Search Market Research Report

1-Decene Market Size, Share Global Analysis Report, 2021 – 2026

1-Decene Market By Derivate (Polyalphaolefins, Oxo Alcohols, Linear Alkyne Benzene, Linear Mercaptans, Chlorinated Olefins, Alkyl Dimethylamine, & Di-Alkyl Dimethylamine), By Application (Poly Alpha Olefin, Polyethylene, Detergent Alcohol, Synthetic Lubricants, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

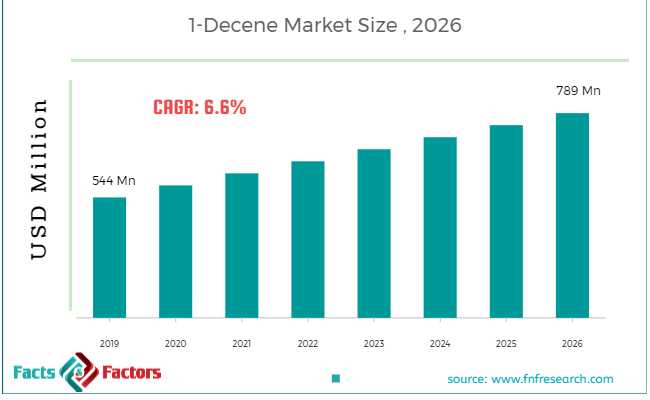

[187+ Pages Report] The latest finding surrounding the “Global 1-Decene Market” published by Facts & Factors offers a neatly packaged and comprehensive read. We at Facts & Factors estimated the global 1-Decene market to reach a projected value of USD 789 Million by 2026 with a growth rate of 6.6% CAGR from an initial value of USD 544 Million in the year 2020.

1-decene is the formed structure that contains ten carbon atoms and two hydrogen atoms and it belongs to a specific family of the alkene group. 1-decene has many isomers of decene that are depending on the geometric and structural integrity of the double bond structure. 1-decene is an intermediate form of synthesis of oxo alcohols, synthetic lubricants, epoxides, amines, synthetic fatty acids, and alkylated aromatics.

The global 1-decene market is expected to be occupied by contributing factors attributes to rising demand for PAO-based lubricants and rising industrialization measures on a global purview to name a few. Additionally, a rising group of higher performance group III base oils coupled with rising regulations on automotive manufacturers is expected to increase the footprint of the global 1-decene market during the advent of the forecast period. Moreover, a rising focus of manufacturers on decreasing carbon-based emissions and overall carbon footprint coupled with increasing demand from the sector of food additives will boost the growth of the global 1-decene market during the advent of the forecast period.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the 1-Decene market is set to grow annually at a rate of around 6.6%.

- It was established through primary research that the 1-Decene market was valued at around USD 544 Million in 2020.

- In terms of volume, the 1-Decene market stood at around USD 910 Million, in 2019.

- The “Oligomerization Method” category, on the basis of type segmentation, was the leading revenue-generating category accounting for around 60% share, in 2019.

- On the basis of application segmentation, the “Poly Alpha Olefin (PAO)” category held the leading share at more than 62%, in 2019.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, 1 decene is expected to have significant demand as the market is suffering from the supply crunch for Poly Alpha Olefin (PAO) which is used for manufacturing synthetic lubricants.

- 1 decene market is expected to have the largest market share in Europe and North America owing to the favoring of the chemical industry and free trade agreement.

- Growing at a CAGR of around 5%, 1-Decene market provides numerous opportunities for all of the involved stakeholders across the entire value chain

- Our analysts have identified the “Oligomerization Method” as the most economical and efficient method to produce 1-Decene.

- Asia is set to become the fastest-growing region in the forecasted period owing to easy access to raw materials.

The global 1-decene market is driven by rising R&D-based activities coupled with an attentive focus of alpha-olefins from a variety of sources to name a few. Factors pertaining to various applicable norms such as hydroformylation, hydration, alkylation, hydrogenation, halogenations, oligomerization, and polymerization coupled with low-cost ethane supply from increasing shale gas products will fuel the growth of the global 1-decene market during the advent of the forecast period. However, a relative weaker economic growth coupled with a lack of on purpose production methods will decrease the market share during the advent of the forecast period.

The global 1-decene market is divided into polyalphaolefins, oxo alcohols, linear alkyne benzene, linear mercaptans, chlorinated olefins, alkyl dimethylamine, and di-alkyl dimethylamine on the basis of derivate. The segment pertaining to polyalphaolefins is expected to witness the largest market share during the advent of the forecast period owing to rising demand from the automotive and manufacturing sector coupled with integrated usage into compressor oil, transmission oil, lube-oil additive, and gear oil to name a few.

Based on application, the global 1-decene market is categorized into poly alpha olefin, polyethylene, detergent alcohols, synthetic lubricants, and others. The segment pertaining to synthetic lubricant is expected to witness the largest market share during the advent of the forecast period owing to rising demand from the cosmetic and food & beverage sector coupled with rising environmental regulations in the automotive sector to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 544 Million |

Projected Market Size in 2026 |

USD 789 Million |

CAGR Growth Rate |

6.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Royal Dutch Shell, INEOS, Chevron Phillips Chemical Company LLC, SABIC, Exxon Mobil Corporation, Qatar Chemical Company II Ltd, and Others |

Key Segments |

Derivate, Applications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

North America is expected to witness the largest market share during the advent of the forecast period owing to rising production of PAO in the region coupled with rising shale gas production and exploration-based activities to name a few. Additionally, the region is home to the key market participants pertaining to the sector which makes the presence of the latter market associated with a larger footprint. Factors pertaining to increasing consumer awareness regarding environmentally friendly use cases and an increase in per capita income among consumers will further push the existing boundaries of the 1-decene market during the advent of the forecast period.

Asia-Pacific is expected to occupy a substantial market share during the advent of the forecast period owing to rising demand from emerging economies such as India and China coupled with favorable government policies regarding a higher production vole in terms of 1-decene to name a few.

Some of the leading players in the global market include

Some of the leading players in the global market include

- Royal Dutch Shell

- INEOS

- Chevron Phillips Chemical Company LLC

- SABIC

- Exxon Mobil Corporation

- Qatar Chemical Company II Ltd

- Idemitsu Kosan Co. Ltd.

- PJSC Nizhnekamskneftekhim

- Alfa Aesar

- Merck Group

- Toronto Chemical Industry Company Limited

- Spectrum Chemical Mfg Corp

- Agene Chemicals

- Gelest Inc.

By Derivate Segment Analysis

By Derivate Segment Analysis

- Polyalphaolefins

- Oxo Alcohols

- Linear Alkyne Benzene

- Linear Mercaptans

- Chlorinated Olefins

- Alkyl Dimethylamine

- Di-Alkyl Dimethylamine

By Application Segment Analysis

By Application Segment Analysis

- Poly Alpha Olefin

- Polyethylene

- Detergent Alcohols

- Synthetic Lubricants

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Royal Dutch Shell

- INEOS

- Chevron Phillips Chemical Company LLC

- SABIC

- Exxon Mobil Corporation

- Qatar Chemical Company II Ltd

- Idemitsu Kosan Co. Ltd.

- PJSC Nizhnekamskneftekhim

- Alfa Aesar

- Merck Group

- Toronto Chemical Industry Company Limited

- Spectrum Chemical Mfg Corp

- Agene Chemicals

- Gelest Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors