Search Market Research Report

Aseptic Packaging Market Size, Share Global Analysis Report, 2019–2026

Aseptic Packaging Market for Coating Industry Methyl chloroform, Methyl chloride, Methyl Acetate, Acetone, Parachlorobenzotrifluoride and Other Products) Market for Coating Industry: Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

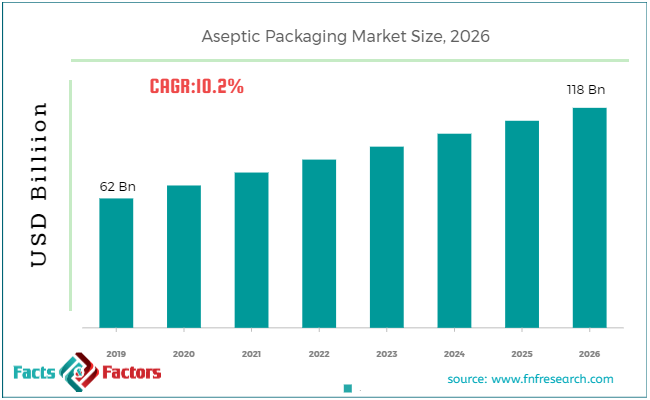

According to the report published by Facts & Factors, the global Aseptic Packaging market size was worth around USD 62 billion in 2019 and is predicted to grow around USD 118 billion by 2026 with a compound annual growth rate (CAGR) of roughly 10.2% between 2020 and 2026.

The report study analyzes the market statistics at the global as well as regional levels to gain an in-depth perspective of the overall aseptic packaging market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volume (Kilo Tons) and value (USD Billion) for 2016 – 2026.

This professional and specialized report study examines the technical and business perspective of the aseptic packaging industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the aseptic packaging market. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

- As per the insights from our primary respondents, the global aseptic packaging market is expected to grow around 10%.

- Through the primary research conducted by the experts, the global aseptic packaging market was valued at around USD 62 Billion in 2019.

- The “Paperboard ” category, on the basis of type segmentation, was the leading category that generated maximum revenue

- The category under “Food”, held on the basis of end-user/application segmentation, had the leading share in 2019.

- There would be huge demand from the Asia Pacifc for this aseptic packaging as these countries are going through continuous development proccesd and packed food.

Key Recommendations from Analysts

Key Recommendations from Analysts

- In recent times Asia Pacific is experiencing an unparalleled boom and is expected to continue to gain traction in the forecast period. This leads mainly to the expansion of the beverage and daily industries along with growing disposable income and rapid industrialization..

- Due to the radical transformation of living standards, the Middle East and Africa are projected to witness propelling growth in the coming years. The Middle East is responsible for the sale of fresh and processed food to the packaged food aseptic packaging.

- The reduced shelf life, products from the milk and dairy industry require a high aseptic atmosphere and are susceptible to spoilage. Scaling up the dairy industry is therefore pushing the aseptic packaging market

Technology Roadmap

Technology Roadmap

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the aseptic packaging market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the aseptic packaging market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the aseptic packaging market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the aseptic packaging market.

The research study provides a critical assessment of the aseptic packaging industry by logically segmenting the market on the basis of Type, and region. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the aseptic packaging industry includes the holistic bifurcation of all five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The aseptic packaging market is segmented based on Type. On the basis of type segmentation, the market is classified into cartons, bags & pouches, vials & ampoules, bottles & cans, and pre-filled syringes among other products. Applications include food & beverage, pharmaceutical, and medical applications among others

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 62 Billion |

Projected Market Size in 2026 |

USD 118 Billion |

CAGR Growth Rate |

10.2% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Robert Bosch GmBH, Dickinson & Company, Ecolean Packaging, Parish Manufacturing, Schott AG, Greatview Aseptic Packaging Co Ltd., Tetra Laval, Becton, Printpack, E.I. du Pont de Nemours and Company, Amcor Limited, Scholle Packaging and, Reynolds Group Holdings , and others. |

Key Segment |

By Type, Material used, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key manufacturers operating in aseptic packaging are

Some of the key manufacturers operating in aseptic packaging are

- Robert Bosch GmBH

- Dickinson & Company

- Ecolean Packaging

- Parish Manufacturing

- Schott AG

- Greatview Aseptic Packaging Co Ltd.

- Tetra Laval

- Becton

- Printpack

- E.I. du Pont de Nemours and Company

- Amcor Limited

- Scholle Packaging and

- Reynolds Group Holdings

This report segments the aseptic packaging market as follows:

Type Segment Analysis

Type Segment Analysis

- Bags & pouches

- Cartons

- Vials & ampoules

- Pre-filled syringes

- Bottles & cans

Material used Segment Analysis

Material used Segment Analysis

- Glass

- Plastic

- Paperboard

- Metal

Application Segment Analysis

Application Segment Analysis

- Pharmaceutical

- Food

- Medical applications

- Beverages

- Other

Regional Segment Analysis

Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising a dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Robert Bosch GmBH

- Dickinson & Company

- Ecolean Packaging

- Parish Manufacturing

- Schott AG

- Greatview Aseptic Packaging Co Ltd.

- Tetra Laval

- Becton

- Printpack

- E.I. du Pont de Nemours and Company

- Amcor Limited

- Scholle Packaging and

- Reynolds Group Holdings

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors