Search Market Research Report

Packaging Machinery Market Size, Share Global Analysis Report, 2024 – 2032

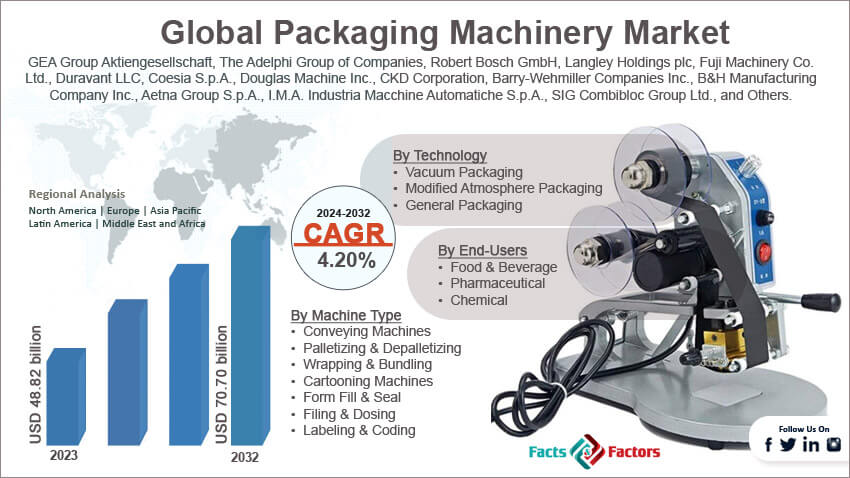

Packaging Machinery Market Size, Share, Growth Analysis Report By Machine Type (Conveying Machines, Palletizing & Depalletizing, Wrapping & Bundling, Cartooning Machines, Form Fill & Seal, Filing & Dosing, Labeling & Coding, And Others), By End-Users (Food & Beverage, Pharmaceutical, Chemical, And Other Industries), By Technology (Vacuum Packaging, Modified Atmosphere Packaging And General Packaging), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

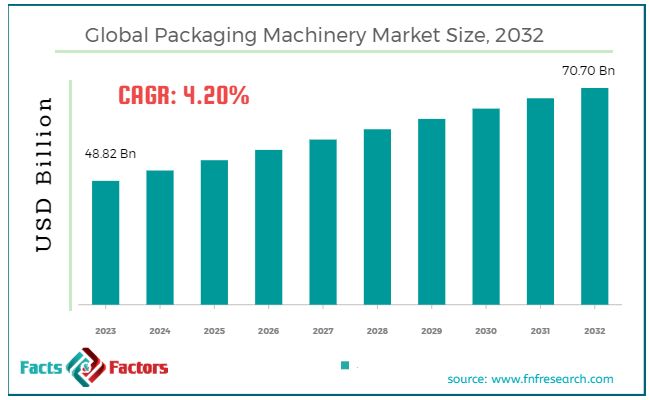

[214+ Pages Report] According to Facts & Factors, the global packaging machinery market size was valued at USD 48.82 billion in 2023 and is predicted to surpass USD 70.70 billion by the end of 2032. The packaging machinery industry is expected to grow by a CAGR of 4.20% between 2024 and 2032.

Market Overview

Market Overview

Packaging machinery is widely used in packaging processes to pack items across different end-user sectors like personal care, pharmaceuticals, food & beverages, household products and industrial goods. Packaging machinery is designed for different tasks like wrapping, labeling, sealing, filing, coding, and palletizing.

Packaging machinery improves the efficiency, productivity, and product quality in manufacturing operations. It also helps companies reduce costs and align with emerging consumer demands. Furthermore, these machineries also assist companies in aligning with the regulatory standards of the government.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global packaging machinery market size is estimated to grow annually at a CAGR of around 4.20% over the forecast period (2024-2032).

- In terms of revenue, the global packaging machinery market size was valued at around USD 48.82 billion in 2023 and is projected to reach USD 70.70 billion by 2032.

- Rising demand for packaging from end-user sectors is driving the growth of the global packaging machinery market.

- Based on the machine type, the filing & dosing segment is growing at a high rate and is projected to dominate the global market.

- Based on the end-users, the food segment is projected to swipe the largest market share.

- Based on the technology, the general packaging segment is expected to dominate the global market.

- Based on the automated equipment, the load haul dump segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Rising demand for packaging from end-user sectors is driving the growth of the global market.

Growing demand from the end sector, particularly in the supply chain industries and logistics & transportation sector, is a huge demand in the global packaging machinery market. Also, the high rate of transportation and logistics sector is further expected to increase the demand for packaging machinery.

People are looking forward to portable, convenient, and long-shelf life products, which is further driving manufacturers to adopt advanced packaging solutions. Furthermore, the rising issues regarding environmental health are anticipated to positively impact the industry. Packaging machinery lowers the waste by using recyclable materials in the production process.

Also, the advanced packaging machinery lowers energy consumption and increases its demand in the market. Strict regulations regarding product safety and environmental sustainability are driving the interest of people in packaging machinery. Packaging machinery helps manufacturers to meet the regulatory standards and ensure product quality & safety in the market. For instance, Tetra Packs is heavily investing in its Revita Plant in August 2019. It is the company's new process plant and will increase its capacity to clean polyols.

Restraints

Restraints

- High initial investments are likely to hamper the growth of the global market.

Heavy upfront costs are likely to deter price-sensitive businesses, particularly small and medium-sized companies that are tight on budgets. Additionally, the ongoing maintenance and operational expenses are further expected to slow down the growth of the global packaging machinery market in the coming years.

Moreover, the regulatory compliance associated with packaging machinery is complex and, therefore, is expected to negatively impact the growth of the industry. Also, maintaining and operating packaging machinery requires specialized training, but the lack of a skilled workforce is expected to further hamper the growth of the industry.

Opportunities

Opportunities

- Emergence of Industry 4.0 technology and automation is likely to foster growth opportunities in the global market.

Industry 4.0 technologies like artificial intelligence, robotics, IoT, and many others, along with automation, are expected to revolutionize the global marketplace. Automation lowers the cost, minimizes errors, and improves efficiency, thereby enabling real-time data monitoring.

Additionally, the emergence of e-commerce platforms is further expected to fuel the demand for packaging machinery. Advanced packaging solutions are ideal for shipping, transportation, and handling hassles. These packaging solutions improve the customer experience. Also, the globalization of supply chains and transportation is another major factor expected to boost the demand in the market in the coming years.

Manufacturers are looking forward to more adaptable, scalable, and versatile packaging solutions to meet the demands of diverse markets. All these factors are likely to boost the growth of the packaging machinery industry in the coming years. For instance, Krones AG collaborated with Stadler Anlagenbau GmbH in 2019 to introduce recycling technology and further help in improving interfaces.

Challenges

Challenges

- Complexity of integration is a big challenge in the global market.

Integrating new packaging machinery with legacy infrastructure is a little time-consuming and complex. These companies pose heavy requirements for adequate training for operators, which is expected to be a big challenge in the packaging machinery industry.

Also, the rapid technological changes and innovation further drive investments in new machinery and staff training, which is further expected to negatively impact the growth trajectory of the industry in the coming years.

Segmentation Analysis

Segmentation Analysis

The global packaging machinery market can be segmented into machine type, end-users, technology, and others.

By Machine Type Insights

By Machine Type Insights

On the basis of machine type, the market can be segmented into conveying machines, palletizing & depalletizing, wrapping & bundling, cartooning machines, form fill & seal, filing & dosing, labeling & coding, and others. The filing & dosing segment is likely to dominate the packaging machinery industry in the coming years. The increasing use of automation and robotics is one of the major factors accentuating the demand in the segment. Automation of filing and dosing significantly lowers the risk of error along with reducing labor cost. It also utilizes advanced technologies like gravimetric filing, volumetric filing, and many others to improve the throughput.

Additionally, the rising demand for packaged products across end-user sectors like household goods, cosmetics, pharmaceuticals, food & beverages, and others further fosters the requirement of filing and dosing in the market. The versatility and customization features offered by filing and dosing machines further help manufacturers to easily fill containers of different shapes and sizes.

By End-Users Insights

By End-Users Insights

On the basis of end-users, the market can be segmented into food, beverage, pharmaceutical, chemical, and other industries. The food segment accounts for the largest share of the global packaging machinery market. Increasing demand for packaged food products all across the globe is boosting the growth of the segment.

The busy lifestyle of people, along with the shifting preference of consumers towards convenience, is paving a high demand for packaged food products. Such demand is boosting the requirement for packaging machinery in the food segment. The food industry is subjected to government regulations to ensure the safety of food products.Therefore, packaging machines are important in assuring food safety by offering hygienic packaging solutions that protect the content against contamination and damage.

Additionally, the food sector has a huge requirement for diverse packaging formats, and therefore, there is a wide scope of packaging machinery in the market. Packaging machinery offers packaging in a wide range of formats like trays, cartons, bottles, cans, pouches, and other flexible packaging materials.

By Technology Insights

By Technology Insights

On the basis of technology, the market can be segmented into vacuum packaging, modified atmosphere packaging and general packaging. General packaging is the fastest-growing segment in the packaging machinery industry. General packaging machinery can handle a number of applications across industries like cosmetics, pharmaceuticals, food & beverages, chemicals, and consumer goods.

This versatility increases the demands for diverse packaging formats, production requirements, and product types. General packaging machinery is also very cost-effective when compared to other options. General packaging machinery also eases the provision of integration into existing production lines.

Moreover, the increasing market demand for standard packaging solutions like vacuum packaging is positively impacting the growth trajectory of the segment. Also, these are easy to upgrade and expand without causing any disruptions in operations. The standard packaging solutions extend the shelf life of the products and also improve the product's freshness. Also, the advancements in the general packaging machinery, like improvements in packaging quality, efficiency, and automation, are further responsible for the high growth of the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 48.82 Billion |

Projected Market Size in 2032 |

USD 70.70 Billion |

CAGR Growth Rate |

4.20% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

GEA Group Aktiengesellschaft, The Adelphi Group of Companies, Robert Bosch GmbH, Langley Holdings plc, Fuji Machinery Co. Ltd., Duravant LLC, Coesia S.p.A., Douglas Machine Inc., CKD Corporation, Barry-Wehmiller Companies Inc., B&H Manufacturing Company Inc., Aetna Group S.p.A., I.M.A. Industria Macchine Automatiche S.p.A., SIG Combibloc Group Ltd., and Others. |

Key Segment |

By Machine Type, By End-Users, By Technology, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market

North America accounts for the largest share of the global packaging machinery market. The reason is a hub for the innovation of packaging machinery technology. Manufacturers in the region are continuously investing in research and development activities to come up with advanced solutions with extreme capabilities.

Also, the increasing interest of people in sustainable packaging solutions is further widening the scope of the regional market. Manufacturers are using eco-friendly technologies in the packaging machinery to reduce energy consumption, carbon footprint, and material waste, which aligns with the goal of a sustainable environment. Increasing usage of automation and robotics in North America is lowering labor costs and improving productivity.

Additionally, the market in the region caters to different end-user sectors like cosmetics, pharmaceuticals, personal care, food & beverages and household products. Consequently, every industry poses different packaging requirements, thereby driving the demand for specialized packaging machinery in the region.

Asia Pacific is another leading region expected to witness a heavy growth rate during the forecast period. Increasing urbanization and industrialization are leading to an increase in demand for packaged goods across sectors like pharmaceuticals, cosmetics, and many others. The growing disposable income of the people is another major factor fueling the demand for consumer goods and packaging.

As a result of the high disposable income of people, manufacturers are scaling their production to cater to rising demands. Technological advancements like digitalization, robotics automation and smart packaging solutions are further driving the interest of people in packaging machinery. The rising focus of people on food safety and hygiene is also expected to foster growth opportunities in the regional market.

For instance, Syntegon Packaging Technology introduced the Sigpack TTMD cartoner in January 2021. The product has built-in delta robots.

Competitive Analysis

Competitive Analysis

The key players in the global packaging machinery market include:

- GEA Group Aktiengesellschaft

- The Adelphi Group of Companies

- Robert Bosch GmbH

- Langley Holdings plc

- Fuji Machinery Co. Ltd.

- Duravant LLC

- Coesia S.p.A.

- Douglas Machine Inc.

- CKD Corporation

- Barry-Wehmiller Companies Inc.

- B&H Manufacturing Company Inc.

- Aetna Group S.p.A.

- I.M.A. Industria Macchine Automatiche S.p.A.

- SIG Combibloc Group Ltd.

For instance, KHS Group came up with Innopal PLR High-Performance Palletizer in January 2022. The product utilizes low-feed machines to work with these palletizers to increase the efficiency of the system.

The global packaging machinery market is segmented as follows:

By Machine Type Segment Analysis

By Machine Type Segment Analysis

- Conveying Machines

- Palletizing & Depalletizing

- Wrapping & Bundling

- Cartooning Machines

- Form Fill & Seal

- Filing & Dosing

- Labeling & Coding

- Others

By End-Users Segment Analysis

By End-Users Segment Analysis

- Food & Beverage

- Pharmaceutical

- Chemical

- Other Industries

By Technology Segment Analysis

By Technology Segment Analysis

- Vacuum Packaging

- Modified Atmosphere Packaging

- General Packaging

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- GEA Group Aktiengesellschaft

- The Adelphi Group of Companies

- Robert Bosch GmbH

- Langley Holdings plc

- Fuji Machinery Co. Ltd.

- Duravant LLC

- Coesia S.p.A.

- Douglas Machine Inc.

- CKD Corporation

- Barry-Wehmiller Companies Inc.

- B&H Manufacturing Company Inc.

- Aetna Group S.p.A.

- I.M.A. Industria Macchine Automatiche S.p.A.

- SIG Combibloc Group Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors