Search Market Research Report

Packaging Supplies Market Size, Share Global Analysis Report, 2024 – 2032

Packaging Supplies Market Size, Share, Growth Analysis Report By Product Type (Boxes, Bags and Pouches, Lids and Closures, Labels, Pallets, and Crates), By Material (Paper and Paperboard, Plastic, Metal, Glass, Wood), By Sustainability (Biodegradable and Compostable, Recyclable, Reusable), By End-Use Industry (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Electronics, Industrial), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

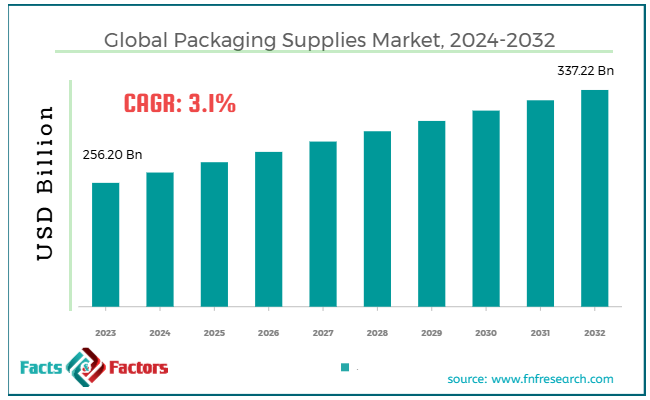

[217+ Pages Report] According to Facts & Factors, the global packaging supplies market size was worth around USD 256.20 billion in 2023 and is predicted to grow to around USD 337.22 billion by 2032, with a compound annual growth rate (CAGR) of roughly 3.1% between 2024 and 2032.

Market Overview

Market Overview

Packaging supplies are the materials that protect, ship, and store products. They comprise boxes, bubble wrap, tape, labels, foam, padding, and shrink wrap. Packaging supplies ensure the safety of products during storage and transport while taking care of organization and branding.

The global packaging supplies market is fueled by the speedy growth of e-commerce, sustainability concerns, and technological improvements. Online shopping has majorly boosted the demand for improved packaging materials. With the growth of e-commerce, packaging suppliers are aiming for better-quality customer satisfaction and fast deliveries.

Moreover, the rising ecological concerns and supportive governmental protocols are impelling environment-friendly and sustainable solutions. Furthermore, improvements in packaging materials, like the emergence of smart packaging, are improving the appeal and functionality of packaging materials. This is substantially fueling the demand for cutting-edge packaging supplies.

Nonetheless, a few barriers hampering the growth of the market comprise the significant cost of sustainable materials and the ecological effects of packaging waste. While environment-friendly packaging materials are in great demand, they are comparatively costlier than the conventional options. This refrains smaller businesses from shifting to modernized packaging materials.

Also, despite the emphasis on sustainability and a healthy environment, packaging waste is still a foremost ecological concern. Excessive packaging and non-recyclable materials are contributing to the rising pollution, and resolving this barrier could be complex and expensive for companies.

Yet, the market is projected to register notable growth owing to the growth of compostable and biodegradable packaging and the progress of the food and beverage industry. The rising demand for biodegradable materials is among the key reasons for the packaging supplies industry growth.

Improvements in plant-based and compostable materials signify prospects for businesses to produce eco-friendly solutions for their consumers. The food and beverage industry is the leading consumer of packaging materials, thus aiding in preserving safety, quality, and enhanced shelf-life.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global packaging supplies market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2024-2032)

- In terms of revenue, the global packaging supplies market size was valued at around USD 256.20 billion in 2023 and is projected to reach USD 337.22 billion by 2032.

- The packaging supplies market is projected to grow significantly owing to the development of smart packaging, rising consumer preferences for aesthetics and convenience, and expansion of worldwide logistics and trade.

- Based on product type, the boxes segment is expected to lead the market, while the bags and pouches segment is expected to register considerable growth.

- Based on material, the plastic segment is the dominating segment among others, while the paper and paperboard segment is projected to witness sizeable revenue over the forecast period.

- Based on sustainability, the recyclable segment is the dominating segment, while the biodegradable and compostable segment is projected to witness maximum growth in the future.

- Based on end-use industry, the food and beverages segment is expected to lead the market as compared to the pharmaceuticals segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Technological improvements in packaging to spur the packaging supplies market growth

Technological advancements play a vital role in improving packaging functionality. Packaging designs are transforming noticeably with the emergence of smart packaging. This comprises technologies like sensors and QR codes for tracking.

Smart packaging also includes active packaging that helps improve freshness and extends shelf life. These solutions not only improve user experience but also enhance the safety and efficiency of the supply chain. The global smart packaging industry is anticipated to progress at a CAGR of 9.2%, with an estimated evaluation of $ 71.5 billion by 2030.

Furthermore, advances in artificial intelligence, robotics, and automation have considerably improved packaging processes, thus impacting the growth of the packaging supplies market.

For instance, smart packaging utilized in the food industry can enlighten consumers on freshness, product safety, and ingredient origins.

- Branding and retail expansion to fuel the industry growth

The progressing retail market, mainly in the developing regions, has boosted the demand for personalized and innovative packaging. The leading companies are actively adopting packaging as a solution for consumer engagement and branding. Customized packaging plays a vital role in enhancing product display, producing an exceptional user experience, and differentiating brands in a highly competitive market.

As retail is continuously progressing in emerging economies, mainly in Africa and Asia Pacific, businesses are spending on tailored packaging technologies to increase their consumer base and appeal to a large population. Prominent companies like Apple, Adidas, and Nike are adopting modernized packaging designs to improve brand loyalty and product appeal.

Restraints

Restraints

- Disturbances in the supply chain act as a key barrier to the packaging supplies market growth

The packaging market has witnessed major disturbances in the supply chain owing to incidences like the coronavirus pandemic, transportation issues, and logistical bottlenecks. These disturbances have led to delays, materials shortages, and increased costs, affecting the delivery and timely production of packaging materials. This negatively impacted the progress of the packaging supplies industry.

In 2022, global shipping prices hiked by more than 500% than the pre-pandemic stages. This resulted in increased costs and delays in finding raw materials for packaging.

In 2023, port congestion and container manufacturers have disturbed the raw materials supply for packaging producers, mainly in North America and Asia Pacific. These interruptions negatively impact the lead times for packaging manufacturing, thus resulting in inventory scarcity and delayed product introductions for many businesses.

Opportunities

Opportunities

- Growth of Direct-to-Consumer (DTC) and e-commerce to fuel the packaging supplies market growth

As e-commerce is progressing, packaging suppliers have a key opportunity to satisfy the unique demands of e-commerce retailers. The rising models of direct-to-consumer (DTC) need tailored packaging solutions that enhance branding and promise product safety during the delivery process. The worldwide e-commerce industry is projected to witness a remarkable CAGR of 9.7%, with USD 8.1 trillion by 2027.

The global e-commerce packaging market has witnessed a surge in demand for tailored boxes, protective materials, and bubble wraps. Brands like Amazon are introducing and improving tailored packaging options to decrease wastage and enhance efficiency in delivery. The growth of DTC models for companies like Glossier and Warby Parker is impelling this trend, thus impacting the packaging supplies industry progress.

Challenges

Challenges

- Growing regulatory compliance costs restrict the growth of the packaging supplies market

The packaging market experiences a rising burden to comply with the changing and complex environmental regulations. These regulations emphasize decreasing plastic wastage, meeting sustainability goals, and promising recyclability. Implementing these protocols needs major investment in research and development, technology upgrades, and novel production techniques.

The packaging market should essentially adjust to the growing regulatory standards associated with disposable plastics. For instance, single-use plastic bans are anticipated to cover more than 100 economies, as per the World Economic Forum.

Several companies like Nestlé and PepsiCo are facing obstacles to comply with the changing carbon footprint regulations and packaging taxes, resulting in a hike in packaging costs. In the United Kingdom, the plastic packaging tax levied in 2022 forced producers to consider material sourcing strategies again, resulting in higher production costs.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 256.20 Billion |

Projected Market Size in 2032 |

USD 337.22 Billion |

CAGR Growth Rate |

3.1% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Amcor, Sealed Air Corporation, International Paper, Berry Global Inc., Smurfit Kappa Group, Mondi Group, WestRock Company, DS Smith, Sonoco Products Company, Clondalkin Group, Kraft Heinz (Packaging Division), Packaging Corporation of America (PCA), Tetra Pak, Georgia-Pacific LLC, Crown Holdings Inc., and Others. |

Key Segment |

By Product Type, By Material, By Sustainability, By End-Use Industry, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global packaging supplies market is segmented based on product type, material, sustainability, end-use industry, and region.

Based on product type, the global packaging supplies industry is divided into boxes, bags and pouches, lids and closures, labels, and pallets and crates. The boxes segment is projected to witness maximum growth over the estimated period. They are broadly used in numerous industries, mainly in the food and beverages, consumer goods, and e-commerce sectors. The prominence of boxes is fueled by durability, versatility, and cost-effectiveness. They offer safety and protection during the entire transport process, can be easily handled, and are broadly recyclable, complying with the rising sustainability stresses.

The bags and pouches segment is also expected to hold a notable share of the market since they are expansively used for packaging liquids, food items, and numerous consumer products.

Based on material, the global packaging supplies market is segmented as paper and paperboard, plastic, metal, glass, and wood. Among others, the plastics segment is anticipated to register a larger share of the market owing to its durability, versatility, and cost-effectiveness. It is broadly used in several packaging forms like containers, flexible packaging, films, and bottles. Moreover, plastic's ability to be shaped in diverse shapes, along with its lightweight nature, increases its preference for many industries. Although concerns about environmental impact are rising, plastic is still dominating owing to modernization in biodegradable and recyclable plastic choices and wider use.

Based on end-use industry, the packaging supplies industry is segmented as food and beverages, pharmaceuticals, personal care and cosmetics, electronics, and industrial. In 2023, the food and beverages segment held the maximum market share and is projected to continue its dominance owing to the growing need for packaging that promises transportation, preservation, and safety of food and beverage items. The rising demand for portion control, convenience, and inclination towards processed and packaged foods lead to the expanded use of packaging materials like cartons, flexible packaging, and bottles. Moreover, sustainability trends are motivating the emergence of environment-friendly options in the domain.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America held a dominant share of the global packaging supplies market in 2023 and is expected to continue its dominance over the forecast period, owing to heavy demand from the food and beverage, e-commerce, and pharmaceuticals industry.

The region's growth is also propelled by regulatory support and technological improvements for sustainable packaging. The speedy growth of online shopping, mainly in the United States, has majorly impacted the demand for better packaging supplies. The packaging market is also closely linked to e-commerce, which demands efficient and protective packaging techniques.

In addition, North America leads in terms of modernization in automated and improved packaging systems and materials. The region also holds developed infrastructure and manufacturing potential, thus increasing its appeal for packaging firms to produce and sell products.

Europe also holds a substantial share of the global market owing to higher demand for sustainable packaging, developed industrial base, and modernized packaging technologies. Other key reasons for the region's growth comprise a higher emphasis on sustainability and heavy consumer and industrial demand. Europe is the leading region for adopting environment-friendly packaging techniques. The region is committed to decreasing plastic wastage and boosting recycling rates.

Moreover, the cosmetics, food and beverage, and pharmaceutical industries are the key propellants of packaging demand in the region. The region also holds a significant consumption rate and a larger manufacturing base, and witnesses steady and constant demand for secondary and primary packaging.

Competitive Analysis

Competitive Analysis

The global packaging supplies industry is led by players like:

- Amcor

- Sealed Air Corporation

- International Paper

- Berry Global Inc.

- Smurfit Kappa Group

- Mondi Group

- WestRock Company

- DS Smith

- Sonoco Products Company

- Clondalkin Group

- Kraft Heinz (Packaging Division)

- Packaging Corporation of America (PCA)

- Tetra Pak

- Georgia-Pacific LLC

- Crown Holdings Inc.

Key Market Trends

Key Market Trends

- Functional and smart packaging:

Modernizations like RFID tags, interactive packaging, and temperature-sensitive packaging are growing popular, providing consumer engagement and improved functionality while enhancing supply chain efficiency.

- Custom and minimalist packaging:

The leading companies are actively emphasizing personalized packaging and minimalist design to stand out in the competition. They are also aiming to improve their brand identity and attract users' aesthetics, mainly in the food and beauty industries.

The global packaging supplies market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Boxes

- Bags and Pouches

- Lids and Closures

- Labels

- Pallets and Crates

By Material Segment Analysis

By Material Segment Analysis

- Paper and Paperboard

- Plastic

- Metal

- Glass

- Wood

By Sustainability Segment Analysis

By Sustainability Segment Analysis

- Biodegradable and Compostable

- Recyclable

- Reusable

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Electronics

- Industrial

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Amcor

- Sealed Air Corporation

- International Paper

- Berry Global Inc.

- Smurfit Kappa Group

- Mondi Group

- WestRock Company

- DS Smith

- Sonoco Products Company

- Clondalkin Group

- Kraft Heinz (Packaging Division)

- Packaging Corporation of America (PCA)

- Tetra Pak

- Georgia-Pacific LLC

- Crown Holdings Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors