Search Market Research Report

Arterial Stents Market Size, Share Global Analysis Report, 2024 – 2032

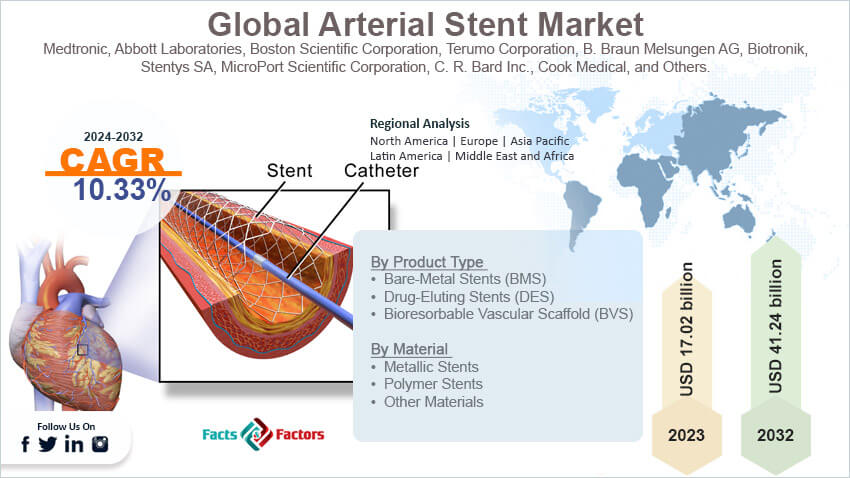

Arterial Stents Market Size, Share, Insights Report By Product Type (Bare-Metal Stents (BMS), Drug-Eluting Stents (DES), Bioresorbable Vascular Scaffold (BVS), By Material (Metallic Stents, Polymer Stents, Other Materials), By Application (Coronary Arteries, Peripheral Arteries), By End-User (Hospitals, Ambulatory Surgical Centers (ASCs), Cardiac Centers), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

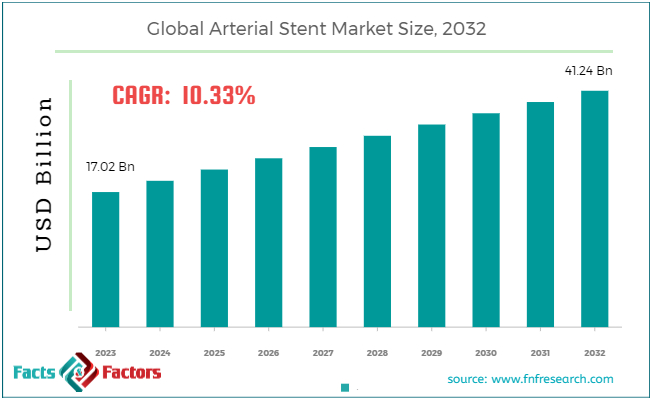

[245+ Pages Report] According to Facts & Factors, the global arterial stents market size in terms of revenue was valued at around USD 17.02 billion in 2023 and is expected to reach a value of USD 41.24 billion by 2032, growing at a CAGR of roughly 10.33% from 2024 to 2032. The global arterial stents market is projected to grow at a significant growth rate due to several driving factors.

Global Arterial Stent Market: Overview

Global Arterial Stent Market: Overview

An arterial stent is a tiny, expandable mesh tube typically made of metal or a combination of metal and polymer. It is inserted into a narrowed or blocked artery to prop it open and improve blood flow. During a minimally invasive procedure, a stent is delivered through a catheter inserted into an artery. Once positioned at the narrowed area, the stent is expanded using a balloon, which pushes the blockage against the artery wall and creates space for blood to flow. The stent remains in place, acting as a scaffold to prevent the artery from collapsing again.

The market for arterial stents is witnessing significant growth due to the rising prevalence of cardiovascular diseases, advancements in stent technology, and a growing preference for minimally invasive procedures.

Key Highlights:

Key Highlights:

- The arterial stents market has registered a CAGR of 10.33% during the forecast period.

- In terms of revenue, the global arterial stents market was estimated at roughly USD 17.02 billion in 2023 and is predicted to attain a value of USD 41.24 billion by 2032.

- The growth of the arterial stents market is being propelled by increasing incidence of cardiovascular disorders, progress in stent technology, and a rising inclination towards minimally invasive therapies.

- Based on Product Type, the Drug-Eluting Stents (DES) segment is expected to see significant growth due to advancements in drug delivery and stent design.

- On the basis of Material, the Peripheral Stents segment is expected to grow at a faster rate (CAGR) due to rising awareness and diagnosis of peripheral artery disease.

- By region, North America dominates the global arterial stent market. However, the Asia Pacific region is expected to witness the fastest growth due to factors like a growing economy, an aging population, and increasing healthcare spending.

Key Growth Drivers

Key Growth Drivers

- Rising Prevalence of Cardiovascular Diseases (CVDs): CVDs, such as coronary artery disease (CAD) and peripheral artery disease (PAD), are the leading causes of death globally. This growing patient population fuels the demand for arterial stents used in procedures like Percutaneous Coronary Intervention (PCI).

- Shift towards Minimally Invasive Procedures: Compared to traditional open surgery, minimally invasive procedures like PCI offer faster recovery times and less patient discomfort. This trend increases the demand for arterial stents as the preferred treatment option.

- Technological Advancements: Continuous advancements in stent design and materials, such as bioresorbable stents that dissolve after serving their purpose, improve patient outcomes and drive market growth.

Restraints

Restraints

- High Cost of Stents and Procedures: The high cost of stents and associated procedures can limit access, particularly in developing countries with limited healthcare budgets. This restricts market growth in certain regions.

- Stringent Regulatory Requirements: Stringent regulatory approval processes for new stent technologies can delay market entry and hinder innovation. These regulations aim to ensure patient safety but can also slow down market expansion.

Opportunities

Opportunities

- Emerging Markets: The growing healthcare infrastructure and rising disposable income in emerging markets present significant opportunities for market expansion.

- Focus on Reimbursement and Cost-Effectiveness: Increasing focus on developing cost-effective and reimbursable stent solutions can improve patient access and market penetration, especially in regions facing affordability challenges.

- Development of Novel Stent Technologies: Continuous research and development in areas like drug-eluting stents and bioresorbable scaffolds offer promising opportunities for market growth and improved patient care.

Challenges

Challenges

- Reimbursement Policies and Pricing Pressures: Reimbursement policies and price control measures implemented by healthcare authorities can put pressure on stent manufacturers' profit margins.

- Competition and Market Saturation: The presence of established players and the potential entry of new competitors in the market can intensify competition and price pressures.

- Concerns over Long-Term Safety and Efficacy: Continuously monitoring and addressing potential long-term safety and efficacy concerns associated with certain stent technologies is crucial for sustained market growth and patient trust.

Arterial Stent Market: Segmentation Analysis

Arterial Stent Market: Segmentation Analysis

The global arterial stent market is segmented based on product type, material, application, and end-user. This division helps stakeholders understand the nuances of the market, identify specific growth opportunities, and tailor their strategies accordingly. Here's an overview of how the arterial stent market can be segmented:

Product Type Insights

- Bare-Metal Stents (BMS): These are metallic stents without a coating. They were the first type of stents used in angioplasty but are now less favored due to higher rates of restenosis compared to drug-eluting stents.

- Drug-Eluting Stents (DES): These stents are coated with medication that is slowly released to help prevent the growth of scar tissue in the artery lining, thereby reducing the risk of restenosis. This segment is expected to see significant growth & is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% due to advancements in drug delivery and stent design.

- Bioresorbable Vascular Scaffold (BVS): Also known as biodegradable stents, these are designed to be absorbed by the body over time, theoretically reducing long-term complications associated with permanent metallic stents.

Material Insights

- Metallic Stents: Traditionally made from metals like stainless steel or cobalt-chromium alloys.

- Polymer Stents: These include bioresorbable polymers used in BVS, which dissolve after their intended purpose of keeping the vessel open is achieved. This segment is expected to grow at a faster rate (CAGR) due to rising awareness and diagnosis of peripheral artery disease.

- Other Materials: Research is ongoing into other materials, including biocompatible materials that could further reduce the risk of rejection or complications.

Application Insights

- Coronary Arteries: Used in the treatment of coronary artery disease (CAD) to prevent heart attacks and improve symptoms of CAD. This segment holds the largest market share and growing at a CAGR of 6.5% due to the high prevalence of coronary artery disease and technological advancements in coronary stents.

- Peripheral Arteries: Used in peripheral arterial disease (PAD) to improve blood flow in arteries outside the heart, such as those in the legs or arms.

End-User Insights

- Hospitals: The primary consumers of arterial stents, where most procedures are performed.

- Ambulatory Surgical Centers (ASCs): These facilities increasingly perform stenting procedures due to advancements in minimally invasive techniques.

- Cardiac Centers: Specialized centers focused on the diagnosis and treatment of heart-related conditions, including the use of stents.

Recent Developments

Recent Developments

- 2023: Abbott Laboratories acquired the Cor stent business from Orbus Neill Medical, aiming to strengthen its peripheral vascular business.

- 2022: Boston Scientific acquired Baylis Medical, a leader in venous access products, expanding its portfolio for minimally invasive procedures.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 17.02 Billion |

Projected Market Size in 2032 |

USD 41.24 Billion |

CAGR Growth Rate |

10.33% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Medtronic, Abbott Laboratories, Boston Scientific Corporation, Terumo Corporation, B. Braun Melsungen AG, Biotronik, Stentys SA, MicroPort Scientific Corporation, C. R. Bard Inc., Cook Medical, and Others. |

Key Segment |

By Product Type, By Material, By Application, By End-User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis:

Regional Analysis:

- North America: This region currently holds the dominant share of the arterial stent market with a CAGR of 5.07%, driven by factors like high healthcare spending, advanced medical infrastructure, and a large aging population. However, the growth rate is expected to be moderate due to market saturation and cost pressures.

- Europe: Europe is another established market with a well-developed healthcare system and a high prevalence of cardiovascular diseases. The market is expected to see steady growth due to factors like government support for healthcare and increasing adoption of advanced stent technologies.

- Asia Pacific: This region is expected to experience the fastest growth in the arterial stent market to witness a CAGR of over 8.9% over the forecast period due to several factors:

- Rapidly growing economies: This leads to increased healthcare spending and rising disposable incomes, making stents more accessible to a larger population.

- Aging population: Similar to other regions, the growing elderly population in Asia Pacific is susceptible to cardiovascular diseases, driving up demand for stents.

- Untapped market potential: Many countries in the Asia Pacific still have a significant unmet medical need for arterial stents, presenting significant growth opportunities.

Arterial Stent Market: Competitive Landscape

Arterial Stent Market: Competitive Landscape

Some of the major players in the global arterial stent market include:

- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- B. Braun Melsungen AG

- Biotronik

- Stentys SA

- MicroPort Scientific Corporation

- C. R. Bard, Inc.

- Cook Medical

These companies are all developing and manufacturing new and innovative arterial stents, which is helping to drive the growth of the market. Here's a brief overview of some of these companies:

Abbott Laboratories:

A global healthcare company that develops and manufactures a wide range of medical devices, including arterial stents. Abbott's Xience stent is a drug-eluting stent (DES) that is effective in reducing restenosis, or the re-narrowing of the artery.

Boston Scientific Corporation:

A global medical device company that develops, manufactures, and markets a wide range of medical devices, including arterial stents. Boston Scientific's Eluvia stent is a DES that is coated with a drug that helps to prevent restenosis.

Medtronic plc:

A global medical technology company that develops, manufactures, and markets a wide range of medical devices, including arterial stents. Medtronic's Resolute Integrity stent is a DES that is designed to improve deliverability and reduce the risk of complications.

The global arterial stent market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Bare-Metal Stents (BMS)

- Drug-Eluting Stents (DES)

- Bioresorbable Vascular Scaffold (BVS)

By Material Segment Analysis

By Material Segment Analysis

- Metallic Stents

- Polymer Stents

- Other Materials

By Application Segment Analysis

By Application Segment Analysis

- Coronary Arteries

- Peripheral Arteries

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Cardiac Centers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- B. Braun Melsungen AG

- Biotronik

- Stentys SA

- MicroPort Scientific Corporation

- C. R. Bard Inc.

- Cook Medical

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors