Search Market Research Report

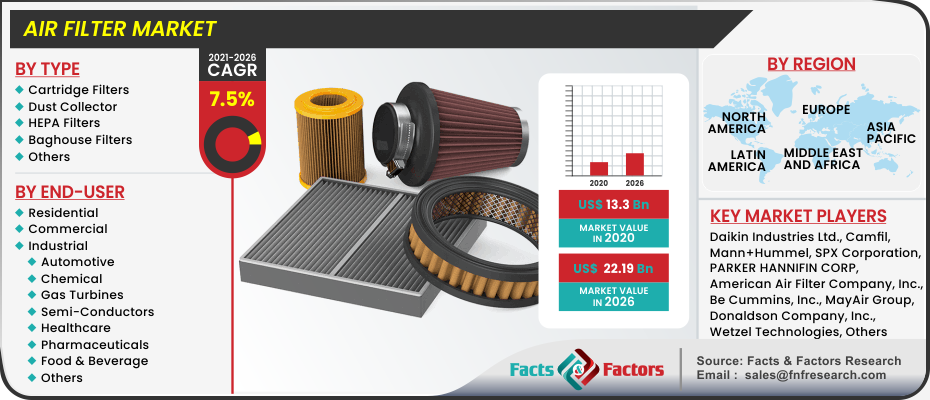

Air Filter Market Size, Share Global Analysis Report, Market By Type (Cartridge Filters, Dust Collector, HEPA Filters, Baghouse Filters, & Others), By End-User (Residential, Commercial, & Industrial), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 - 2026

Air Filter Market By Type (Cartridge Filters, Dust Collector, HEPA Filters, Baghouse Filters, & Others), By End-User (Residential, Commercial, & Industrial), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 - 2026

Industry Insights

[187+ Pages Report] We at Facts & Factors have recently published an analytical and comprehensive outlook market study titled “Global Air Filter Market”. We estimate that the global Air Filter Market will be valued at an estimated projection of USD 22.19 Billion in the year 2026 from an initial value of USD 13.3 Billion in the year 2020 with growth at a CAGR of about 7.5% during the forecast period 2021-2026.

Market Overview

Market Overview

Air filters are devices that are usually composed of porous or fibrous materials that are used for cleaning and elimination of solid particles such as dust, pollen, mold, and other forms of bacteria from the air. Advanced models of air filters come equipped with adsorbent catalysts such as charcoal which may further remove harmful odors and gaseous pollutants of volatile nature. Air filters are usually employed in applications or environments where a luscious flow of clean air is required. The most common applications of air filters are aircraft, internal combustion engines, and satellites to name a few.

Industry Growth Factors

Industry Growth Factors

The driving factors behind the significant growth of the global air filter market are increasing vehicular production, stringent emission regulations and norms, growing health concerns, and rising demand for purified air to name a few. Furthermore, with the advent of COVID-19, the air filter industry has remained virtually unaffected because of its distinct properties and applications. Air filters are a crucial part of heating, ventilation, and air conditions systems and are equipped in order to remove dirt from the air for smooth functioning. Increasing demands for HVAC systems is expected to boost the growth of the global air filter market to a larger extent.

Moreover, rising demands for better public hygiene and consumer awareness regarding better indoor air quality (IAQ) among others will further boost the growth of the market. Improvements in technology such as biofiltration and the ability to remove minute particles from the air will further attract a wider range of consumers. Improved government support will further open new revenue streams for the global air filter market. Increasing demand for installation of indoor air filters will further nudge the market toward a positive overview. Moreover, the booming automobile industry will further lead to a tenfold volumetric increase in sales in the global air filter market over the forecast. However, high initial cost and maintenance cost of these filters is expected to hamper the growth of the market to a certain extent.

Segmentation Analysis

Segmentation Analysis

The global air filter market can be segmented into types, end-users, and regions.

The global air filter market can be divided into cartridge filters, dust collector, HEPA filters, baghouse filters, and others. The other segment can be further broken down into mist filters, and others. HEPA filters are expected to witness the largest market share during the forecast owing to their distinct property to eliminate minute particles with an efficiency of over 99.97%. These filters further possess advanced filtering techniques such as diffusion which makes them highly valuable in a variety of sectors such as healthcare, automobile, commercial & residential buildings, and other similar applications. Dust collectors are expected to witness the fastest growing CAGR during the forecast owing to their capability to manage a higher quality of air. The global air filter market can be fragmented into residential, commercial, and industrial. The industrial segment can be further broken down into automotive, chemical, gas turbines, semi-conductors, healthcare, pharmaceuticals, food & beverage, and others. The industrial category is expected to witness the largest market share during the forecast owing to an ample demand from manufacturing applications. These filters provide a suitable environment by minimizing risks of microbiological and molecular contamination. The automobile sector will contribute to the maximum of market share in this category.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 13.3 Billion |

Projected Market Size in 2026 |

USD 22.19 Billion |

CAGR Growth Rate |

7.5% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Daikin Industries Ltd., Camfil, Mann+Hummel, PARKER HANNIFIN CORP, American Air Filter Company, Inc., Be Cummins, Inc., Donaldson Company, Inc., Wetzel Technologies, SPX Corporation, MayAir Group, Airventil Pvt Ltd., Absolent Group AB, V&T Group BV, HEPA Corporation, DuPont, and Fildex Filters, and Others |

Key Segment |

By Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast in terms of global revenue contribution. Factors pertaining to the dominant growth in the region can be contributed to the rising automotive sector coupled with an increase in preventive measures undertaken by the government to restrain the pollution being caused by manufacturing industries. Asia-Pacific is expected to witness the fastest growing CAGR during the forecast owing to rapid urbanization and industrialization in emerging economies such as China, India, and Japan. Due to rising air pollution, government bodies across the countries have undertaken several measures to counteract the effects of the rising manufacturing sector which will in turn aid the sales of air filters in the region.

Competitive Players

Competitive Players

The key participants in the global air filter market are :

- Daikin Industries Ltd.

- Camfil

- Mann+Hummel

- PARKER HANNIFIN CORP

- American Air Filter Company Inc.

- Be Cummins Inc.

- Donaldson Company Inc.

- Wetzel Technologies

- SPX Corporation

- MayAir Group

- Airventil Pvt Ltd.

- Absolent Group AB

- V&T Group BV

- HEPA Corporation

- DuPont

- Fildex Filters

- among others

By Type Segment Analysis

By Type Segment Analysis

- Cartridge Filters

- Dust Collector

- HEPA Filters

- Baghouse Filters

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Residential

- Commercial

- Industrial

- Automotive

- Chemical

- Gas Turbines

- Semi-Conductors

- Healthcare

- Pharmaceuticals

- Food & Beverage

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Daikin Industries Ltd.

- Camfil

- Mann+Hummel

- PARKER HANNIFIN CORP

- American Air Filter Company Inc.

- Be Cummins Inc.

- Donaldson Company Inc.

- Wetzel Technologies

- SPX Corporation

- MayAir Group

- Airventil Pvt Ltd.

- Absolent Group AB

- V&T Group BV

- HEPA Corporation

- DuPont

- Fildex Filters

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors