Search Market Research Report

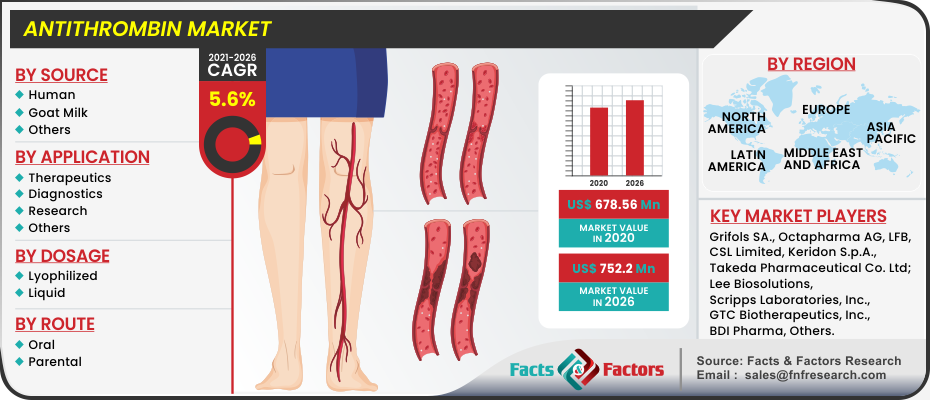

Antithrombin Market Size, Share Global Analysis Report, in Market By Source (Human, Goat Milk, & Others), By Application (Therapeutics, Diagnostics, Research, & Others), By Dosage Form (Lyophilized & Liquid), By Route (Oral & Parental), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 - 2026

Antithrombin Market By Source (Human, Goat Milk, & Others), By Application (Therapeutics, Diagnostics, Research, & Others), By Dosage Form (Lyophilized & Liquid), By Route (Oral & Parental), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 - 2026

Industry Insights

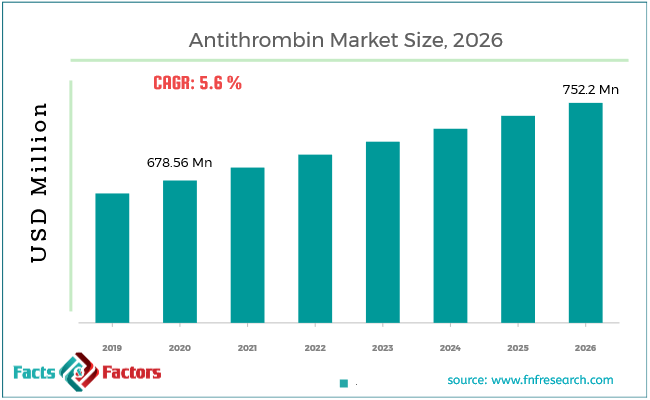

[196+ Pages Report] The latest market study titled “Antithrombin (AT) Market” aims to bring to the notice of the readers that this report covers a completely comprehensive and extensive overview of the market from both the global and regional perspectives. We at Facts and Factors interpolate that the market value for the global Antithrombin Market was projected to be around USD 678.56 Million in the year 2020 and is expected to grow with a CAGR value of 5.6% to push the market at a forecast value of USD 752.2 Million by the end of the year 2026.

Market Overview

Market Overview

Antithrombin (AT) is a protein bonded in the human body which plays a pivotal role in decreasing the chances of blood clots as it intervenes as a natural blood thinner. AT is used in surgical procedures at an extensive pace for its natural ability to prevent blood clots. Antithrombin is a natural glycoprotein that is produced by the liver and consists of a range of 432 amino acids and further contains three disulfide bonds alongside four possible glycosylation sites. Recent studies have concluded that deficiency of antithrombin in the human body often leads to excessive bleeding disorders which can prove to be fatal in case of late detection.

Industry Growth Factors

Industry Growth Factors

The driving forces behind the growth related to the growing prevalence of disorders include sepsis, congenital antithrombin deficiency, disseminated intravascular coagulation (DIC), and extracorporeal membrane oxygenation (EMCO) coupled with a rising trend of open-heart surgeries. Furthermore, thrombotic diseases often require a longer base of treatment, and thus, there is an increase in the sale of antithrombin drugs which later add to the growth of the antithrombin market. Additionally, the increased usage of rapid diagnostic testing boosts the market value of the antithrombin market during the forecast period.

The rising prevalence of people suffering from antithrombin deficiency and increased usage of antithrombin during cardiac surgeries will further open new revenue opportunities for the market. An increase in genetically identifiable thrombophilia will further boost the sales of the antithrombin market. Increased functionality of antithrombin drugs has prompted the integration of the latter during phase 2 and phase 3 drug trials for a range of blood clotting disorders. Moreover, increasing applications of biologics and the high initial cost of antithrombin drugs will hamper the growth of the market to a certain extent.

Segmentation Analysis

Segmentation Analysis

The global antithrombin market can be segmented on the basis of source, application, dosage form, route, and region.

On the basis of source, the global antithrombin market can be divided into human, goat milk, and others. The goat milk segment is expected to witness the largest market share during the forecast due to easy availability, cost-effectiveness, and proven clinical efficacy. On the basis of application, the global antithrombin market can be fragmented into therapeutics, diagnostics, research, and others. The therapeutics segment is expected to witness the largest market share during the forecast in terms of global revenue collection. Factors pertaining to the dominant position can be contributed to the increasing prevalence of antithrombin deficiency and the increasing cases of bleeding during surgical procedures.

Additional factors include growing surgical requirements and the rising prevalence of antithrombin deficiencies such as nephrotic syndrome, liver failure, and severe burns associated with the aftermath. On the basis of dosage form, the global antithrombin market can be broken down into lyophilized and liquid. The lyophilized segment is expected to witness the largest market share during the forecast period. On the basis of the route, the global antithrombin market can be segmented into oral and parental. The oral segment will account for the largest market share due to easy application and access to the human anatomy.

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the forecast period owing to global revenue collection. The presence of emerging economies like China and India in the region contributing heavily to the market will establish a strong foothold for the antithrombin market. Additional factors for the dominant position of the market in the region can be contributed to increasing in non-refundable income among consumers and widened spending power on healthcare. Moreover, ongoing studies reveal that the occurrence of venous thromboembolism (VTE) in the Asian population is less than in the Western hemisphere. Rising awareness among patients will further boost the sales of antithrombin drug volume during the forecast.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 678.56 Million |

Projected Market Size in 2026 |

USD 752.2 Million |

CAGR Growth Rate |

5.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Grifols SA., Octapharma AG, LFB, CSL Limited, Takeda Pharmaceutical Company Limited, Keridon S.p.A., Lee Biosolutions, Scripps Laboratories, Inc., GTC Biotherapeutics, Inc., and BDI Pharma, among others. |

Key Segment |

By Source, By Application, By Dosage Form, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

The global competitive players in the global antithrombin market are

- Grifols SA.

- Octapharma AG

- LFB

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Keridon S.p.A.

- Lee Biosolutions

- Scripps Laboratories Inc.

- GTC Biotherapeutics Inc.

- BDI Pharma

- among others

By Source Segment Analysis

By Source Segment Analysis

- Human

- Goat Milk

- Others

By Application Segment Analysis

By Application Segment Analysis

- Therapeutics

- Diagnostics

- Research

- Others

By Dosage Form Segment Analysis

By Dosage Form Segment Analysis

- Lyophilized

- Liquid

By Route Segment Analysis

By Route Segment Analysis

- Oral

- Parental

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Grifols SA.

- Octapharma AG

- LFB

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Keridon S.p.A.

- Lee Biosolutions

- Scripps Laboratories Inc.

- GTC Biotherapeutics Inc.

- BDI Pharma

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors