Search Market Research Report

Aromatic Solvents Market Size, Share Global Analysis Report, 2022 – 2028

Aromatic Solvents Market By Flash Point (Low Flash Point De-aromatic Solvents, Medium Flash Point De-aromatic Solvents, High Flash Point De-aromatic Solvents). By Boiling Point (Type 1 De-aromatic Solvents, Type 2 De-aromatic Solvents, Type 3 De-aromatic Solvents). By Application (Paints, Coatings and Inks, Metal Working, Industrial Cleaning, Adhesives and Sealants, Drilling Fluids, Consumer Products, Others), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022 – 2028

Industry Insights

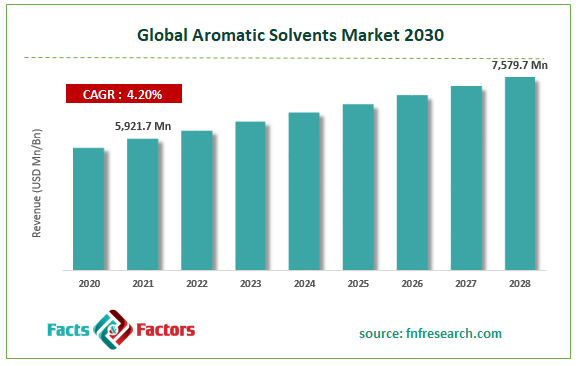

[205+ Pages Report] According to Facts and Factors, The Global Aromatic Solvents Market was worth around USD 5,921.7 million in 2021 and is estimated to grow to about USD 7,579.7 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.2% over the forecast period. The report analyzes the Aromatic Solvents Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Aromatic Solvents Market.

Market Overview

Market Overview

Aromatic solvents are a type of solvent that contains an aromatic hydrocarbon, such as toluene, naphtha, or xylene. These are organic chemicals used in a variety of applications such as paints, adhesives, adhesives and sealants, oil and gas, and so on. It possesses features such as high solvency, corrosion resistance, and others. The demand from end-use industries is a major factor driving the Aromatic Solvents Market's growth. In addition, the automotive industries are likely to increase during the projection period, providing chances for industry participants. Growing industrialization and urbanization in developing regions throughout the world are projected to drive the market in the coming years.

Moreover, rising energy demand has increased oil and gas activity, which is fuelling market expansion due to its usage as corrosion inhibitors in the oil and gas industry. The Aromatic Solvents Industry is a profitable market that is predicted to grow at a rapid pace during the forecast years. This increase is primarily due to the increased use of aromatic solvents in the paints and coatings industry, among other things. Furthermore, rising demand for paints, resins, and coatings is likely to drive the aromatic solvents market during the forecast period.

COVID-19 Impact:

COVID-19 Impact:

The ongoing COVID-19 pandemic has had a significant impact on the demand for aromatic solvents as it caused disturbances in the supply chain across the globe. Since aromatic solvents are manufactured in refinery complexes, they are impacted by the overall downturn in the oil and gas industry as a result of the current pandemic. The market for paints and coatings has fallen as a response to COVID-19, and as an outcome, the demand for solvent has decreased as well. China is the largest producer of solvents; however, due to the COVID-19 pandemic, the lack of supply of raw material was caused, which affected the production of solvents in the country.

As a result of the cancellation of building projects, demand for paints and coatings has declined, which has reduced the demand for aromatic solvents. The automobile production facilities were closed during the initial months of 2020 in the majority of the countries, which hindered the demand for aromatic solvents. Exploration and production efforts have recently come to a standstill, significantly impacting total market demand.

Growth Driver

Growth Driver

Aromatic solvents are effective organic liquid solvents. As a result, they are widely used in a variety of sectors such as paints, petrochemicals, nail polish removers, cleansers, dyes, and varnishes. These solvents are a strong bonding and dissolving agent for organic liquids, which has expanded their applicability to a variety of industries, fueling industry growth. The aromatic solvents market is expanding due to rising demand for these chemicals in the construction, automotive, oil and gas, and packaging industries. These solvents are primarily employed as carriers in paints and varnishes for surface coating applications in the construction sector. As a result, with increasing development and urbanization in many nations throughout the world, demand for these solvents is likely to surge.

The oil and gas industry is also contributing to the global expansion of the aromatic solvents market. Aromatic solvents are largely employed in this business as corrosion inhibitors to protect pipelines during the fractional distillation process. The demand for aromatic solvents has increased in recent years due to their increasing use in the automotive industry, resulting in a high demand for adhesives and sealants to connect the car parts in order to provide mechanical stiffness to the vehicle and therefore avoid failure.

Restraint

Restraint

The increased emphasis on green solvents derived from agricultural crops is impeding the growth of the aromatic solvents market. Green solvents are completely biodegradable, non-corrosive, and non-carcinogenic. Furthermore, as a result of the severe rules and regulations established by various governments throughout the world, businesses are increasingly focusing on using greener products in their industrial operations in order to achieve sustainable development.

Segmentation Analysis

Segmentation Analysis

The Aromatic Solvents Market is segregated based on Flash Point, Boiling Point, and Application.

By Flash Point, the market is classified into Low Flash Point De-aromatic Solvents, Medium Flash Point De-aromatic Solvents, and High Flash Point De-aromatic Solvents. Among the flash point-based segments, the medium flashpoint has the biggest market share. During the forecast period, rising demand for greener, eco-friendly alternatives such as powder coatings and solvent-free coatings is likely to stymie the expansion of medium flash point solvents. During the forecast period, consumption of high flash point de-aromatized solvents is estimated to be driven by an increase in demand for these solvents from printing and metalworking applications.

By Boiling Point, the market is classified into Type 1 De-aromatic Solvents, Type 2 De-aromatic Solvents, and Type 3 De-aromatic Solvents. The type 1 (150–200°C) group obtained the most market share in terms of boiling point. During the forecast period, the category is expected to maintain its dominance. Type 2 (200-2400C) is expected to expand the fastest and will be increasingly employed in metalworking, inks, water treatment, and industrial applications.

By Application, the market is classified into Paints, Coatings, and Inks, Metal Working, Industrial Cleaning, Adhesives and Sealants, Drilling Fluids, Consumer Products, and Others. In terms of value, the paints and coatings segment held the highest market share in the forecast period. The global expansion of the automotive OEM, machinery, and appliances sectors, together with an increase in building and construction activities, is likely to fuel demand for this application over the projection period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,921.7 Million |

Projected Market Size in 2028 |

USD 7,579.7 Million |

CAGR Growth Rate |

4.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ExxonMobil Corporation, Royal Dutch Shell Plc, Total S.A., Idemitsu Kosan Co., Ltd., Neste Oyj, Raj Petro Specialties P. Ltd., Avani Petrochem Private Limited, Neste Oyj., Isu Exachem Co. Ltd., DHC Solvent Chemie GmbH, Calumet Specialty Products Partners, L.P., SK Global Chemical Co., Ltd., CEPSA., and Others |

Key Segment |

By Flash Point, Boiling Point, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

During the projection period, APAC is expected to have the greatest market share. The APAC construction sector is expanding as a result of rising population, fast urbanization, and industrialization. The region's expanding construction demand has resulted in a spike in the paints and coatings industry, which has contributed to the overall expansion of the aromatic solvents market. Furthermore, expanding industrial development, particularly in China, India, and Japan, will drive market expansion throughout the evaluation period.

North America is another key market, accounting for the second-largest market share. The resurgence of the construction industry in the United States is expected to result in significant revenue gains for the total market. Moreover, the presence of major vehicle manufacturers in the region is expected to drive demand for aromatic solvents. Construction, transportation, and electronics, among other developed end-user industries, are considerably driving market expansion. Furthermore, the newly elected administration has initiated a new wave of investment in the building and restoration of residential and commercial infrastructure, which is likely to increase demand for paint and coatings, hence contributing to the expansion of the Aromatic Solvents Market.

The European market is a profitable market that is primarily driven by the established electrical and electronics, building, and automobile sectors. Additionally, the increased application in the oil and gas sector, combined with increasing infrastructure development, is a major driver driving the growth of the Aromatic Solvents Market. Furthermore, demand from the developed pharmaceutical sector has increased the use of aromatic solvents in the region.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the Aromatic Solvents Market include -

- ExxonMobil Corporation

- Royal Dutch Shell Plc

- Total S.A.

- Idemitsu Kosan Co. Ltd.

- Neste Oyj

- Raj Petro Specialties P. Ltd.

- Avani Petrochem Private Limited

- Neste Oyj.

- Isu Exachem Co. Ltd.

- DHC Solvent Chemie GmbH

- Calumet Specialty Products Partners L.P.

- SK Global Chemical Co. Ltd.

- CEPSA.

The global aromatic solvents market is segmented as follows:

By Flash Point Segment Analysis

By Flash Point Segment Analysis

- Low Flash Point De-aromatic Solvents

- Medium Flash Point De-aromatic Solvents

- High Flash Point De-aromatic Solvents

By Boiling Point Segment Analysis

By Boiling Point Segment Analysis

- Type 1 De-aromatic Solvents

- Type 2 De-aromatic Solvents

- Type 3 De-aromatic Solvents

By Application Segment Analysis

By Application Segment Analysis

- Paints, Coatings and Inks

- Metal Working

- Industrial Cleaning

- Adhesives and Sealants

- Drilling Fluids

- Consumer Products

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- ExxonMobil Corporation

- Royal Dutch Shell Plc

- Total S.A.

- Idemitsu Kosan Co.Ltd.

- Neste Oyj

- Raj Petro Specialties P. Ltd.

- Avani Petrochem Private Limited

- Neste Oyj.

- Isu Exachem Co. Ltd.

- DHC Solvent Chemie GmbH

- Calumet Specialty Products Partners

- L.P.

- SK Global Chemical Co.Ltd.

- CEPSA.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors