Search Market Research Report

Smart Mining Market Size, Share Global Analysis Report, 2024 – 2032

Smart Mining Market Size, Share, Growth Analysis Report By Services (Implementation & Integration Services, Product Training Services, Consulting Services, Engineering & Maintenance Services, And Others), By Solutions (Connectivity Platforms, Analytics Solutions, Data & Operational Management Software, And Others), By Components (RFID Tag & Sensor Intelligence Systems, Hardware, And Others), By Automated Equipment (Robotic Trucks, Mining Excavators, Load Haul Dumps, Drillers & Breakers, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

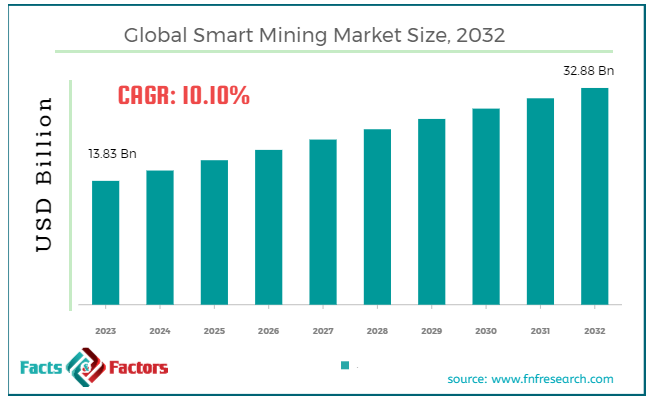

[203+ Pages Report] According to Facts & Factors, the global smart mining market size was valued at USD 13.83 billion in 2023 and is predicted to surpass USD 32.88 billion by the end of 2032. The smart mining industry is expected to grow by a CAGR of 10.10% between 2024 and 2032.

Market Overview

Market Overview

Smart mining involves the utilization of digital solutions, the latest technologies and automation to align the operational efficiency in the mining industry. Smart mining involves automation, which helps companies foster autonomous operations of processes like blasting, drilling, hauling and mineral processing. The remote monitoring and control system further helps companies monitor the environmental conditions and worker safety parameters from the centralized control center.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global smart mining market size is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2024-2032).

- In terms of revenue, the global smart mining market size was valued at around USD 13.83 billion in 2023 and is projected to reach USD 32.88 billion by 2032.

- Need for operational efficiency is driving the growth of the global smart mining market.

- Based on the services, the consulting service segment is growing at a high rate and is projected to dominate the global market.

- Based on the solutions, the analytics solution segment is projected to swipe the largest market share.

- Based on the components, the intelligent system segment is expected to dominate the global market.

- Based on the automated equipment, the load haul dump segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Need for operational efficiency is driving the growth of the global market.

Smart mining technologies streamline the processes and thereby improve the operational efficiency which is a major factor for the high growth rate of the global smart mining market. Smart mining technologies facilitated the automation of various tasks like hauling, blasting and drilling, which resulted in cost-cutting and increased operational efficiency.

Furthermore, ongoing technological advancements like integration with the Internet of Things, artificial intelligence, and big data analytics are further expected to propel the growth of the industry. Smart mining solutions work for real-time data monitoring.

Remote monitoring and control systems further facilitate centralized control systems, thereby reducing the requirement for on-site personnel and increasing flexibility. Smart mining solutions optimize the usage of raw material, water, and energy with predictive analytics, which further resulting cost savings and environmental benefits. Real-time tracking systems reduce energy consumption and maximize resource efficiency.

For instance, Hitachi Construction Machinery Co. entered into a partnership with ABB in March 2021. The major goal of this partnership is to utilize ABB’s platform to come up with digital solutions for Hitachi.

Restraints

Restraints

- Cybersecurity issues are likely to hamper the growth of the global market.

Smart mining technologies depend on digital connectivity and data exchange. These expose the whole system to hacking and malware attacks. Therefore, the growing concerns regarding cyber-attacks are expected to slow down the growth trajectory of the smart mining industry. Also, the limited skilled experts and workforce are likely to restrict the growth of the industry. Implementation of these smart mining technologies poses a huge requirement for expert professionals.

Opportunities

Opportunities

- Growing investments are likely to foster growth opportunities in the global market.

Growing investments, along with increasing demand because of the ongoing infrastructural development and industrialization, are likely to foster growth opportunities in the global smart mining market. The mining companies are investing in smart technologies to align with the rising demand in the market. Regulatory compliance is also driving demand for smart mining solutions.

Smart mining technologies manage and monitor worker safety and lower the risk of penalties. Smart mining solutions align with the goal of environmental sustainability. Technologies like drones and sensors help companies to manage air & water quality and biodiversity conservation.

For instance, Komatsu Mining Corporation inaugurated its new distribution center, Walcol, in Brisbane in March 2022. The center also includes an innovation hub offering advancements in mining automation, smart construction, and many others. For instance, Komatsu Mining Corporation inaugurated its new distribution center, Walcol, in Brisbane in March 2022. The center also includes an innovation hub offering advancements in mining automation, smart construction, and many others.

Challenges

Challenges

- Resistance to change is a big challenge in the global market.

The introduction of new technologies in the market is expected to witness resistance from unions and workers because of their preference to stick to traditional practices. Organizational inertia and cultural resistance are further expected to be a big challenge in the smart mining industry.

Segmentation Analysis

Segmentation Analysis

The global smart mining market can be segmented into services, solutions, components, automated equipment, and regions.

By Services Insights

By Services Insights

On the basis of services, the market can be segmented into implementation & integration services, product training services, consulting services, engineering & maintenance services, and others. The consulting service segment accounts for the largest share of the smart mining industry. Consulting firms offer customized solutions on the basis of the current challenges and objectives. Consulting services help companies leverage smart technologies to address their needs with a personalized approach.

Consulting services offer strategy, guidance, valuable insights, and practices for implementing smart mining solutions. Moreover, these help companies mitigate risks associated with regulatory compliance data, security technology, integration and change management.

By Solutions Insights

By Solutions Insights

On the basis of solutions, the market can be segmented into connectivity platforms, analytics solutions, data & operational management software, and others. The analytics solution is the fastest-growing segment in the global smart mining market. Analytics solution helps mining companies to leverage the huge amount of data generated through systems. Advanced analytic techniques help companies make informed decisions based on valuable insights from techniques like data visualization, machine learning, and predictive modeling.

The analytics solution further helps with resource optimization. The system analyses the consumption pattern, material supply, and water usage, thereby helping companies reduce waste and conserve resources like raw materials, water, energy, and others. The system also integrates with other smart mining solutions to offer end-to-end visibility and control over mining operations.

By Components Insights

By Components Insights

On the basis of components, the market can be segmented into RFID tag & sensor intelligence systems, hardware, and others. The intelligent system segment is likely to dominate the smart mining industry during the forecast period. Intelligent systems serve as the core functionality of whole mining operations. This system offers enhanced decision-making capabilities and data processing to align with the mining activities.

Advanced vehicles are integrated with the latest technologies like sensors, RFID tags, and IoT devices to act upon real-time data in smart mining operations. These devices work on predictive analytics algorithms to offer prior information on maintenance requirements and equipment failures. Therefore, the system reduces downtime, extends the lifespan of mining equipment, and offers proactive maintenance planning.

By Automated Equipment Insights

By Automated Equipment Insights

On the basis of automated equipment, the market can be segmented into robotic trucks, mining excavators, load haul dumps, driller & breakers, and others. The load haul dump segment is projected to witness significant developments in the coming years. Load haul dumps play an important role in material handling. This vehicle helps in loading the blasted or waste material onto haul trucks. These trucks further transport the material to the right place on-site for further processing. These vehicles are important for optimizing the working during mining operations.

However, the advancements in these vehicles have significantly revolutionized smart mining environments. Autonomous vehicles make use of algorithms and sensors to detect obstacles executing the loading and hauling task without manual labor. These automated devices improve efficiency and productivity by enabling faster cycle time and lower downtime.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.83 Billion |

Projected Market Size in 2032 |

USD 32.88 Billion |

CAGR Growth Rate |

10.10% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Trimble, Bosch Global, Rio Tinto, Cisco Systems Inc, Rockwell Automation, Caterpillar Inc, Copco, Outotec Oyj, Komatsu Ltd, ABB Ltd, Hitachi Construction Machinery Co. Ltd, and Others. |

Key Segment |

By Services, By Solutions, By Components, By Automated Equipment, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global smart mining market. The region is a hub for technological innovations, and therefore, the companies in the region are widely adopting smart mining technologies to improve their operations. Advanced technologies like automation IOT a further expected to optimize processes and increase productivity. The regulatory standards in the region are further expected to encourage smart mining solutions. Companies are investing in smart solutions to minimize usage in order to align with the regulatory standards of the regional government.

The ongoing safety concern in the region of further promoting Smart mining solutions to 4 state oka safety and reduce the mind site accidents. Advanced solutions like real-time monitoring systems help analyze and mitigate the risk, thereby preventing accidents and improving the emergency response. The geographical spread of mining operations is posing a huge requirement for remote monitoring capabilities. Remote operations help in managing the site from a centralized location by assuring seamless coordination across multiple sites.

Asia Pacific is likely to see significant developments in the smart mining industry in the coming years. The regional market has rich mineral resources like iron, coal, copper and other rare earth elements, which draw more attention of miners and investors. The mining companies in regions are adopting smart money technologies to streamline their operations and foster sustainability.

Rapid industrialization and urbanization are expected to positively impact the growth of the regional market. Infrastructure development projects in the region are also posing a requirement for minerals and other raw materials which is further expected to support the growth trajectory of the regional market. For instance, Epiroc came up with the latest upgrade on Boomer S10 S in May 2022. It is likely to offer productivity in mine development. The product will offer new surgical precision in drilling.

Competitive Analysis

Competitive Analysis

The key players in the global smart mining market include:

- Trimble

- Bosch Global

- Rio Tinto

- Cisco Systems Inc

- Rockwell Automation

- Caterpillar Inc

- Copco

- Outotec Oyj

- Komatsu Ltd

- ABB Ltd

- Hitachi Construction Machinery Co. Ltd

For instance, Metso Outotec partnered with Dynoamox in June 2022 to help develop easy-to-use and sustainable digital solutions for customers. They collaborated through Dynamox’s condition monitoring platform.

The global smart mining market is segmented as follows:

By Services Segment Analysis

By Services Segment Analysis

- Implementation & Integration Services

- Product Training Services

- Consulting Services

- Engineering & Maintenance Services

- Others

By Solutions Segment Analysis

By Solutions Segment Analysis

- Connectivity Platforms

- Analytics Solutions

- Data & Operational Management Software

- Others

By Components Segment Analysis

By Components Segment Analysis

- RFID Tag & Sensor Intelligence Systems

- Hardware

- Others

By Automated Equipment Segment Analysis

By Automated Equipment Segment Analysis

- Robotic Trucks

- Mining Excavators

- Load Haul Dumps

- Drillers & Breakers

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Trimble

- Bosch Global

- Rio Tinto

- Cisco Systems Inc

- Rockwell Automation

- Caterpillar Inc

- Copco

- Outotec Oyj

- Komatsu Ltd

- ABB Ltd

- Hitachi Construction Machinery Co. Ltd

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors