infotainment systems, and driver safety systems, among others. These systems are specifically equipped for meeting the demands for enabling rapid communication and faster data allotment among users.

Industry Growth Factors

Industry Growth Factors

The global automotive Ethernet market is expected to be occupied by contributing factors such as the rising prevalence of electric vehicles on a global purview coupled with rising government initiatives for electrification of the current generation of automobiles to name a few.

Additionally, the rising deployment of advanced driver assistant systems (ADAS) coupled with decreasing cost of ethernet equipment is expected to increase the footprint of the global automotive Ethernet market during the advent of the forecast period.

Moreover, the integration of ethernet for high-performance navigation systems and high-end entertainment &telematics to offer better and more efficient data transfer is expected to fuel the growth of the global automotive Ethernet market during the advent of the forecast.

The global automotive Ethernet market is expected to be driven by the integration of IoT in automotive ethernet coupled with the proliferation of high bandwidth ethernet for the emergence of connected cars to name a few. Factors pertaining to reduced labor costs coupled with minimum latency due to the rising technological advancements are expected to push the boundaries of the global automotive Ethernet market during the advent of the forecast period.

However, the rising complexities and intricacy coupled with difficulty in the integration of automotive ethernet equipment toward the older generation of automobiles are expected to hamper the growth of the global automotive Ethernet market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global automotive ethernet market can be segmented into components, bandwidth, application, vehicle type, and region.

On the basis of components, the global automotive Ethernet market is divided into hardware, software, and services. The services segment is expected to witness the largest market share during the advent of the forecast owing to stronger demand from OEMs toward simplifying in-vehicle networks coupled with the rising incidences of challenges faced by the implementation of ethernet for training and support services to name a few.

The global automotive Ethernet market is segmented into 10Mbps, 100Mbps, 1Gbps, and 2.5/5/10Gbps on the basis of bandwidth. The 1Gbps category is expected to witness the largest market share during the advent of the forecast owing to the rising demand for stronger bandwidth coupled with lower latency to name a few. Based on application, the global automotive Ethernet market is fragmented into advanced driver assistance systems (ADAS), infotainment, powertrain, body & comfort, and chassis.

The ADAS is expected to witness the largest market share during the advent of the forecast owing to a shifting tradition between consumers’ preference for a strong and fuel-efficient vehicle coupled with the rapid increase in the integration of high-tech devices from OEMs to name a few. Based on vehicle type, the global automotive Ethernet market is categorized into passenger cars, commercial cars, and farming & off-highway vehicles. The passenger vehicles segment is expected to be increasing vehicular production coupled with rising disposable income among consumers and rising need for private transportation to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 1.9 Billion |

Projected Market Size in 2026 |

USD 5.9 Billion |

CAGR Growth Rate |

19.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Broadcom, NXP Semiconductors N.V., Marvell, Microchip Technology, Inc., Vector Informatik, System-On-Chip Engineering S.L., Molex LLC, Texas Instruments, Cadence Design Systems, Inc., and TTTech Auto AG., among others. |

Key Segments |

Components, Bandwidth, Applications, Vehicle Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to the rising demand for automotive in the region coupled with rising technological innovation to name a few. Additionally, stable socio-economic condition coupled with the presence of massive production hubs such as China and India is expected to increase the footprint of the automotive ethernet market during the advent of the forecast period.

Rising per capita income among consumers coupled with an increasing number of OEMs is expected to push the boundaries of the automotive ethernet market to a higher boundary. Moreover, the penetration of international players in the region and favorable government policies are further expected to fuel the growth of the automotive ethernet market during the advent of the forecast period.

Competitive Players

Competitive Players

The key market participants in the global automotive Ethernet market are:

- Broadcom

- NXP Semiconductors N.V.

- Marvell

- Microchip Technology Inc.

- Vector Informatik

- System-On-Chip Engineering S.L.

- Molex LLC

- Texas Instruments

- Cadence Design Systems Inc.

- TTTech Auto AG.

- Excelforce

- Spirent Communications

- Aukua Systems Inc.

- RUETZ SYSTEM SOLUTIONS

- Rohde & Schwarz

By Component Segment Analysis

By Component Segment Analysis

- Hardware

- Software

- Services

- Consulting & Implementation

- Training & Support

By Bandwidth Segment Analysis

By Bandwidth Segment Analysis

- 10Mbps

- 100Mbps

- 1Gbps

- 2.5/5/10Gbps

By Application Segment Analysis

By Application Segment Analysis

- Advanced Driver Assistance Systems (ADAS)

- Infotainment

- Powertrain

- Body & Comfort

- Chassis

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Passenger Cars

- Commercial Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Farming & Off-Highway Vehicles

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Broadcom

- NXP Semiconductors N.V.

- Marvell

- Microchip Technology Inc.

- Vector Informatik

- System-On-Chip Engineering S.L.

- Molex LLC

- Texas Instruments

- Cadence Design Systems Inc.

- TTTech Auto AG.

- Excelforce

- Spirent Communications

- Aukua Systems Inc.

- RUETZ SYSTEM SOLUTIONS

- Rohde & Schwarz

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors