Search Market Research Report

Allulose Market Size, Share Global Analysis Report, 2021 – 2026

Allulose Market By Form (Powder, Liquid, & Crystal), By Application (Food, Bakery & Confectionery, Table-Top Sweetener, Dairy & Frozen Desserts, Sauces & Dressings, Ice Creams & Desserts, Beverages, & Pharmaceuticals), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

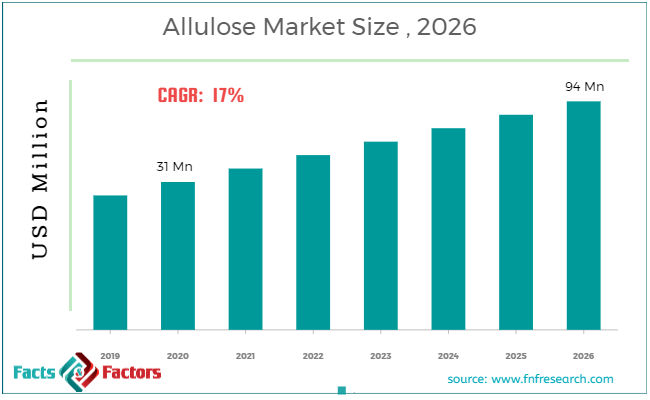

[198+ Pages Report] The latest finding surrounding the Global Allulose Market published by Facts & Factors offers a neatly packaged and comprehensive read. We at Facts & Factors estimated that the global allulose market will reach a projected value of USD 94 Million by 2026 with a growth rate of 17% CAGR from an initial value of USD 31 Million in the year 2020.

Market Overview

Market Overview

Allulose or D-Psicose or D-allulose is a form of low-calorie based monosaccharide sugar and is used in the sector of commercial food & beverage for presenting a tinge of sweetness in these ingredients. Allulose is further estimated to be 70% sweeter than the original sucrose-based sugar. Most of the commercial-based cellulose is extracted from corn and is used for yogurt, ice creams, baked goods, and other forms of high calorific value.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the Australia allulose market is set to grow annually at a rate of around 17%.

- It was established through primary research that the Australia allulose market was valued at around USD 31 Million in 2020.

- In terms of volume, the Australiaallulose market stood at approximately 450 Tons, in 2019.

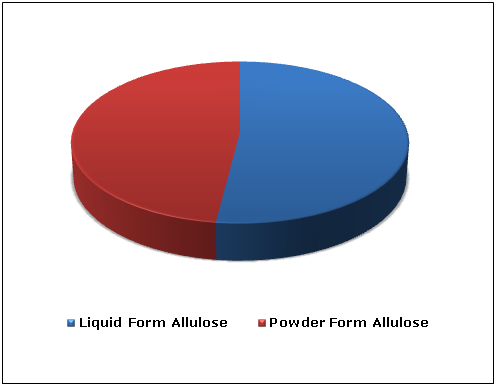

- The “powder form allulose” category, on the basis of type segmentation, was the leading revenue-generating category accounting for more than 50% share, in 2019.

- On the basis of application segmentation, the “dairy” category held the leading share at more than 20%, in 2019

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the allulose market in Australia is not popular for many. Only concerning industries such as Beverages and Confectionery industries are aware of this potential market.

- Growing at a CAGR of around 9%, Australiaallulose market provides numerous opportunities for all of the involved stakeholders across the entire value chain

- Our analysts have identified “powder form allulose” and “beverages” categories as the leading investment pockets for Australiaallulose market in terms of type and application segmentations respectively

Market Attractiveness – By Type

Market Attractiveness – By Type

Industry Growth Factors

Industry Growth Factors

The driving forces for the global allulose market are the rising trend of low-calorie consumption of food articles coupled with reduced usage of sugar to name a few. Additionally, rising consumer awareness regarding health consciousness coupled with rising urbanization measures is expected to increase the footprint of the global allulose market during the advent of the forecast period. Moreover, the rising health issues due to increased consumption of sugar coupled with decreased usage of synthetic sweeteners are expected to fuel the growth of the global allulose market during the forecast period.

The global allulose market is expected to be driven due to the rising focus of the key market participants on advancing research & development activities coupled with an increasing number of diabetes patients to name a few. The launching of new products comprised of new flavors, ingredients, and textures is expected to fuel the growth of the global allulose market during the advent of the forecast duration. However, a higher cost of processing of allulose when compared to its counterparts and fluctuation prices of raw materials is expected to decrease the growth of the global allulose market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global allulose market is segmented into form, application, and region.

On the basis of form, the global allulose market is divided into powder, liquid, and crystal. The segment pertaining to powder is expected to witness the largest market share during the advent of the forecast owing to increasing usage of the latter due to a well-blended form into yogurts, smoothies, and other drinks when compared to its counterparts coupled with rising use case scenarios among bakery based items such as biscuits, cakes, rye bread, and meat dishes to name a few. Based on application, the global allulose market is categorized into food, bakery & confectionery, table-top sweetener, dairy & frozen desserts, sauces &dressings, ice creams & desserts, beverages, and pharmaceuticals.

The bakery & confectionery foods category is expected to witness the largest market share during the advent of the forecast owing to factors pertaining to improved moisture content, increased water retention rate, and softness upon usage to name a few. Additionally, changing lifestyle of consumers coupled with rising product adoption in terms of bread, pastries, and cakes is expected to cement the dominant market share of the latter during the advent of the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 31 Million |

Projected Market Size in 2026 |

USD 94 Million |

CAGR Growth Rate |

17% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Tate & Lyle, Quest Nutrition, Matsutani Chemical Industry Co. Ltd, McNeil Nutritional, Anderson Global Group, CJ Cheil Jedang, Cargill, Inc., Ingredion Incorporated, and Apura Ingredients, among others. |

Key Segments |

Form, Applications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast owing to rising demand for allulose-based products in the food & beverage sector coupled with changing food preferences of the population to name a few. Additionally, shifting consumer preference toward a healthier outlook and habits coupled with favorable government regulations is expected to increase the footprint of the allulose market during the advent of the forecast period. Europe is expected to occupy a substantial market share after the latter region owing to recognizance of lack of serious side effects by allulose products by Europe’s regulatory bodies coupled with increasing product safety to name a few. Additionally, new product launches coupled with increasing distribution channels in the region will further upend the allulose market toward a higher consumer base.

Competitive Players

Competitive Players

The key market participants for the global allulose market are :

- Tate & Lyle

- Quest Nutrition

- Matsutani Chemical Industry Co. Ltd

- McNeil Nutritional

- Anderson Global Group

- CJ Cheil Jedang

- Cargill Inc.

- Ingredion Incorporated

- Apura Ingredients

- among others

By Form Segment Analysis

By Form Segment Analysis

- Powder

- Liquid

- Crystal

By Application Segment Analysis

By Application Segment Analysis

- Food

- Bakery & Confectionery

- Table-Top Sweetener

- Dairy & Frozen Desserts

- Sauces & Dressings

- Ice Creams & Desserts

- Beverages

- Pharmaceuticals

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Tate & Lyle

- Quest Nutrition

- Matsutani Chemical Industry Co. Ltd

- McNeil Nutritional

- Anderson Global Group

- CJ Cheil Jedang

- Cargill Inc.

- Ingredion Incorporated

- Apura Ingredients

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors