Search Market Research Report

Rolling Stock Market Size, Share Global Analysis Report, 2021 – 2026

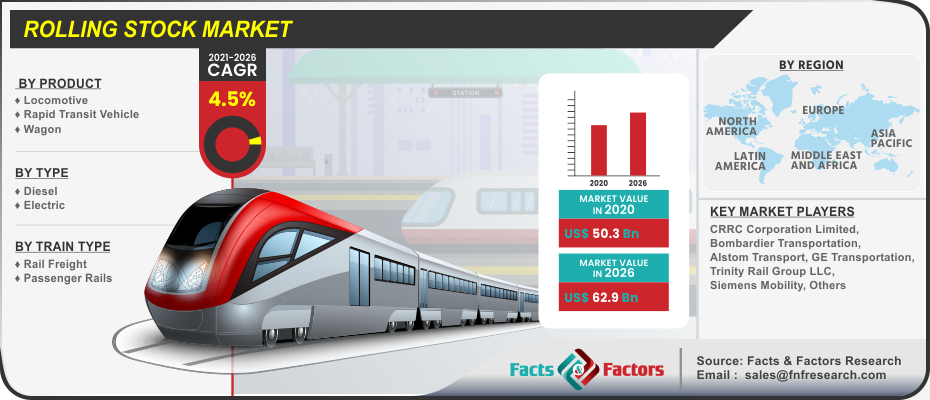

Rolling Stock Market By Product (Locomotive, Rapid Transit Vehicle, & Wagon), By Type (Diesel & Electric), By Train Type (Rail Freight & Passenger Rails), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

[189+ Pages Report] The latest finding surrounding the “Global Rolling Stock Market” published by Facts & Factors offers a neatly packaged and comprehensive read. In the current study, the global rolling stock market is estimated to reach a projected value of USD 62.9 Billion by 2026 with a growth rate of 4.5% CAGR from an initial value of USD 50.3 Billion in the year 2020.

Market Overview

Market Overview

The term rolling stock in rail transport refers to both the powered and unpowered vehicles that include locomotives, freight and passenger cars, and non-revenue cars. Passengers cars are the most popular by far in this sector and are often powered and self-propelled and come in the form of single or multiple units. However, the term rolling stocks refer to wheeled vehicles that are often used by businesses on roadways as well as the previous definition to name a few.

Industry Growth Factors

Industry Growth Factors

The global rolling stock market is expected to rise at an exceptional growth rate during the forecast period owing to increasing urbanization, rising demand for passenger transportation, increasing investment in rail infrastructure, and expansion of rail networks systems to name a few. Additionally, a rising number of metro-based projects coupled with a rapid rate of electrified network routes on a global purview is expected to increase the footprint of the global rolling stock market during the forecast period. Moreover, rising disposable income among consumers, insufficient lack of road networks in emerging countries, and rising road congestion measures will further boost the growth of the global rolling stock market during the advent of the forecast period.

The global rolling stock market is driven by increased integration of advanced maintenance coupled with rising usage of data analytics in rolling stock vehicles to name a few. Rising demand among users for assets availability measures coupled with increasing consolidation trends among the key market players will fuel the growth of the global rolling stock market during the advent of the forecast period. However, capital-intensive measures for raising infrastructure needs coupled with refurbishment and restoration of existing rolling stock projects will hamper the growth of the global rolling stock market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global rolling stock market is segmented into product, type, train type, and region.

On the basis of product, the global rolling stock market is divided into a locomotive, rapid transit vehicle, and wagon. The rapid transit vehicles segment is expected to witness the largest market share during the advent of the forecast period owing to higher speed transits routes coupled with enhanced comfortability measures to name a few. Additionally, the rising demand for automated trains and magnetic levitation trains among the extended users will further cement the growth of the latter segment during the forecast period. Based on type, the global rolling stock market is classified into diesel and electric. The segment pertaining to diesel vehicles is expected to occupy the largest market share during the advent of the forecast period owing to rising demand from oil and gas, mining, and manufacturing coupled with cost-effective measures to name a few. On the basis of train type, the global rolling stock market is bifurcated into rail freight and passenger rails. The segment pertaining to passenger rails is expected to witness the largest market share during the advent of the forecast period owing to rising demand from users in the form of trams, metros, and high-speed trains coupled with the implementation of GPS tracking systems and intelligent systems for improving the quality of the latter to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 50.3 Billion |

Projected Market Size in 2026 |

USD 62.9 Billion |

CAGR Growth Rate |

4.5% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

CRRC Corporation Limited, Bombardier Transportation, Alstom Transport, GE Transportation, Trinity Rail Group LLC, Siemens Mobility, Bombardier Transportation, Alstom Transport, GE Transportation, Trinity Rail Group LLC, Siemens Mobility, Stadler Rail AG, Hitachi Rail Systems, The Greenbrier Co., Hyundai Rotem, Kawasaki Heavy Industries, Wabtec Corporation, Transmashholding, and Trinity Industries Inc.,, Others |

Key Segments |

Product, Type, Train Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to the large-scale adoption of rail vehicles in the region coupled with increasing investments in metro and electric trains to name a few. Additionally, a rising railway infrastructure-based network in the region coupled with an increasing innovative overview for the latter will increase the footprint of the rolling stock market during the forecast period. Europe is expected to witness a substantial market share during the advent of the forecast period owing to capturing a larger portion of the market by Tier-1 suppliers in terms of rising collaborations coupled with rising R&D activities to name a few. Moreover, rising demand from the oil and gas industry and increasing instances of transporting oil from one place to another will boost the growth of the rolling stock market during the advent of the forecast period.

Competitive Players

Competitive Players

The key market participants of the global rolling stock market are

- CRRC Corporation Limited

- Bombardier Transportation

- Alstom Transport

- GE Transportation

- Trinity Rail Group LLC

- Siemens Mobility

- Stadler Rail AG

- Hitachi Rail Systems

- The Greenbrier Co.

- Hyundai Rotem

- Kawasaki Heavy Industries

- Wabtec Corporation

- Transmashholding

- Trinity Industries Inc.

By Product Segment Analysis

By Product Segment Analysis

- Locomotive

- Rapid Transit Vehicle

- Wagon

By Type Segment Analysis

By Type Segment Analysis

- Diesel

- Electric

By Train Type Segment Analysis

By Train Type Segment Analysis

- Rail Freight

- Passenger Rails

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Industry Major Market Players

- CRRC Corporation Limited

- Bombardier Transportation

- Alstom Transport

- GE Transportation

- Trinity Rail Group LLC

- Siemens Mobility

- Stadler Rail AG

- Hitachi Rail Systems

- The Greenbrier Co.

- Hyundai Rotem

- Kawasaki Heavy Industries

- Wabtec Corporation

- Transmashholding

- Trinity Industries Inc.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors