Search Market Research Report

Green Bond Verification Market Size, Share Global Analysis Report, 2019–2026

Green Bond Verification Market By Services (Pre-Issuance Verification & Post-Issuance Verification Services, Advisory Services, and Others) and By Verticals (BFSI, Real Estate, Energy & Utilities, Consumer Goods, Automotive and Others): North America Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

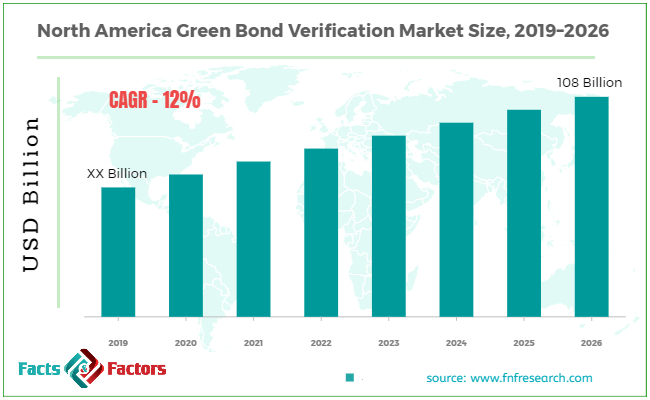

[110+ Pages Report] According to the report published by Facts and Factors, the north green bond verification market size was valued around USD XX billion in 2019 and is expected to grow to around USD 108 Billion by 2026 with a compound annual growth rate (CAGR) of roughly 12% between 2019 and 2026. The report analyzes the north green bond verification market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the north green bond verification market.

This professional and specialized report study examines the technical and business perspective of the green bond verification market. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the green bond verification market. The report study analyzes the market statistics in North America as well as the regional levels to gain an in-depth perspective of the overall green bond verification market.

The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of value (USD Billion) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

- After conducting wide ranging interviews with C-level executives for future prospectus of the Green Bond Verification market, we analyzed that the North America market to foresee a considerable growth in vicinity of12 % till 2026 end.

- Their insights projected that the North American region to surpass value of USD 108 Billion by 2026. We validated the projected figure with our secondary research undertaken by our experienced analysts.

- There projection predicts that thepre-issuance verification & post-issuance verification services will be the majorlyconsumed service type. The advisory services are also expected to witness double digit growth.

- The United States is expected to remain the highest revenue generating country in the North America region. CXOs also believe United States to witness the fastest growth with expected CAGR of above 30 % in foreseeable future. The CXO projects for noteworthy increase in number of corporate, municipal, and sovereign green bonds.

- Among the verticals, energy & utility is estimated to continue its dominance in the vertical segment of North America Green Bond Verification market. The major impacting factor is expected to be the significant shift away from fossil fuel-derived energy in North America region.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend for increased focus on energy and utility vertical in United States.They expects the dominating energy and utility vertical to exhibit highest growth with increasing number of large and medium scale renewable projects.

- The investors are subjective about selection of investment. They are increasingly incorporating environmental, governance and social factorswhile considering for investment for projects.

- Advisory inputs for building brand equity will help in building relationship with investors who are seeking the investment opportunity for building sustainable brand equity.

- Our analyst also predict for significant rise in green bond issuance by local and state government bodies majorly to tackle the consequence of increase in dramatic climate change.

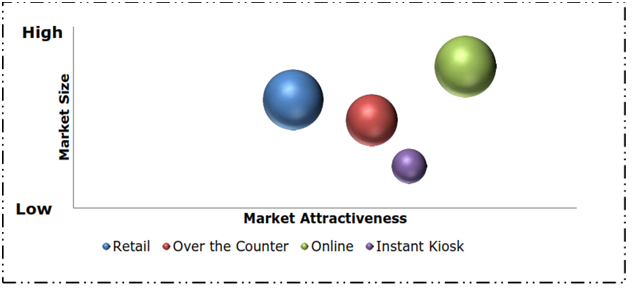

Top Investment Pockets – By Distribution Channel

Top Investment Pockets – By Distribution Channel

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the green bond verification market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the green bond verification market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the green bond verification market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the green bond verification market.

The research study provides a critical assessment of the green bond verification market by logically segmenting the market on the basis of services, verticals, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional analysis of the green bond verification market includes the holistic bifurcation of the North America region into the US, Canada, and Mexico.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD XX Billion |

Projected Market Size in 2026 |

USD 108 Billion |

CAGR Growth Rate |

12% CAGR |

Base Year |

2019 |

Forecast Years |

2019-2026 |

Key Market Players |

Kestrel Verifiers, Carbon Trust, EY, Indufor Group, First Environment Inc., Sustainalytics, DNV GL, KPMG International Cooperative, ISS Corporate Solutions Inc., S&P Trucost Limited, VigeoEiris TÜV NORD GROUP., and Others |

Key Segment |

By Services, Verticals, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

The green bond verification market growth is primarily due to the meteoric rise in investments, specifically in the United States and China. The rising number of bonds issued by local, state and national governments are anticipated to fuel the market for green bonds market, in turn driving the green bond verification market. Investors will find relatively safe and reliable returns although not so significant.

The rapid growth of the green bond verification market is further boosted by high-profile corporates commitments for green investments, symbolic development in interest from utilities and strong demand from investors. The increased demand for disclosure of environmental investment data incorporates company annual report either mandated or voluntary, which can possibly further fuel the growth in number of green bond issuance.

Additionally, the widening scope for green bond finance in different types of a project like water and transport, are further boosting the opportunities for investment.

The Green Bond Verification market is segmented based on services and verticals. On the basis of service segmentation, the market is classified into Pre-Issuance Verification & Post-Issuance Verification Services, Advisory Services, and Others. On basis of verticals segmentation, the market is bifurcated into BFSI, Real Estate, Energy & Utilities, Consumer Goods, Automotive and Others.

Some of the leading players in the global market include:

Some of the leading players in the global market include:

- Kestrel Verifiers

- Carbon Trust

- EY

- Indufor Group

- First Environment Inc.

- Sustainalytics

- DNV GL

- KPMG International Cooperative

- ISS Corporate Solutions Inc.

- S&P Trucost Limited

- VigeoEiris TÜV NORD GROUP.

The taxonomy of the Green Bond Verification Market by its scope and segmentation is as follows:

By Services Segmentation Analysis

By Services Segmentation Analysis

- Pre-Issuance Verification & Post-Issuance Verification Services

- Advisory Services

- Others

By Verticals Segmentation Analysis

By Verticals Segmentation Analysis

- BFSI

- Real Estate

- Energy & Utilities

- Consumer Goods

- Automotive

- Others

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Mexico

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Industry Major Market Players

- Kestrel Verifiers

- Carbon Trust

- EY

- Indufor Group

- First Environment Inc.

- Sustainalytics

- DNV GL

- KPMG International Cooperative

- ISS Corporate Solutions Inc.

- S&P Trucost Limited

- VigeoEiris TÜV NORD GROUP.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors