Search Market Research Report

Anti-counterfeit Pharmaceutical Packaging Market Size, Share Global Analysis Report, 2024 – 2032

Anti-counterfeit Pharmaceutical Packaging Market Size, Share, Growth Analysis Report By Applications (Diagnostics, Therapeutics, Surgical, Medical Equipment, Surgical Tapes, Pharma & Biological, And Other Medical Supplies), By Adhesions (Repositionable, Removable, And Permanent), By Printing Technology (Mass Serialization, Barcode, Mass Encryption, Holograms, Security Seals, RFID, And Others), By Packaging Formats (Bottles & Jars, Vials & Ampoules, Blisters, Trays, Pouches & Sachets, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

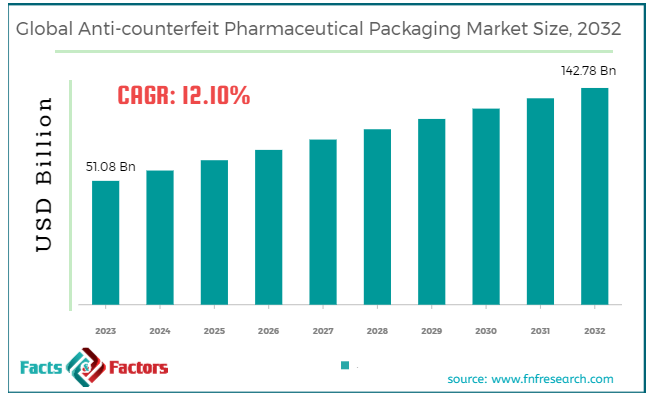

[216+ Pages Report] According to Facts and Factors, the global anti-counterfeit pharmaceutical packaging market size was valued at USD 51.08 billion in 2023 and is predicted to surpass USD 142.78 billion by the end of 2032. The anti-counterfeit pharmaceutical packaging industry is expected to grow by a CAGR of 12.10% between 2024 and 2032.

Market Overview

Market Overview

Anti-counterfeit pharmaceutical packaging refers to the packaging solutions which prevent the unauthorized use of pharmaceutical items. Counterfeiting drugs are risky to public health and safety. Anti-counterfeiting packaging protects consumers with innovative technology, which makes it difficult for people to replicate the products.

These packaging products are equipped with tamper-evident seals to protect the pharma products. Advanced technologies like RFID, NFC, barcodes, QR codes, and others enable real-time monitoring of the products across the supply chain.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global anti-counterfeit pharmaceutical packaging market size is estimated to grow annually at a CAGR of around 12.10% over the forecast period (2024-2032).

- In terms of revenue, the global anti-counterfeit pharmaceutical packaging market size was valued at around USD 51.08 billion in 2023 and is projected to reach USD 142.78 billion by 2032.

- Increasing cases of counterfeiting are driving the growth of the global anti-counterfeit pharmaceutical packaging market.

- Based on the applications, the pharma & biological segment is growing at a high rate and is projected to dominate the global market.

- Based on the adhesions, the permanent segment is projected to swipe the largest market share.

- Based on the printing technology, the RFID segment is expected to dominate the global market.

- Based on the packaging formats, the bottles and jars segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing cases of counterfeiting are likely to drive the growth of the global market.

The growing prevalence of counterfeit pharmaceuticals is a major reason propelling the growth of the global anti-counterfeit pharmaceutical packaging market. Counterfeiting poses a significant risk to public health and safety. The increasing requirement for a strong counterfeiting packaging solution to ensure the integrity of pharmaceutical products is driving the interest of people.

However, the growing awareness among people and healthcare professionals regarding the risk associated with counterfeiting activities is also contributing towards the higher growth rate of the industry. Nowadays, patients are looking forward to the product's authenticity thereby forcing pharma companies to invest in counterfeit packaging solutions.

Regulatory agencies are also imposing strict rules to implement anti-counterfeiting measures. Also, the globalization of the pharmaceutical supply chain is a major reason for the high demand for anti-counterfeiting solutions. The increasing complexity and vulnerability to counterfeiting posed a greater need for secure and traceable packaging solutions to eliminate the Counterfeiting infiltration across the supply chain.

For instance, Gerresheimer partnered with TruTag Technologies in March 2023. The former company holds expertise in glass packaging and the latter is a brand protection specialist. Both companies came together to introduce a new secure digital solution.

Restraints

Restraints

High implementation costs are restraining the growth of the global market.

Anti-counterfeiting packaging solutions pose high upfront investment in equipment technology, which is a major reason hampering the growth of the global anti-counterfeit pharmaceutical packaging market. The complexity of integration is another reason for slowing down the growth of the industry. Counterfeiters are evolving tactics to pass anti-counterfeiting measures that are further likely to impact the growth of the industry negatively.

Opportunities

Opportunities

- Demand for serialization and tracking technology Is fostering growth opportunities in the group market.

There is increasing demand for serialization and track and trace Technology for Keeping up with the authentication of pharmaceutical products is driving the growth of the anti-counterfeit pharmaceutical packaging industry. Technologies offer enhanced counterfeiting, detection capabilities and visibility into the product movement. Government and regulatory agencies are implementing regulations to combat counterfeiting pharmaceuticals Is also driving the growth of the industry.

Challenges

Challenges

- Supply chain fragmentation is a big challenge in the global market.

The supply chain pharmaceutical industry is highly fragmented. Distribution, retailing, and manufacturing in the industry are posing a huge challenge because of the miscoordination between the parties. Furthermore, the integration complexities, diverse regulatory environment, and various infrastructures are again expected to slow down the growth trajectory. Also, the limited resource infrastructure is likely to hinder the growth of the global anti-counterfeit pharmaceutical packaging market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global anti-counterfeit pharmaceutical packaging market can be segmented into applications, adhesions, printing technology, packaging formats, and others.

By Applications Insights

By Applications Insights

By applications, the market can be segmented into diagnostics, therapeutics, surgical, medical equipment, surgical tapes, pharma & biological, and other medical supplies. The pharma & biological segment is anticipated to lead the anti-counterfeit pharmaceutical packaging industry during the forecast period. Pharmaceutical and biological products are of immense value and are more susceptible to counterfeiting because of the high profits associated with these products.

Additionally, the strict regulations across the globe regarding pharmaceutical products for safety and authenticity further lead to the high requirement for anti-counterfeit packaging solutions. The pharma and biological companies are investing heavily in anti-counterfeiting packaging to protect their brands and secure their reputation. Additionally, counterfeiting leads to risk to patient safety which further results in fatalities. Therefore, companies are committing to patient safety by adopting anti-counterfeiting packaging.

By Adhesions Insights

By Adhesions Insights

By adhesions, the market can be segmented into repositionable, removable, and permanent. The permanent segment is likely to dominate the anti-counterfeit pharmaceutical packaging industry in the coming years. Permanent adhesives are long-lasting and, therefore, ensure that packaging stays intact across the complete life cycle of the product. It boosts security and lowers the risk of counterfeiting. Permanent adhesives are widely used in labels and seals to alert consumers regarding potential counterfeiting activity. The regulatory compliances need tamper-evident solutions to check for anti-counterfeiting measures.

Additionally, permanent adhesive is more durable and remains undamaged under challenging conditions like temperature, fluctuation, transportation, handling and many others. One of the major benefits it offers to pharmaceutical companies is brand protection. Counterfeiting causes huge losses to brands by damaging their reputation.

Moreover, these permanent adhesives are more cost-effective as compared to other removable options. The need to constantly check for counterfeiting is full of hassle work & expensive, and therefore, the companies prefer to opt for permanent adhesives.

By Printing Technology Insights

By Printing Technology Insights

By printing technology, the market can be segmented into mass serialization, barcode, mass encryption, holograms, security seals, RFID, and others. RFID technology is the fastest-growing segment in the global anti-counterfeit pharmaceutical packaging market. Radiofrequency identification technology is growing rapidly because of its increasing adoption across industries. RFID is a cost-effective solution which is highly accessible to pharmaceutical companies.

Furthermore, this technology can easily be integrated with other advanced technologies like IoT, cloud computing, and other platforms. This feature helps pharmaceutical companies to easily check data insights and office supplies and optimize for better decision-making. The regulatory agencies and governments are implementing rules and regulations for pharmaceutical companies to deploy the tracking solution in order to fight against counterfeiting and ensure patient safety. The technology streamlines the inventory management processes by automating the tasks, which also helps companies lower the overall cost and increase efficiency.

By Packaging Formats Insights

By Packaging Formats Insights

By packaging formats, the market can be segmented into bottles & jars, vials & ampoules, blisters, trays, pouches & sachets, and others. The bottles and jars segment accounts for the largest share of the anti-counterfeit pharmaceutical packaging industry. Jars and bottles are used because of their versatility.

These can accommodate a wide range of products like powders, liquids, capsules and tablets, which further drives the interest of companies. Jarz and bottles are used because of their versatility. These can accommodate a wide range of products like powders, liquids, capsules, and tablets which drives the interest of companies.

Additionally, the pharmaceutical products are solid dosage forms which pose a huge requirement of anti-counterfeiting packaging. These formats are popular because of their convenience in storing, handling, and dispensing of medications.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 51.08 Billion |

Projected Market Size in 2032 |

USD 142.78 Billion |

CAGR Growth Rate |

12.10% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Stevanato Group, Savi Technology Inc., OpSec Security Inc., AlpVision SA, Zebra Technologies Corporation, TruTag Technologies Inc., Authentix Inc., Nipro Corporation, Ardagh Group SA, Klockner Pentaplast Group, Gerresheimer AG, Schott AG, SICPA Holdings, CCL Industries, ATL Security Label Systems, Alien Technology, and Others. |

Key Segment |

By Applications, By Adhesions, By Printing Technology, By Packaging Formats, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global anti-counterfeit pharmaceutical packaging market during the forecast period. The leading regulatory agencies in the region, like the US Food and Drug Administration, have implemented strict regulations to fight against counterfeiting.

The government are further upgrading their regulations and fostering a huge requirement for advanced anti-counterfeiting technologies and serialization systems to initiate tracking activities across the supply chain. The region is at the forefront of technological innovation, particularly in the field of counterfeiting.

Therefore, companies in the region are boosting research activities to come up with more advanced solutions like serialization, holographic labels and many others. Increasing investments in anti-counterfeiting solutions are also likely to improve security, trackability, and product authentication. Furthermore, the presence of major players in the region is further expected to boost the growth of the market.

Asia Pacific is another major region evolving rapidly in the anti-counterfeit pharmaceutical packaging industry in the forthcoming years. The region is witnessing a heavy burden of counterfeiting pharmaceuticals, which is the major reason for the high growth of the regional market. The major regions driving the requirements for anti-counterfeiting solutions are porous borders, regulatory enforcement, and many others. Growing economies like South Korea, India, and China are implementing serialization solutions to enable traceability and authenticity of pharmaceutical products.

The technological advancements in anti-counterfeiting packaging solutions are further likely to Feel the growth of the regional market. The rapid growth of the pharmaceutical industry in the region is also essential in meeting the demand for anti-counterfeit packaging solutions to ensure product integrity and maintain regulatory compliance. However, the requirement to protect intellectual property is also propelling the demand in the region.

Competitive Analysis

Competitive Analysis

The key players in the global anti-counterfeit pharmaceutical packaging market include:

- Stevanato Group

- Savi Technology Inc.

- OpSec Security Inc.

- AlpVision SA

- Zebra Technologies Corporation

- TruTag Technologies Inc.

- Authentix Inc.

- Nipro Corporation

- Ardagh Group SA

- Klockner Pentaplast Group

- Gerresheimer AG

- Schott AG

- SICPA Holdings

- CCL Industries

- ATL Security Label Systems

- Alien Technology

For instance, CCL Industries Inc. said to take over Faubel & Co. in July 2023 successfully. The acquired company has its headquarters in Melsungen, Germany.

The global anti-counterfeit pharmaceutical packaging market is segmented as follows:

By Applications Segment Analysis

By Applications Segment Analysis

- Diagnostics

- Therapeutics

- Surgical

- Medical Equipment

- Surgical Tapes

- Pharma & Biological

- Other Medical Supplies

By Adhesions Segment Analysis

By Adhesions Segment Analysis

- Repositionable

- Removable

- Permanent

By Printing Technology Segment Analysis

By Printing Technology Segment Analysis

- Mass Serialization

- Barcode

- Mass Encryption

- Holograms

- Security Seals

- RFID

- Others

By Packaging Formats Segment Analysis

By Packaging Formats Segment Analysis

- Bottles & Jars

- Vials & Ampoules

- Blisters

- Trays

- Pouches & Sachets

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Stevanato Group

- Savi Technology Inc.

- OpSec Security Inc.

- AlpVision SA

- Zebra Technologies Corporation

- TruTag Technologies Inc.

- Authentix Inc.

- Nipro Corporation

- Ardagh Group SA

- Klockner Pentaplast Group

- Gerresheimer AG

- Schott AG

- SICPA Holdings

- CCL Industries

- ATL Security Label Systems

- Alien Technology

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors