Search Market Research Report

Testing, Inspection and Certification (TIC) Market Size, Share Global Analysis Report, 2023 – 2030

Testing, Inspection and Certification (TIC) Market Size, Share, Growth Analysis Report By Domain (Consumer Goods, Medical & Life Science, Chemical, and Food & Beverages), By Type (Testing, Inspection, and Certification), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

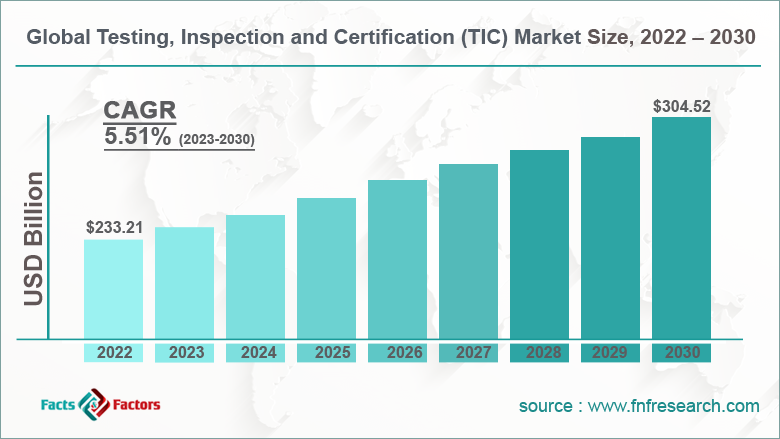

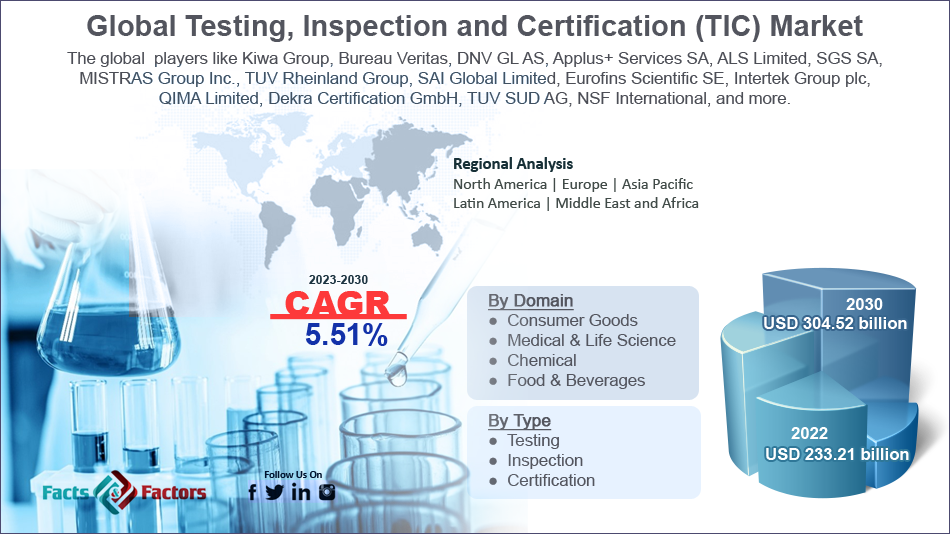

[218+ Pages Report] According to the report published by Facts and Factors, The global testing, inspection, and certification (TIC) market size was worth around USD 233.21 billion in 2022 and is predicted to grow to around USD 304.52 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.51% between 2023 and 2030. The report analyzes the global testing, inspection, and certification (TIC) market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the testing, inspection, and certification (TIC) market.

Market Overview

Market Overview

The industry refers to service providers that function in the sector and perform functions like testing, inspecting, and certifying systems, products, or services. Their main role is to ensure that the product or service being tested or certified meets regulatory requirements and is at par with quality standards while ascertaining that the products are also safe to use.

The market or players operating in the market are crucial to determining services and products that comply with domestic or international standards and regulations and they are safe to be used or operated along with being reliable. The services offered by the market are used across sectors including the fastest growing industries like automotive, construction, healthcare, aerospace, food & beverages (F&B), and enterprises working in the consumer goods segment. The providers of TIC services are generally third parties who are licensed or accredited to perform these roles.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global testing, inspection, and certification (TIC) market is estimated to grow annually at a CAGR of around 5.51% over the forecast period (2022-2030)

- In terms of revenue, the global testing, inspection, and certification (TIC) market size was valued at around USD 233.21 billion in 2022 and is projected to reach USD 304.52 billion, by 2030.

- The market is projected to grow at a significant rate due to the rapidly rising global trade

- Based on domain segmentation, consumer goods was predicted to show maximum market share in the year 2022

- Based on type segmentation, testing was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Rapidly rising global trade to ensure market growth

The global testing, inspection, and certification (TIC) market is projected to grow owing to the rising international trade across economies from one continent to another. Globalization is the result of growing trade relations between economies that intend to achieve mutual benefit. As the companies seek to expand their businesses and foray into other territories, they will be required to take assistance for TIC services since typically, these institutes are reliable in terms of ensuring the products meet international standards before they become available in the market for sale.

TIC service providers are equipped with expert professionals who work dedicatedly to understanding and staying updated with domestic and international regulatory measures since these rules and regulations are extremely complex. Furthermore, the growth in technology that has led to the development of products requiring certification and testing before being rolled out is another important factor for market growth.

Restraints

Restraints

- High cost of services to restrict market expansion

Since TIC services deal with complicated domestic and international trade laws and regulatory measures, their services are generally high in price since it entails the use of expert professionals. Small and medium-sized firms may find it difficult to afford these services on a regular basis. Furthermore, the pool of skilled professionals in this sector is relatively low compared to the demand for the services. This further leads to disparity in supply and demand causing a rise in prices for undertaking these services.

Opportunities

Opportunities

- Emerging markets to provide excellent growth opportunities

Currently, world leaders are focusing on the development graph of emerging economies like India, China, and others. The nations have true potential which when explored can lead to tremendous growth. TIC service providers are likely to target service-seekers in emerging countries since international players are rapidly making their entry into these economies. Furthermore, regional governments are providing necessary support to domestic players assisting them in international expansion projects which is another likely contributor to global market growth.

Challenges

Challenges

- Geographical expansion is a major challenge to overcome

Since TIC service providers are constantly looking to expand their services in international and new markets, it may get difficult for them to keep up with the ever-evolving international laws and regulations due to various cultural or technical differences.

Furthermore, understanding regulatory laws for every territory is difficult and requires a dedicated team of personnel who are consistently working toward adapting their knowledge as per the latest changes. This acts as a significant barrier to global market growth.

Segmentation Analysis

Segmentation Analysis

The global testing, inspection, and certification (TIC) market is segmented based on domain, type, and region.

Based on domain, the global market is segmented into consumer goods, medical & life science, chemical, and food & beverages.

- The largest contributing segment in the industry is the consumer goods section followed by medical & life science, and food & beverages

- Consumer goods are products that are used regularly by users like toys, electronics, and clothing items

- Since generally the providers of consumer goods products aim at rapid international expansion, they are in constant need of consulting and operational services that can ease the process of entering a foreign land

- Furthermore, it is critical for enterprises in the healthcare segment to ensure that products received necessary regulatory approvals before being launched

- In 2021, Société Générale de Surveillance (SGS), one of the leading TIC service providers, generated around USD 6.7 billion in revenue for the first half

Based on type, the global market segments are testing, inspection, and certification.

- Although the type of service undertaken depends on client requirements, testing was the highest revenue-generating segment in 2022 and accounted for more than 69.9% of the segmental share

- These services include the evaluation and testing of materials, and products along with processes that ensure that the product meets regulatory requirements

- Inspection, on the other hand, deals with the physical and operational checking of products including pre-shipment, quality control, and other processes

- Certification involved generating and providing essential regulatory certificates as proof of quality check

Recent Developments:

Recent Developments:

- In January 2023, KKR, a globally leading investment firm, announced partnering with Amir Agarwal and Andy Silvernail, former senior executives employed at Thermo Fisher and Omega Engineering and KKR Executive Advisor respectively, to make strategic decisions for building an empire in the TIC industry. The company’s Ascendant strategy committed to delivering a fund of USD 250 million for the new platform

- In January 2022, SGS announced its collaboration with technology giant Microsoft. The partnership aims to leverage the strengths of both companies to develop helpful and innovative solutions in the TIC sector

- In December 2020, SGC acquired around 80% stake in Ryobi Geotechnique International Pvt Ltd, a company specializing in geoengineering solutions for instrumentation, soil investigation, and geotechnics for the construction sectors

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 233.21 Billion |

Projected Market Size in 2030 |

USD 304.52 Billion |

CAGR Growth Rate |

5.51% |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Kiwa Group, Bureau Veritas, DNV GL AS, Applus+ Services SA, ALS Limited, SGS SA, MISTRAS Group Inc., TUV Rheinland Group, SAI Global Limited, Eurofins Scientific SE, Intertek Group plc, QIMA Limited, Dekra Certification GmbH, TUV SUD AG, NSF International, and Others |

Key Segment |

By Domain, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to lead with the highest CAGR

The global testing, inspection, and certification (TIC) market is projected to register the highest growth in Asia-Pacific which, in 2022, led to more than 30.1% of the global market share. The regional growth is attributed to the growing economies of South Korea, India, China, Japan, and Singapore since these countries have registered high industrial and commercial growth in recent years.

Furthermore, enterprises and businesses in Asia-Pacific have now adopted a more aggressive approach to entering new markets which required them to be equipped with information related to international trade laws and regulatory protocols.

Furthermore, the rise and adoption of artificial information (AI) technology to improve products and services could act as a major factor in regional expansion. In addition to this, countries of China and India are home to a large pool of skilled labor that act as advisors for domestic and foreign TIC service providers thus attracting more clients.

Competitive Analysis

Competitive Analysis

- Kiwa Group

- Bureau Veritas

- DNV GL AS

- Applus+ Services SA

- ALS Limited

- SGS SA

- MISTRAS Group Inc.

- TUV Rheinland Group

- SAI Global Limited

- Eurofins Scientific SE

- Intertek Group plc

- QIMA Limited

- Dekra Certification GmbH

- TUV SUD AG

- NSF International

The global testing, inspection, and certification (TIC) market is segmented as follows:

By Domain Segment Analysis

By Domain Segment Analysis

- Consumer Goods

- Medical & Life Science

- Chemical

- Food & Beverages

By Type Segment Analysis

By Type Segment Analysis

- Testing

- Inspection

- Certification

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Kiwa Group

- Bureau Veritas

- DNV GL AS

- Applus+ Services SA

- ALS Limited

- SGS SA

- MISTRAS Group Inc.

- TUV Rheinland Group

- SAI Global Limited

- Eurofins Scientific SE

- Intertek Group plc

- QIMA Limited

- Dekra Certification GmbH

- TUV SUD AG

- NSF International

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors