- CHAPTER 1. Executive Summary

- CHAPTER 2. Anhydrous Hydrofluoric Acid market - Type Analysis

- 2.1. Global Anhydrous Hydrofluoric Acid Market - Type Overview

- 2.2. Global Anhydrous Hydrofluoric Acid Market Share, by Type, 2018 & 2025 (USD Million)

- 2.3. Global Anhydrous Hydrofluoric Acid Market share, by Type, 2018 & 2025 (Kilo Tons)

- 2.4. 99.90% Anhydrous Hydrofluoric Acid

- 2.4.1. Global 99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 2.4.2. Global 99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- 2.5. 99.90% Anhydrous Hydrofluoric Acid

- 2.5.1. Global 99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 2.5.2. Global 99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- CHAPTER 3. Anhydrous Hydrofluoric Acid market - Application Analysis

- 3.1. Global Anhydrous Hydrofluoric Acid Market - Application Overview

- 3.2. Global Anhydrous Hydrofluoric Acid Market Share, by Application, 2018 & 2025 (USD Million)

- 3.3. Global Anhydrous Hydrofluoric Acid Market share, by Application, 2018 & 2025 (Kilo Tons)

- 3.4. Industrial Chemistry

- 3.4.1. Global Industrial Chemistry Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 3.4.2. Global Industrial Chemistry Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- 3.5. Silicon Chip Manufacturing

- 3.5.1. Global Silicon Chip Manufacturing Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 3.5.2. Global Silicon Chip Manufacturing Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- 3.6. Oil Refining

- 3.6.1. Global Oil Refining Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 3.6.2. Global Oil Refining Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- 3.7. Others

- 3.7.1. Global Others Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

- 3.7.2. Global Others Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

- CHAPTER 4. Anhydrous Hydrofluoric Acid market - Regional Analysis

- 4.1. Global Anhydrous Hydrofluoric Acid Market Regional Overview

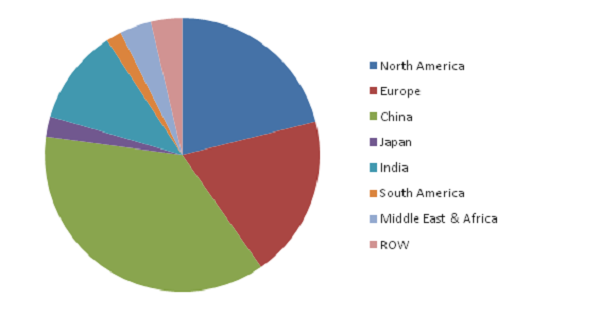

- 4.2. Global Anhydrous Hydrofluoric Acid Market Share, by Region, 2018 & 2025 (Value)

- 4.3. Global Anhydrous Hydrofluoric Acid Market Share, by Region, 2018 & 2025 (Volume)

- 4.4. North America

- 4.4.1. North America Anhydrous Hydrofluoric Acid Market size and forecast, 2016-2026

- 4.4.2. North America Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (USD Million)

- 4.4.3. North America Market size and forecast, 2016-2026 (Kilo Tons)

- 4.4.4. North America Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (Kilo Tons)

- 4.4.5. North America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026

- 4.4.6. North America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026

- 4.4.7. U.S.

- 4.4.8. Canada

- 4.5. Europe

- 4.5.1. Europe Anhydrous Hydrofluoric Acid Market size and forecast, 2016-2026

- 4.5.2. Europe Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (USD Million)

- 4.5.3. Europe Market size and forecast, 2016-2026 (Kilo Tons)

- 4.5.4. Europe Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (Kilo Tons)

- 4.5.5. Europe Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026

- 4.5.6. Europe Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026

- 4.5.7. Germany

- 4.5.8. France

- 4.5.9. U.K.

- 4.5.10. Italy

- 4.5.11. Spain

- 4.5.12. Rest of Europe

- 4.6. Asia Pacific

- 4.6.1. Asia Pacific Anhydrous Hydrofluoric Acid Market size and forecast, 2016-2026

- 4.6.2. Asia Pacific Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (USD Million)

- 4.6.3. Asia Pacific Market size and forecast, 2016-2026 (Kilo Tons)

- 4.6.4. Asia Pacific Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (Kilo Tons)

- 4.6.5. Asia Pacific Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026

- 4.6.6. Asia Pacific Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026

- 4.6.7. China

- 4.6.8. Japan

- 4.6.9. India

- 4.6.10. South Korea

- 4.6.11. South-East Asia

- 4.6.12. Rest of Asia Pacific

- 4.7. Latin America

- 4.7.1. Latin America Anhydrous Hydrofluoric Acid Market size and forecast, 2016-2026

- 4.7.2. Latin America Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (USD Million)

- 4.7.3. Latin America Market size and forecast, 2016-2026 (Kilo Tons)

- 4.7.4. Latin America Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (Kilo Tons)

- 4.7.5. Latin America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026

- 4.7.6. Latin America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026

- 4.7.7. Brazil

- 4.7.8. Mexico

- 4.7.9. Rest of Latin America

- 4.8. The Middle-East and Africa

- 4.8.1. The Middle-East and Africa Anhydrous Hydrofluoric Acid Market size and forecast, 2016-2026

- 4.8.2. The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (USD Million)

- 4.8.3. The Middle-East and Africa Market size and forecast, 2016-2026 (Kilo Tons)

- 4.8.4. The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Country, 2018 - 2025 (Kilo Tons)

- 4.8.5. The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026

- 4.8.6. The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026

- 4.8.7. GCC Countries

- 4.8.8. South Africa

- 4.8.9. Rest of Middle-East Africa

- CHAPTER 5. Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import by Regions

- 5.1. Global Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

- 5.2. Global Import and Export Analysis, by Region

- CHAPTER 6. Anhydrous Hydrofluoric Acid market - Competitive Landscape

- 6.1. Competitor Market Share - Revenue

- 6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 6.3. Competitor Market Share - Volume

- 6.4. Strategic Development

- 6.4.1. Acquisitions and Mergers

- 6.4.2. New Products

- 6.4.3. Research & Development Activities

- CHAPTER 7. Company Profiles

- 7.1. Honeywell

- 7.1.1. Company Overview

- 7.1.2. Honeywell Sales, Revenue, Price, and Gross Margin

- 7.1.3. Product portfolio

- 7.1.4. Recent initiatives

- 7.2. Fujian Longfu Chemical Co., Ltd.

- 7.2.1. Company Overview

- 7.2.2. Fujian Longfu Chemical Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 7.2.3. Product portfolio

- 7.2.4. Recent initiatives

- 7.3. Solvay

- 7.3.1. Company Overview

- 7.3.2. Solvay Sales, Revenue, Price, and Gross Margin

- 7.3.3. Product portfolio

- 7.3.4. Recent initiatives

- 7.4. Fujian Shaowu Yongfei Chemical Co., Ltd.

- 7.4.1. Company Overview

- 7.4.2. Fujian Shaowu Yongfei Chemical Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 7.4.3. Product portfolio

- 7.4.4. Recent initiatives

- 7.5. Yingpeng Chemical

- 7.5.1. Company Overview

- 7.5.2. Yingpeng Chemical Sales, Revenue, Price, and Gross Margin

- 7.5.3. Product portfolio

- 7.5.4. Recent initiatives

- 7.6. Gulf Fluor

- 7.6.1. Company Overview

- 7.6.2. Gulf Fluor Sales, Revenue, Price, and Gross Margin

- 7.6.3. Product portfolio

- 7.6.4. Recent initiatives

- 7.7. Sinochem Corporation

- 7.7.1. Company Overview

- 7.7.2. Sinochem Corporation Sales, Revenue, Price, and Gross Margin

- 7.7.3. Product portfolio

- 7.7.4. Recent initiatives

- 7.8. Zhejiang Fluorescence Chemical Co., Ltd.

- 7.8.1. Company Overview

- 7.8.2. Zhejiang Fluorescence Chemical Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 7.8.3. Product portfolio

- 7.8.4. Recent initiatives

- 7.9. Jiangxi Chinafluorine Chemical Co., Ltd.

- 7.9.1. Company Overview

- 7.9.2. Jiangxi Chinafluorine Chemical Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 7.9.3. Product portfolio

- 7.9.4. Recent initiatives

- 7.10. Fubao Group

- 7.10.1. Company Overview

- 7.10.2. Fubao Group Sales, Revenue, Price, and Gross Margin

- 7.10.3. Product portfolio

- 7.10.4. Recent initiatives

- 7.11. Air Liquide

- 7.11.1. Company Overview

- 7.11.2. Air Liquide Sales, Revenue, Price, and Gross Margin

- 7.11.3. Product portfolio

- 7.11.4. Recent initiatives

- 7.12. Fluorchemie Group

- 7.12.1. Company Overview

- 7.12.2. Fluorchemie Group Sales, Revenue, Price, and Gross Margin

- 7.12.3. Product portfolio

- 7.12.4. Recent initiatives

- 7.13. Derivados del Fluor

- 7.13.1. Company Overview

- 7.13.2. Derivados del Fluor Sales, Revenue, Price, and Gross Margin

- 7.13.3. Product portfolio

- 7.13.4. Recent initiatives

- CHAPTER 8. Anhydrous Hydrofluoric Acid — Industry Analysis

- 8.1. Introduction and Taxonomy

- 8.2. Anhydrous Hydrofluoric Acid Market - Key Trends

- 8.2.1. Market Drivers

- 8.2.2. Market Restraints

- 8.2.3. Market Opportunities

- 8.3. Value Chain Analysis

- 8.4. Key Mandates and Regulations

- 8.5. Technology Roadmap and Timeline

- 8.6. Anhydrous Hydrofluoric Acid market - Attractiveness Analysis

- 8.6.1. By Type

- 8.6.2. By Application

- 8.6.3. By Region

- CHAPTER 9. Raw Material analysis

- 9.1. Anhydrous Hydrofluoric Acid Key Raw Material Analysis

- 9.1.1. Key Raw Materials

- 9.1.2. Price Trend of Key Raw Materials

- 9.2. Key Suppliers of Raw Materials

- 9.3. Proportion of Manufacturing Cost Structure

- 9.3.1. Raw Materials

- 9.3.2. Labor Cost

- 9.4. Manufacturing Expenses Analysis of Anhydrous Hydrofluoric Acid

- CHAPTER 10. Industrial Chain, Sourcing Strategy and Downstream Buyers

- 10.1. Anhydrous Hydrofluoric Acid Industrial Chain Analysis

- 10.2. Upstream Raw Materials Sourcing

- 10.2.1. Risk Mitigation:

- 10.2.2. Supplier Relationships:

- 10.2.3. Business Processes:

- 10.2.4. Securing the Product:

- 10.3. Raw Materials Sources of Anhydrous Hydrofluoric Acid Major Manufacturers in 2016

- 10.4. Downstream Buyers

- 10.5. Distributors/Traders List

- CHAPTER 11. Marketing Strategy Analysis, Distributors

- 11.1. Marketing Channel

- 11.2. Direct Marketing

- 11.3. Indirect Marketing

- 11.4. Marketing Channel Development Trend

- 11.5. Economic/Political Environmental Change

- CHAPTER 12. Report Conclusion

- CHAPTER 13. Research Approach & Methodology

- 13.1. Report Description

- 13.2. Research Scope

- 13.3. Research Methodology

- 13.3.1. Secondary Research

- 13.3.2. Primary Research

- 13.3.3. Models

List of Figures

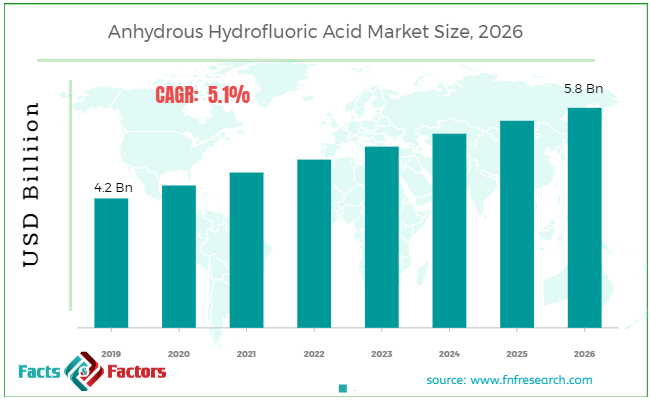

FIG. 1 Global Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 2 Global Anhydrous Hydrofluoric Acid Market Share, by Type, 2018 & 2025 (USD Million)

FIG. 3 Global Anhydrous Hydrofluoric Acid Market share, by Type, 2018 & 2025 (Kilo Tons)

FIG. 4 Global >99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 5 Global >99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 6 Global <99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 7 Global <99.90% Anhydrous Hydrofluoric Acid Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 8 Global Anhydrous Hydrofluoric Acid Market Share, by Application, 2018 & 2025 (USD Million)

FIG. 9 Global Anhydrous Hydrofluoric Acid Market share, by Application, 2018 & 2025 (Kilo Tons)

FIG. 10 Global Industrial Chemistry Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 11 Global Industrial Chemistry Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 12 Global Silicon Chip Manufacturing Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 13 Global Silicon Chip Manufacturing Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 14 Global Oil Refining Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 15 Global Oil Refining Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 16 Global Others Anhydrous Hydrofluoric Acid Market, 2016-2026 (USD Million)

FIG. 17 Global Others Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 18 Global Anhydrous Hydrofluoric Acid Market Share, by Region, 2018 & 2025

FIG. 19 Global Anhydrous Hydrofluoric Acid Market Share, by Region, 2018 & 2025

FIG. 20 North America Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 21 North America Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 22 U.S. Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 23 U.S. Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 24 Canada Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 25 Canada Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 26 Europe Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 27 Europe Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 28 Germany Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 29 Germany Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 30 France Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 31 France Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 32 U.K. Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 33 U.K. Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 34 Italy Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 35 Italy Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 36 Spain Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 37 Spain Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 38 Rest of Europe Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 39 Rest of Europe Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 40 Asia Pacific Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 41 Asia Pacific Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 42 China Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 43 China Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 44 Japan Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 45 Japan Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 46 India Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 47 India Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 48 South Korea Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 49 South Korea Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 50 South-East Asia Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 51 South-East Asia Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 52 Rest of Asia Pacific Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 53 Rest of Asia Pacific Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 54 Latin America Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 55 Latin America Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 56 Brazil Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 57 Brazil Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 58 Mexico Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 59 Mexico Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 60 Rest of Latin America Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 61 Rest of Latin America Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 62 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 63 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 64 GCC Countries Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 65 GCC Countries Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 66 South Africa Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 67 South Africa Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 68 Rest of Middle-East Africa Anhydrous Hydrofluoric Acid Market, 2016-2026

FIG. 69 Rest of Middle-East Africa Anhydrous Hydrofluoric Acid Market, 2016-2026 (Kilo Tons)

FIG. 70 Global Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 71 North America Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 72 Europe Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 73 Asia Pacific Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 74 Latin America Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 75 Middle East and Africa Anhydrous Hydrofluoric Acid production and revenue, 2015-2025 (USD Million) (Kilo Tons)

FIG. 76 Competitor Market Share – Revenue

FIG. 77 Competitor Market Share – Volume

FIG. 78 Honeywell Revenue and Growth Rate

FIG. 79 Honeywell Market Share

FIG. 80 Fujian Longfu Chemical Co., Ltd. Revenue and Growth Rate

FIG. 81 Fujian Longfu Chemical Co., Ltd. Market Share

FIG. 82 Solvay Revenue and Growth Rate

FIG. 83 Solvay Market Share

FIG. 84 Fujian Shaowu Yongfei Chemical Co., Ltd. Revenue and Growth Rate

FIG. 85 Fujian Shaowu Yongfei Chemical Co., Ltd. Market Share

FIG. 86 Yingpeng Chemical Revenue and Growth Rate

FIG. 87 Yingpeng Chemical Market Share

FIG. 88 Gulf Fluor Revenue and Growth Rate

FIG. 89 Gulf Fluor Market Share

FIG. 90 Sinochem Corporation Revenue and Growth Rate

FIG. 91 Sinochem Corporation Market Share

FIG. 92 Zhejiang Fluorescence Chemical Co., Ltd. Revenue and Growth Rate

FIG. 93 Zhejiang Fluorescence Chemical Co., Ltd. Market Share

FIG. 94 Jiangxi Chinafluorine Chemical Co., Ltd. Revenue and Growth Rate

FIG. 95 Jiangxi Chinafluorine Chemical Co., Ltd. Market Share

FIG. 96 Fubao Group Revenue and Growth Rate

FIG. 97 Fubao Group Market Share

FIG. 98 Air Liquide Revenue and Growth Rate

FIG. 99 Air Liquide Market Share

FIG. 100 Fluorchemie Group Revenue and Growth Rate

FIG. 101 Fluorchemie Group Market Share

FIG. 102 Derivados del Fluor Revenue and Growth Rate

FIG. 103 Derivados del Fluor Market Share

FIG. 104 Market Dynamics

FIG. 105 Global Anhydrous Hydrofluoric Acid – Value Chain Analysis

FIG. 106 Key Mandates and Regulations

FIG. 107 Technology Roadmap and Timeline

FIG. 108 Market Attractiveness Analysis – By Type

FIG. 109 Market Attractiveness Analysis – By Application

FIG. 110 Market Attractiveness Analysis – By Region

FIG. 111 Manufacturing Cost Structure of Anhydrous Hydrofluoric Acid

FIG. 112 Anhydrous Hydrofluoric Acid Industrial Chain Analysis

FIG. 113 Market Channel

FIG. 114 Marketing Channel Development Trend

FIG. 115 Growth in World Gross Product, 2008-2018

List of Tables

TABLE 1 Global Anhydrous Hydrofluoric Acid market, 2018 & 2025 (USD Million)

TABLE 2 Global Anhydrous Hydrofluoric Acid market, by Type, 2016-2026 (USD Million)

TABLE 3 Global Anhydrous Hydrofluoric Acid market, by Type, 2016-2026 (Kilo Tons)

TABLE 4 Global Anhydrous Hydrofluoric Acid market, by Application, 2016-2026 (USD Million)

TABLE 5 Global Anhydrous Hydrofluoric Acid market, by Application, 2016-2026 (Kilo Tons)

TABLE 6 Global Anhydrous Hydrofluoric Acid market, by region, 2016-2026 (USD Million)

TABLE 7 Global Anhydrous Hydrofluoric Acid market, by region, 2016-2026 (Kilo Tons)

TABLE 8 North America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (USD Million)

TABLE 9 North America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (Kilo Tons)

TABLE 10 North America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (USD Million)

TABLE 11 North America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (Kilo Tons)

TABLE 12 Europe Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (USD Million)

TABLE 13 Europe Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (Kilo Tons)

TABLE 14 Europe Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (USD Million)

TABLE 15 Europe Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (Kilo Tons)

TABLE 16 Asia Pacific Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (USD Million)

TABLE 17 Asia Pacific Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (Kilo Tons)

TABLE 18 Asia Pacific Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (USD Million)

TABLE 19 Asia Pacific Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (Kilo Tons)

TABLE 20 Latin America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (USD Million)

TABLE 21 Latin America Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (Kilo Tons)

TABLE 22 Latin America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (USD Million)

TABLE 23 Latin America Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (Kilo Tons)

TABLE 24 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (USD Million)

TABLE 25 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Type, 2016-2026 (Kilo Tons)

TABLE 26 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (USD Million)

TABLE 27 The Middle-East and Africa Anhydrous Hydrofluoric Acid Market, by Application, 2016-2026 (Kilo Tons)

TABLE 28 North America Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import, 2016-2019

TABLE 29 Europe Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import, 2016-2019

TABLE 30 Asia Pacific Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import, 2016-2019

TABLE 31 Latin America Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import, 2016-2019

TABLE 32 Middle East & Africa Anhydrous Hydrofluoric Acid Production, Consumption, Export, Import, 2016-2019

TABLE 33 Global Anhydrous Hydrofluoric Acid Market - Company Revenue Analysis 2016-2019 (USD Million)

TABLE 34 Global Anhydrous Hydrofluoric Acid Market - Company Revenue Share Analysis 2016-2019(%)

TABLE 35 Global Anhydrous Hydrofluoric Acid Market - Company Volume Analysis 2016-2019 (Kilo Tons)

TABLE 36 Global Anhydrous Hydrofluoric Acid Market - Company Volume Share Analysis 2016-2019(%)

TABLE 37 Acquisitions and Mergers

TABLE 38 New Product/Service Launch

TABLE 39 Research & Development Activities

TABLE 40 Market Drivers

TABLE 41 Market Restraints

TABLE 42 Market Opportunities

TABLE 43 Production Base and Market Concentration Rate of Raw Material

TABLE 44 Key Suppliers of Raw Materials

TABLE 45 Raw Materials Sources of Anhydrous Hydrofluoric Acid Major Manufacturers in 2016

TABLE 46 Major Buyers of Anhydrous Hydrofluoric Acid

TABLE 47 Distributors/Traders of Anhydrous Hydrofluoric Acid by Region

Key Insights from Primary Research

Key Insights from Primary Research Key Recommendations from Analysts

Key Recommendations from Analysts Market Concentration Ratio and Market Maturity Analysis

Market Concentration Ratio and Market Maturity Analysis

Report Scope

Report Scope Some of the essential players operating in the Anhydrous Hydrofluoric Acid market, but not restricted to include

Some of the essential players operating in the Anhydrous Hydrofluoric Acid market, but not restricted to include  By Type Segment Analysis

By Type Segment Analysis By Application Segment Analysis

By Application Segment Analysis Regional Segment Analysis

Regional Segment Analysis KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT: